Summary:

- 3M is likely to end up paying $2 to $3 billion per year in settlement costs.

- The company’s planned spin-off of its medical division adds further uncertainty to its dividend safety and growth outlook, with the potential for a reduced dividend after the spin-off.

- Investors seeking safer high-yield alternatives to 3M can consider many companies which offer better dividend safety and long-term return potential.

- This article highlights two far better high-yield blue-chips that are likely to outperform 3M over time.

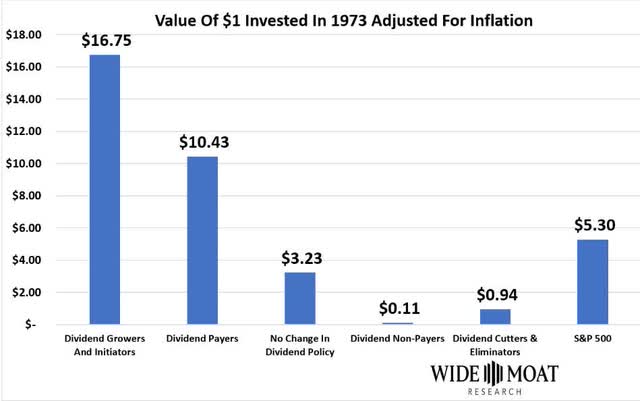

- If 3M does cut its dividend, history says you should sell and never look back.

LumerB

This article was published on Dividend Kings on Monday, June 26th

—————————————————————————————

My loyalty is never to a company, not even a dividend aristocrat.

My loyalty is to you, my readers, and that means to the truth, as best as anyone can know it.

When the facts change, I change my mind, what do you do sir?” – John Maynard Keynes

Here is my warning of 3M’s deteriorating fundamentals in December of 2022.

3M’s Dividend Streak Might Be About To End

And here is my warning that 3M’s dividend safety was continuing to deteriorate.

3M (NYSE:MMM) Safety And Quality Score Down Grade Due To Law Suit Costs

Dividend Safety

| Rating | Dividend Kings Safety Score (250 Point Safety Model) | Approximate Dividend Cut Risk (Average Recession) | Approximate Dividend Cut Risk In Pandemic Level Recession |

| 1 – unsafe | 0% to 20% | over 4% | 16+% |

| 2- below average | 21% to 40% | over 2% | 8% to 16% |

| 3 – average | 41% to 60% | 2% | 4% to 8% |

| 4 – safe | 61% to 80% | 1% | 2% to 4% |

| 5- very safe | 81% to 100% | 0.5% | 1% to 2% |

| MMM | 53% | 2.00% | 5.40% |

| Risk Rating | Medium Risk 89th percentile risk management $2 billion per year lawsuit liabilities | A negative outlook credit rating =0.66% 30-year bankruptcy risk | 2.5% or less max risk cap- speculative |

Overall Quality

| MMM | Final Score | Rating |

| Safety | 53% | 3/5 average |

| Business Model | 90% | 3/3 wide-moat |

| Dependability | 53% | 3/5 average |

| Total | 65% | 9/13 Above-average |

| Risk Rating |

3/5 medium- Risk |

|

| 2.5% OR LESS Max Risk Cap Rec – speculative |

30% Margin of Safety For A Potentially Good Buy |

3M’s safety and quality score, based on a 3,000-point quality model that incorporates over 1,000 fundamentals and which is designed to be 95% accurate at predicting dividend safety in recessions, has continued to deteriorate.

Let me clarify that the risk of a dividend cut remains small to mild, for the historically average S&P company with its current fundamentals, during a recession.

The risk is higher for any specific company, such as 3M facing tens of billions in potential litigation costs and the $12.5 billion it just settled for with 300 cities and states over PFAS.

According to my Bloomberg Terminal, in a recent conference call, 3M’s CFO is responding to an analyst about whether 3M’s dividend will be maintained. “So we’ll have to see as that plays itself out” – 3M CFO.

That’s hardly a ringing endorsement of dividend safety from the person in charge of running 3M’s books.

Why 3M Might Be The Next Failed Dividend King

Let me be clear, a “failed dividend king” is a dividend king that cuts its dividend and loses its streak. It doesn’t mean a bankrupt company.

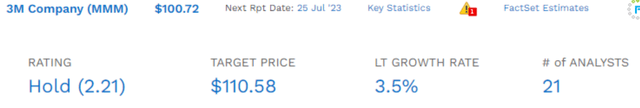

At the moment, the consensus from 21 analysts is that 3M will NOT cut its dividend.

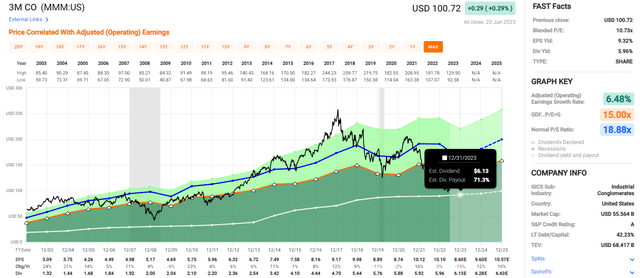

FactSet also shows no dividend cut, though elevated payout ratios through 2025.

For context, 60% or lower payout ratios are considered safe for industrials, according to rating agencies.

But this is today, and things could keep getting worse for 3M. I am warning investors, for a 3rd time, for one simple reason.

When the dividend is cut, statistically speaking, it’s time to sell.

So let’s look at the latest news from 3M’s years-long legal struggle to see why about $2 billion in long-term legal costs could be about to turn 3M into the next failed dividend king.

Upon further review, we move our 3M Uncertainty Rating to Very High. Consistent with our June 23 note, we think estimating 3M’s legal risks is a highly uncertain exercise. We reiterate that we think the settlement payment poses a risk to the dividend, particularly after the upcoming healthcare spinoff and with additional lingering legal risks like per- or poly-fluoroalkyl substance-related personal injury or additional environmental claims.” – Morningstar

Morningstar now estimates that the total PFAS settlement costs, including the $12.5 billion settlement reached with states and cities, will total about $20 billion.

The settlement with cities and states does not cover several other pending cases.

The $12.5 billion will be paid out over 13 years, about $1 billion per year that will be hanging around 3M’s neck until 2036.

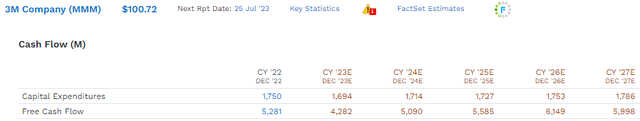

3M’s dividend costs $3.4 billion per year, and in 2023, it’s expected to generate $4.3 billion in free cash flow.

So basically, the annual settlement cost brings the payout ratio to 100% on a free cash flow basis.

Note that higher free cash flows are expected to bring this down in the future.

However, dividend sustainability is more than just payout ratios.

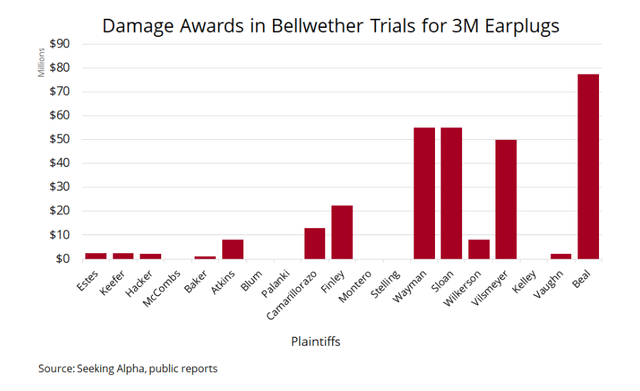

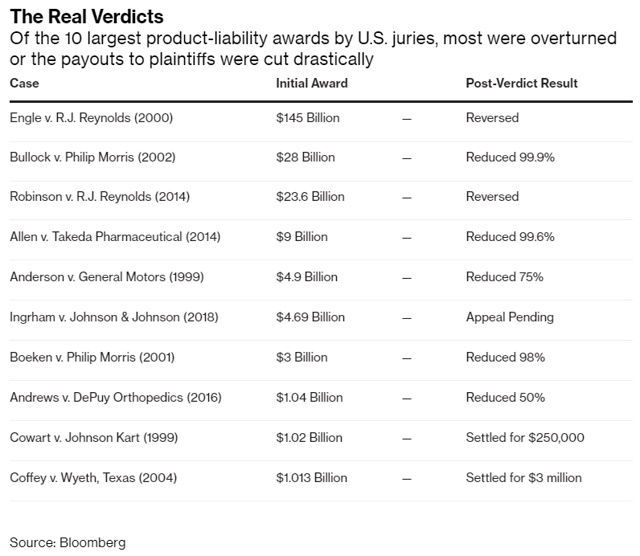

There are 260,000 pending cases over earplugs in which US military servicemen and women are claiming that 3M earplugs resulted in hearing loss.

The awards given by Juries so far range from a few million to almost $80 million.

Here’s the good news for 3M about that.

Normally, very large jury awards are overturned on appeal.

Here’s the bad news for 3M.

On Friday, U.S. Bankruptcy Judge Jeffrey Graham in Indianapolis dismissed Aearo’s bankruptcy claim, describing it as “fatally premature.” – SA

MMM has angered judges by attempting the “Texas Two Step,” in which it transfers all lawsuits to a subsidiary called Aearo Technologies, then that company files for bankruptcy, and 3M settles all outstanding claims for about $3 billion.

3M has claimed it is not liable for the hearing loss because it was following DOD specs, and so the government should be liable.

The DOD claims 3M messed up production and then knowingly kept selling the earplugs.

The worst-case scenario for 3M is estimated to be $140 billion in ear-plug liabilities through $4 to $20 billion, which is estimated to be the final cost after appeals.

Morningstar estimates $4 billion for a total lawsuit liability cost of $24 billion.

The consensus range is about $10 to $15 billion for earplugs.

- $22.5 billion to $35 billion total legal cost

That works out to about $2 billion to $3 billion per year in legal costs for the next 13 years or so to just over $2 billion.

3M’s Spin-Off Adds Even More Uncertainty

3M is planning on spinning off its medical division, which is its best-performing unit, in early 2024.

This will create two companies, and if the cumulative dividend of both is $6/share, then 3M’s streak remains intact.

However, as 3M’s CFO is now saying, it is too early to say whether 3M investors will be made whole or if the new combined dividend is going to be smaller.

It is very likely 3M’s dividend is going to be reduced because the medical division generates about 30% of free cash flow.

- post-spin 3M will be generating about $3 billion in free cash flow

- and $2 billion in likely annual legal expenses

The spin-off itself is expected to bring 3M, about $10.5 billion, nearly paying for the PFAS settlement.

- That only settles most of, not all of, those claims

Why does Morningstar believe that 3M is going to have to pay $7.5 to $10 billion more to settle PFAS?

Because the case against 3M is very strong.

Minnesota sued 3M and settled for nearly $1 billion because its forever chemicals were both toxic and contaminating people at a startling rate.

Biomonitoring studies by the Federal Centers for Disease Control and Prevention show that the blood of nearly all Americans is contaminated with PFAS.” – Environmental Working Group

So 3M poisoned the country (as well as most of the world).

PFAS are everywhere and in most animals surveyed,” said Rainer Lohmann, a professor of oceanography at the University of Rhode Island who focuses on PFAS contamination and was not involved in the Environmental Working Group’s review. “But collecting that information and putting it together is a huge effort. And I am not sure the general public is fully aware how thoroughly these chemicals have penetrated the environment.” – NYT

So it appears that 3M may have potentially poisoned hundreds of millions of people, possibly billions. It’s a good thing (for 3M) that most countries don’t have class action laws, or they could be facing trillions in liabilities.

So between $8 billion and $1.6 trillion per year to fix the PFAS problem globally. $330 million to $66 billion per year in the US. Not sure how cost-effective this is, but one thing’s for sure, 3M probably can’t afford it.

- The global economy is approximately $100 trillion

- cleaning up PFAS just in human water could cost 1.6% of the global GDP

- cleaning up the oceans is economically unfeasible

Bankrupting the company is not going to help anyone, but now you hopefully get an idea of the size of this problem.

S&P rates 3M 89th percentile on global risk management. I’ll defer to their expertise given their 1,000 metric risk model, but this data makes me personally question that score.

But Wait, It Gets Worse

Whether or not you’re mad enough at 3M for poisoning you and your family, along with what appears to be the entire country and much of the world and its food chain, to not own the stock is a personal issue.

However, all this legal liability, along with the spin-off of its best unit (largely to pay legal bills), has badly hurt 3M’s growth outlook.

Before the settlement news, 3M’s long-term median growth consensus was 7.2%.

It’s been cut in half on news of what will likely be $2 billion to $3 billion in annual settlement costs.

- Assuming that the earplug settlements are “only $4 to $15 billion.”

So even if 3M’s 6% yield was still safe, which is highly in doubt, it means the long-term total return potential is now 9.5%.

3M growing at the new slower rate is historically worth about 16.5X earnings, which implies that it COULD potentially deliver around 100% returns by 2025.

That’s attractive, but remember that long-term 3M is now offering rather uninspiring return potential.

| Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return |

| Vanguard Dividend Appreciation ETF | 1.9% | 10.7% | 12.6% | 8.8% |

| Nasdaq | 0.8% | 11.2% | 12.0% | 8.4% |

| Schwab US Dividend Equity ETF | 3.6% | 7.6% | 11.2% | 7.8% |

| REITs | 3.9% | 7.0% | 10.9% | 7.6% |

| Dividend Champions | 2.6% | 8.1% | 10.7% | 7.5% |

| Dividend Aristocrats | 1.9% | 8.5% | 10.4% | 7.3% |

| S&P 500 | 1.7% | 8.5% | 10.2% | 7.1% |

| 3M | 6.0% | 3.5% | 9.5% | 6.7% |

| 60/40 Retirement Portfolio | 2.1% | 5.1% | 7.2% | 5.0% |

(Source: FactSet, Morningstar)

So, assuming you can forgive 3M for poisoning you and your family, and you’re OK with what may be years of ongoing lawsuits, 3M is offering you worse return potential than most popular ETFs.

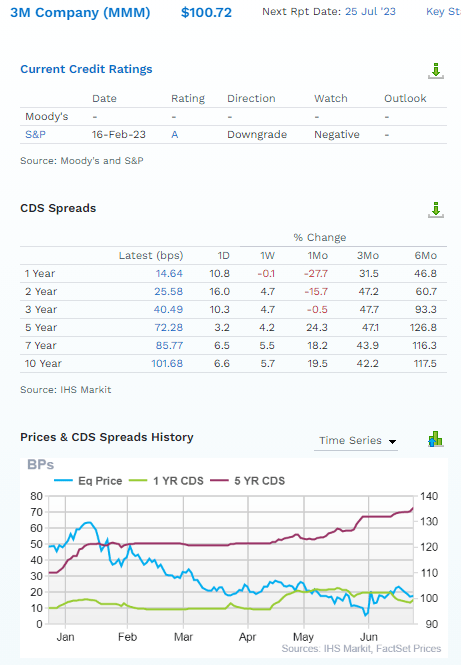

FactSet Research Terminal

The good news is that the bond market estimates the risk of 3M going bankrupt in the next 30 years at about 3%, an A- rated company.

But that risk is up 118% in the last six months.

Much Safer High-Yield Alternatives To 3M

I did a quick screen that took me 1 minute to find a list of safe alternatives to 3M.

- non-speculative (no turnarounds)

- credit rating: A- or better

- 81+% safety score (very safe 1% to 2% risk of a cut in severe recession)

- 11+% long-term consensus total return potential (vs. 10% S&P and 11% aristocrats)

Dividend Kings Zen Research Terminal

I will summarize U.S. Bancorp (USB) and Philip Morris (PM) PURELY because EPD and OTCPK:ALIZY have tax implications that some investors don’t want to deal with.

- EPD K1 tax form

- ALIZY 26% dividend tax withholding (own in taxable accounts to get a tax credit)

All these other alternatives are great. I don’t have time to talk about all of them.

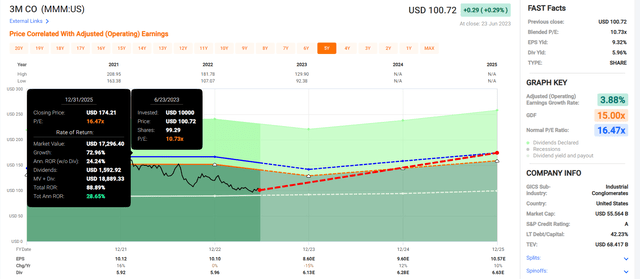

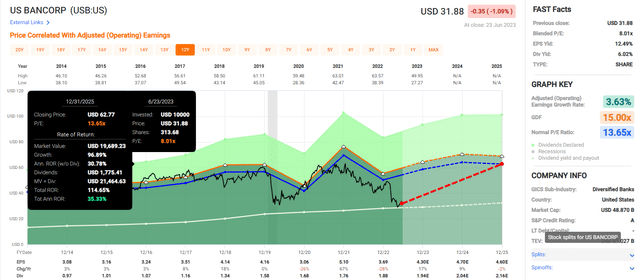

U.S. Bancorp: The King Of Super Regional Banks

Further Reading

Why USB Is A Great Buy Today

Founded in 1929 in Minneapolis, Minnesota, US is a 94-year-old bank that has survived and thrived through:

-

15 recessions

-

the Great Depression

-

inflation as high as 22%

-

interest rates as high as 20%

-

23 bear markets

-

the Great Financial Crisis (during which it remained profitable)

U.S. Bank is Morningstar’s “lowest risk” regional bank recommendation with the lowest risk of a bank run.

Why?

“U.S. Bancorp is the largest non-GSIB in the U.S. and has been one of the most profitable regional banks we cover. Few domestic competitors can match its operating efficiency and returns on equity over the past 15 years.” – Morningstar

USB is the new gold standard of good banking, a title once held by Wells Fargo before it sank under an ocean of scandal.

Fundamental Summary

- DK quality score: 79% medium risk 12/13 Super SWAN

- DK safety score: 88% very safe dividend (1.6% dividend cut risk in severe recession)

- Historical fair value: $60.43

- Current price: $31.88

- Discount to fair value: 47%

- DK rating: potential Ultra Value (Buffett-style fat pitch) buy

- Yield: 6.0%

- Long-term growth consensus: 9.0%

- Consensus long-term return potential: 15.0%

USB offers 115% return potential over the next 2.5 years, about 30% more than 3M.

Philip Morris: Dividend King Which Is the Industry Growth King

Further Reading

Why PM Is A Good Buy Today

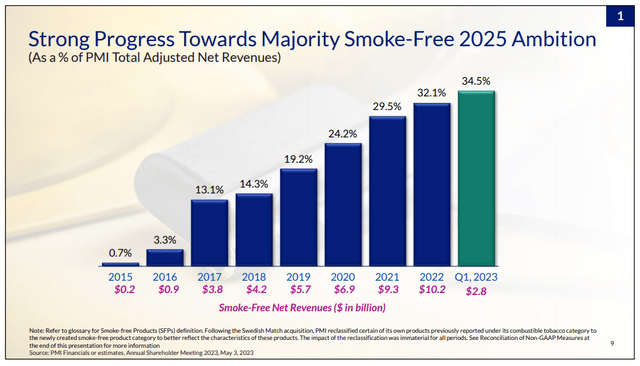

PM is the industry leader in reduced-risk products, generating 35% from RRPs.

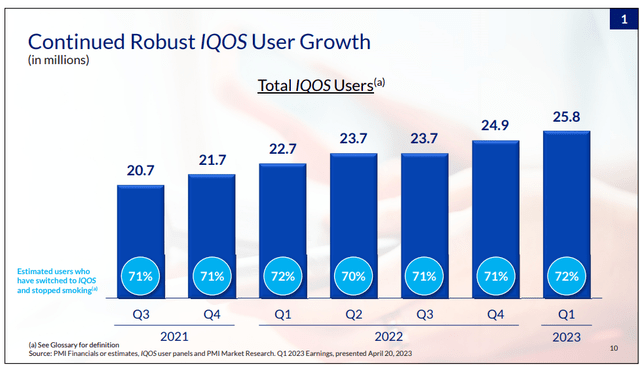

iQos is PM’s heat-stick brand, and 72% of smokers who try it switch permanently and stop smoking.

iQos is also now generating gross margins 0.1% above PM’s traditional cigarettes.

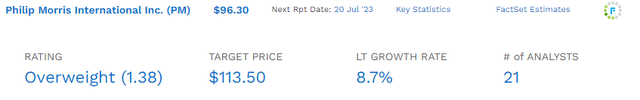

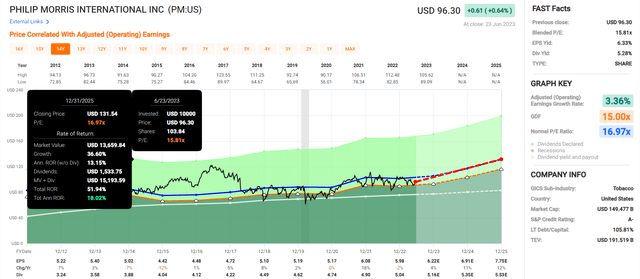

PM’s growth consensus is almost as high as 3M’s entire total return potential.

Fundamental Summary

- DK quality score: 98% very low risk 13/13 Ultra SWAN dividend king

- DK safety score: 100% very safe dividend (1.0% dividend cut risk in severe recession)

- Historical fair value: $109.25

- Current price: $96.30

- Discount to fair value: 12%

- DK rating: potential good buy

- Yield: 5.3%

- Long-term growth consensus: 8.7%

- Consensus long-term return potential: 14.0%

PM’s short-term return potential is similar to the long-term return potential, which is highly attractive and sustainable.

Bottom Line: 3M’s Dividend Might Be Doomed, So Buy Safer Alternatives

It now appears that 3M may have known that its earplugs were defective and kept selling them anyway, harming the hearing of nearly 300,000 US soldiers.

It will likely take years for the truth of that to come out.

But what’s not in doubt is that 3M spent decades producing toxic chemicals that have contaminated essentially all Americans. Globally PFAS is present in almost all marine animals, having contaminated much of the world’s oceans. Billions of humans have been poisoned, though not only by 3M.

Bloomberg estimates that 3M may have to take on $15 billion in new debt, doubling its interest costs during a period of high rates, which could send its debt/EBITDA to 5X and add $1 billion in annual interest costs.

If that happens, this dividend would be recklessly unsustainable because it would lose 3M’s A-credit rating.

Should you sell 3M? That’s a personal choice, but I would, if only because poisoning all Americans with toxic chemicals and covering it up for decades is an ethical line I cannot cross.

Note that 3M is still owned in popular ETFs like VIG and SCHD, and as long as the dividend remains uncut, it will remain in those ETFs, so I will own a small amount.

S&P says that even with the diabolically unethical PFAS contamination, it’s still a very well-run company, so I would be fine owning 3M via ETFs…if it avoids a dividend cut.

If it cuts its dividend, then I would sell and never look back.

SCHD and VIG’s quality screens will eliminate 3M, and I will be glad to be rid of it.

3M is a dividend growth legend and a hometown hero in my community, or it was.

But to be a good investor, you need to have loyalty only to the truth, and the truth is that 3M has done wrong, very wrong.

Its turnaround, which began in 2018, is now in year five, and its legal bills are forcing it to spin off its best business unit.

Its growth outlook has been cut in half.

Whether or not you care about 3M’s ethics, USB and PM are far better alternatives right now.

And yes, I understand the irony of saying that “if you’re bothered by 3M for poisoning the world, buy a tobacco company because it’s less unethical. LOL.

- S&P still considers 3M to have superior risk management than PM

- 3M 89th global percentile vs. PM’s 83%

But the point is that PM and USB offer superior dividend safety and long-term return potential.

And dozens of very safe high-yield blue-chips currently look like better investments than 3M.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

For now, 3M is owned by VIG and SCHD, 2 ETFs I own.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—————————————————————————————-

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

-

Access to our 13 model portfolios (all of which are beating the market in this correction)

-

my correction watchlist

- my family’s $2.5 million hedge fund

-

50% discount to iREIT (our REIT-focused sister service)

-

real-time chatroom support

-

real-time email notifications of all my retirement portfolio buys

-

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.