Summary:

- Much of the semiconductor industry is facing a slowdown. That includes Texas Instruments Incorporated.

- I believe the company is well positioned for long-term success despite the present headwinds.

- I appreciate management’s unrelenting focus on shareholder value creation and its aversion to hype.

Sundry Photography

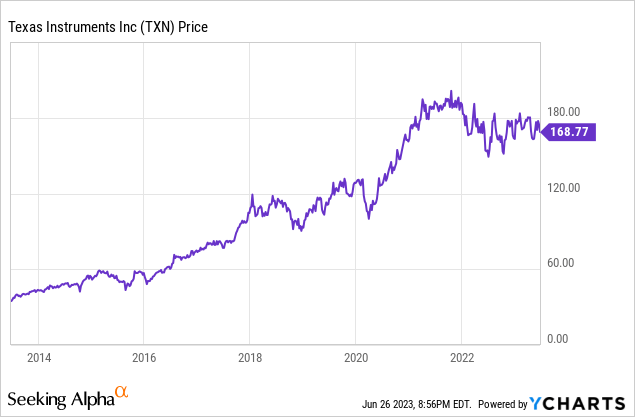

I’ve been a long-time investor in Texas Instruments Incorporated (NASDAQ:TXN), having held shares since 2016 and adding periodically to that position on dips. The company has richly rewarded its loyal shareholders.

But while Texas Instruments has been a tremendous performer, shares have merely been marking time since 2021:

Now, this is not a bad performance by any means given what has happened to many other tech companies over the past 24 months. Still, for a known long-term capital compounder like Texas Instruments, several years of flat to slightly down share price performance is somewhat uncommon.

And, admittedly, there are reasons to think that Texas Instruments shares may remain stuck in this holding pattern into 2024, as I’ll explain in a moment. Despite that, the company is a great building block for portfolios and that any further weakness represents an attractive buying opportunity.

Short-Term Bumps Ahead

We’ll get the positives in a minute, but let’s start with the concerns. Semiconductors are a cyclical industry, and analog chips are no exception. Texas Instruments’ products aren’t quite as boom/bust as something like, say, memory, where demand is projected to drop 35% year-over-year in 2023.

As Texas Instruments isn’t chasing fast-moving consumer electronics such as smartphones, it isn’t as tied to fickle trends or product launch cycles either.

That said, Texas Instruments’ products go into a lot of industrial applications, such as vehicles, which are tied to the strength of the overall economy. It’s no secret that there was an intense shortage of chips that went into cars, among other durable goods, during the pandemic. This led to strong demand, favorable pricing, and outsized margins. There’s a persuasive argument that Texas Instruments and its analog chip peers were overearning, and it will take a while for us to figure out where demand really is and what earnings look like in a more normal operating environment. Analog Devices (ADI) recently issued an earnings warning, which further reinforces this point.

Additionally, there’s no guarantee that things merely level off as the economy cools. Given the surge in interest rates, it wouldn’t be at all surprising if we see at least a mild recession in 2024, which could greatly impact demand for autos and other big-ticket goods which require analog semiconductors. You won’t see the sorts of unprecedented demand declines that we saw in GPUs, memory chips, and other parts of the semiconductor industry. But Texas Instruments could see earnings remain off peak levels for several years before things pick back up, depending on how the economic winds settle.

I’d point out a different sort of intermediate-term risk as well. That is that Texas Instruments is adjusting its capital allocation strategy to an extent. It is now investing heavily in additional fabrication facilities in the United States.

I expect that management has correctly calculated this decision and that it will be a long-term benefit in terms of generating higher returns on capital for investors. Keep in mind that the U.S. government is heavily incentivizing these sorts of plans via the CHIPs Act which subsidizes domestic semiconductor production. Even so, investors have long appreciated Texas Instruments’ relatively capital-light strategy, and deploying more money to property, plants and equipment will slow the pace of dividend increases and share buybacks for the time being.

Why Texas Instruments Is My Favorite Chip Stock

The bull case for Texas Instruments is a fairly simple one based on two truths.

First, analog semis are among the best kinds of chips for investors. And Texas Instruments is the #1 player in analog chips by market share.

Analog units go into more niche applications and have product lifecycles that last in decades rather than a couple of years you’d get for a new GPU or chip that goes into a smartphone. Texas Instruments has a catalog that runs into the tens of thousands of different items. Sell a lot of niche chips with little competition for many years. This is how you get high returns on capital and a stable business within a historically highly cyclical industry.

Texas Instruments is also known for its ruthless efficiency. Management prioritizes all decisions by their ability to produce more free cash flow per share.

It’s literally right there in the company’s investor relations document:

“We run the company with the mindset of being a long-term owner. We believe that growth of free cash flow per share is the primary driver of long-term value.”

This framework also underpins all its decisions in terms of M&A, building new fabs, and the like. If it doesn’t make more FCF/share, TXN isn’t going to do it.

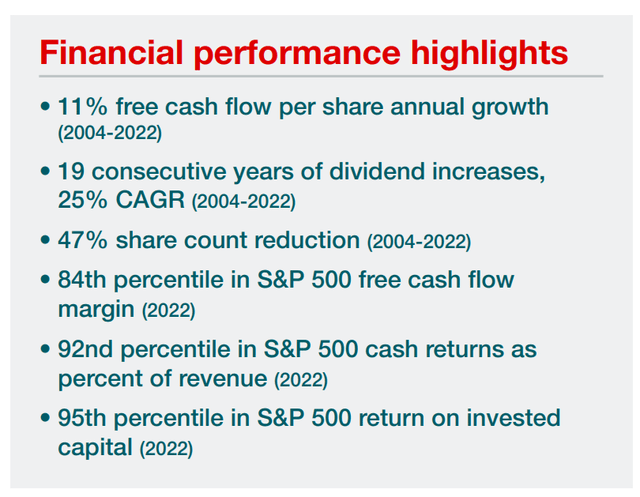

How has this played out in practice? The results speak for themselves:

TXN Long-term metrics (Corporate presentation)

It’s uncommon for a company as large as Texas Instruments to be able to maintain double-digit FCF/share growth for such an extended period. And the 25% CAGR dividend growth rate over the past 19 years is simply astonishing.

In addition to TXN’s focus on making unglamorous but highly profitable and predictable chips, and its unmatched capital allocation decisions, Texas Instruments has one other thing I really respect: Management never hypes investors up. It’s a straightforward team that tells you how it is without embellishment.

An exchange from earlier in June at the Bernstein Strategic Decisions Conference highlights this last point and why I’m so confident allocating my capital to TXN over the long-term.

Stacy Rasgon – Bernstein Analyst

“Look, every company these days needs to have an AI story. Like what’s the Texas Instruments AI story?”

Haviv Ilan – CEO of Texas Instruments

“We have an allergy at Texas Instruments for big words like AI, IoT [Internet of Things] and 5G and all that, so we usually don’t talk about it.

But look, the biggest opportunity in terms of the market and it’s not new, we’ve been spending effort on it, and we are expanding our presence there is all these computes they require a lot of apps. And you start to talk about kilowatts, right? So the power opportunity is high. It’s growing. It’s actually in two areas. First, on the — to power the server, you have a high-voltage power delivery box, and that’s more in our industrial business we call it power delivery sector. And you take energy, you take AC in and you make it into DC for the right consumption nodes. And then you have the processors themselves more and more phases, more inputs of power, and it has to be controlled. It has to be very efficient. And this is where our RFAB2 investment, the new process technologies we put there for power.”

Given an opportunity to spin investors some fantastic story about artificial intelligence changing everything, Texas Instruments’ CEO instead pivoted to talking about selling more chips for power supplies and delivery boxes. Just about the least glamorous part of the AI supply chain you could think of.

And yet it will be highly profitable and deliver tons of additional free cash flow to Texas Instruments, just like every other product it chooses to produce.

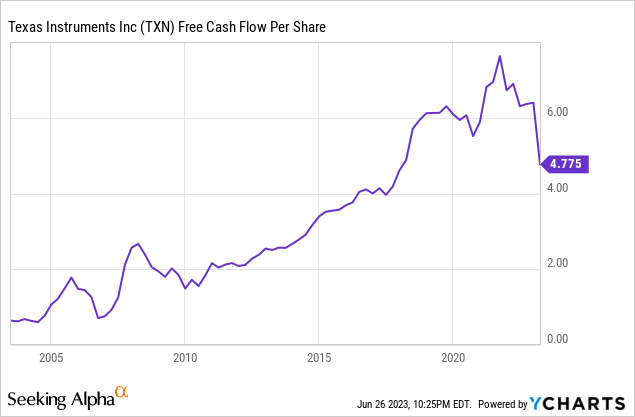

Is TXN stock especially cheap today? No, not really. It’s at 22x forward earnings, and earnings are likely to be flat or down through 2024 as inventories are analog chips are building. That said, TXN grew its free cash per share from less than $1 in 2003 to $7 at the top of the most recent cycle, and with remarkably little volatility along the away in the traditionally boom/bust chip industry:

If TXN stock sells off a bit more, it should be highly intriguing for folks wanting additional exposure to semiconductors without having to pay an AI hype cycle premium.

Admittedly, free cash flow (“FCF”) is down at the moment in part because the firm is heavily investing in new U.S. manufacturing facilities. The near-term weakness in the analog market also isn’t helping matters. These factors will limit dividend growth and share repurchases in the near term but should pay off going forward.

I see Texas Instruments’ track record as speaking for itself, and investors should give the company the benefit of the doubt as it navigates this challenging period with rapidly fluctuating demand and shifting supply chains. The company’s 2023 and 2024 earnings are unlikely to be particularly outstanding, but I don’t see anything to worry about here that would disrupt the longer-term business model.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TXN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you enjoyed this, consider Ian’s Insider Corner to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.