Summary:

- Tesla, Inc. faces increasing competition in the electric vehicle market, with Toyota’s recent battery development and electric vehicle design posing a threat to the company’s financial position.

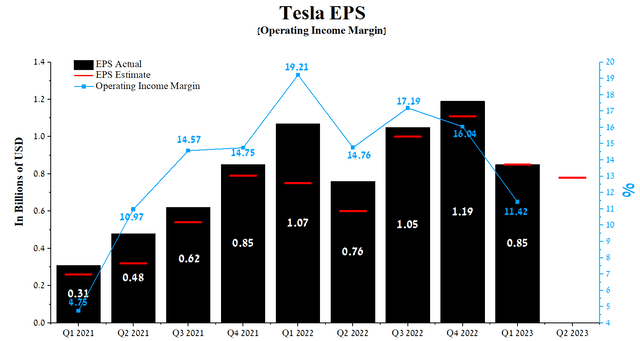

- Tesla’s operating income margin in Q1 2023 was 11.42%, continuing a decline that began in Q1 2022, and the company’s EPS for Q1 2023 was $0.85, down 28.6% quarter-on-quarter.

- Initiating coverage of Tesla with a “hold” rating for the next 12 months as the company needs to continue expanding its vehicle lineup and minimize delays in commissioning new factories.

Anski

Tesla, Inc. (NASDAQ:TSLA) is a pioneer in the electric vehicle market, revolutionizing the automotive industry. With 127,855 employees and an efficient business model built under the leadership of Elon Musk, Tesla has become one of the largest companies in the development and sale of cars and trucks and energy generation and storage systems.

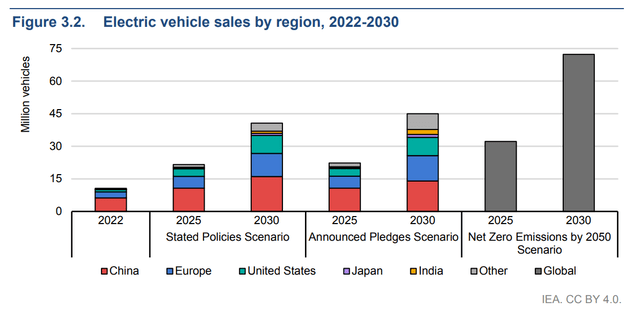

According to the International Energy Agency and considering the Stated Policies Scenario (STEPS), the number of electric vehicles (EVs) could reach 240 million units or 10% of the total road vehicle fleet by 2030, creating a substantial commercial opportunity for Tesla. However, increasing competition among automakers puts pressure on the margins of Elon Musk’s company due to the need to develop better batteries and autopilot technologies.

Most recently, Toyota Motor (TM) shocked the industry when it unveiled innovations in battery development and electric vehicle design at a technical briefing that will lead to significant cost savings. Given that these cars will hit the market as early as 2026 and will be able to drive 600 miles, which is more than a Tesla, this poses a threat to Tesla’s financial position.

However, 2026 is still a long time away, while in early June, Tesla announced that buyers are eligible for a federal tax deduction of $7,500 on Model 3 sedans, which will help increase demand for the company’s cars. The recent talks between the company’s management and the Prime Minister of India could open the door for Tesla to a fast-growing economy and thereby reduce the cost of car production, which is critical to maintaining positive cash flow during a period of price decline.

We initiate our coverage of Tesla with a “hold” rating for the next 12 months.

The financial position of Tesla and its prospects

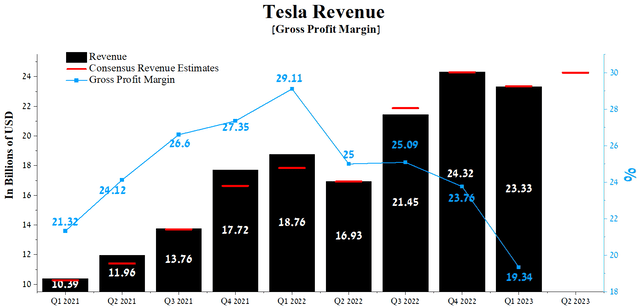

Tesla’s revenue for the first three months of 2023 was $23.33 billion, down 4.1% from the previous quarter and up 24.4% from the first quarter of 2022.

Author’s elaboration, based on Seeking Alpha

In recent quarters, Elon Musk’s company has experienced underwhelming financial results despite the rapid development of the automotive market and government efforts to encourage the public to switch from internal combustion engine (“ICE”) vehicles to electric cars.

2021 was the start of the recovery from the COVID-19 pandemic, when the company’s vehicle sales growth rate was impressive and demonstrated to investors, especially the conservative ones, that Tesla differs from traditional automakers such as Ford (F), Toyota, and Volkswagen (OTCPK:VWAGY) in both business model and in terms of its development. However, since 2023, storm clouds have begun to gather over Tesla, and have started to question its affiliation with growth stocks, which often have incredibly high valuation multiples in the industry.

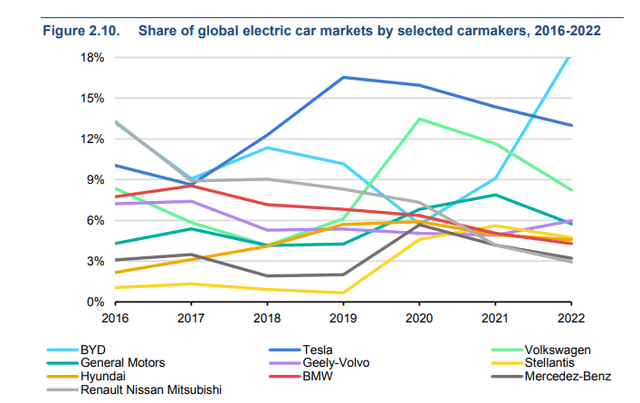

The situation in recent quarters began to change for the worse for the company, and according to the International Energy Agency (“IEA”), Tesla continues to lose share in the global electric car market and, by the end of 2022, lost its leadership to the Chinese EV giant BYD Company Limited (OTCPK:BYDDF, OTCPK:BYDDY).

Overall, auto sales revenue was $18,878 million for Q1 2023, up 21.7% year-on-year but down about 6.7% quarter-on-quarter. The slowdown in revenue growth year on year and the beginning of negative dynamics on a quarterly basis was due to the continued saturation of the electric vehicle market and the strengthening of the U.S. dollar against the euro, the Chinese yuan, and the Japanese yen.

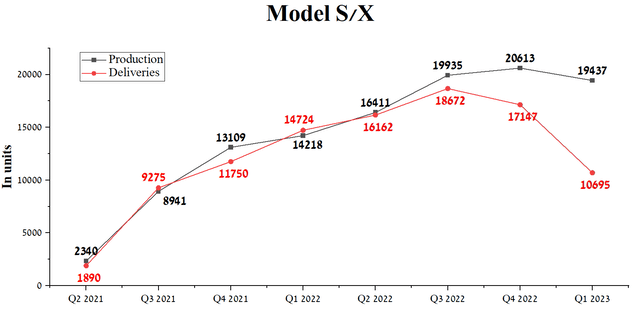

Moreover, Elon Musk tried to neutralize the increased competition with Chinese car manufacturers and, to this end, began a policy to reduce the selling prices of such cars as Model 3, Model Y, and Model X in the USA, Asia, and Europe. However, it was unsuccessful, and Model S and Model X deliveries totaled 10,695 units in Q1 2023, down sharply from the previous quarter.

Author’s elaboration, based on quarterly securities reports

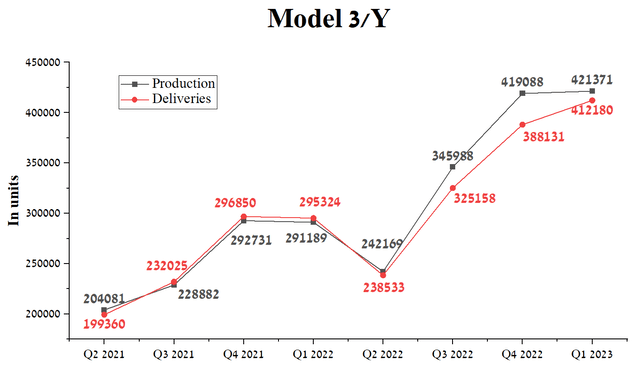

In addition, we see the stabilization of production and delivery volumes of Model 3 and Model Y, which is the cheapest in the line of cars of this American brand. This not only casts doubt on Elon Musk’s ability to attract new customers, but also accelerates the pace of development of competitors that are getting closer and closer to the leading positions of Tesla in the race for the multibillion-dollar electric car market, which is starting to worry investors.

Author’s elaboration, based on quarterly securities reports

Tesla’s Q2 2023 revenue is expected to be $23.3-26.38 billion, up 4% from analysts’ expectations for the first three months of 2023. At the same time, it will be at the level of revenue received in the fourth quarter of 2022, which may become one of the first black spots in the company’s history due to the lack of upward momentum in sales of Tesla products.

In China, one of the industry’s key markets, 77,695 Tesla vehicles were sold in May, up only 2.44% from the previous month, according to the China Passenger Car Association (CPCA).

On the other hand, the Inflation Reduction Act (IRA), which entered into force in January 2023, is again starting to impact the company’s share price positively. So, in early June 2023, the company announced that buyers are eligible for a federal tax deduction of $7,500 on Model 3 sedans, which will help increase demand for the company’s cars. That being said, we believe that to maintain the expected growth in sales for the company’s most affordable vehicle and maintain its first-mover advantage, Tesla will need to lower service costs and keep its prices relatively low.

Another important initiative that will support the growth ambitions of Elon Musk is the continuation of preparatory work for the release of the long-awaited Cybertruck. So, at the Q1 2023 earnings call, Musk stated the following.

Regarding the Cybertruck, we continue to build Alpha versions of the Cybertruck on our pilot line for testing purposes. It’s a great product, and we’re completing the installation of the volume production line at Giga Texas, and we’re anticipating having delivery event, a great delivery event probably in Q3.

The company’s plans are staggering, and, according to Electrek, it expects to produce 375,000 Cybertrucks per year. However, in our estimation, these expectations are too high and will not be met in the coming years because, in addition to expanding and increasing the number of factories in both the U.S. and China, Tesla needs to rapidly improve its delivery and charging infrastructure in order not to disappoint customers from ownership of the company’s futuristic pickup truck. Moreover, only in the 4th quarter of 2022, the cumulative sales of Tesla cars exceeded 375,000 units, and thus it took about ten years from the date of their first sale to achieve such volumes. We believe that Cybertruck’s sales pace will not differ from that of the Model S and Model X due to the increased competition in the market.

Moreover, in June 2023, Elon Musk held a sensible meeting with the Prime Minister of India, and one of the main topics was the discussion of the automaker’s investment in the country. In the case of successful negotiations between the management of Tesla and the government of India, factories for the construction of electric vehicles and the production of batteries will likely be built in a rapidly developing country with enormous economic potential.

Tesla first unveiled the Cybertruck in 2019, but the COVID-19 pandemic has taken its toll on those plans. Although the launch of this car is scheduled for this year, the continued increase in competition and the release of pickup trucks from companies such as Ford, Rivian Automotive (RIVN), and General Motors (GM) will lead to lower prices for Tesla’s car relative to those that could be if the company’s product was released in 2021. In addition, there will no longer be a “wow” effect from the appearance of Cybertruck on the roads, as it was with the Tesla Model S in 2012, which may lead to lower sales compared to Elon Musk’s expectations. On the Q1 2023 earnings call, Musk stated the following.

We plan to continue to invest heavily into our future plans, which include the Cybertruck next-generation platform, in-house cell production, energy storage business and our autonomy and AI-enabled products. And we plan to do this while keeping the business financially healthy and industry leading.

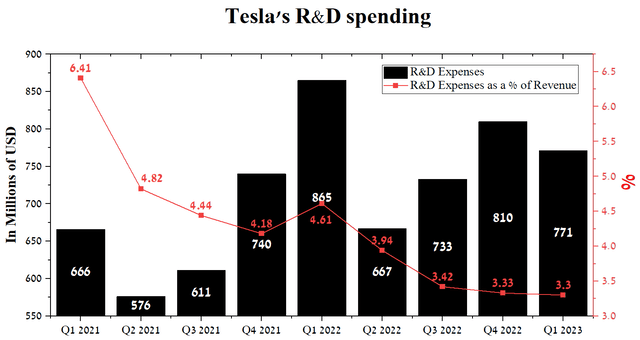

However, we are not entirely sure of achieving the set goals, as we believe that the company continues to reap the benefits of previous years when the company had the advantage of being a first-to-market. The pace of its development has significantly decreased in recent years relative to those that were in the period from 2012 to 2019. One of the key reasons for this is the decline in R&D spending, which amounted to $771 million in Q1 2023, down 10.9% year-on-year. At the same time, Tesla’s main competitors, like NIO Inc. (NIO) and Rivian, spend more than 20% of their revenue on R&D, which could eventually lead to the fall of Musk’s company from the top of the automotive industry.

Author’s elaboration, based on Seeking Alpha

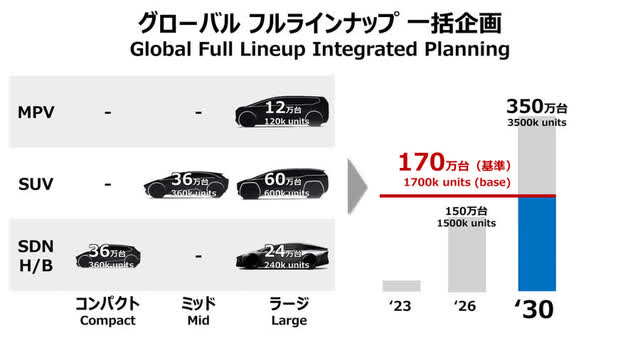

In addition, as noted above, Toyota Motor shocked the industry when it unveiled innovations in battery development and production of its electric vehicles at a technical briefing, which will have an increased range compared to Tesla’s cars. Moreover, the body of the company’s electric vehicles will consist of only three main components, thanks to the introduction of giga casting, which will significantly reduce the number of processes and the time to complete them. At the same time, the Japanese company plans to sell 3.5 million electric vehicles by 2030, which is about 10% of the total global sales of the entire industry, according to the International Energy Agency.

In addition, Toyota continues to actively develop next-generation lithium-ion batteries, which should be ready in four years and have a longer life, but at the same time, they will take less time to charge. In addition, the company has achieved a technological breakthrough in increasing their durability and, given their expected relatively low price, will contribute to capturing the electric car market, especially in the budget class.

Musk’s company needs to continue expanding its vehicle lineup again and work to minimize the likelihood of delays in commissioning new factories to reach the goal of increasing sales of up to 20 million electric vehicles per year by 2030.

According to the International Energy Agency and considering the Stated Policies Scenario (STEPS), the number of electric vehicles could reach 240 million units, or 10% of the total road vehicle fleet by 2030. At the same time, more than 40 million electric cars will be sold yearly, creating huge commercial opportunities for newcomers to the market and traditional automakers.

Tesla’s operating income margin in Q1 2023 was 11.42%, continuing the decline that began in Q1 2022 and below its average of 13.74% between January 1, 2021, and the end of March 2023.

This financial figure is higher than that of the automotive industry and primary competitors, such as the Mercedes-Benz Group (OTCPK:MBGAF), Toyota, and Ford, except Ferrari (RACE), another factor attracting investors to choose Tesla as a long-term investment.

We forecast that by 2023, Tesla’s operating income margin will reach 10%, and by 2024 this figure will increase slightly to 11.5%, thanks to lower inflation, cheaper production due to economies of scale, and the entry of Cybertruck and Tesla Semi into the market.

The company’s EPS for the first three months of 2023 was $0.85, down 28.6% quarter-on-quarter and, just as importantly, beating analyst consensus estimates in eight of the last nine quarters.

Moreover, Tesla’s Q2 EPS is expected to be in the $0.57-$0.9 range, down 7.1% from the Q1 2023 consensus estimate. At the same time, Tesla’s Non-GAAP P/E [TTM] is 66.71х, 418.32% higher than the sector average and 60.57% less than the average over the past five years. On the other hand, the P/E Non-GAAP [FWD] is 73.02x, which is one of the factors indicating that Tesla is slightly overvalued during the current period of declining inflation and China’s economic recovery.

Author’s elaboration, based on Seeking Alpha

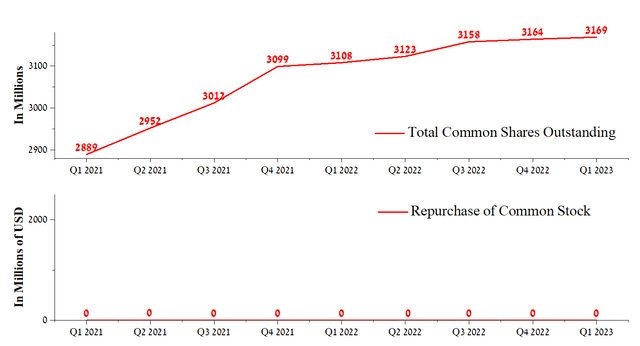

But at the same time, we believe that Tesla’s beating of the consensus EPS is not related to the share buyback program, the idea of authorizing which the company’s management considered in 2022. Elon Musk stated the following at the Q3 2022 earnings call.

But we want to work through the right process to do a buyback, but it’s certainly possible for us to do a buyback on the order of $5 billion to $10 billion, even in the downside scenario next year, even — given if next year is a very difficult year, we still have the ability to do a $5 billion to $10 billion buyback.

However, we estimate the likelihood of a share buyback program being authorized as moderate, even though the total cash & short-term investments exceed $22 billion. The reason for this is the need to continue actively developing the company to remain a leader in the industry for as long as possible.

Author’s elaboration, based on Seeking Alpha

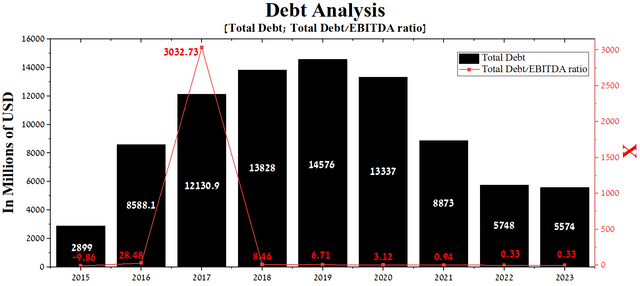

At the end of the first quarter of 2023, Tesla’s total debt stood at about $5.56 billion, a significant decrease from 2021, while the total debt/EBITDA ratio fell from 0.94x to a record low of 0.33x for the company.

Author’s elaboration, based on Seeking Alpha

With the maturity dates of the senior notes, stable net income, and meager total debt/EBITDA ratio, we do not expect Tesla to have any problems with their redemption, and anticipate that Musk will continue to pursue an active policy of business expansion.

Conclusion

Most recently, Toyota Motor shocked the industry when it unveiled innovations in battery development and electric vehicle design at a technical briefing that will lead to significant cost savings. Given that these cars will hit the market as early as 2026 and will be able to drive 600 miles, which is more than Tesla, this poses a threat to Tesla’s financial position.

However, Elon Musk is not going to stop. He plans to launch Cybertruck and Tesla Semi next year, sales of which will play a significant role in resuming Tesla’s high revenue rates, which were common before 2023.

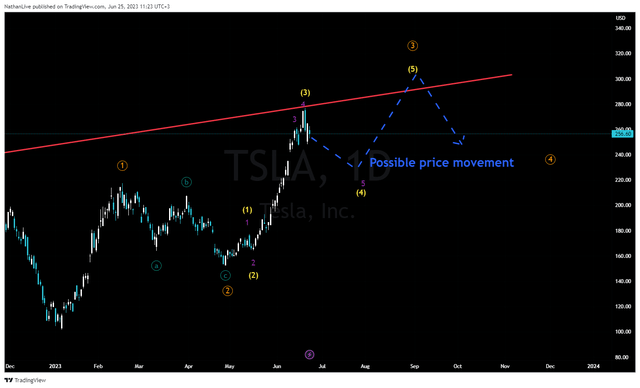

Regarding technical analysis, Tesla’s share price recently bounced off a resistance line that formed way back in 2020. We expect the corrective movement to continue up to a strong support zone in the range of $228 from $232 per share. After that, the price of the company’s shares will continue to move upward to break through the resistance line, thereby signifying for Wall Street that the most speculative investors are once again bullish on Tesla.

TradingView – Nathan Aisenstadt

We initiate our coverage of Tesla with a “hold” rating for the next 12 months.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.