Summary:

- Pfizer’s share price is going nowhere – the float is too big. Even after COVID allowed the company to generate >$100bn in revenues, it is back on the slide again.

- The company has spent ~$70bn on M&A and promised $25bn of new product revenues – but other key drugs are losing patent protection.

- Pfizer’s dividend has been hiked to $0.41 and the yield is now >4%.

- The company is coming off the back of 4 FDA approvals in 5 weeks – but no matter how positive the news flow, the share price isn’t budging.

- While other Pharmas’ valuations skyrocket on breakthroughs in e.g. weight loss, Pfizer’s sliding share price increase the dividend yield. With downside protection in place, PFE stock makes for a quite reasonable investment.

Kent Smith/iStock via Getty Images

Investment Overview: Why Pfizer’s Stock Price Doesn’t Grow

Pfizer Doubled Revenues Overnight Thanks To Covid Franchise – But The Market Still Wasn’t Buying It

Midway through 2021, Pfizer (NYSE:PFE) stock was worth less than it was 20 years ago, which is a sobering statistic that suggests investors hoping for a bull run on the Pharma’s stock are unlikely to see their wish fulfilled.

You will not find many analysts advising Pfizer shareholders to sell their stock, however – the last bearish article written by a Seeking Alpha analyst was penned over 50 articles ago – by myself, in March 2022 – the stock is indeed down >30% since I published that note.

In my most recent note, however, penned a few hours after the company released its Q1’23 earnings – $18.3bn of revenues and earnings per share (“EPS”) of $1.23 on an adjusted basis – I was also bullish on the company.

Pfizer shares did go on a bull run between February 2021 – when shares traded at $33.5 – to an all-time high of $59.5 in December 2021 – a gain of 68%. Do not expect lightning to strike twice, however.

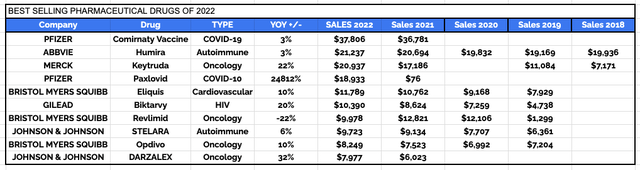

Those gains were driven by Pfizer’s twin COVID drugs, the vaccine Comirnaty, and the antiviral Paxlovid. Comirnaty sales in FY21 and FY22 were $36.7bn, and $36.8bn respectively, whilst Paxlovid sales in 2022 were $18.93bn. That makes Comirnaty and Paxlovid the first and fourth highest selling drugs of 2022 by a US Pharma.

Best selling drugs of 2022 (my table using company reported data)

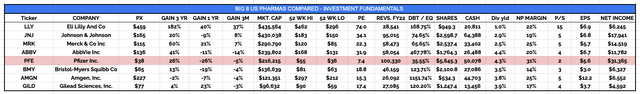

Pfizer’s revenues doubled between 2020 and 2021, from $41.7bn, to $81.3bn, and in 2022 they topped $100bn – which is $5bn more than the next best (in terms of revenue generation) Pharma Johnson & Johnson (JNJ). Despite this, JNJ’s market cap valuation of $430bn is more than 2x greater than Pfizer’s.

“Big 8” US Pharmas compared – investment fundamentals (my table using data from TradingView, Google Finance)

As soon as the market began to sense the end of the pandemic, it concluded that Comirnary and Paxlovid sales would plummet, and sold Pfizer stock. That will inevitably prove to be the case – guidance for Paxlovid and Comirnaty sales in FY23 is for $13.5bn, and $8bn respectively, but even so, most Pharmas can only pray for the kind of boost to revenues – and profits – these 2 drugs have given Pfizer: $115bn in 3 years! In the case of Pfizer – its stock price today trades at a lower value than it did pre-pandemic.

The Market’s Lack of Faith In Pfizer’s Products & Pipeline

As I have discussed frequently in posts about Pfizer and the current most valuable global Pharma – Eli Lilly (LLY) – the market perceives that Lilly and Pfizer are heading in opposite directions. Even though Lilly posted revenues of ~$28.5bn in 2022 – ~3.5x less than Pfizer – and net income of $6.2bn – 5x less than Pfizer – it is 2x more valuable than Pfizer today because the market seems to believe its weight loss and Type 2 diabetes franchise, led by tirzepatide and “Triple G” retatrutide, will address a >$100bn per annum market by 2030, with only one serious competitor – Novo Nordisk’s (NVO) semaglutide.

For good measure, Lilly also has an Alzheimer’s Disease therapy close to approval that could command >$10bn in annual sales, and spent $2.9bn this week acquiring Dice Therapeutics and its potentially ground breaking, preclinical, IL-17 targeting autoimmune franchise, which could see it take on AbbVie (ABBV) in dermatology and anti-inflammatory.

While the market celebrates Lilly’s pipeline and the hype around weight loss runs wild, Pfizer has been busy spending the mountains of cash it collected in profits during the pandemic. As I wrote in my last post on the company:

Since mid-2021 Pfizer has completed: a $2.3bn deal for Trillium Therapeutics and its 2 CD-47 targeting blood cancer drug candidates; a $7bn deal for Arena Pharmaceuticals and its late stage autoimmune candidate Etrasimod; an $11.6bn deal for Biohaven and its lead candidate Nurtec, indicated for migraine treatment; a $5.4bn deal for Global Blood Therapeutics and its ~$200m per annum commercial stage drug Oxbryta, indicated for Sickle Cell Disease (“SCD”), and lead candidate GBT601, which may offer a functional (permanent) cure for SCD; and a $525m deal for Reviral and its antiviral therapeutics targeting respiratory syncytial virus (“RSV”).

Since I wrote that, Pfizer has spent another $43bn acquiring Seagen (SGEN), an oncology focused, antibody drug conjugate (“ADC”) specialist with 4 approved drugs, that drove ~$2bn of revenues last year – but made a net loss of >$600m, as it did in the prior year.

Pfizer believes it can generate $25bn in annual revenues from its new migraine franchise, auto-immune drug Etrasimod, and it also believes that new product launches – an RSV vaccine, alopecia areata therapy, multiple myeloma therapy, flu vaccine, metastatic NSCLC therapy, pneumococcal vaccine, atopic dermatitis therapy, prostate cancer drug and endometriosis therapy – will add another $20bn of new revenues by the end of the decade.

These are not small numbers, but of course, they barely offset the lost COVID revenues, and have come at a cost of ~$70bn of M&A investment. To sum up Pfizer’s recent progress, the company announced this week that its hair loss therapy – a once-daily oral JAK inhibitor branded as Litfulo – has been approved by the FDA for commercial use.

There are apparently 7m people with alopecia in the US, and the drug is likely to cost ~$49k, according to Fiercebiotech, a theoretical $343bn market. Pfizer, however, estimates the opportunity to be worth ~$1bn in annual sales. Perhaps the Pharma should try to poach a few members of Lilly’s PR team, who appear to be able to whip up market enthusiasm to fever pitch with arguably, smaller market opportunities (and 4x less net income).

At the same time as announcing the alopecia win, Pfizer shared the news that it would stop developing lotiglipron, an oral treatment targeted at obesity and Type 2 diabetes mellitus – i.e. a drug with the same mechanism of action as Lilly’s tirzepatide. Every small step forward Pfizer takes, it seems to take a giant step back.

Should PFE Stock Investors Be Worrying?

Pfizer has a monumental, >5.6bn share float, so perhaps it is understandable that the share price rarely takes flight. Even the most optimistic, one-eyed Pfizer bull would likely admit that revenues in 2030 will be lower than in 2022. Does that mean Pfizer shareholders should be worried?

Not necessarily because just as bond yields go up as their prices go down, so Pfizer’s dividend yield goes up as its share price falls. Pfizer currently pays a dividend of $0.41, which has risen from $0.28 at the beginning of 2015 – a 46% gain.

The dividend currently yields ~4.3%, which is higher than any other Pharma bar AbbVie (ABBV), and AbbVie’s share price is also under pressure as a result of its >$20bn selling drug Humira losing its patent protection. If you can buy an asset that pays 4.3% per annum, with limited downside risk – Pfizer’s share price hardly ever budges – would you consider that a good return? Perhaps not with interest rates climbing, but it would not be a bad stock to hold as part of a balanced portfolio.

Pfizer does have some patent expiry problems of its own – Eliquis, which earned revenues of $6.5bn for Pfizer in 2022, will lose its patent protection sometime around 2026, while the Vyndaqel family of drugs – which treat hereditary forms of transthyretin amyloid cardiomyopathy (“ATTR-CM”), and earned revenues of $2.5bn last year, and $1.8bn selling Xeljanz also look set to lose patent exclusivity around 2025.

Oncology drugs Xtandi, Ibrance, and Inlyta could be under threat from generic drugs by 2027, and these 3 drugs delivered nearly $7.5bn of revenues in 2022. The number of drugs going off patent is a little troubling – for context, AbbVie does not expect a single asset to go off patent between now and the end of the decade – but in fairness to Pfizer, its M&A spending ought to help its ex-COVID product portfolio generate revenue growth over the coming years, despite the expiring patents of several key drugs.

Some Other Strengths & Weaknesses To Be Aware Of

This week, Pfizer was also celebrating an FDA approval for its growth hormone deficiency (“GHD”) drug Ngenla (somatrogon-ghla), co-developed with partner OPKO Health (OPK), making it 4 FDA approvals in 5 weeks, with Litfulo, RSV vaccine Abryvso also being approved, and Paxlovid receiving its full approval.

The company also had its marketing application for a hemophilia B therapy, fidanacogene elaparvovec, accepted by both the US and EU authorities, meaning the drug – a potential blockbuster – could be approved this year.

On the negative side, the effects of the Inflation Reduction Act (“IRA”) introduced by President Biden last year, which prevent drug makers raising drug prices faster than the rate of inflation, are being felt across the entire Pharma industry – except of course, Eli Lilly, whose drugs – or PR team – have made the company completely unaffected by adverse market news. A prominent Pharma lobbying company has even opted to sue the US government over the rules introduced by the IRA.

Despite its spending. Pfizer still reported cash and investments of $20bn as of Q1’23, and current assets of $50bn, although current liabilities stand at $36.5bn, and there is $32bn of debt to pay down. By Pharma standards, this shouldn’t be too challenging, and the company should retain its investment grade debt rating, protecting the company’s valuation.

Concluding Thoughts – Pfizer’s Road To Nowhere Is Not Such A Bad Trip To Be On

In this post we have explored some of the positives and negatives of investing in Pfizer, the New York based Pharma giant. Revenues will likely shrink in 2023: to $67 – $71bn, according to management’s guidance, but the forecast adjusted EPS of $3.25 – $3.45 offers a forward PE ratio of ~11x, which is favorable.

Pfizer earned a fortune from its COVID assets, but although these additional revenues initially pushed the company valuation up, the end of the pandemic sent shares crashing back down below pre-COVID levels. Pfizer has been on an M&A buying spree, but new product revenues will mainly be offsetting lost COVID revenues and the loss of exclusivity of several key products, such as blood thinner Eliquis.

Pfizer pays a generous dividend, but investors can forget about share price growth. Pfizer has plenty of cash, but plenty of debt too. In short, there is a kind of yin and yang to Pfizer – whatever advantages are handed to the company seem to handed back just as quickly.

The obscene COVID profits aside, you could almost describe Pfizer as the workhorse of the Pharma industry, diligently buffing its mediocre – in financial terms, yet valuable – in medical terms – pipeline and products whilst the likes of Lilly promotes a self-injecting drug that makes you lose your appetite and get thinner. That may be a little flippant towards Lilly, and it is unlikely to be Pfizer’s intention to have such a stagnant share price, but at the end of the day, 5.7bn shares with almost no upside potential can’t be wrong, whilst a dividend paying >4% feels just as right.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV, BMY, GILD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.