Summary:

- The bioprocessing market is currently in a downturn and pulling companies like Danaher and Sartorius down.

- Danaher has a clean balance sheet to make good deals in this downturn.

- Margins have temporary headwinds but should recover in 2024.

- At the current price, Danaher is an attractive opportunity for the long-term.

Feverpitched

Last week, German bioprocessing player Sartorius (OTCPK:SARTF) shocked the bioprocessing and life sciences market by significantly lowering its 2023 forecast, further intensifying the worries about the challenging environment for the sector. Cited reasons were the general weak demand dynamics, longer-than-expected lasting reduction in inventories among biopharma customers and low investment activities. Bioprocessing sales were revised from high-single-digit growth excluding Covid revenues to a high-single-digit to teens decline. At the same time, the EBITDA margin was changed from 35.7% to 31% due to lower volume expectations. This shot the stock down around 20% but also dragged down peers like Danaher (NYSE:DHR) and Thermo Fisher (TMO) by a few percentage points.

I have been an owner of Danaher for three years and have covered the stock for the last year. If you want to read my prior coverage showing why Danaher is a high-quality business, check out my previous articles. This article will therefore focus on Danaher and how it is affected by the bioprocessing downturn.

Danaher declining sales

In Q4 22, Danaher split its Life Sciences business into two reporting units: Biotechnology and Life Sciences. Biotechnology had a -1% revenue decline (4% core growth), while the overall company had 2.5% growth (7.5% core growth). Danaher expected Q1 23 to see mid-single-digit base business growth with a 30% operating margin.

It turned out that Q1 23 was worse than expected and saw a 7% overall revenue decline (4% core revenue decline) and an operating margin of 25% instead of 30%. The decline was driven by Biotechnology down 16% (13% core revenue decline) and Diagnostics down 10% (7.5% core revenue decline) and operating margins for these segments down mid-single-digits year over year. Q2 and full-year guidance were largely unchanged on a revenue basis, but the operating margin for the full year was lowered to 30% from 31%.

Management offered a lot of commentary regarding the situation in its earnings call. Emerging biotech companies largely drove the decline in the early stages of development. Many of these are pre-revenue and rely on outside funding from venture capital or the stock market to operate and invest in R&D. As the macro environment changes, money isn’t flowing as easily to these companies and they had to scale back investment. These players represented 20-30% and were down mid-teens. This is in line with Sartorius, which is more of a bioprocessing pure play and they felt the pain of this development a lot more. On the bright side, Danaher’s large account bioprocessing customers grew mid-single-digits in the quarter.

Destocking is another issue. Due to the macro turning, working capital management is gaining importance and companies are more careful restocking. Destocking has taken longer than expected, but this is a temporary issue. 75% of Danaher’s medical business is recurring, and customers need to return to operate their devices.

Margin opportunity

Covid was a tailwind for many healthcare businesses and Danaher also profited well from it. As Covid evolves from a pandemic to an endemic, we had to expect a scaling down of operations and margin compression. Danaher gave a few examples of the margins pre covid, during covid and what they expect going forward:

| Pre-Covid | During Covid | Post-Covid | |

| Cepheid | 20-25% | 45%+ | 35-40% |

| Biotech | high 30s | 45% | low 40s |

Danaher managed to push out a large installed base thanks to covid that will keep benefiting them as customers continue to use these products in other applications. According to the Bank of America (BAC) conference, Cepheids installed base more than doubled to 50,000 devices today and consolidates other platforms:

And, we see customers consolidating other platforms onto the GeneXpert platform, because of its ease-of-use, and, you know, its turnaround time on the right answer.

Rainer Blair, Danaher CEO

Danaher’s large competitive advantage is its ability to adapt and improve a little bit daily due to its DBS (Danaher Business System). The company is using the opportunity to enhance its supply chain and align capacity to better locations. Covid made them rush expansion, but now they can improve it. In the long term, this should lead to margin improvements. This realignment will cost a few hundred million in the short term, further depressing margins for this year.

An improving M&A playing field

Ever since the company was founded by the Rales brothers in the 80s, the company believed in expansion by M&A. Through Covid, Danaher was pretty quiet regarding acquisitions, with the only significant deal being the $9.6 billion Aldevron deal. Prices were high and that made Danaher less interested. To quote Rainer Blair from the BAC conference:

But it’s important to note, and I’d like to say it as often as possible, we stay with our discipline of attractive end markets, assets within those end markets for which we can either acquire or create a competitive advantage for the long-term with that asset. And then, of course, the financial model has to work for us. And that continues to be our discipline.

The M&A team at Danaher is always looking for deals and conversations are getting more constructive than over the last years, but they are still not happy with the prices yet:

And as you think about the market environment that we’ve been in, it’s been more constructive, the conversations that we’ve had, had been more constructive than let’s say, 12 months ago. But I do think there’s still more to be done here in terms of aligning, you know, Board expectations with what the reality is from a valuation perspective.

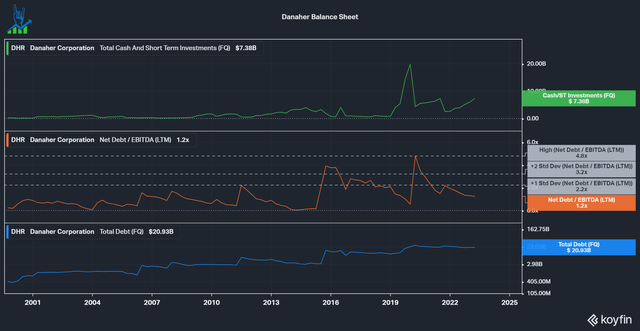

At just a net debt/EBITDA ratio of just 1.2 times, Danaher has a clean balance sheet and the optionality to do larger deals. In the past, Danaher often levered up to make acquisitions and then rapidly delevered again. The peak was 4.8 times levered in 2020 for the General Electric (GE) deal. If we use a range of 2.2 times (+1 standard deviation to the mean) and 3.2 times (+2 standard deviation to the mean), we could see them taking on up to $20 billion of additional debt for M&A. I expect some moves from Danaher during this downturn.

Danaher Balance sheet (Koyfin)

Danaher is a buy

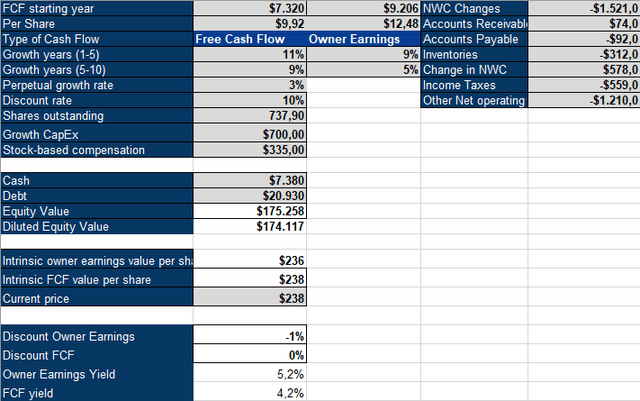

To value Danaher, I use an inverse DCF Model using traditional Free Cash Flow and Owner Earnings (Free Cash Flow + Growth CapEx – stock based compensation +/- NWC Changes). Danaher would be required to grow Owner Earnings by 9% over the next five years, followed by 5% over the following five. Given the secular growth markets the business operates in (mid to high single-digit organic growth expected), potential margin expansion from DBS and capital deployment, I believe this to be fairly conservative. Danaher itself expects to generate low teens EPS growth over the cycle, which is a realistic goal. I have been aggressively buying Danaher over the last months and will continue to do so while the stock is attractive. Danaher is now my second-largest position at 11% weighting. I upgrade Danaher to a strong buy due to the attractive valuation and potential to consolidate business and acquire great assets during this downturn.

Danaher Inverse DCF (Authors Model)

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not financial advise.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.