Summary:

- PayPal’s strong business model and economic moat make it an attractive long-term investment, despite recent e-commerce growth slowdown and management concerns.

- The company’s two-sided network, branded checkout, and digital wallet position provide a solid foundation for future growth and monetization.

- PayPal’s valuation and potential catalysts, such as improved earnings and BNPL externalization, suggest a 35% short-term upside and long-term compounding potential.

Justin Sullivan

Thesis

PayPal (NASDAQ:PYPL) is a strong business that has fallen on tough times due to a temporary slowdown in e-commerce growth and management concerns. This has resulted in their stock price growing to what we view as a very attractive entry point in a potential long-term compounder

Strong Business Model: Economic Moat, Flywheel Effect, and Network Effect

Before getting into each segment, I think it’s important to mention PayPal’s strong business model and economic moat that will persist no matter short-term qualms.

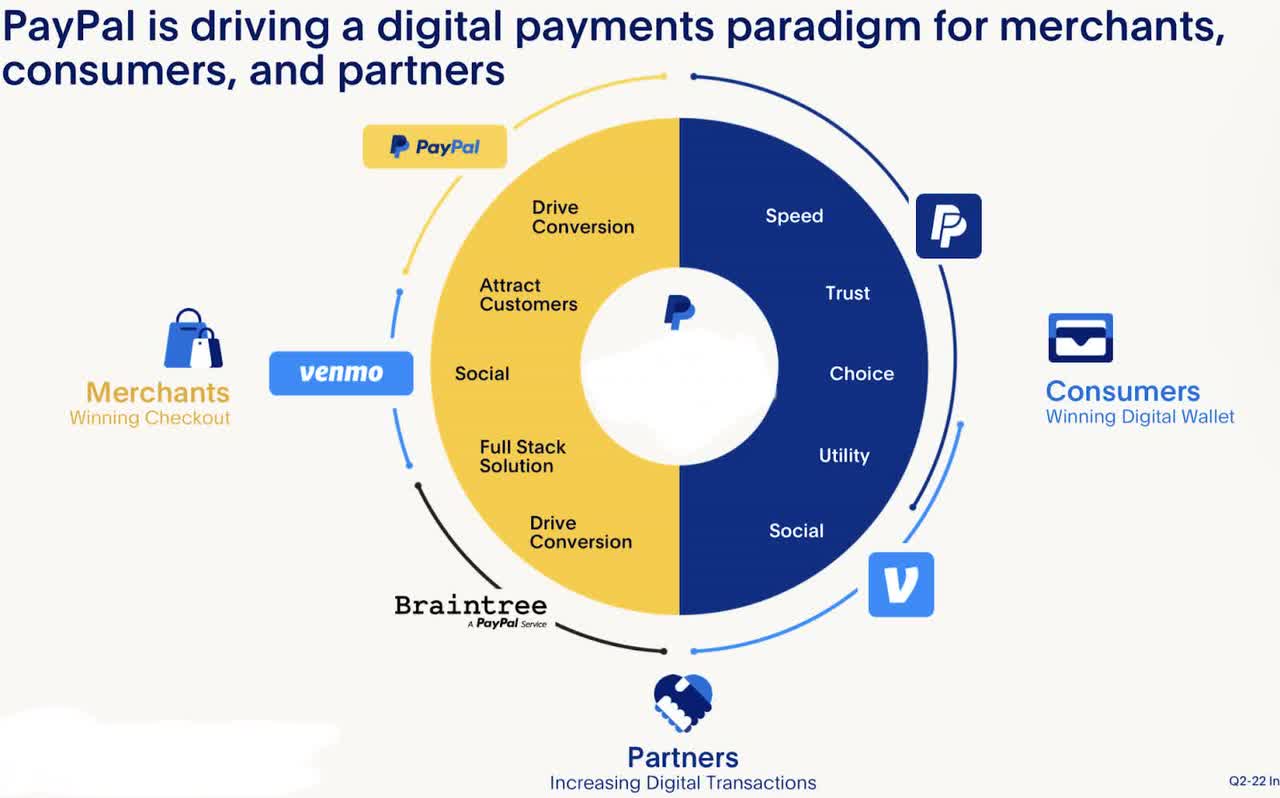

PayPal’s economic moat and its flywheel effect (yes overused but very applicable) all come down to its two-sided network with over 35M merchants and over 400M consumers (PYPL Q4-22 Investor Presentation). The company’s branded checkout, payment processing, and other merchant services allow for merchants to accept payments from most APMs, most importantly PayPal’s digital wallets.

PayPal’s value proposition for merchants is strong and self-reinforcing as expanding to new merchants through unbranded processing integrations results in a more attractive and active digital wallet business which makes integrating with PayPal more attractive. This is their flywheel.

PayPal

Branded Checkout

The branded checkout is the PayPal/Venmo button you see in online checkout and is part of the larger branded segment. Branded Checkout is the bread and butter of the business because of its high-margin fee structure.

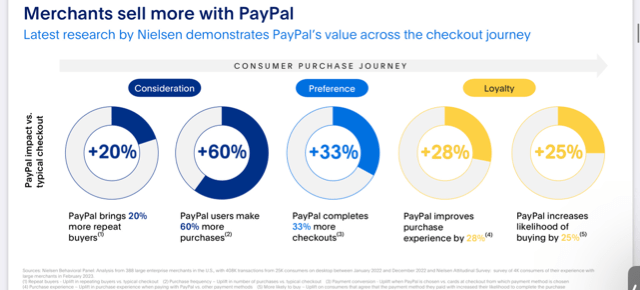

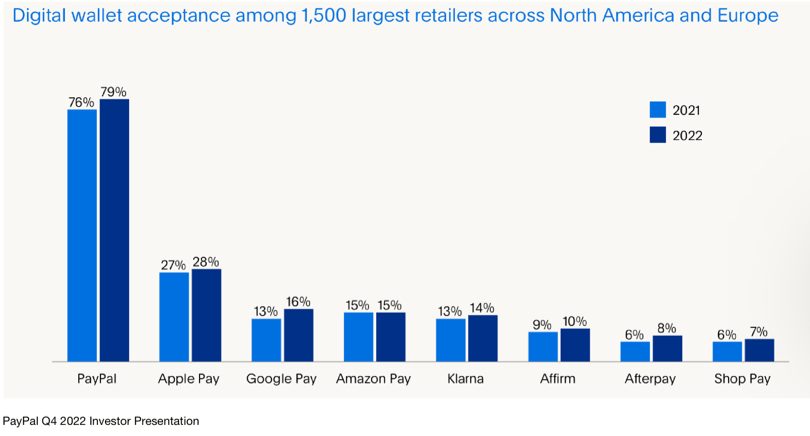

PayPal is the market leader in branded online checkout with 35m merchants that accept them and 80% of the top 1500 online U.S retailers.

PayPal

As seen, no one is close to that rate of acceptance, and with authorization rates of 6% better than the industry average and strong conversion uplift when merchants accept PayPal.

PayPal has undergone a variety of initiatives such as reducing latency, allowing for more passwordless login, tethered ID, biometrics, APIs, and SDKs for better checkout design, and no pop-up screen.

Because of PayPal’s history and long-time checkout placement, it tends to be better than other buttons such as Shopify (SHOP) and though Apple Pay (AAPL) has some advantages through identity and especially through NFC (near-field comm.) chip, PayPal is still taking share from manual credit entry and its competitors are small.

Though PayPal is nowhere near the 99% merchant acceptance rate of Amex (AXP)/Visa (V)/Mastercard (MA), it is the largest among APMs and has been for a while meaning those who use it, have used it for a fair amount of time and with good user growth, its position is strong.

Branded Checkout growth and results

In 2022, branded checkout TPV grew 5%, compared to 23% the year prior. In Q1 2023, momentum returned with a 2% sequential increase from Q4 and a 6.50% increase YoY (PayPal’s Q1-2023 Earnings Analyst Call). This is attributable largely to continued strong growth in U.S. and Europe.

In 2021 and 2020, due to COVID impact, e-commerce growth was pulled ahead significantly and unfortunately, management expected that this growth would continue and was part of the larger secular trend. This was grossly wrong, with e-commerce growing 7.7% in 2022, though expectations are solid for 2023 at HSD and for the next 5-10 years after, e-commerce should continue its secular trends growing in the low teens, though I expect branded checkout to grow 5%-7% in 2023 and possibly 2024. Over the long run, branded checkout should mirror E-commerce growth in low teens and likely be higher considering merchant additions.

Digital Wallet Position and User Base

The Digital Wallet segment is composed of the following businesses/products: the core PayPal app, Venmo, along with Xoom and HyperWallet as smaller contributors. As of current, there are 435M total active users (including merchants) with MAUs of 190M which is positive LSD growth over the last year.

Though I expect growth to be MSD for active users, the company’s focus is on growing monetization and engagement of their MAUs with them launching a rewards program that has 6M users already.

As of right now, P2P TPV was $380B, with $245B of that being Venmo and TPV being $63B in Q1 2023 (PYPL Q1-23 Investor Update). Recent expansion of Pay with Venmo (branded checkout segment) has been in Xbox, McDonalds, Starbucks, and Amazon over the last 6 months. Along with this, increased cross-border use should help Venmo TPV start to grow again, though, with MAUs at 60M and active users at 90M for Venmo, monetization has become a priority.

It’s estimated Venmo has a bit over $1.3B in revenue in 2022 with that being $900M-$1B in 2021, a 40% increase (actual) even though TPV only grew 7%. Compare this to the Cash app with 51M MAUs and 4.5B in annualized non-bitcoin revenue (Block Q1 Results). Of course, Venmo’s appeal is that it is more of a starter app in the ecosystem, but nevertheless, monetization potential is large.

Overall Venmo is being invested in with new initiatives such as a Venmo teen account, merchant additions, rewards program, P2P cross-platform, and other small things, allowing for Venmo to grow revenue in the low twenties.

To discuss competition, even though there are a lot of P2P applications like Zelle, CashApp, Google Pay (GOOG) (GOOGL), Apple Pay, Shop Pay, and Amazon Pay (AMZN), the fact is that Venmo and PayPal as a whole have the head start and are very established in the branded checkout space. PayPal Core and Venmo have their user base and combined (or just Venmo) are part of the market leaders.

To mention because of PayPal’s history with eBay (EBAY), due to their payment processing agreement ending in 2018/2020, eBay has gone from being 15% of revenue to just 1%-2%, so this headwind is almost completely gone.

Braintree Overview

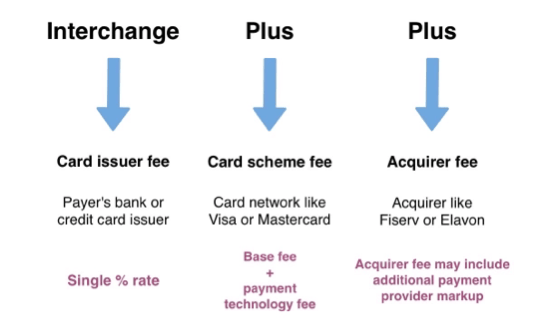

Braintree was acquired with Venmo in 2013 and is part of the unbranded segment offering back-end payment processing primarily to enterprise clients and the upper end of the SMB market. Because these large clients see huge volumes, margins are pretty small and the market is commoditized. These low margins are due to the IC++ pricing model of being a payment processor:

IC++ pricing model explanation (mobile transaction)

The three largest players in the e-commerce payment processing market are Adyen (OTCPK:ADYEY) (enterprise-focused), Stripe (SMB-focused), and Braintree. Braintree most directly competes with Adyen, though Stripe can also operate in the enterprise market and is recognized as the technological leader because of its developer-oriented platform.

Braintree’s differentiation is in their back-end open architecture for better access to third-party services & PSPs, along with the fact that branded checkout integration is easier.

PayPal Complete Payments (PPCP) Overview

As said, Braintree is more focused on enterprise clients, and historically, for SMBs, the only PayPal option for payment processing was PayPal Pro which was expensive and non-competitive. Along with this, problems with customer support over the last few years in both businesses due to lack of being developer friendly has resulted in a massive overhaul of both with Braintree becoming more developer friendly with new APIs and SDKs for developers with some DevOps groups saying Braintree is now better than the group favorite Stripe.

For the failure of PayPal Pro though, the company’s overhaul has resulted in the sunsetting of the business with it being replaced by PPCP which is much more flexible and easier to integrate for SMBs which is its target market. It’s focused on SaaS mass customization at scale for SMBs along with better checkout integration.

Unbranded Initiatives

Besides improving developer friendliness for both platforms, Braintree and PPCP are about to see massive monetization growth over the next 2 years. Basically, for an enterprise payment processor like Adyen, almost 80% of revenue is from value-added services (VAS) with it similar to Stripe, though margins are naturally higher downmarket.

Stripe and Adyen had roughly $800B USD in TPV while all of the unbranded processing for PayPal was roughly $800B USD with that being split evenly between branded and third parties.

Even with this, Braintree is still under-developed with VAS and so the opportunity in both Braintree and PPCP is in:

-

Going Omni-channel, through the use of Zettle (PayPal acquired POS terminal company), they can get payment processing in brick and mortar and integrate with third parties to expand volumes

-

Expanding services with FX-as-a-service allowing for multiple currency use for a 100BP charge (biggest incremental contributor), BNPL (PayPal Payments), along with Risk-as-a-service which should be the third largest contributor, along with a bunch of other possible value-added services that are not only incrementally high margin, but wanted by merchants

-

Data collection improving to automate more and improve the service offering and especially the checkout experience

These improvements (VAS mainly) should be seen in the last quarter of 2023 and especially into 2024. Overall, though we have some color on Braintree’s growth we only have qualitative info on PPCP, though we know 20% of Legacy TPV has been replaced through partnerships with Shopify, Adobe, and Tiktok and this will also grow volume, along with other channels partners and their inside sales force that has been starting to include/sell. Along with this, the great thing about PPCP is that when these millions of SMBs through channel partners use it, they are automatically branded checkout integrated.

Other Value-Added Services Segment (non-transactional interest revenue)

Before talking about BNPL’s growth over the last two years, I want to first talk about the Other Value-Added Services segments which consist of interest on consumer balances, consumer loans/receivables, and merchant loans receivables.

The consumer balance interest is what you would expect, as of Q1 2023, they have $39.03B in funds payable with that being backed by a combination of AFS debt securities with current durations, cash and equivalents, and CDs all producing interest. The Consumer loans are BNPL installment loans of $6.1B. The $2.1B in Merchant loans are working capital loans largely to SMBs.

In Q1 2023, OVAS revenues were $676M with it being $2.312B in 2022. OVAS growth should be at least 20% if not more. As of current, the coverage ratio for consumer and merchant loans is 7.8%, with the company starting efforts to externalize its portfolio.

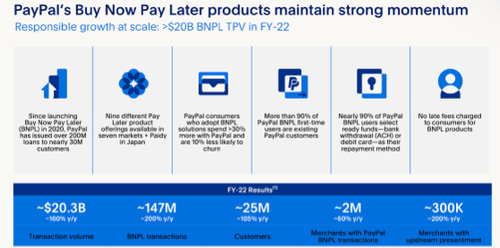

Buy Now Pay Later Model and Growth

The standard model for BNPL players like Klarna, Afterpay, and Affirm (AFRM) is to get their sales team to target merchants, show them a solid uptick in conversion, and then they make money from a fixed fee.

This is where PayPal has the advantage, they already have merchants with their unbranded processing and branded checkout. This allows them to have merchants who can just update their checkout integration with the BNPL feature at no cost. The benefit for the merchant is they can often drive 30% higher conversion rates and volume in transactions without having to pay more besides the branded checkout fee increasing at the same fee %, which is PayPal’s benefit.

PayPal

PayPal has continued to take share with them having $6B in TPV in Q1 2023 making them #2 or #3 (tied to Afterpay and behind Klarna), though for PayPal, it just adds nice incremental volume.

Acquisition History and Future

Though there haven’t been any really recent acquisitions, PayPal before being a part of eBay and after has a long list of acquisitions (20+) so I will only mention a few.

As mentioned already, Braintree and Venmo were acquired in 2013, iZettle and Xoom for POS and P2P remittance, Hyperwallet for merchant payments, and Paidy for Japanese BNPL. Though some of these have been at questionable valuations, many of them are integral parts of the PayPal platform.

Cost Reduction and Efficiency Initiatives

Over the last year, similar to many other tech companies, PayPal has undergone cost reduction and workforce reduction initiatives. In August 2022, they identified $1.3B of cost savings and an additional $600M of incremental savings, equivalent to a likely 10% decline in non-transactional OpEx.

This is, of course, great, but management is also saying that non-transaction OpEx will continue to go down over the next couple of years as products get better, less customer support is needed, and AI helps through better chat bots, automated regulatory compliance, and quality assurance along with legacy infrastructure being replaced (sunsetting PayPal Pro and branded checkout replacement with channel partners).

Overall, I believe an assumption of beyond 2023, LSD to MSD increase of non-transactional OpEx over the long-term as these initiatives are very likely to come to fruition as they are reasonable and actively being achieved.

Management

Over the last year, there have been significant moves occurring in the management of PayPal. In April of 2022, after 7 years at PayPal, CFO John Rainey departed from the company and became the CFO of Walmart (WMT), largely due to pay/prestige reasons. After him, Blake Jorgensen was recruited, but by September, due to health reasons, he took a leave of absence and SVP of Corporate Finance Gabrielle Rabinovitch has been Acting CFO and Treasurer since.

Next after a tumultuous last year through a successful last 8 years, Dan Schulman CEO announced his retirement with him officially leaving by the end of 2023 with the company currently headhunting, which I view as a positive.

Along with this, on a minor note, the CAO and CPO left but were replaced by qualified people and all of these departures were career driven, not due to PayPal culture.

Executive Compensation

For the sake of shareholder alignment though, let’s discuss their compensation and incentive plan. LTIP is the most important with it being based on FCF CAGR and Revenue CAGR with the former being good, but I think a better measure to dissuade senseless acquisitions would be ROIC. Overall though, compensation is pretty fair.

Valuation

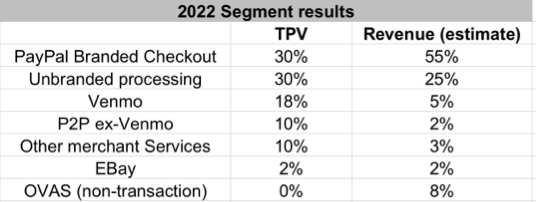

The fact is that a lot of this analysis has been more holistic due to the fact not much is released directly on segmented revenue and contribution. As such, I don’t believe a DCF analysis would be wise, though here is my rough estimation of revenue segmentation:

PayPal

TPV stands to grow in the HSD to low teens in the long term with earnings a bit higher due to margin expansion from cost reduction and unbranded/Venmo initiatives. Here is the comparative analysis used to derive a valuation:

-

Legacy merchant services/acquirers — legacy payment processors/gateways that simply leverage and acquire payment companies thus resulting in them having LSD/MSD organic growth rates. There are 3 public: FISV, GPN, & FIS. The average NTM EV/EBITDA multiple ranges for these companies is 9x-11x over the last year, though pre-COVID, they were more in the 12x-14x range

-

Card Networks – MA and V are payment duopolies connecting banks to merchants/consumers which is no doubt stronger than PayPal’s model and with almost no competition, but PYPL still is asset-light with a high ROIC. V/MA both trade at an average NTM EV/EBITDA range of 20x-22x over the last year and in similar, wider (18x-25x) ranges pre-COVID

-

E-commerce payment processors – Unfortunately only Adyen and another small player Nuvei (Nuvei) (more in-person skewed) are public for comparison, with Adyen being a direct competitor to Braintree. Adyen’s NTM EV/EBITDA has fluctuated a lot over the past 5 years in the 40x-90x range, with it being 40x-50x range over the last year

The fact is that PayPal in its current state is a mix of the latter two, though critics believe that PayPal will end up like the legacy acquirers in the near future. Clearly as shown, this is extremely unlikely considering the growth opportunities ahead in almost all segments.

Management has put an intentionally low starting guidance of operating margins expansion of 100BP-125BP, revenue growth for 2023 & 2024 expected to be in the MSD to HSD, FCF of $5B for 2023 ($4B before SBC added), 2023 Non-GAAP EPS of $4.95, and GAAP EPS of $3.42 (PYPL Q1-23 Investor Update).

I modeled a more realistic scenario that barely even considers likely profitability initiatives and focuses more on reasonable revenue growth of 9.52% (“calculations not shown”);

-

The result of this is a 2023FY Non-GAAP margin expansion of 300BP relative to 2022FY, still 50BP lower than 2021FY

-

EBITDA of $6.6B and GAAP EPS of $3.70

As of current, the market cap is $74.1B and the enterprise value is $76.4B as of the June 20th, 2023 close. This gives a 2023 EV/EBITDA multiple of 11.5x, 18.6x 2023 GAAP earnings multiple, or a more accurate 2023 FCF/adjusted GAAP multiple of 17x.

The fact is that after 2023, profitability initiatives will begin to reap their benefits, and earnings are expected to grow in the 10%-15% range over a long amount of time as the secular trend of e-commerce continues. Through looking at peer multiples and at periods where PYPL was seeing similar levels of growth versus efficiency in 2015-2017, a conservative/base case of 16x 2023 EV/EBITDA equivalent to 23.5x FCF. This is a share price of 92.5 (adjusting for buybacks) or a 35% short-term upside. Remember, these are using pretty conservative estimates for 2023 and earnings growth beyond 2023 will be higher in the low teens most likely.

Catalysts

-

Improved earnings and beating guidance – the fact is that earnings will continue to improve and management set guidance low in order to not over-promise. As earnings growth goes from MSD to HSD, then ending up in the low teens for a good amount of time, PayPal should be related and the strength of its model recognized.

-

BNPL externalization – a funny coincidence that on Thursday, June 22nd as this was being written/published, KKR agreed to buy PayPal’s European BNPL portfolio and future originations in many European countries leading to buybacks planned for 2023 going from $4B to $5B. Definitely nice to see as 30% of BNPL is from the EU and the total value of promised originations is $40B or roughly 6 years at current origination levels.

Risks

-

E-commerce – The secular growth trend of e-commerce doesn’t grow as much as expected. I don’t view this risk as having really any significance given that only 15% of retail sales are e-commerce leaving a long pathway for e-commerce to take more share.

-

Competition – though already discussed, PayPal faces a significant amount of competition. The fact is, though, that PayPal has the highest acceptance rate of any APM and continues to grow its user base. Along with this, Braintree’s growth and lower competition compared to the branded segment mean that merchant growth will continue and checkout integration will occur.

-

Management – the fact is that as of current, the management team is in kind of a glut, but one factor I view that gives me hope is that the strategic vision will be kept as current management and board sees this as a priority for a candidate.

Conclusion

Overall, this upside of 35% is conservative and doesn’t give sight to the fact that PayPal is a long-term compounder. As PayPal develops over the coming years, its growth should resume in sync with the long-term secular trend of E-commerce as it monetizes its unbranded processing and Venmo segments significantly, resulting in its strong 2-sided network economic moat and business model growing even stronger.

Analyst Recommendation by: Blake G. Skolnick

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.