Summary:

- Nike’s stock valuation may limit its upside in the near term due to challenges in the global economy and slowing growth in China.

- The company’s strong brand name, pricing power, and customer loyalty contribute to its premium valuation and limit its downside, but its PEG ratio of 5.11 suggests limited growth potential.

- Investors can consider various options strategies, such as selling put spreads, calendar put spreads, broken butterflies, or covered call spreads, to potentially profit from Nike’s current situation.

winhorse/iStock Unreleased via Getty Images

Nike, Inc. (NYSE:NKE) is one of America’s most iconic companies and it fully deserves its place in Dow Jones Industrial Index (DIA) which houses the top 30 industrial companies in the US. Meanwhile the stock’s current valuation could limit its upside in the near term especially considering the challenges in the global economy.

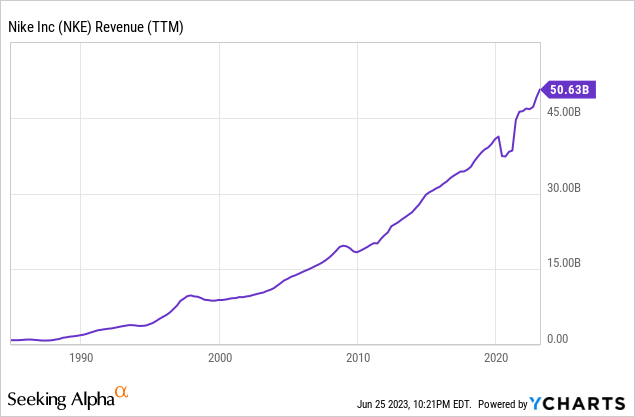

One thing Nike has shown over the years is that it can keep growing its revenues through thick and thin and it enjoys such a tremendous pricing power driven by its strong brand name that it can usually pass its higher costs onto customers without much problem. On the other hand, the company is trading at a P/E of 31 while the global economy is slowing down and China’s comeback hasn’t been as robust as people thought it would be. This is very important for Nike since the company has relied so much on China for its growth over the last 3 decades.

Last quarter when the company announced its earnings, its revenues in China were down -8% year-over-year or up 1% in constant-currency basis. The management acknowledged that this was less than ideal but they were very hopeful about the future especially with China’s economy reopening from extended COVID restrictions. As a matter of fact, economists were all hopeful about prospects of the new Chinese economy but so far it failed to deliver the growth people were looking for. Since China is the world’s production house, its problems might not be local. If demand for goods made in China is slowing, this could signal a global problem. This wouldn’t be surprising either since central banks around the world have been tightening money supplies for the last year and half in order to combat inflation across the world.

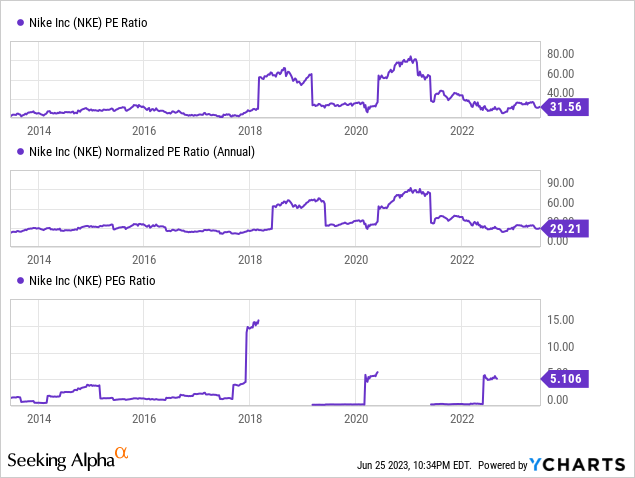

Even though Nike’s stock has been underperforming lately, it still hasn’t sufficiently priced in the slowdown in company’s growth rate. Currently Nike trades for a P/E ratio of 31.56, normalized P/E ratio of 29 and PEG ratio of 5.11. The last metric (PEG ratio) is particularly important because it looks at a company’s PE ratio in relation to its growth. You want this metric to be ideally below 1 but absolutely not much above 2.

This doesn’t mean the stock will crash or that you should short it though. Nike almost always trades at a premium valuation because investors appreciate “stickiness” of its business model. The company has a very strong brand name, solid pricing power and high customer loyalty so it’s unlikely to trade at a low P/E ratio anytime soon but its upside might be limited in the future due to its high valuation coupled with slowdown in its growth we are likely to see this year mostly driven by a slowdown in global economy as well as one in China.

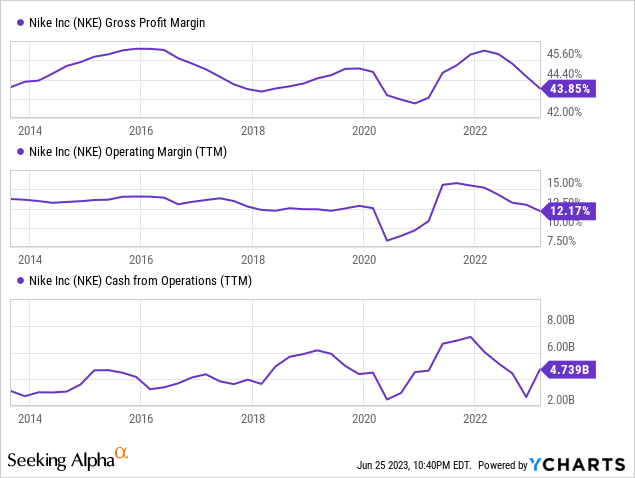

We can clearly see the effects of Nike’s strong brand name and pricing power when we look at the company’s profitability metrics. With its gross margins in mid 40s and operating margin in 12%, the company was able to generate $4.74 billion from its operations in the last 12 months. It may look like the company’s margins are down from last year’s all time high but they are only slightly down from last year’s 45%. As a matter of fact, the company’s gross margins have been in a tight range between 43% and 46% for much of the last decade and it’s been pretty stable over the years because it can usually pass its higher costs onto customers by raising prices and people still seem to buy their products.

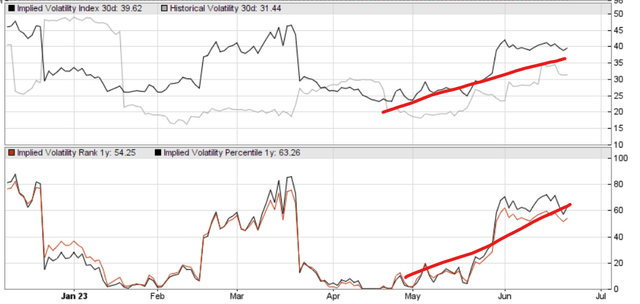

While I think the company’s long term prospects are excellent, I believe there is limited upside in the near future. I am also seeing limited downside unless last year’s bear market makes a big comeback. If that were to happen, all stocks would see significant downside and Nike would be no exception. I am also seeing implied volatility in Nike’s options rising recently even with overall market’s implied volatility (measured by VIX) is heading to multi-year lows. This could be a good time for some investors to sell NKE options contracts in order to take advantage of the situation.

Nike’s implied volatility history (Volafy.net)

There are a few plays investors can make depending on their risk profile and appetite. It also depends on if you want to hold the stock in the long term or not because if any of these plays go against you, your option might get exercised and you might find yourself holding the stock which you shouldn’t mind if you are bullish on the company’s long term prospects like I am. Now let’s dive into our option play options (no pun intended).

Option 1: Selling put spreads

Currently the stock trades at $109 per share and you can sell $90-100 put spreads expiring in June 2024, which is a year from now. You’d get a credit of $260 per contract for a total risk of $740 per contract. If NKE is above $100 a year from now, you get to keep all of $260 which is a 32% return on investment based on your risk. If the stock drops below $100 and stays there, you can either roll your options lower at a later date (such as $80-90 put spreads for 6 months later) or you can wait to be exercised if you don’t mind owning NKE shares at a price below $100. You can also get exercised on your short put and keep writing covered calls to bring your breakeven price lower over time.

Option 2: Selling calendar put spreads

This is very similar to our first option but with a twist. We still sell June 2024 NKE puts with a strike price of $100 but instead of buying $90 strikes of the same date, we actually buy $90 strikes for an earlier date, such as January 2024, turning our play into a calendar spread. Why? Because it’s cheaper which means we get to keep more of our premium. Instead of paying $4.75 per share for our $90 contract expiring in June, we are paying $3.10 for the same contract expiring in June. This increases our maximum gain from $260 to $420. Similarly our profit profile also changes. Let’s say the Nike reported horrible results and the stock suddenly crashed to $75. If we had just sold Nike put spreads, we’d suffer the maximum loss of $740 per contract but in this play we would lose a lot less. Why? Because if the stock suddenly crashed like that, time value of our options would drop close to zero almost immediately and since the time value of the option we sold was $420 higher than the time value of the option we bought, it would cushion a lot of the drop. Instead of our position being down $740, it would be only down about $300.

This play would also require us to either close our position early or roll the long position for another 5 months once January comes though because our short and long options have different expirations and we don’t want to be without a coverage once January comes.

Option 3: Broken butterfly

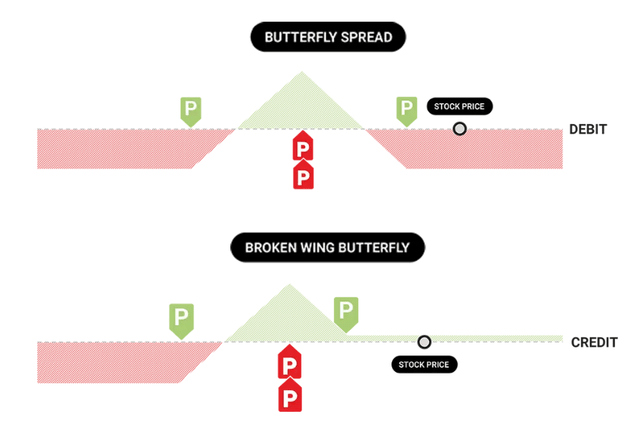

This is actually what I am personally doing right now. Basically you sell 2 call options near the current price, buy 1 call option deep in the money and also buy 1 call option out of money. This creates 2 call spread positions on top of each other. If you want to make a fully neutral position you build your spreads with equal width but if you are slightly bullish, you build them with unequal width. What do I mean by that? When you are building an iron condor, iron butterfly or similar positions, your width is the same with your bullish and bearish side. For example, if you were doing this for Nike, you’d sell your options at $110, and buy options at strike prices of $80-140 which would create two wings with width of $30 ($80-$110, $110-$140). This would be a totally neutral position where you benefit if NKE stays between $80 and $140.

Broken butterfly play (Tastylive.com)

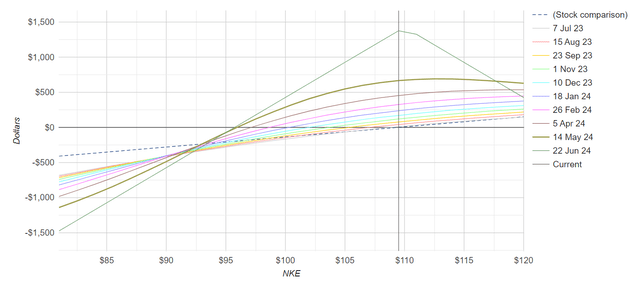

Here we are creating a “broken” butterfly with unequal widths so we are keeping the width of the bearish side of the play shorter so our play is slightly bullish. So we still sell 2 $110 call options, buy 1 $80 call option but instead of also buying a $140 call option, we are buying a $120 call option. So now one side of our play is $30 wide while the other part of our play is only $10 wide. This creates a slightly bullish position where we benefit if the stock rises slightly, stays flat or even drops a bit. For example if the stock rises to $140, we make $425 per position. If the stock stays flat, we make $1,425 per position. If the stock drops slightly to $100, we make about $420 per position. The worst case scenario for us is if the stock drops well below $90. If it were to drop to $80, we could lose up to $1,500 but that’s if we don’t adjust our play or make any modifications.

Profit-loss profile for NKE options play (optionsprofitcalculator)

When you make this kind of play you also have to pay attention to IV of the stock though. Earlier I mentioned how NKE’s implied volatility has been on the rise lately. If the stock’s IV were to suddenly drop 20% overnight, this play would immediately turn a profit of $100-150 per contract but similarly if the stock’s IV were to climb 20% overnight, the play could lose a similar amount. Since the stock’s current IV profile is above its historical average and IVs tend to regress to the mean over time, a drop in IV is more likely than a rise in it though.

Option 4: Covered call spreads

There is yet another play investors can make. I am not talking about plain covered call but a covered call spread where you buy 100 shares of a stock, sell a call option slightly out of money and buy another call option further out of money. This is different from straight covered call because it allows you to actually partake in surprise upside moves. For example, if you bought 100 shares of NKE at a price of $110 and sold 2024 June covered calls at a strike price of $120 for $10.20, your upside would be very limited and you wouldn’t be participating in any upside beyond $120. If you woke up one day and NKE trades at $150, you’d miss out on all those gains. Instead if you bought 100 NKE shares and sold $120 calls at $10.20 but also bought $130 calls at $6.70, you are still collecting a premium of $3.50 but this time participating in any upside above $130 so if the stock were to suddenly climb to $150, you’d participate in $20 of that move even after collecting your premium.

There are many other options plays investors can do in this stock while waiting for Nike’s earnings to catch up to its valuation. I wouldn’t recommend these options plays for anyone because you might end up holding a stock that you might not believe in for the long run. Only do one of these plays if you believe in the company long-term future and don’t mind holding it for a long time if it came to that. The goal of these plays is not necessarily to benefit from short term movements but to create a cushion where we can either have more downside protection or boost our long-term gains by creating our own dividends along the way.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NKE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.