Summary:

- Nike has a bearish-leaning setup into Q4 earnings this week.

- I’m looking for progress on comparable sales, gross margins, and SG&A costs, but the bar to clear is high.

- I’m neutral going into the report, but the odds are that this resolves in a bearish manner.

Robert Way/iStock Editorial via Getty Images

Shoe legend Nike (NYSE:NKE) is set to report earnings this week, and the stock is heading into the report on the backfoot. Nike’s had its fair share of revenue and margin challenges, so when the report comes out, there’s a handful of things I’m looking for. But before we get to that, let’s take a look at the technical setup heading into the release.

The last time I covered Nike was heading into the Q2 report, and I called it a hold. The stock has risen about 5% since then, losing to the S&P 500 by about 8% over the that period. Today, I’m reiterating my position that Nike is likely to be a poor relative performer for the foreseeable future.

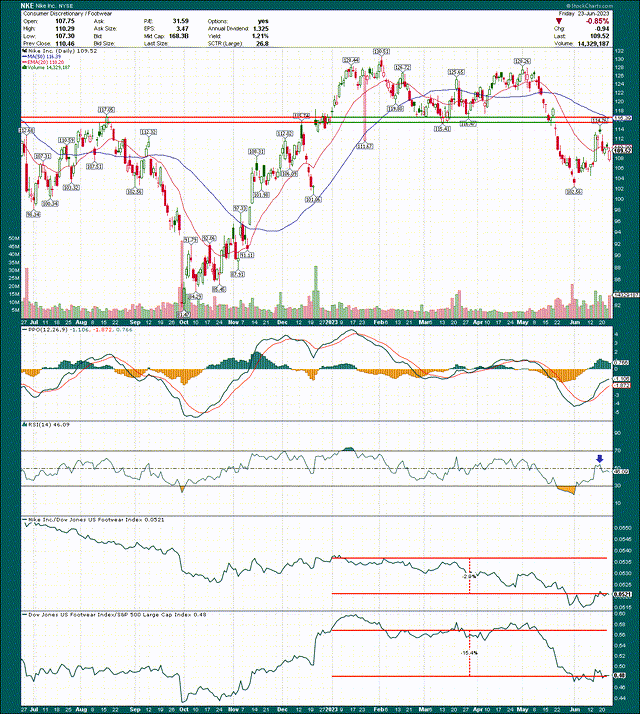

A key breakdown yet to be resolved

While anything can happen with an earnings release, the overwhelming majority of evidence for Nike is that of weakness. The key zone of support in the mid-$110s was lost in May, and the stock has been weak since. Unless and until that level is crested, Nike is going to struggle, and it certainly looks to me like this is the start of a downtrend after major support was lost.

The moving averages are both headed lower, and the 20-day exponential moving average is below that of the longer 50-day simple moving average. In addition, the PPO remains well below the centerline, and the 14-day RSI is going oversold before relatively weak bounces. The last bounce fell away at about 60 on the RSI, all of which adds to the bearishness.

Finally, relative strength has been pretty awful thus far in 2023. The footwear group was really hot at the end of last year, but that has eroded since the beginning of May. The group is off 19% against the S&P 500, while Nike is also losing to its peer group. The bottom line here is that I don’t see a lot of cause for optimism, as it appears Wall Street is looking for a report that’s not particularly bullish. We’ll see, and if the mid-$110s zone of resistance is cleared, there will be room for the bulls. That’s not my base case, but if it’s a great report and a good reaction, we’ll have something to talk about.

What I’m looking for

There are three key things Nike needs to show progress on, in my view, for the bulls to gain some traction. First, comparable sales drive the top line. Second, gross margins show whether the company has enough pricing power to overcome input cost inflation and supply chain issues. And third, SG&A costs, which were out of control for a long time, have improved recently, and I’d like to see cost discipline remain in place.

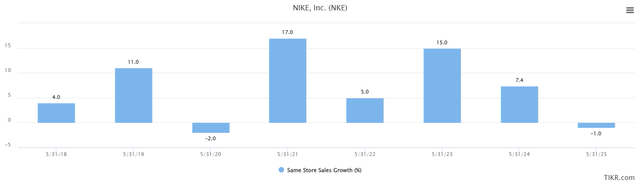

Comparable sales have always been quite volatile for Nike, as we can see a +11% in 2019 followed by a -2% in 2020, only to see a +17% the next year. Fiscal 2023 – which ended on 5/31 – is expected to see a gain of 15%, so that’s the target for the full year when Nike reports. If actuals are better than that, the bulls will have something to latch onto. If not, well, you know.

Actuals for FY2023 are important, but perhaps more important is any guidance we get for the top line for FY2024, which has been underway for about a month. Current expectations are for +7.4% comparable sales, so that’s the target, and if we get cautious guidance on weak consumer spending, the stock is likely to see more selling.

Gross margins were pretty awful in the Q2 report, coming in at 43.3% of revenue, off a staggering 330bps from the year-ago period. This was due to markdowns to liquidate inventory, unfavorable forex rates, higher input costs, and higher freight and logistics costs. The company put in some pricing actions to help combat this, but it clearly wasn’t enough.

Now, higher freight and logistics costs almost certainly haven’t gotten any better in the last three months, and input costs are likely to remain a headwind as well. The key here is commentary on markdowns to liquidate old inventory. If the worst is past in terms of inventory reduction, that’s a big headwind removed for the stock. Nike’s gross margins were a major weakness in FY2023, but as we can see, analysts are looking for a rebound.

We’ve seen volatility in gross margins, just like comparable sales, but the issue here is that analysts are already pricing in gross margins rising to 45.3% for FY2024. That’s a ~170bps improvement that is the baseline for Nike to hit; surprising meaningfully to the upside will take a 200bps move or better. That’s a big mountain to climb but it’s possible, so long as the inventory position has been worked through. That’s why gross margins are critical for the Q4 report, and why investors should keep a keen eye on inventory/markdown guidance.

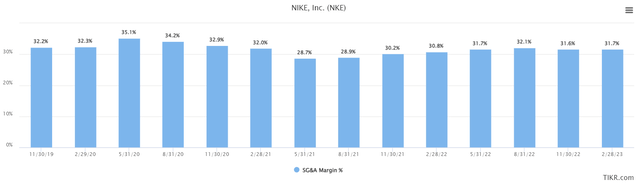

Finally, I mentioned SG&A costs, which I’ve long held as a major reason I was generally not particularly keen on Nike shares in the past. However, the company has turned a corner, as evidenced below.

SG&A has settled in the low-30s as a percentage of revenue, which is sustainable. It also affords low-double digit operating margins with gross margins in the mid-40s, so it’s fine. This, however, is another area that is critical for profitability, and we need to see what management thinks in terms of spending against what should be rising revenue into FY2024. Cutting costs is just as effective as boosting gross margins in terms of growing profits, so actuals and guidance here are quite impactful.

A middling valuation leaves shares fairly valued

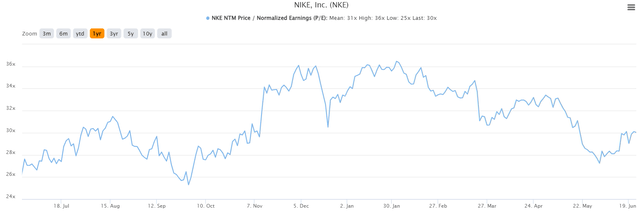

Nike has immense competitive advantages, and a long history of capitalizing on those advantages, so its valuation is never “cheap” in the traditional sense. The stock rarely trades below 25X times forward earnings, and today is no different.

For the past year, which represents somewhat normalized post-COVID conditions, shares have averaged 31X forward earnings. Heading into the report, we’re looking at 30X forward earnings, so it’s neither expensive nor cheap. That in and of itself is fine, but given the weak chart, and the fact that the major fundamental elements (revenue, gross margins, SG&A) are not looking so great, I’m leaning towards the risk being skewed lower here, not higher.

If we take that assumption, along with the discussion points above, it will take a strong report to turn the tide here for Nike. I’m sticking with a neutral rating for now but if this report comes in weak, and doesn’t drive the share price over the mid-$110s resistance level, I’d be much more willing to flip to a sell rating. It would take a huge amount of positive news to turn Nike bullish, and while that’s certainly possible, the probability is low enough in my view that I’m not interested in owning it heading into the report; better to let the dust settle and reevaluate.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you liked this idea, sign up for a no-obligation free trial of my Seeking Alpha Marketplace service, Timely Trader! I sift through various asset classes to find the best places for your capital, helping you maximize your returns. Timely Trader seeks to find winners before they become winners, and keep you out of losers. In addition, you get access to our community via chat, direct access to me, real-time price alerts, a model portfolio, and more.