Summary:

- Chevron Corporation is one of the world’s largest corporations engaged in integrated energy and chemical operations, headquartered in San Ramon, California.

- Chevron’s revenue for the first three months of 2023 was $50.79 billion, down 10.1% from the previous quarter and 6.6% from the first quarter of 2022.

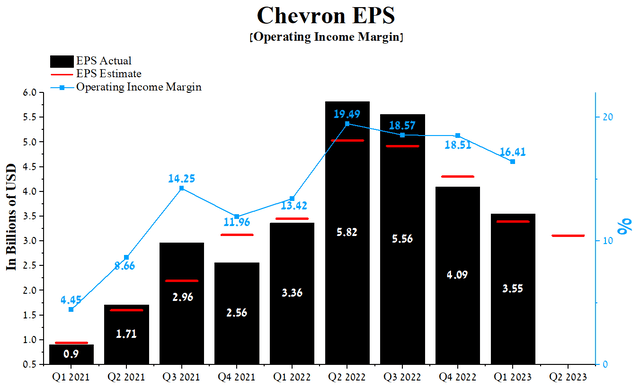

- Chevron Corporation’s operating income margin in Q1 2023 was 16.41%, down slightly from the previous quarter.

- The reduction in oil production carried out by the OPEC countries did not lead to support for crude oil prices, but, on the contrary, they continue to decline.

- We initiate our coverage of Chevron Corporation with an “underperform” rating for the next 12 months.

nemchinowa/iStock via Getty Images

Chevron Corporation (NYSE:CVX) is one of the world’s largest integrated energy and chemical corporations headquartered in San Ramon, California. The company operates in two business segments, Upstream and Downstream.

2021-2022 was a golden year for the energy sector, and Chevron represented an attractive hedge against rising prices for goods and services. This is due to several factors, including high inflation rates and the investors’ conviction, inspired by Mr. Market, that interest rates will continue to rise for a long time. However, since 2023, the situation began to develop in a different scenario, and the revenue and net profit of two of Chevron Corporation’s business segments, Upstream and Downstream, continue to decline, which creates pressure from short sellers.

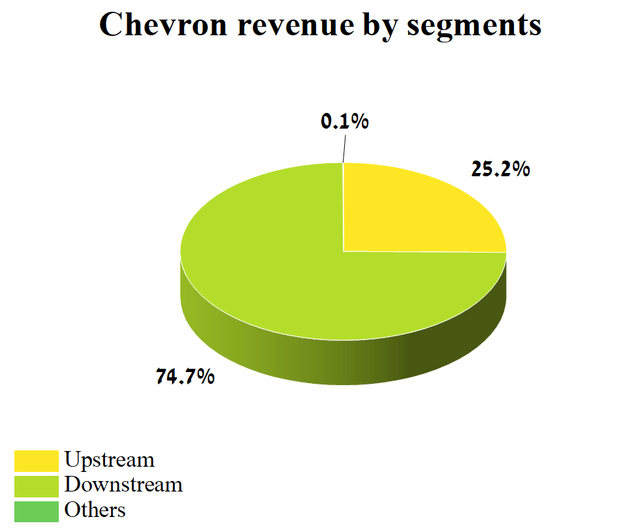

The upstream segment is focused mainly on the production, exploration, and transportation of natural gas and oil. In addition, this segment is engaged in regasification associated with LNG and transporting crude oil through international oil pipelines. Downstream operations consist primarily of processing crude oil into refined products and then selling it. Also, this segment, which brought Chevron 74.7% of the company’s total revenue in the 1st quarter of 2023, produces and sells renewable fuels, plastics for industrial use, and additives to various lubricants.

Author’s elaboration, based on 10-Q

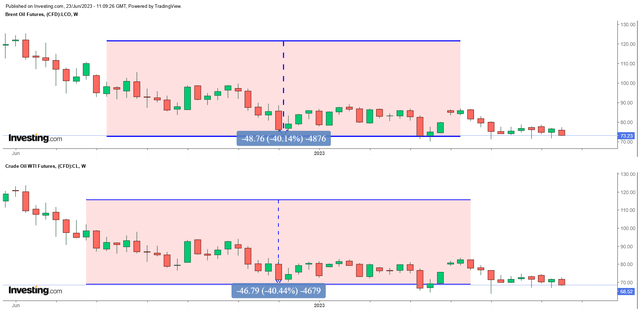

Over the past year, WTI crude (CL1:COM) and Brent (CO1:COM) futures have fallen 40.44% and 40.14%, respectively, but the share prices of many of the oil and gas industry leaders have risen significantly over this period, which creates a divergence between the two asset classes and which sooner or later will end with their prices moving in the same direction.

Author’s elaboration, based on Investing.com

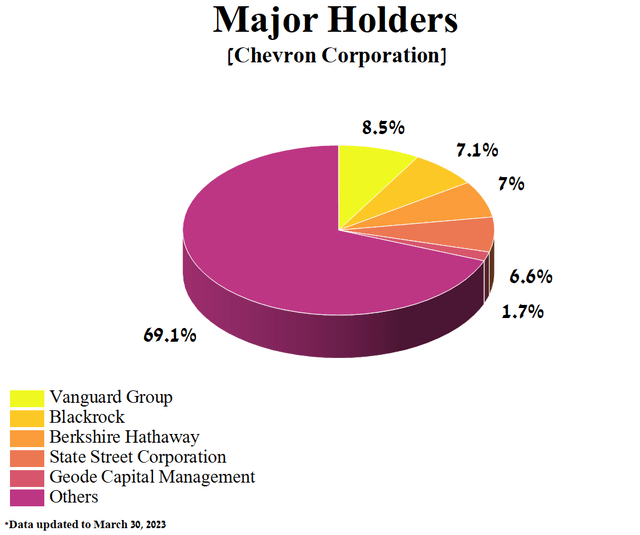

Despite the decline in energy prices, the five largest shareholders of Chevron Corporation, with a combined share of 30.9% in the company, have long been such Wall Street mastodons as Berkshire Hathaway, Vanguard Group, BlackRock, Geode Capital Management, and State Street.

Author’s elaboration, based on Yahoo Finance

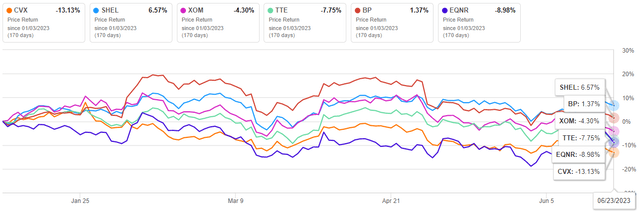

On April 28, 2023, Chevron published financial results for the first three months of 2023, which showed their deterioration on an annualized and quarterly basis, but on the other hand, actual revenue was higher than the analysts’ consensus estimate. As a result, since the beginning of 2023, Chevron’s share price has shown one of the most significant drops in the energy sector relative to competitors such as Shell (SHEL), Exxon Mobil (XOM), and BP (BP).

Author’s elaboration, based on Seeking Alpha

We initiate our coverage of Chevron Corporation with an “underperform” rating for the next 12 months.

Chevron Corporation’s Financial Position

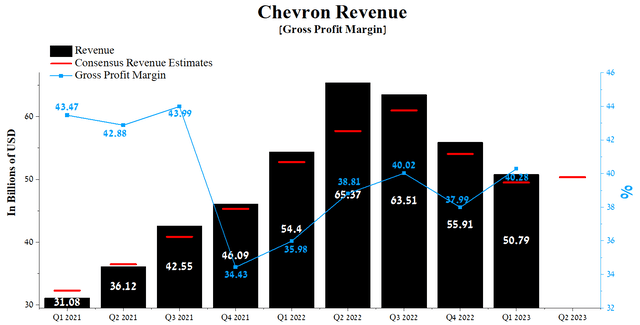

Chevron’s revenue for the first three months of 2023 was $50.79 billion, down 10.1% from the previous quarter and 6.6% from the first quarter of 2022.

Author’s elaboration, based on Seeking Alpha

The rise in hydrocarbon prices between the third quarter of 2020 and the third quarter of 2022, caused by the economic measures taken at the time to combat the COVID-19 pandemic, led not only to a sharp increase in inflation but also to a high growth rate of the company’s sales. That said, Chevron’s actual revenue beat analysts’ consensus estimates in only seven of the last nine quarters.

The consensus estimate for Chevron’s revenue for Q2 2023 is $41.6-56.85 billion, up 1.7% from analysts’ expectations for the first three months of 2023. We estimate that this is too high an expectation, and according to our model, Chevron Corporation’s revenue will continue to decline year-on-year to $45.5 billion in the second quarter of 2023.

In 2021-2022, fossil fuels and oil and gas companies represented an attractive hedge against rising prices for goods and services. This is due to several factors, including high inflation rates and the investors’ conviction, inspired by Mr. Market, that interest rates will continue to rise for a long time. However, since 2023, the situation began to develop according to a different scenario.

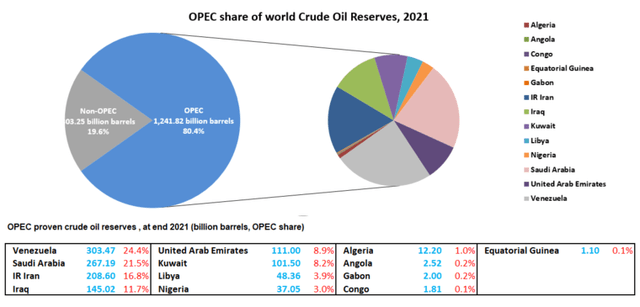

The continued decline in oil production by OPEC countries did not support crude oil prices, and, on the contrary, they continue to decline, which casts doubt on the organization’s ability to mitigate the risks associated with a weaker pace of China’s economic recovery. At the same time, we believe in continued downward pressure on hydrocarbon prices due to the growth of exports and oil production by Iran, which continue to break new highs, despite sanctions imposed by the United States.

Moreover, Chevron Corporation’s oil exports are expected to rise from Venezuela, which has the largest amount of proven oil reserves on earth, surpassing countries such as Russia, Saudi Arabia, and Kuwait.

Source: OPEC Annual Statistical Bulletin 2022

We expect that on the eve of the 2024 US presidential election, President Biden, who announced his intention to be re-elected for a second term, may go for easing sanctions against Nicolas Maduro, which will eventually flood the world markets with Venezuelan oil and thereby accelerate the decline in inflation.

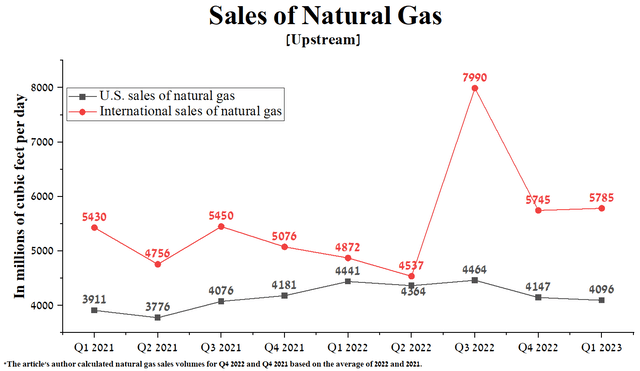

Natural gas, along with crude oil, is one of Chevron Corporation’s primary sources of revenue, and sales in the US totaled 4,096 million cubic feet per day (MMcfpd) in Q1 2023, down 7.8% year-on-year and thus one of the lowest in recent years. What’s more, the company’s international natural gas sales were slightly better at 5,785 million cubic feet per day due to the urgent need for European countries to fill gas storage facilities ahead of the approaching winter.

Author’s elaboration, based on quarterly securities reports

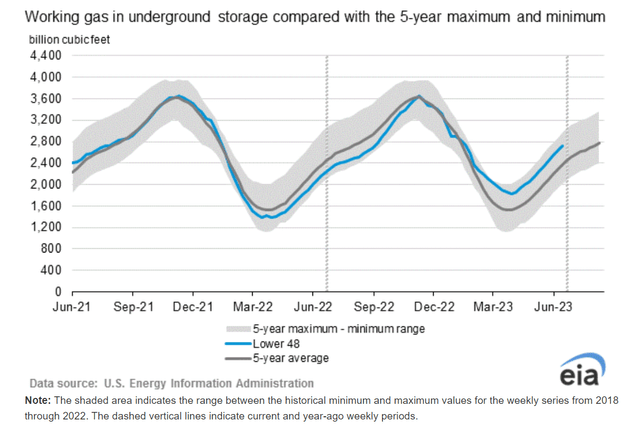

As of June 23, 2023, the US natural gas price is $2.564 per MMBTU, up slightly from the previous week, but high US storage filling rates are putting downward pressure on the price. Moreover, according to EIA estimates, as of June 16, 2023, the total working natural gas in storage was 2,729 billion cubic feet (Bcf), up 96 Bcf from the previous week and 571 Bcf from the prior year.

U.S. Energy Information Administration (EIA)

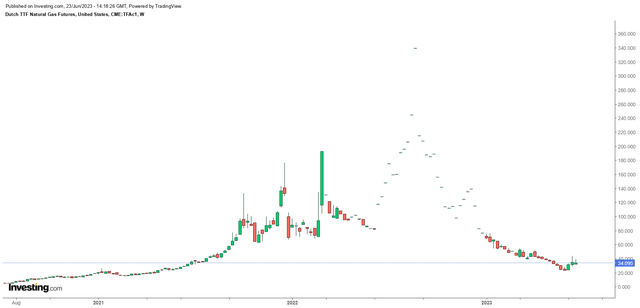

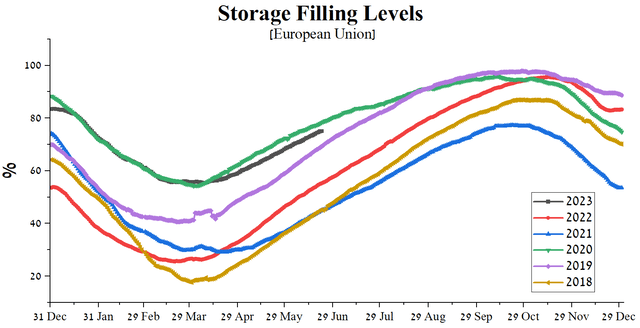

At the same time, from the first to the third week of 2023, European natural gas prices slightly corrected from their peak values and have now begun to move downward again, reaching the level of mid-2021, when the global economy began to recover after 2020, the year of mass panic due to COVID-19.

We expect the decline in Chevron Corporation’s upstream revenue to continue for at least the next three quarters due to hot summers in the US and the European Union, the world’s leading economies, and the resumption of repairs at the Nyhamna gas processing terminal, after which a sharp increase in gas production is expected in Norway. Moreover, the lack of natural gas supplies by Gazprom has ceased to affect the energy security of European countries, thanks to the long-term contracts concluded with Arab countries for the supply of LNG.

Thus, according to the data of the Gas Infrastructure of Europe (GIE), as of June 21, 2023, natural gas storage facilities in the European Union were filled by more than 75%, which significantly exceeds not only the level of 2022 but also pre-COVID years. As a result, this instills confidence in the strategies of European leaders, who continue to actively work to neutralize the consequences of the Ukrainian-Russian conflict and reduce the price of energy resources in the long term. We estimate that European natural gas (TTF) prices will reach 18-20 euros per MWh by early 2024.

Author’s elaboration, based on Gas Infrastructure Europe (GIE)

Chevron Corporation’s operating income margin in Q1 2023 was 16.41%, down slightly from the previous quarter. At the same time, we forecast that by 2023 the company’s operating margin will reach 13.5%, and by 2024 this value will decrease to 10.5%, mainly due to falling hydrocarbon prices.

The company’s earnings per share for the first three months of 2023 were $3.55, down 13.2% from Q4 2022, and since 2021, it has beaten analyst consensus estimates in only five of the last nine quarters.

However, Chevron Corporation’s Q2 EPS is expected to be in the $2.63-$3.98 range, down 8.3% from the Q1 2023 consensus estimate. At the same time, the P/E of Non-GAAP [TTM] is 8.03x, and the P/E of Non-GAAP [FWD] is 11.01x, which is higher by 28.8% and 24.8% relative to the average for the energy sector, respectively. As a result, this is one of the factors indicating the overvaluation of Chevron Corporation in the current period of growth in investment in the technology sector.

Author’s elaboration, based on Seeking Alpha

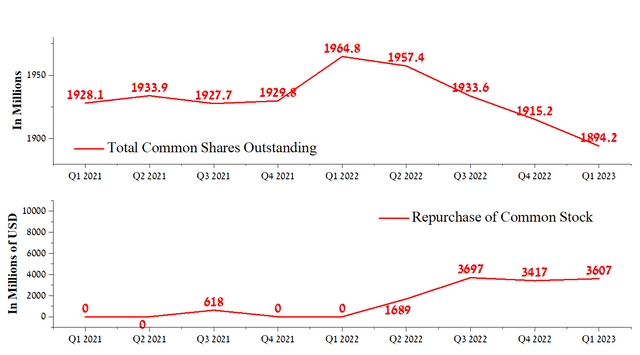

That being said, we believe that Chevron’s beating of consensus EPS in the first quarter of 2023 is mainly due to increased use of the share repurchase program. In the first quarter of 2023, Chevron conducted a share buyback for approximately $3.61 billion. In addition, the company’s management plans to allocate an amount of $4.375 billion in the second quarter of 2023 for further share buybacks, including reducing pressure from short sellers.

Author’s elaboration, based on Seeking Alpha

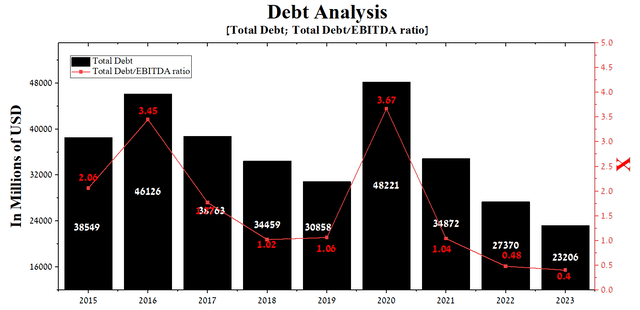

At the end of the first quarter of 2023, the company’s total debt was about $23.21 billion, down $11.67 billion from the end of 2021. However, even despite the sharp drop in EBITDA over the past few quarters, the total debt/EBITDA ratio has fallen from 1.04x to a record low of 0.4x for Chevron.

Author’s elaboration, based on Seeking Alpha

With positive cash flow, a meager total debt/EBITDA ratio, a large amount of cash, and maturity dates for senior bonds and debentures, we do not expect Chevron to have problems servicing or redeeming them.

Conclusion

2021-2022 was a golden year for the energy sector, and Chevron Corporation, being one of the world’s largest corporations, was an attractive hedge against rising prices for goods and services. However, since 2023, the situation began to develop according to a different scenario, and the company’s revenue and net profit continue to decline, which creates pressure from short sellers.

The reduction in oil production carried out by the OPEC countries did not lead to support for crude oil prices, but, on the contrary, they continue to decline. This raises doubts about the organization’s ability to offset the risks associated with a slower economic recovery in China. At the same time, we believe that downward pressure on hydrocarbon prices will continue due to the growth of exports and oil production by Iran and Venezuela, despite the sanctions imposed by the United States.

Despite the decline in the investment attractiveness of the energy sector, Chevron has an authorized share buyback program and a high dividend yield, which will slow down the decline in the company’s share price.

Overall, we expect Chevron Corporation’s share price to drop to $137-$138 per share in the next two months before reaching a strong support zone. We initiate our coverage of Chevron Corporation with an “underperform” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.