Summary:

- Lucid Group plans to enter the rapidly growing Chinese electric vehicle market, potentially accelerating delivery and revenue growth going forward.

- China offers a significant opportunity for EV manufacturers due to its large population, high EV adoption rate, and government investments in EV infrastructure.

- Despite short-term risks and potential entry into the penny stock range, Lucid’s shares are an attractive long-term investment, in my opinion.

- Lucid’s long-term growth potential is intact and the company has a unique opportunity to enter a new market where sedan EVs are gaining in popularity.

hapabapa

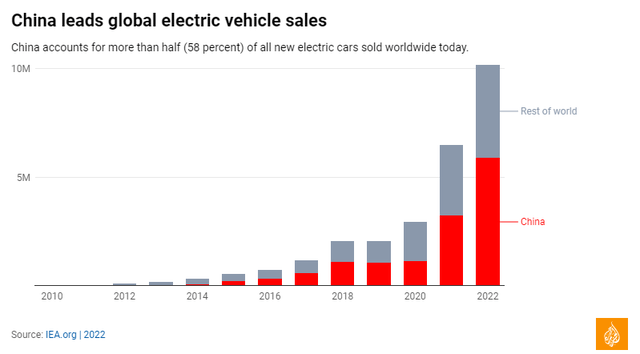

Lucid Group’s (NASDAQ:LCID) new hire Zhu Jiang said in June that the EV maker was planning on tapping the huge potential of the Chinese electric vehicle market. Lucid’s production and delivery growth has slowed in its core market, the U.S., and the EV company has lowered its delivery forecasts three times since the beginning of FY 2022, making international expansion an attractive pathway for the company to generate delivery growth. China is the fastest-growing and largest electric vehicle market in the world and it has one of the highest electric vehicle adoption rates as well. The possibility of Lucid generating delivery and revenue growth outside of the U.S. could be a catalyst for shares to move into a new up-leg!

Lucid is set to enter China’s attractive and expanding EV market

Earlier in June it was reported that Lucid is preparing to enter the Chinese electric vehicle market in the near future and that it made a key hire to push the company’s expansion into new markets. Lucid hired Zhu Jiang who is a seasoned automotive executive with experience at Ford, BMW, Jidu Auto and NIO. Lucid only recently announced a $3.0B stock offering and the EV company may very well use some its newly raised cash to fund its expansion into the attractive Chinese market… and potentially even open up a manufacturing plant there.

Lucid’s main sponsor, the government of Saudi Arabia, has consistently backed the company’s production initiatives and expansion ambitions through participation in new equity offerings, despite mounting losses. Opening up a new facility in China would likely also find the support of Saudi Arabia’s sovereign wealth fund as it could be a way for Lucid to turbocharge its production growth and tap into China’s demand for electric vehicles.

Currently, Lucid projects to spend $1.4-1.6B in capex in FY 2023. A new manufacturing plant would be expensive — Lucid secured about $3.4B in financing and incentives alone for its plant in Saudi Arabia — but I would also expect Saudi Arabia to approve of additional capex if the company decided to build its own plant in China.

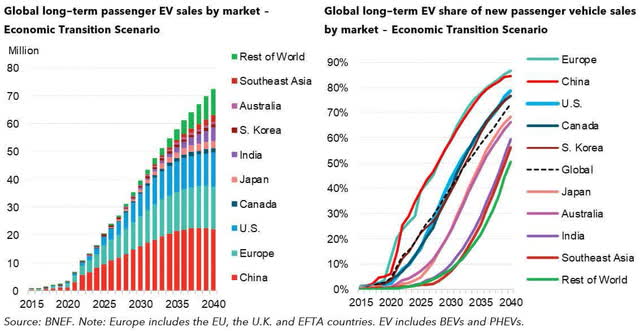

The Chinese EV market offers a great opportunity for U.S.-based EV start-ups, in large part because the market is expanding quickly and has a high adoption rate for electric vehicles. Besides a population size of 1.4B and aggressive investments from the government and companies into EV charging infrastructure, China has one of the highest EV adoption rates in the world. According to the International Energy Agency, China accounted for more than half (58%) of electric vehicle sales worldwide in 2022 and the country is not stopping there: the Chinese government has laid out an aggressive plan that calls for 40% of all auto sales to be electric vehicles by 2030.

According to forecasts made by Bloomberg New Energy Finance, China is going to remain the largest market for electric vehicles over at least the next two decades…

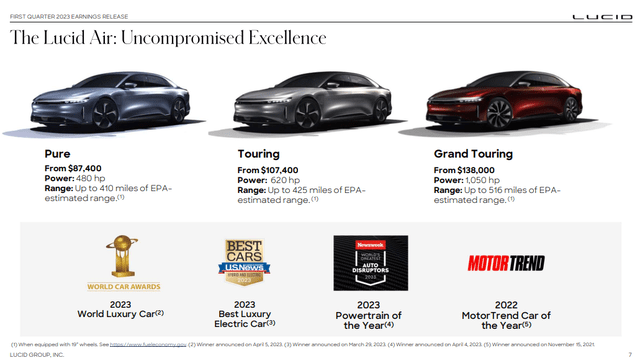

Why China could be a game-changer for NIO

According to Counterpoint Research, eight out of the ten best-selling electric vehicles of 2022 were sedans, not sport utility vehicles… which dominated the EV line-up of Chinese EV makers in the last couple of years. Since sedans are gaining in popularity in China and Lucid so far only offers luxury sedans, Lucid may find a lucrative entry into the Chinese EV market with its premium-focused Lucid Air. China’s market does not have an EV manufacturer that exclusively produces luxury electric vehicles that appeal chiefly to performance-minded car enthusiasts. Lucid’s Pure electric vehicle has 480 horsepower and comes with a starting price of $87,400.

NIO could directly target sedan-oriented EV buyers that don’t mind spending a lot of money on premium electric vehicles. The average EV price in China is below $30,000, but Tesla’s (TSLA) Model Y is hugely popular (consistently a top-selling EV in China) and the company is not seeing a shortage of buyers, despite the above-average price tag. Tesla’s Model Y Performance, as an example, costs about $50,000.

Although the electric vehicle company has not said whether it plans to just export EVs or build its own manufacturing base there, like Tesla did, the market entry could result in a much improved delivery picture for Lucid going forward. This is especially true because Lucid still has such a low delivery volume that international expansion could make a big difference for the EV company. Over the longer term, I can see Lucid generate 20-30% of its revenues outside of the U.S., with the lion share likely coming from China.

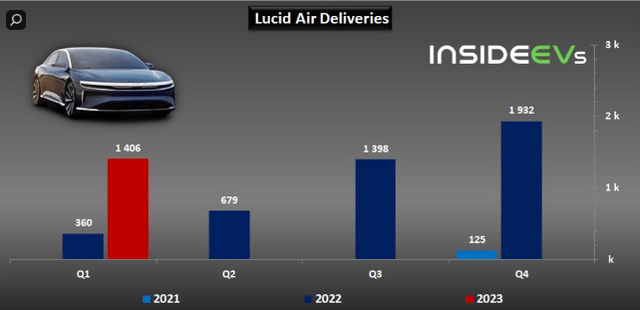

Lucid has started to ramp up deliveries of its first-ever production car, the Lucid Air, but the rate of delivery growth (+290% Y/Y in Q1’23) has disappointed investors and the company lowered its production guidance multiple times since the start of 2022. An entry into a new EV market, especially a hot one like China, could boost Lucid’s delivery growth going forward and result in an acceleration of revenue growth as well.

Lucid’s valuation, penny stock concerns

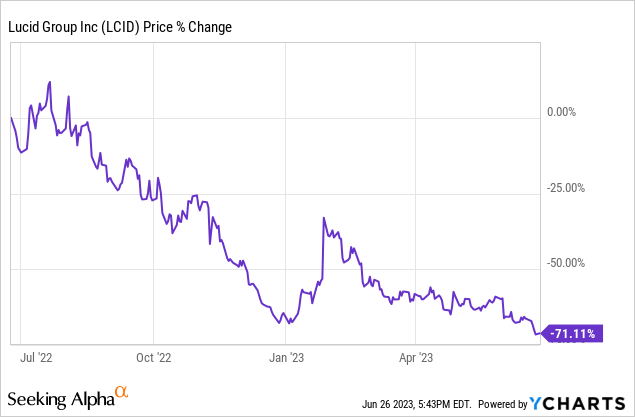

Lucid has seen a strong downside revaluation of its shares in the last year and the company’s share price is coming very close to the penny stock range ($1-5). While there is a short term risk that Lucid enters the penny stock range due chiefly to the company failing to meet production targets and investors losing patience, the long term potential for growth and disruption remains intact, in my opinion.

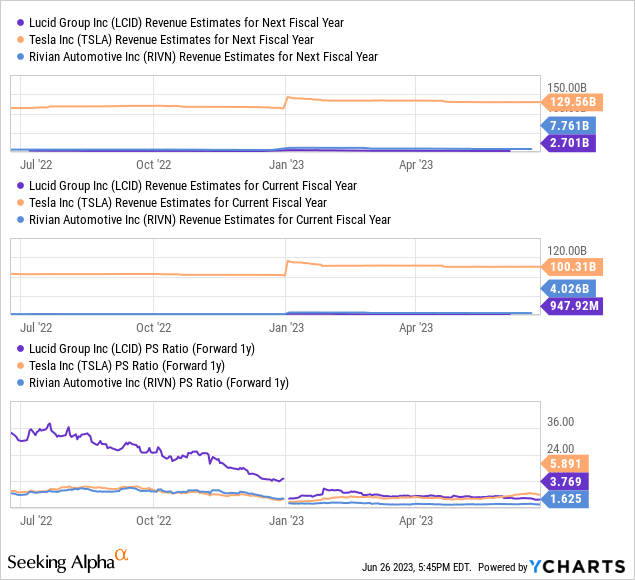

Lucid is projected to grow its revenues 185% next year to $2.70B, according to Seeking Alpha-provided consensus estimates. Rivian Automotive (RIVN) is expected to generate a revenue base four times larger than Lucid’s while Tesla remains the uncontested leader in the EV space.

Based off of revenues, Lucid is valued at a price-to-revenue ratio of 3.8X. Tesla is the most expensive U.S.-based EV manufacturer with a P/S ratio of 5.9X while Rivian trades at 1.6X revenues. Lucid is not expected to be profitable in the next few years, but the market expects the firm to achieve break-even in FY 2027.

Risks with Lucid

There is a considerable risk, at least in the short term, that shares of Lucid could fall into the penny stock range (achieve a value of $5 or less) as investor sentiment has continued to sour after the company said it now expects to produce 10 thousand or more electric vehicles in FY 2023 (as opposed to up to 14 thousand EVs previously). From a commercial perspective, Lucid has considerable timeline and delivery risks which may translate to slower than expected revenue growth going forward. What would change my mind about Lucid is if the EV manufacturer were to cut its delivery goal a fourth time, delayed production of its first SUV model or failed to gain any traction in China in the near term.

Closing thoughts

Lucid entering the rapidly expanding Chinese electric vehicle market makes a lot of strategic sense: EV adoption is accelerating in China and sedans, Lucid’s core focus so far, are rising in popularity. Lucid’s premium-segment Lucid Air would be well-suited for the Chinese EV market, in my opinion. While shares of Lucid are not cheap, despite a 71% downside revaluation in the last year, I believe Lucid remains one of the most attractive EV manufacturers worthy of a long term investment commitment. International expansion potential combined with Lucid’s recently announced Saudi-supported $3.0B stock offering suggests that the EV maker could accelerate its production and delivery growth going forward!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LCID, NIO, LI, XPEV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.