Summary:

- Amazon will likely compete meaningfully in generative AI opportunities as a result of its large market share, high switching costs, commoditization of LLMs and its own AI chips.

- Amazon’s retail segment proved to be able to manage the macroeconomic headwinds as all parts of the business did better than expected.

- The retail segment is also contributing to operating margin improvement in the near-term due to the fulfillment center improvement and efficiency improvements.

- For AWS, commentary about April’s 500 basis points deceleration was the main worry, but I argue that the optimization we are seeing is industry-wide and temporary.

- My 1-year price target is $169, meaning that there is a 35% upside potential.

FinkAvenue

This article was first posted in Outperforming the Market on June 22, 2023.

I have decided to look into Amazon (NASDAQ:AMZN) again and position The Barbell Portfolio for any opportunity that might arise if the stock pulls back meaningfully. Earlier, I shared a review of the Amazon shareholder letter and another earlier article on the attractive buying opportunity we have with Amazon.

I also shared with members of Outperforming the Market that I will be waiting for the right opportunity to enter Amazon and will send out a Buy trigger alert if that were to happen.

This article will go deeper into the generative AI opportunity for AWS, as well as how the company is faring in the current macroeconomic environment given cloud spend optimizations and discretionary spending headwinds.

AWS able to compete on generative AI with Azure and GCP despite being late to the game

One question I get asked often is whether AWS is able to compete meaningfully against Azure and GCP on the generative AI opportunity.

I believe the answer to that is yes.

The common belief, and rightly so, is that Microsoft (MSFT) and Google’s (GOOG) currently available models are often seen as superior to that of AWS, and Amazon is coming from behind on Large Language Models (“LLMs”).

However, I will highlight a few points below:

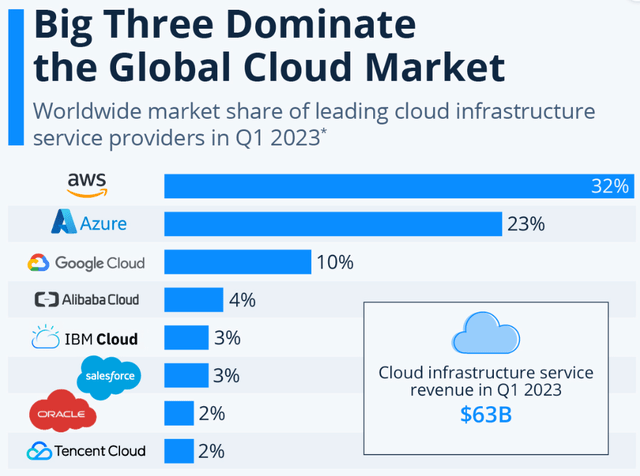

Firstly, as highlighted in the chart below, AWS has the largest market share position in the global cloud market. What this means is that its customers are already training on AWS and storing data with AWS. Hence, they are also more likely to use AWS’s generative AI products given the high switching costs.

Big three global cloud market share (Statistica)

Secondly, AWS has two chips targeting AI training and AI inference (Trainium and Inferentia). Both Microsoft and Google currently source their AI chips from Nvidia (NVDA), although Microsoft is rumored to be working on its own AI chip. When there is a chip shortage, this will limit competitors’ ability to compete and allow AWS to catch up to them.

Thirdly, while AWS has some work to do, my channel checks suggest that foundational models and LLMs could be commoditized, which will benefit AWS. This is because as models get more commoditized, there is less incentive for customers to switch from AWS to Azure or GCP.

What are some of AWS’ new generative AI offerings?

Firstly, there is Amazon Bedrock and Titan. I will elaborate more on Amazon Bedrock below. Amazon Titan makes two Amazon foundational models available to customers through Amazon Bedrock. One LLM works tasks like summarization, text generation, classification, open-ended Q&A, and information extraction. The other is an embeddings LLM that translates text inputs into numerical representations and is useful for applications like personalization and search since it produces better word matching.

Secondly, AWS has two chips that target AI training and AI inference, AWS Trainium and AWS Inferentia. AWS Trainium chip offers lower cost for training models in the cloud, while AWS Inferentia chips are focused on lower costs for running inference in the cloud. According to Amazon, instances based on Trainium are up to 140% faster than GPU-based instances at up to 70% lower cost, while Inferentia2 drives 40% better inference price performance than other comparable Amazon EC2 instances.

Lastly, Amazon CodeWhisperer is a machine learning-based coding tool that improves developer productivity by generating code suggestions. It provides 15 programming languages, including Python, Java, and JavaScript. It is integrated with several development environments, including VS Code, IntelliJ IDEA, AWS Cloud9, AWS Lambda console, JupyterLab and Amazon SageMaker Studio.

As a result of the large market share of AWS today, high switching cost, the likely commoditization of LLMs, and AWS’s AI chip advantage, I do think that AWS is able to compete meaningfully with Azure and GCP despite being slightly behind the two players today.

The next question is when will Amazon see the upside that Microsoft and Google are seeing?

I think the acceleration will come in the second half of 2023, particularly in the fourth quarter as that is when most of its generative AI products and solutions like Bedrock will be rolled out generally. By then, AWS revenue and growth should have stabilized, and this will bring incremental upside to the AWS business.

However, the near-term concerns around AWS continue to be about cloud spend optimization.

Optimizations continue at AWS but likely to be temporary and industry wide

In the 1Q23 earnings call, management had this to say about optimizations at AWS:

As expected, customers continue to evaluate ways to optimize their cloud spending in response to these tough economic conditions in the first quarter.

And we are seeing these optimizations continue into the second quarter with April revenue growth rates about 500 basis points lower than what we saw in Q1.

While 1Q23 revenue growth of 16% year on year ex-FX was better than expected (more on that below), the market’s focus was on the deceleration in April’s revenue growth by 500 basis points, which brings growth down to 11% ex-FX.

I would highlight that we need to see this 500-basis points deceleration in context. This 500-basis points deceleration is actually similar to the 400 to 500 basis points deceleration that Microsoft (MSFT) Azure expected in 2Q23.

As a result, I am of the opinion that the optimization pressures that AWS is facing is what the rest of the industry is experiencing as well and that there is no need for too big of a worry on the AWS deceleration we have seen.

As we move into the second half of 2023, I expect that growth rates could stabilize as we lap a full year of optimizations. In addition, Amazon stated that 90% of compute is still on-premises, while bringing strong long-term demand to Amazon.

In addition, growth could reaccelerate as Amazon has an opportunity with Generative AI and LLMs, with Bedrock and CodeWhisperer. Amazon Bedrock, which I mentioned above, was recently launched, and it is a managed foundational model service that helps customers to build and scale generative AI application with foundation models. Amazon CodeWhisperer, which I also mentioned above, is another game changer as it helps developers build applications faster and acts as their AI coding companion.

In addition, I mentioned this in my Amazon shareholder letter article, but the company’s Trainium and Inferentia chips are in their early days, which could add to the upside to the company. I believe that AWS already has a sizeable, if not significant AI and ML business.

One final upside on Amazon that I think the market is not pricing in is that I expect the reductions in headcount in AWS to drive and sustain margins in the following quarters to come.

This was evident in the 1Q23 results where AWS generated 24% operating margins, but after adjusting for the severance charge operating margins would have been 25% (which I will explain more on below).

This improvement in operating margins comes as revenue is decelerating, which highlights improving efficiencies at AWS.

Retail segment going strong

I think that the market has been expecting macroeconomic headwinds to impact the retail business negatively.

The better-than-expected growth in retail is one of the main surprises for me in the 1Q23 quarter because this was achieved despite the current macro headwinds.

This was said of the spending levels in its retail segment in its 1Q23 call:

We saw moderated spending on discretionary categories as well as shifts to lower-priced items and healthy demand in everyday essentials, such as consumables and beauty.

Management also highlighted easing macro pressures in Europe, while almost all segments from third party seller services, advertising and physical stores saw upside in the numbers, highlighting the conservatism baked into the consensus estimates.

On the margins for the retail business, the company is investing in delivery speed and transitioning to a regionalized fulfillment center network with its eighth region launched in March.

While this should result in more wallet share gains for Amazon’s retail segment and higher retail margins due to the more efficient model resulting in lower freight fuel costs due to shorter travel distances.

I think that we could see significant margin expansion from North America Retail going forward as efficiency has been improved over the past year or so.

Where is Amazon’s operating income headed?

I think we will see sustained operating income beats going forward.

Where will this come from?

The bulk of it, at least in the near-term, will come from the retail segment as efficiencies continue to improve. AWS could contribute to this more meaningfully as demand stabilizes in that segment.

In addition, Amazon has reduced its corporate headcount by 8%, improved on its fulfillment center network, optimizing its portfolio of businesses, which will help with Amazon’s margins going forward.

Also, capital expenditures are expected to decline from 2023 as management intends to reallocate the capital spend from areas like fulfillment center and transport spend more towards AWS infrastructure, generative AI and LLMs.

Strong overall results

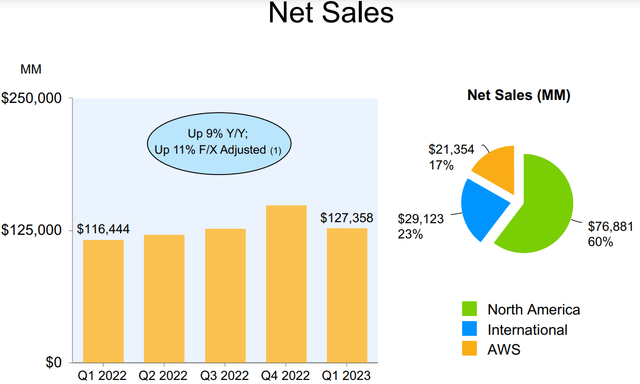

Amazon’s overall revenue for 1Q23 came in better than expected at $127 billion, which implies 11% growth from the prior year excluding the effects of FX. This was 2% higher than consensus.

Amazon 1Q23 presentation (Amazon IR)

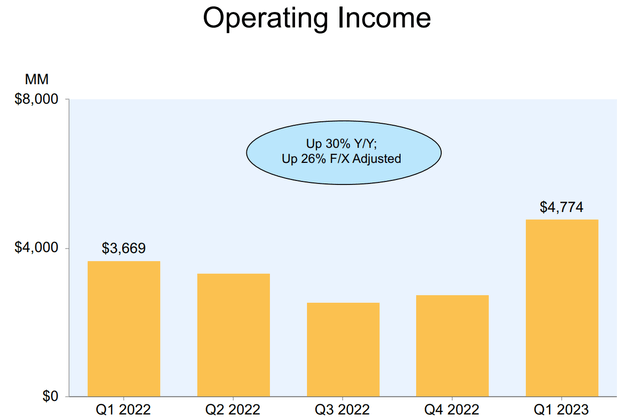

In addition, the overall operating income was also solid, coming in at $4.8 billion or implying a 3.7% margin.

This was almost 20% higher than the high-end of the operating income guidance of $4 billion.

To be clear, this includes $500 million in severance costs, so excluding those costs would imply a beat of more than 30% for operating income.

The beat in operating income came from AWS and North America Retail, as well as lower losses than expected for International Retail.

Amazon operating income (Amazon IR)

As a result, the GAAP EPS reported for 1Q23 was also a strong beat, coming in at $0.31 compared to the consensus expectations of $0.21.

Retail segment was firing on every cylinder

In the retail segment, there was a beat across every segment.

North America Retail revenue for 1Q23 was $77 billion, growing 11% from the prior year, 2% above consensus while International Retail revenue was $29 billion for 1Q23, up 9% from the prior year ex-FX, which is 5% above consensus.

In terms of the respective line items, third party seller services revenue came in at $30 billion, 4% above consensus while online stores revenue came in at $51 billion, 1% above consensus.

In addition, physical store revenue came in at $4.9 billion, 2% above consensus and advertising revenue came in at $9.5 billion, 5% above consensus.

AWS growth deceleration likely could still be a worry for the market

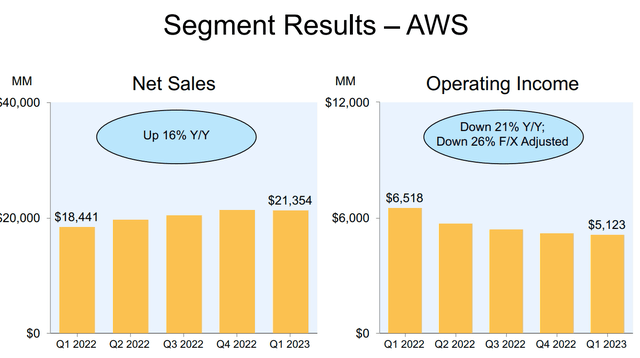

For AWS, 1Q23 revenue came in at $21 billion, up 16% from the prior year ex-FX, which is 1% higher than consensus.

To note, consensus expectations were somewhat low in my view and the setup was favourable for AWS. AWS growth exited March at a 15% year on year growth rate.

AWS operating margins came in at 24% compared to expectations of 23%, and this figure includes the severance charges.

When we adjust for the severance charges, AWS operating margins were more like 25.3%, which means the beat in AWS operating margins were greater.

AWS segment results (Amazon IR)

Guidance somewhat in-line

The 2Q23 revenue guidance was in-line while the operating income guidance was slightly below guidance at the mid-point. Management guided for revenues to come in between $127 billion and $133 billion in 2Q23 and operating income to come in between $2 billion and $5.5 billion, while consensus expectations were at $4.45 billion.

Valuation

Amazon is trading at 13x 2024 EV/EBITDA and 48x 2024 P/E.

In the last ten years, Amazon has traded at an average of 18x 1-year forward EV/EBITDA and because its P/E has been highly variable, with the last 5-year P/E average at 139x.

I used the discounted cash flow model and my 5-year financial forecasts for Amazon to derive my intrinsic value, and thus, ideal entry price for the company, which can be found in my deep dive article.

My 1-year price target for Amazon is based on 18x 2024 EV/EBITDA. 18x EV/EBITDA is justified, in my view, given Amazon’s leading position in AWS and retail segments.

As such, my 1-year price target is $169, meaning that there is a 35% upside potential.

Conclusion

The near-term caution around Amazon surrounds its growth deceleration in AWS for April, and the overall underlying demand for the industry in general. I think we will see that the growth challenges cited in 1Q23 and most of last year as a result of optimizations are temporary and industry wide, which leaves me to conclude that this means that Amazon is trading at a much more reasonable valuation given even AWS is somewhat discounted through more pessimism in the price.

That said, I think we will see AWS become a beneficiary of the rise of generative AI solutions and LLM solutions in general, which could drive near-term upside on AWS.

In addition, the retail segment is holding up well despite the macroeconomic headwinds. More importantly, the margin upside that the retail business is driving is material and likely will drive the near-term operating margin upside for the overall business until AWS demand stabilizes.

My 1-year price target is $169, meaning that there is a 35% upside potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 51% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!