Summary:

- FTC has filed a complaint against Amazon that it used a “deceptive” web design to sign-up users for Prime subscription and made it difficult for them to cancel.

- Subscriptions are a major business segment for Amazon which contributes over $35 billion annually to the company’s revenue base.

- This complaint is likely to be a minor speed bump as it is usually very difficult to prove what is an easy or hard signup/cancellation process.

- At the current growth rate, subscription revenue should reach $100 billion by 2030 which makes this business a key driver for future valuation growth.

- Despite some regulatory challenges, Amazon stock is a good bet at the current price point as the company has a number of growth businesses.

4kodiak/iStock Unreleased via Getty Images

Amazon (NASDAQ:AMZN) is facing another FTC complaint which claims that the company “tricked” customers into signing up for Prime subscriptions and also made it very difficult to cancel them. The company has recently settled another complaint by FTC for $25 million which claimed that it was flouting kid’s privacy requests. The regulators are becoming more active against Big Tech companies and investors would need to keep this in mind before making a long-term bet on Amazon or other Big Tech companies. Amazon stock has shown a bull run this year despite a slowdown in AWS growth rate, as I mentioned in a previous article. The current regulatory issue will be a minor speed bump for the stock and we could see good bullish momentum in the near term.

We could see a long process before a final judgment is made in the recent complaint about Prime subscriptions. This complaint is very subjective because the cancellation process could be difficult for an 80-year-old grandpa while it might be easy for a 20-year-old college student. Amazon might need to make some changes in its signup/cancel process but this complaint is unlikely to cause massive fines. It should also be noted that the renewal rate for Prime membership is over 90% according to Bloomberg and other sources. It is unlikely that mere web design has led to such high renewal rates while other subscription businesses have a higher churn rate.

Subscription business is the key to building a strong economic moat for Amazon. The company is able to invest these resources in streaming video, logistics, and adding new services at discounted rates. At the current pace, subscription revenue should hit $100 billion annually by 2030. The FTC complaint will likely be a minor speed bump for Amazon with some changes in the web design for the signup/cancel process. Subscription business will continue to be a key pillar supporting better revenue growth and ecosystem for Amazon.

Increase in regulatory challenges

As the Big Tech companies become massive, there has been an increase in regulatory pressure across different geographies. Amazon has also faced numerous fines and complaints regarding its business practices. Some of these fines seem high but they do not have a significant impact on the bottom line for the company. The last update by Amazon revealed that there are over 200 million Prime members worldwide. It is likely that the company will face some challenges from regulators due to the massive customer base of this service.

Besides looking at the monetary fines, it is also important to gauge the impact of new regulations on the company’s business model. In the recent FTC complaint, the core business model of Prime subscriptions would not be negatively impacted. Amazon might need to change the web design for the completion of signup/cancel process. This is a minor change that should not change the long-term growth trajectory of subscription business.

On the other hand, we can see significant regulatory challenges for Apple (AAPL) within its App Store due to demands by regulators to allow third-party payment services. If Apple allowed third-party payment options, it would completely change the commission-based model for its App Store. This would also destroy a very high-margin revenue stream for the company.

Amazon is not facing any regulatory challenges which might hurt the core business model of the company similar to Apple’s App Store. We can also see that Amazon has less than 50% market share in most of the business segments where it operates. This includes AWS, retail, digital advertising, subscriptions, and others. Healthy competition in all these businesses should limit the need for greater regulations.

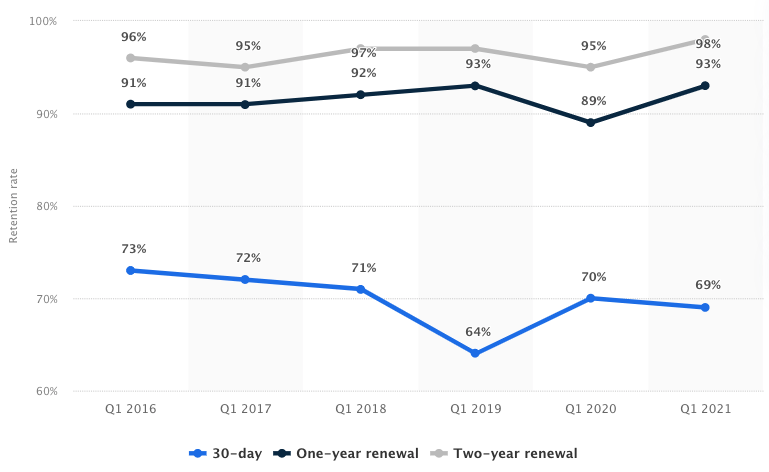

High renewal rate

One of the biggest advantages of Prime membership is the high renewal rate among members who have used the service for over a year. Bloomberg had earlier reported that the renewal rate could be higher than 90%. This renewal rate is likely to increase in the future as the company invests more in original content and adds new services.

Statista

Figure 1: Renewal rate for Prime membership. Source: Statista

A recent rumor about Amazon looking to give low-cost mobile service to its Prime members ended up causing a major correction in all the telecom stocks. This shows that Amazon has a number of options to increase loyalty within its Prime membership business. It is unlikely that Amazon achieves this level of renewal rate by mere web design which adds a few steps before the cancel process.

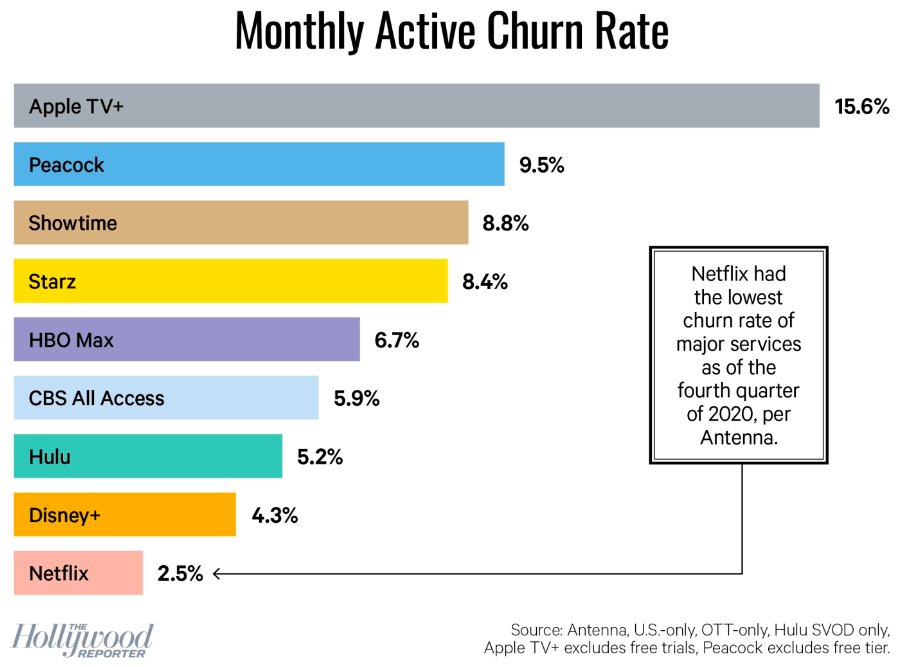

Antenna

Figure 2: Monthly churn rate in streaming services. Source: Hollywood Reporter, Antenna

We can see that the monthly churn rate of many streaming services is more than the annual churn rate of Prime. Many customers subscribe to a streaming service and then binge-watch the content they like before canceling the service. This hurts the streaming service as it needs to continuously invest in new content to attract more customers and retain current customers. Amazon’s Prime membership has a high renewal rate which helps the company invest over a longer horizon in its logistics and streaming services.

Road to $100 billion

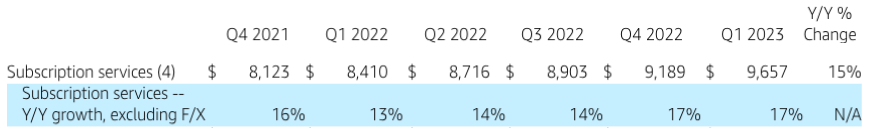

Subscription segment reported $35 billion in revenue in the last twelve months. At the current growth rate, the subscription business should reach over $100 billion in revenue by 2030. This is a massive recurring revenue base that would help Amazon launch new services and increase investment in its original streaming. We have already seen Amazon launch several high-budget series and this should continue in the next few years.

Amazon Filings

Figure 3: Growth rate and revenue of Subscription segment in the last few quarters. Source: Amazon Filings

Amazon can add a number of different services to keep the growth engine running for the subscription business. Even if the margin on new services is wafer-thin, a better value proposition of Prime membership can attract and retain more customers which creates a halo effect for its ecommerce business and other services.

Impact on Amazon stock

Wall Street has been calm over the recent FTC complaint on Amazon Prime. One reason is that these complaints take a long time to resolve. It is unlikely that there will be any material impact on the company’s subscription service in the near term. This complaint will not alter the business model for the subscription business in my opinion and we likely should see Amazon continue to invest heavily in new services and logistics.

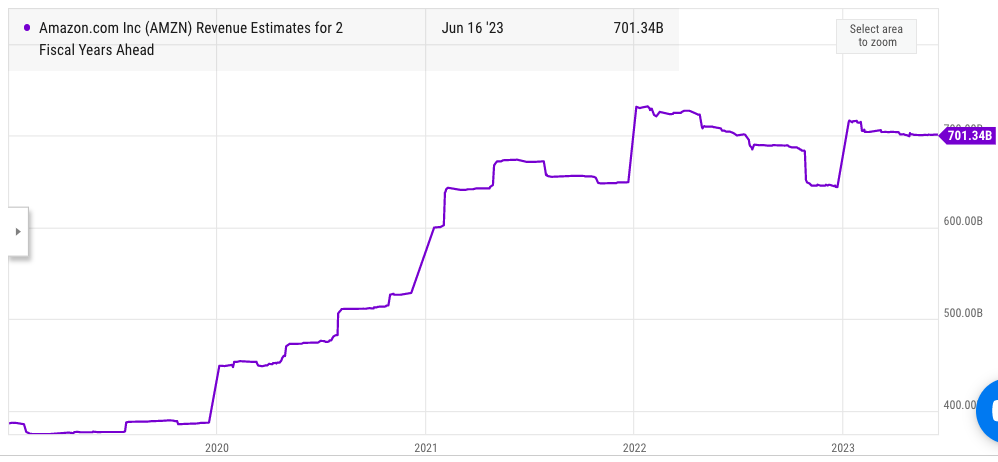

Ycharts

Figure 4: Revenue estimates for Amazon 2 fiscal years ahead. Source: Ycharts

The forward revenue estimates of Amazon are quite good and the company should cross $700 billion in revenue by 2025. The revenue share of subscription business is also growing steadily. Five years back in Q1 2018, Amazon reported $3.1 billion in subscription revenue on a total revenue base of $51 billion which equates to a revenue share of 6%. In the recent quarter, Amazon reported subscription revenue of $9.6 billion on a total revenue base of $127 billion which equates to revenue share of 7.5%.

Higher revenue share of subscription business allows the company to gain a recurring revenue base which can be invested in building long-term logistics and services. At the current trend, the subscription services should exceed 10% revenue share by 2030 making this segment a key growth driver for the company.

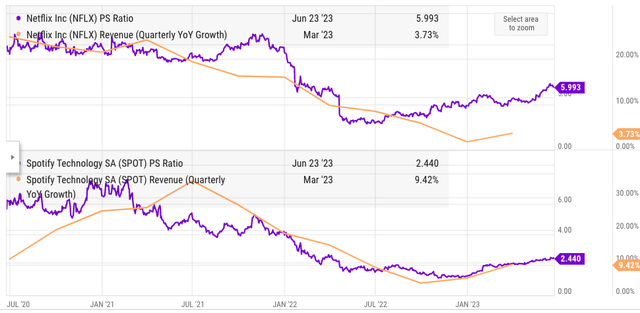

Figure 5: PS ratio and YoY quarterly revenue growth rate of Netflix and Spotify. Source: Ycharts

We can gauge the standalone valuation of Amazon’s subscription business by looking at other peers. Netflix (NFLX) has a PS ratio of 6 while Spotify (SPOT) has a PS ratio of 2.5. Netflix’s YoY revenue growth has dropped steadily and is close to 4% while Spotify is at 9%. On the other hand, Amazon’s subscription business reported 17% YoY growth rate. Amazon’s subscription business should also gain a higher valuation multiple as it creates a flywheel effect for other business segments which the company can monetize. Netflix and Spotify cannot do this and have only streaming business.

Even at a conservative PS multiple of 6, Amazon’s $35 billion in subscription revenue should have a standalone valuation of $210 billion. If we take a more optimistic multiple of 10 due to the flywheel effect and higher growth rate, then the standalone valuation of Amazon’s subscription business is as high as $350 billion or more than 25% of the total market cap of Amazon. This shows the importance of subscription business and the future contribution it can make in delivering a bullish momentum for Amazon stock.

Investor Takeaway

The final decision from the current FTC complaint is likely to take a long time. The complaint does not impact the core business model of the company. It is unlikely that any fines on the company will impact the key metrics. The subscription business is growing rapidly despite a large base. Amazon can also add new services like low-cost mobile services to attract new customers and increase loyalty to this service.

The renewal rate for Prime is the highest among all the subscription services giving it a massive edge over the long run. The subscription revenue should cross $100 billion by 2030 making it a very important segment. Despite near-term regulatory challenges, Amazon stock is a good bet due to its strong moat and decent growth potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.