Summary:

- Tesla’s recent run-up back toward a trillion dollar valuation has many analysts scratching their heads.

- While many still regard Tesla as primarily a car company, others call it the biggest AI play around.

- Despite Tesla’s recent decrease in profitability, the company illustrated an excellent ability to acquire market share from its competitors.

- Also, Tesla remains substantially more profitable than traditional automakers and is well ahead of its pure-EV competition.

- Tesla deserves its premium valuation, and its stock price should appreciate considerably as Tesla continues growing sales aggressively and improving profitability in the coming years.

jetcityimage

Tesla, Inc. (NASDAQ:TSLA) stock has had quite a run-up since I discussed the bottom in the EV giant’s share price in the $100-120 range. We’ve seen Tesla’s share price nearly triple, appreciating by approximately 180% since the stock price crashed to a bottom early this year. We’ve recently seen a 15% correction in Tesla’s share price as Goldman Sachs (GS) and other investment houses came out with “downgrades” after the six-month run-up in Tesla’s stock.

Despite being overbought in the near term, Tesla’s stock offers significant intermediate and long-term potential. While Tesla remains well-disguised as just an automaker, the EV leader offers enormous potential in energy generation and storage, robotics, AI, and more. Furthermore, Tesla should continue growing sales rapidly, and the company should continue optimizing operations and increasing profitability substantially as it moves forward. Due to its high level of profitability, significant profitability potential, and enormous growth prospects, Tesla deserves its premium valuation, and the company’s stock price should appreciate considerably in the coming years.

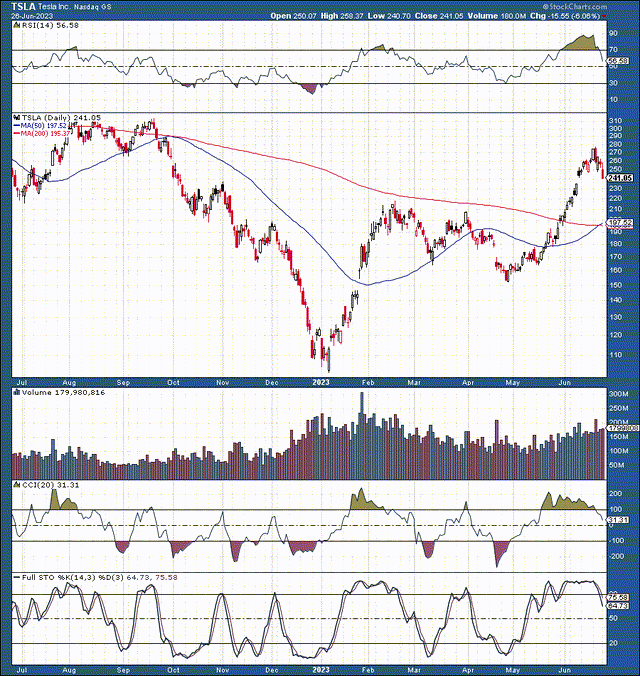

Technically – Buying The Dip

Tesla recently became very overbought on a short-term basis. The stock came up too far too fast, the RSI hit 90, and other technical indicators became highly overextended. The stock price nearly tripled in about a six-month time frame. The AI hype pushed Tesla’s share price to an extreme. Therefore, we’re happy to see a welcomed/healthy pullback in Tesla shares. Moreover, the 50-day MA just moved above the 200-day MA, implying that Tesla’s long-term technical image is strengthening. Thus, while we may see more transitory downside, anything in the $240-200 zone is a buying opportunity for Tesla’s stock.

When Were Investment Houses Positive On Tesla?

Goldman Sachs changed its buy rating to neutral regarding Tesla’s shares. The investment bank also put out a $248 price target for the company’s stock. Several days ago, Morgan Stanley’s (MS) Adam Jonas downgraded Tesla from a buy to a hold while raising his price target to $250 from $200. Barclay’s Levy came out with a similar report, downgrading Tesla from buy to hold while growing the price target from $220 to $260. However, when were investment houses ever forward-looking or right about Tesla?

I’ve been reporting on Tesla for about six years now. I proposed that Tesla could become a trillion-dollar company when its valuation was in the $30-50B range. I remember some people were outraged by my report, and Tesla remained one of the most shorted companies for years. Also, many analysts were skeptical of Tesla in the last few years, missing out on much of the spectacular gains over the previous decade. Therefore, while we’re seeing some analysts pulling the plug on Tesla, the downgrade cycle is transitory, and Tesla’s share price should continue rising long-term.

Tesla – “The Biggest AI Play Around”

ARK Invest’s Cathie Wood called Tesla the “biggest AI play around.” The fund manager cited Tesla’s immense potential in the driverless taxi arena, adding that the auto giant could see a massive run-up in its stock price to around $2,000 in the coming years. Wood also predicted that autonomous driving platforms will deliver $10 trillion in revenues from almost zero by 2038 globally. Tesla has an extensive AI and robotics program, including projects like the Tesla Bot, FSD chips, Dojo chips, and much more. Therefore, it’s challenging to value Tesla like a traditional automaker, provided the company has enormous potential in the driverless taxi business, robotics, and AI.

Tesla’s Abnormal Profitability

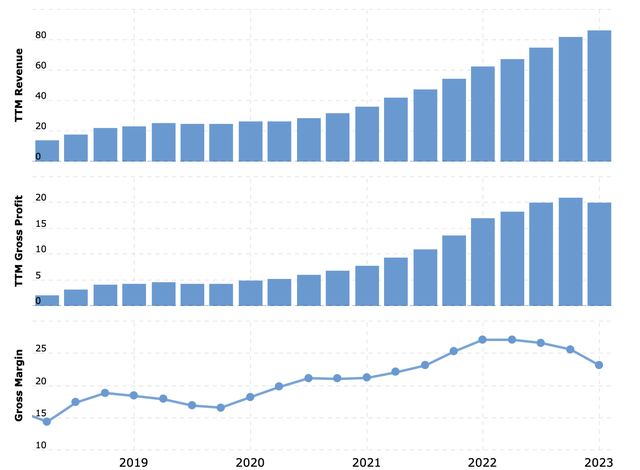

Tesla remains abnormally profitable for an auto company, with tremendous sales growth and profitability growth potential as we advance. Tesla generated a gross profit margin of about 23% in its latest quarter, a decline from the 27% gross profit margin the company saw last year. While the deterioration appears substantial, we should recognize that the lower profit margins occurred because of the temporary economic slowdown and Tesla’s price-cutting measures to acquire market share from its competitors.

In its recent round of price cuts, Tesla brought the price of its mainstream Model 3 vehicle below $40,000 in the U.S. Americans can now save $2K on a standard Model 3 vehicle or receive $3K in savings when purchasing a Model Y. It is pretty simple for Tesla to make the significant price cuts as it remains highly profitable in any case. Conversely, it is far more difficult for newer EV companies to compete with Tesla. Companies like Lucid (LCID), Rivian (RIVN), NIO (NIO), and others are finding out just how complex the car game is. In addition to mass production, newer EV startups recognize the difficulty of dealing with a slower-than-expected economy and the challenges of competing with Tesla in the ultra-competitive EV race.

Tesla – Profitability Metrics

Tesla profitability (macrotrends.net)

We’ve seen a steady rise in Tesla’s profitability metrics in recent years. As Tesla optimized the production of the Model 3 and other vehicles, its gross profit margin nearly doubled from a low of around 14% to a high of about 27% in early 2022. The recent decline in gross margin is likely due to transitory/challenging market conditions and competitive price cuts (not a Tesla-specific problem). Despite the transitory drop in Tesla’s profitability, its gross margin should recover and return to its exceptionally high level of close to 30%. Moreover, let’s discuss how profitable Tesla is compared with other automakers.

Recent Gross Profit Margins

- General Motors (GM): 13%

- Ford (F): 15%

- Toyota (TM): 17%

- Volkswagen (OTCPK:VLKAF): 19%

- Honda (HMC): 20%.

We see “normal” gross profit margins of 10-20% for many auto stocks. However, we only see sustainable 20-30% gross margins from Tesla. Moreover, companies such as Lucid, Rivian, and other EV start-ups have yet to demonstrate the ability to mass-produce vehicles, never mind producing sustainable profits. Also, as Tesla continues expanding into robotics, chips, and AI, the company should provide substantial sales growth, becoming more profitable in the coming years.

Tesla’s Explosive Revenue-Generating Potential

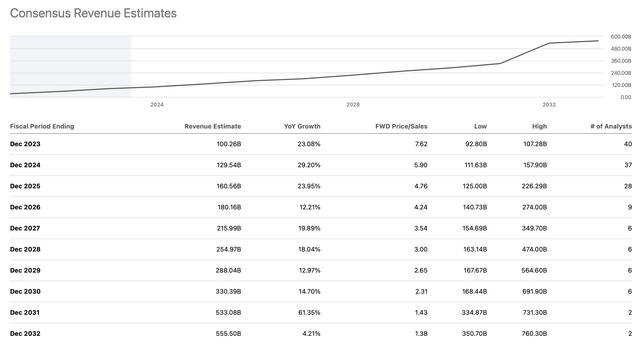

Sales growth (SeekingAlpha.com )

Tesla should deliver approximately $100B in revenues this year. Moreover, consensus analysts’ figures imply Tesla should provide about $130B in revenues next year, roughly 30% YoY sales growth. Additionally, Tesla still has a long growth runway and should provide substantial 15-30% revenue growth in the coming years. Furthermore, current revenue and EPS growth projections may be lowballed, and Tesla could surpass the depressed forecasts as we advance.

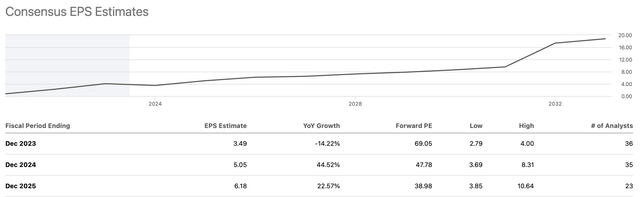

EPS Estimates (SeekingAlpha.com )

Consensus forecasts predict an EPS decline of about 15% this year. Next year’s consensus figure is only $5.05, while the range around $3.70-8.30 is extensive. This dynamic implies that there is little consensus on what Tesla will earn in the coming years, and some analysts could be very wrong regarding their estimates. I expect Tesla to make closer to $4 in EPS this year and about $6-7 in 2024. Moreover, Tesla could earn around $8-10 in EPS in 2025. Therefore, while forward P/E ratios may appear elevated now, Tesla’s valuation may be lower than it seems due to Tesla’s remarkable earning ability.

If Tesla provides EPS of $6-7 next year, its stock is now trading at a forward P/E ratio of 34-40. Moreover, if Tesla declines to about $200, we may be looking at a stock trading at a forward P/E ratio below 30, making Tesla shares appear inexpensive again. Furthermore, if we consider 2025’s earnings power, $8-10 in EPS implies the stock is now trading at about 24-30 2025’s EPS. Likewise, if Tesla declined to the $200 buy-in level, its stock may sell at approximately 20-28 times 2025’s EPS.

Where Tesla’s stock could be in future years:

| The year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $105 | $155 | $215 | $275 | $350 | $438 | $538 | $657 |

| Revenue growth | 29% | 48% | 39% | 28% | 27% | 25% | 23% | 22% |

| EPS | $4 | $7 | $10 | $14 | $19 | $25 | $31 | $38 |

| EPS growth | 25% | 80% | 44% | 40% | 36% | 32% | 25% | 22% |

| Forward P/E | 34 | 35 | 34 | 33 | 32 | 30 | 28 | 27 |

| Stock price | $240 | $350 | $480 | $627 | $800 | $930 | $1,065 | $1,200 |

Source: The Financial Prophet.

Tesla Risks

A slowdown in demand, increased competition, supply issues, decreased growth, issues with regulators and foreign governments, and other variables are all risks we should consider before betting on Tesla to move higher. Serious concerns could cause Tesla’s valuation to lose altitude, compress its multiple, and the company’s share price could even head in reverse if any serious issues should arise. Therefore, one should consider these and other risks carefully before committing any capital to a Tesla investment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!