Summary:

- The US is reportedly planning new AI chip export controls targeting China, which could impact companies like Nvidia that have previously been affected by such measures.

- Despite potential restrictions, the impact on Nvidia is unlikely to be dramatic as the majority of its customers are in the US and China may still be able to buy chips indirectly or through a third party.

- This article suggests caution for investors chasing AI investments, particularly in Nvidia, which has seen its shares rise by 187% this year.

John M. Chase/iStock Unreleased via Getty Images

Article Thesis

Trade tensions between the US and China remain elevated, and the chip industry is among the most at-risk industries in that regard. AI chip developers are among the most at-risk players in the broad semiconductor industry. For Nvidia (NASDAQ:NVDA), this could be a risk factor going forward.

What Happened?

Reportedly, the US is considering new (artificial intelligence) chip export controls targeting China. No official announcement has been made so far, but the Wall Street Journal has reported that the new measures could be announced as early as July.

Chip export controls have been in place for a while, as the US has been trying to keep an edge over China when it comes to important tech developments such as artificial intelligence. Nvidia has been among the companies that were impacted by chip export controls in the past, with others such as Advanced Micro Devices (AMD) feeling an impact as well. For more on these past export control measures that were announced late last year, you can check out Seeking Alpha’s coverage here. Nvidia was banned from selling its A100 AI chips to China unless there was a valid export license. Similar restrictions are in place when it comes to AI chip exports to Russia.

What Could Export Restrictions Mean For Nvidia And Other Chip Companies?

AI chip export restrictions have been in place for some time, and so far, they do not seem to have an overly large impact. That being said, Nvidia’s revenue performance in recent quarters was far from great, although export restrictions only play a minor role here. Instead, weak demand from consumers for new gaming hardware and weaker crypto markets were primarily responsible for Nvidia’s revenue downturn. The company’s data center business has performed well.

Nvidia’s guidance for the current quarter implies massive revenue growth, driven, primarily by strong demand for Nvidia’s AI chips. We don’t know what the geographic breakdown of those AI chip sales will look like, but it seems reasonable to me to assume that the majority of AI chips will be sold to the American mega-cap tech players that have been investing heavily in AI and that see this as an important growth market. This includes companies such as Microsoft Corporation (MSFT), Alphabet Inc. (GOOG)(GOOGL), Meta Platforms, Inc. (META), and so on.

China does not have tech companies of a similar size, although it has large tech players as well, including Alibaba Group Holding Limited (BABA) and Tencent Holdings Limited (OTCPK:TCEHY). Some of these have been investing in AI as well and would thus seem like logical customers for Nvidia’s AI chips (and for those of some of its peers).

China-based AI players include Baidu (BIDU), which has recently stated that its in-house Large Language Model “Ernie Bot” was outperforming the better-known, Microsoft-backed ChatGPT (this statement has not been verified by any outside source as far as I can tell). Ant Group, in which Alibaba owns a stake, is working on an in-house Large Language Model as well.

While the US AI industry is larger and more prominent, there’s a Chinese AI industry as well. If Nvidia was able to sell to these potential customers in China, that would be nice and could result in incremental growth opportunities. With the AI chip export rules in place that were announced last fall, Nvidia’s ability to sell to Ant Group, Baidu, and so on was already restricted, although the company worked on some ways to still be able to sell AI chips to China. Its A800 chip was specifically launched in response to these rules that had hurt Nvidia’s A100 chip sales. When the chip was launched, Nvidia stated:

“The Nvidia A800 GPU, which went into production in Q3, is another alternative product to the Nvidia A100 GPU for customers in China. The A800 meets the U.S. Government’s clear test for reduced export control and cannot be programmed to exceed it.”

With new export restrictions on the horizon, Nvidia’s ability to sell the A800 chip could get hurt as well. In that case, Nvidia might try to bring an additional chip to the market, similar to what it did with the A800. But it’s possible that Nvidia’s potential customers don’t want to buy a chip that has been slowed down too much, thus the economic success of such a potential new chip development seems questionable.

New export rules being in the works also bring up the question of the effectiveness of these restrictions. The sanctions on Russia, by both the US and the European Union, have not brought as much success as first hoped for. Via third-country trading, Russia is still able to sell large amounts of oil and is even able to still buy military spec chips. When clear sanctions didn’t work too well here, it seems questionable whether export controls on AI chips will be sufficient to slow down China’s chip buying dramatically. It’s possible that sales of AI chips will be made indirectly, i.e. with a third party/country in between in order to forego these export restrictions.

I thus believe that it’s unlikely that the impact on Nvidia from new AI chip export regulation will be dramatic: First, the biggest customers are in the US, and second, China might still be able to buy chips even if new rules are announced, either due to Nvidia developing a new chip that complies with these rules (similar to the A800), or due to indirect exports via a third country.

Nevertheless, it seems pretty clear that these new rules, if announced, are still a negative factor for Nvidia. Even if they were to result in a sales hit of just 1%, that would be a headwind. And complying with these new rules could add costs, as products would likely need to get certified, and as additional bureaucratic work is added.

A similar logic applies to other semiconductor companies, although they would most likely be less impacted than Nvidia with its AI leadership. New export rules add costs and could be a headwind for sales, and are thus a headwind for the semiconductor industry. But the headwind shouldn’t be dramatic.

AI: Potential And Hype

Artificial Intelligence is, so far, not having a large impact on our lives. But that will most likely change a lot over the coming years and decades. It’s not possible to know exactly who the winners will be, however. Naturally, large and deep-pocketed players have an advantage, as they can spend on ventures that aren’t profitable yet and since they can also acquire either IP or entire companies (similar to Microsoft’s purchase of a stake in ChatGPT developer OpenAI). And yet, it’s also possible that the largest players today will get surpassed or disrupted – similar to what happened with former mobile phone king Nokia Oyj (NOK).

I do thus believe that investors shouldn’t be too aggressive when it comes to chasing AI investments. Nvidia, which has seen its shares rise by a hefty 187% so far this year, is a good example of a stock that’s currently being chased. It was a good investment one year ago, or half a year ago, but today, Nvidia is priced for perfection:

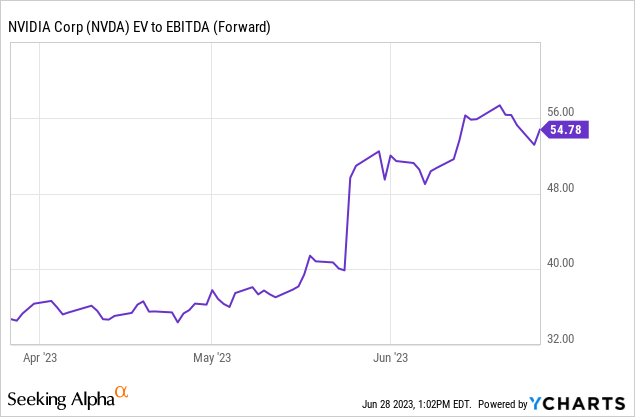

Over the last couple of months, Nvidia’s enterprise value to EBITDA multiple has risen from a high level in the mid-30s to a very high level in the mid-50s. An earnings multiple of 55 would be quite expensive already, while an EV/EBITDA multiple of 55 is even more extreme – generally, companies are valued at 10x – 15x EBITDA or so. Of course, Nvidia has a better growth outlook than the average company, but that does not mean that the valuation should be this high — if NVDA was trading with a 25x EBITDA multiple, it would trade at a substantial premium compared to the average company as well.

At times, the market can be irrational and some investors are chasing stocks that have run up a lot without considering the company’s valuation – we have seen this during the dot.com bubble, during the e-commerce bubble in the midst of the pandemic, during the EV bubble not too long ago, and so on. Today, we could be experiencing an AI bubble – some of the moves in AI stocks are hard to explain from a fundamental basis. Nvidia with its share price gain of close to 190% belongs to that group of potentially overvalued companies, driven by the current AI hype, which is why I’m staying away right here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA, GOOG, META, MSFT, TCEHY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!