Summary:

- Meta Platforms is one of the largest technology companies in the world, having grown into a global mastodon with multiple platforms and services in just 19 years.

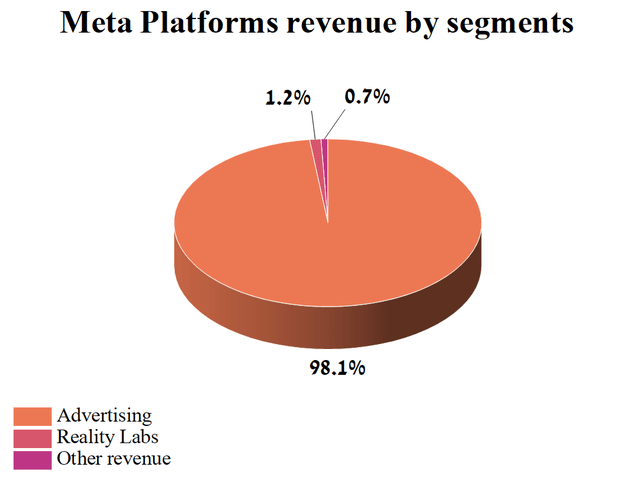

- The company’s Reality Labs segment contributed only 1.2% of total revenue, with advertising making up 98.1%.

- At the same time, at the end of March 2023, the remaining authorization to repurchase Meta Platforms shares amounted to $41.73 billion.

- The launch of a short-form blogging service called Threads is expected soon, which will become the closest competitor to Elon Musk’s Twitter.

- We initiate our coverage of Meta Platforms with a “hold” rating for the next 12 months.

grinvalds

Meta Platforms (NASDAQ:META) is one of the largest technology companies in the world, founded by Mark Zuckerberg in 2004, and has since grown into a global mastodon with multiple platforms and services. The company operates in two business segments such as Family of Apps (FoA) and Reality Labs (RL).

The Family of Apps segment consists of products such as Facebook, one of the world’s largest social networks, Instagram, and two messaging apps, Messenger and WhatsApp.

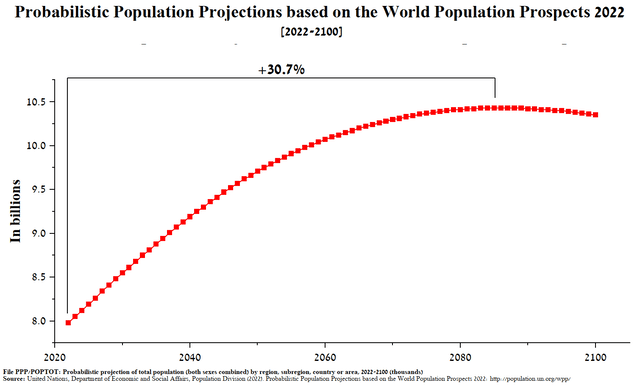

We are incredibly optimistic about this segment, not only due to the launch of new services but also due to the growth of the world’s population. According to the forecast of the United Nations, by 2083, the number of people on the planet will be about 10.43 billion, which is 2.45 billion more than in 2022. Moreover, the population of the US and Canada will grow at a high rate, which is especially important for the financial position of Meta due to their high level of consumer demand and cultural influence on other countries. This is one of the critical factors that contribute to the continued high interest in Meta Platforms from advertising agencies and media companies, which are one of the company’s primary sources of revenue.

The second segment is Reality Labs, which invests in developing new technologies and products. One of its strategic goals is to expand its business and diversify its sources of income to reduce Meta Platforms’ reliance on advertising on its social media and ensure sustainable cash flow for decades to come.

This segment is focused on developing next-generation interfaces and exploring the use of artificial intelligence in various areas, including automatic content moderation, speech recognition, and interpretation. In addition, Meta continues to develop actively and research technologies such as neural interfaces using electromyography that allow people to control devices using signals from muscles and nerves.

Meta Platforms continues to make massive progress in improving the performance and usability of augmented and virtual reality electronic devices like the Meta Quest and Meta Quest Pro. From year to year, content including games, fitness, and virtual worlds is expanding, which helps to attract new users, and one of the most important events for the RL segment was the launch of Horizon Worlds, a social platform where people can have fun and productively spend time.

However, due to the recent release of Apple Vision Pro, we expect the company led by Mark Zuckerberg will have to significantly increase its investment in developing the metaverse to try to maintain a share in the industry. Already, the Reality Labs segment’s revenue is starting to decline year-on-year, and operating losses amounted to about $4 billion in Q1 2023, up $1.03 billion from Q1 2022.

But despite Mark Zuckerberg’s best efforts, 98.1% of the company’s total revenue for the first quarter of 2023 came from advertising and only 1.2% from Reality Labs. This is one of the main risks to Meta’s financial position due to high-interest rates, which continue to pressure large companies’ advertising budgets and prevent them from more aggressive marketing policies.

Author’s elaboration, based on 10-Q

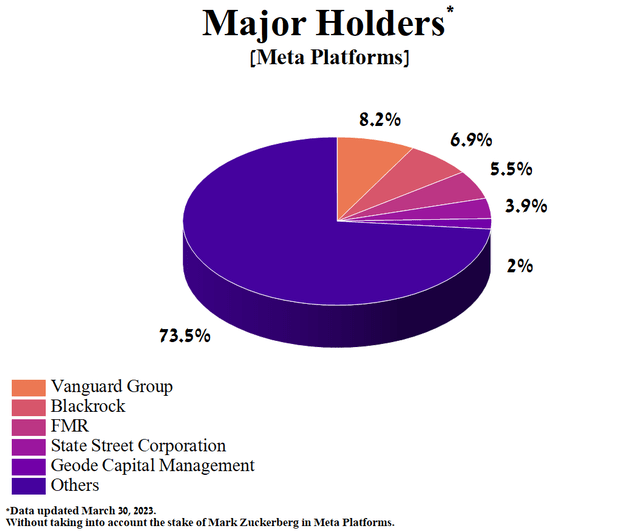

Despite the active sale of shares of Meta’s CEO until 2022, he has about a 14% stake in the company. At the same time, Wall Street giants such as Geode Capital Management, FMR, Vanguard Group, BlackRock, and State Street have long been Meta’s five other largest shareholders, with a combined stake of 26.5% in the company.

Author’s elaboration, based on Yahoo Finance

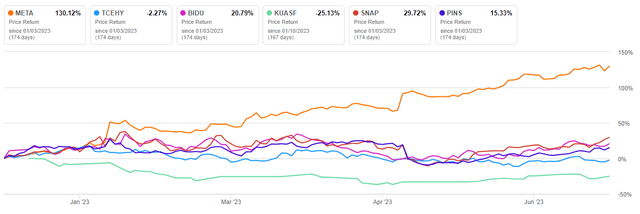

On April 25, 2023, Meta released its first quarter 2023 financial results, which far beat analysts’ expectations and demonstrated that advertising revenue is starting to rise again despite high central bank interest rates preventing companies from increasing their advertising budgets in the post-COVID-19 era. As a result, since January 1, 2023, Meta’s share price has risen by more than 130%, outperforming such major competitors in the technology sector as Pinterest (PINS), Snap (SNAP), and Baidu (BIDU).

Author’s elaboration, based on Seeking Alpha

We initiate our coverage of Meta Platforms with a “hold” rating for the next 12 months.

The financial position of Meta Platforms and its prospects

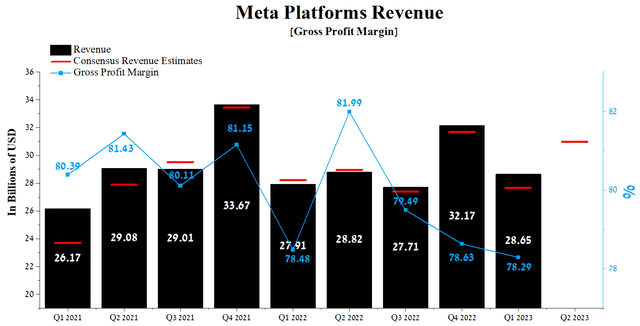

Meta’s revenue for the first three months of 2023 was $28.65 billion, down 10.9% from the previous quarter and up 2.7% from Q1 2022. Despite a continued challenging macro environment, including due to high central bank interest rates that continue to put downward pressure on corporate advertising budgets and the continued strength of the US dollar driven by geopolitical tensions, Meta Platforms’ actual revenue has beaten analyst consensus estimates in six of the past nine quarters. And more remarkable, the company led by Mark Zuckerberg was able to significantly outperform Wall Street’s expectations for the first quarter of 2023, ultimately driving Meta’s share price to a massive rally from $213 to $288 in less than two months.

Author’s elaboration, based on Seeking Alpha

Meta Platforms’ revenue for the second quarter of 2023 is expected to be $29.79-$31.72 billion, up 12% from analysts’ expectations for the first quarter 2023. These expectations are in the range of the guidance indicated by Meta management at the Q1 2023 earnings call.

We expect second quarter 2023 total revenue to be in the range of $29.5 billion to $32 billion. Our guidance assumes foreign currency headwinds will be less than 1% to year-over-year total revenue growth in the second quarter based on current exchange rates.

We estimate that Meta’s Q2 revenue will be near the lower end of the company’s forecast range at $30.2 billion. Our assumption is based on an analysis of historical trends in the number of people visiting a company’s platforms, which directly affect the amount of Facebook and Instagram ads they see, and our analysis of the current ad market.

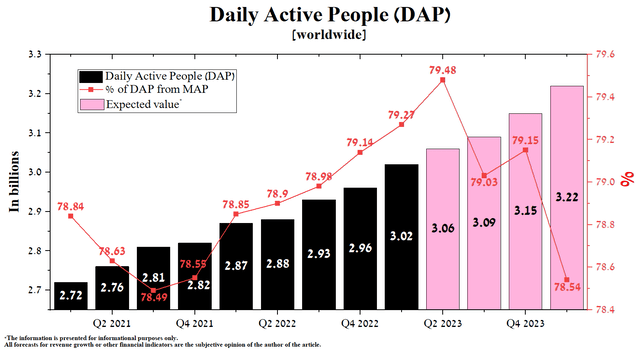

Thus, the total number of daily active people in the 1st quarter of 2023 amounted to about 3.02 billion people, showing an increase relative to the previous year and the quarter due to the introduction of artificial intelligence into the company’s products, increasing user satisfaction from their use.

So, regarding the impact of artificial intelligence on Meta’s financial indicators, Mark Zuckerberg stated the following.

Now, more than 20% of content in your Facebook and Instagram feeds are recommended by AI from people groups or accounts that you don’t follow. Across all of Instagram, that’s about 40% of the content that you see.

Since we launched Reels, AI recommendations have driven a more than 24% increase in time spent on Instagram. Our AI work is also improving monetization. Reels monetization efficiency is up over 30% on Instagram and over 40% on Facebook quarter-over-quarter. Daily revenue from Advantage+ shopping campaigns is up 7x in the last six months.

Thanks to the various initiatives and technologies that continue to be rolled out to Facebook and Instagram, we expect a total daily active people of 3.06 billion in Q2 this year, up 6.25% year-over-year. At the same time, in the next 12 months, their number will continue to grow and amount to 3.22 billion people at the end of March 2024.

This increase will also be provided by the expected entry into the market of a short-form blogging service called Threads, which will become the closest competitor to Musk’s Twitter. Interest in Threads is heating up thanks to a verbal skirmish between Elon Musk and Mark Zuckerberg, which, although unlikely, can lead to a fight between them.

On a larger scale, we expect that the number of users of the company’s platforms will continue to grow not only due to the launch of new services but also the growth of the world’s population. According to the forecast of the United Nations, by 2083, the number of people on the planet will be about 10.43 billion, which is 2.45 billion more than in 2022.

United Nations, Department of Economic and Social Affairs, Population Division (2022)

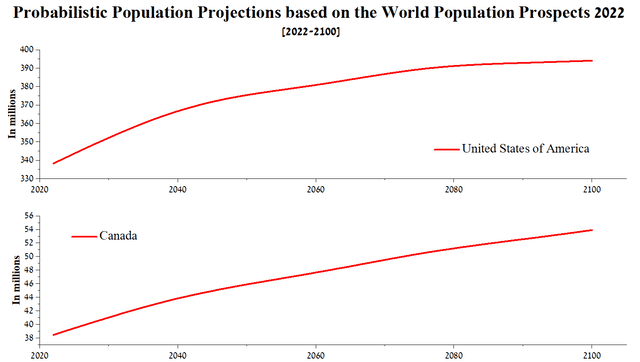

But at the same time, the population in the US and Canada will show higher growth rates, which is especially important for Meta Platforms since these countries bring in the lion’s share of net income, which is urgently needed to increase the volume of the share buyback program and continue active R&D programs to maintain a leading position in the social media industry.

United Nations, Department of Economic and Social Affairs, Population Division (2022)

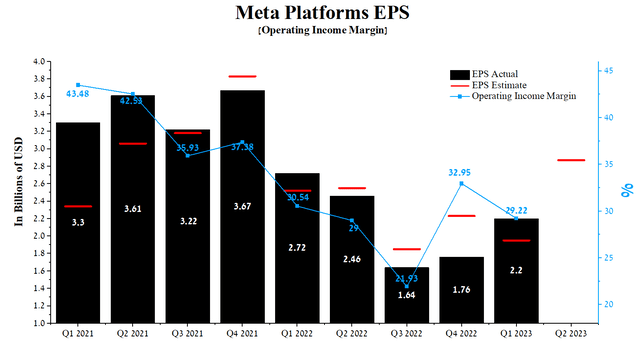

Meta Platforms’ Q1 2023 operating income margin was 29.22%, down both QoQ and 2022 and below its median of 33.66% between January 1, 2021, and the end of March 2023. At the same time, this financial indicator is higher than that of the communications sector and slightly inferior to one of its main competitors like, Apple (AAPL), which was also one of the factors attracting investors to choose Meta Platforms as a long-term investment.

We predict that by 2023, Meta’s operating income margin will reach 33.5%, and by 2024 this value will decrease slightly to 31.8% due to unsatisfactory sales of Meta Quest, an increase in R&D costs required for the development of virtual and augmented reality devices and technologies for the metaverse to maintain market share after the release of Apple Vision Pro, which has a competitive advantage over the company’s devices.

Meta Platforms’ earnings per share (EPS) for the first three months of 2023 was $2.2, up 25% quarter-on-quarter, and just as importantly, it beat analyst consensus estimates in five of the last nine quarters.

Moreover, Meta Platforms’ Q2 2023 EPS is expected to be in the $2.08-$3.34 range, up 46.7% from the Q1 2023 consensus estimate. At the same time, Meta’s Non-GAAP P/E [TTM] is 34.55x, 139.47% higher than the average for the sector, and 48.96% higher than the average over the past five years. On the other hand, the P/E Non-GAAP [FWD] is 24.24x, which indicates that the company is overvalued in the current period of high-interest rates.

Author’s elaboration, based on Seeking Alpha

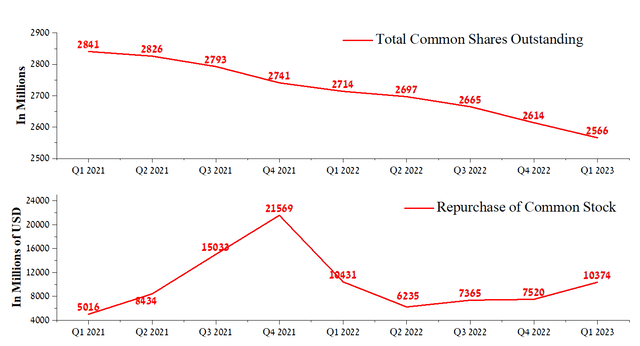

One of the key reasons behind Meta’s beating the consensus EPS is primarily due to the share buyback program. Since the second quarter of 2022, the amount of cash flow directed towards this goal has continued to grow, and in the first three months of 2023, Meta Platforms bought back its shares for about $10.37 billion. At the same time, at the end of March 2023, the remaining authorization to repurchase Meta Platforms shares amounted to $41.73 billion. In our estimation, this partially minimizes the impact of short sellers on the company’s share price in the event of a Fed rate hike in 2023.

Author’s elaboration, based on Seeking Alpha

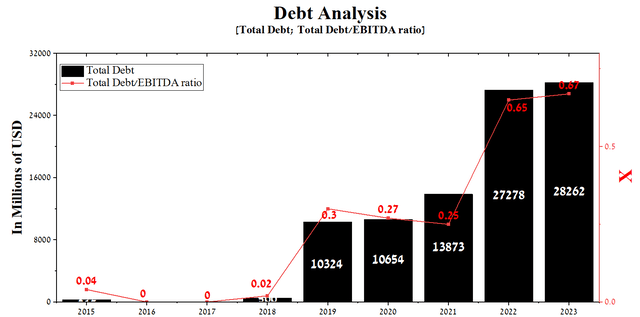

At the end of the first quarter of 2023, Meta Platforms’ total debt was about $28.26 billion, up over 100% from 2021 due to the need to accelerate the creation of the metaverse. Moreover, due to a slight drop in the company’s EBITDA in recent years, the total debt/EBITDA ratio has increased from 0.25x to a record high of 0.67x for Meta.

Author’s elaboration, based on Seeking Alpha

With senior notes maturing between 2027 and 2062, total cash & short-term investments, and stable cash flow, we do not expect Meta Platforms to have any issues redeeming them, and Mark Zuckerberg will continue to pursue an active R&D policy to maintain its leading position in the industry.

Conclusion

Meta Platforms is one of the largest technology companies in the world, founded by Mark Zuckerberg in 2004, and has since grown into a global mastodon with multiple platforms and services.

Mr. Market has welcomed the improvement in Meta Platforms’ financial indicators in recent quarters, resulting in a fantastic rally in its share price. At the same time, in our opinion, they are already included in their price, and it is necessary to consider additional factors that few people consider.

We expect the share price to start to decline in the coming quarters due to increased competition from Apple Vision Pro, which has a competitive advantage over the company’s devices. As a result, this will lead to the need to increase investment in the development of metaverses to support the ambitious plans of Mark Zuckerberg. Already, the Reality Labs segment’s revenue is starting to decline year-on-year, and operating losses amounted to about $4 billion in Q1 2023, up $1.03 billion from Q1 2022. Moreover, the Fed’s expected interest rate hike in 2023 will increase downward pressure on Meta’s share price.

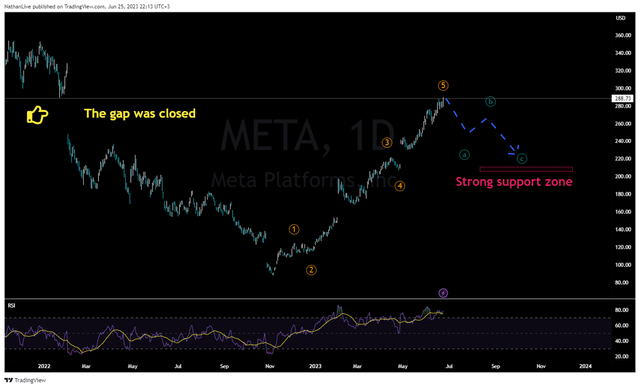

Regarding technical analysis, the price of Meta Platforms shares recently closed the gap formed in February 2022, completing the impulse phase of the cycle, which consists of five waves. We expect the beginning of a corrective wave ⓐ-ⓑ-ⓒ, which will continue until reaching a strong support zone in the range of $210 from $214 per share. After that, the price of Meta’s shares will again continue to move upwards as the Fed’s interest rate decreases, which will help increase the advertising budgets of advertisers and thereby increase the company’s net income.

TradingView – Nathan Aisenstadt

We initiate our coverage of Meta Platforms with a “hold” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.