Summary:

- Nvidia Corporation is one of the largest technology companies in the world, and in a relatively short time has become a world leader in visual computing and artificial intelligence.

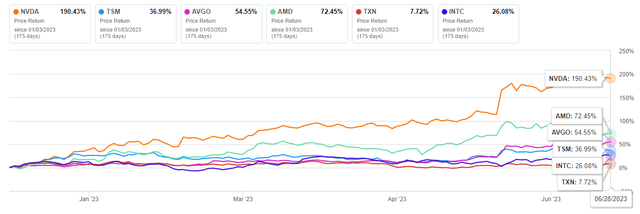

- The company’s share price has grown by about 168.54% since the beginning of 2023, outperforming major competitors in the technology sector.

- Nvidia Corporation’s Q1 FY 2024 financial results significantly beat analysts’ expectations, with revenues of $7.19 billion.

- On the other hand, the intensifying economic and geopolitical confrontation between China and the U.S., which could significantly reduce exports of the company’s flagship GPUs to China, is putting downward pressure on Nvidia’s share price.

- We initiate our coverage of Nvidia with a “hold” rating for the next 12 months.

Deagreez/iStock via Getty Images

Founded in 1993 by Chris Malachowski, current CEO Jensen Huang, and Curtis Priem, Nvidia Corporation (NASDAQ:NVDA) is one of the largest technology companies in the world and has become a global leader in visual computing and artificial intelligence. In addition to the world-famous GeForce GPUs that have changed the world of gaming and entertainment, the company’s portfolio includes the GeForce NOW game streaming service, graphics cards such as Quadro/NVIDIA RTX, and Omniverse Enterprise software for creating the metaverse.

In addition to higher interest rates, slowing down the semiconductor industry’s recovery, and negatively affecting consumer spending on games and equipment, a key risk to Nvidia’s financial position is the economic and geopolitical confrontation between China and the United States. Currently, the Biden-Harris Administration is considering updating the wide-ranging export controls, initially introduced in the second half of last year, that aims to tighten export licensing requirements and restrict the export of AI chips to China.

If new, more stringent restrictions come into force, this will not only negatively affect the company’s revenue but also require significant expenses for transferring part of operations from China. Moreover, it will slow down the research and development of next-generation chips, benefiting competitors looking to keep up with the performance and energy efficiency of the A100 and H100.

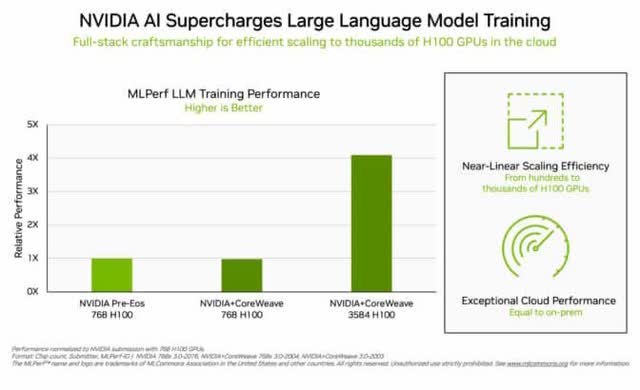

But despite the emergence of negative political news, Nvidia continues to delight investors with the performance results of flagship chips developed on the NVIDIA Hopper GPU architecture. According to the MLPerf benchmark results published on June 27, the NVIDIA H100 GPU set records in all tests. More importantly, it was the only one to pass them all in the study. This is an important point, as it demonstrates to the industry the versatility of Nvidia’s AI platform, in contrast to competitors such as Google’s supercomputer, running on tensor processing units. As a result, we believe in a surge in demand for Nvidia GPUs in the coming years as the best solution on the market from big data companies.

On May 24, 2023, Nvidia published financial results for the 1st quarter of the financial year 2024. They not only significantly beat analysts’ expectations, but were able to demonstrate that the revenues of the company’s two main business segments continue to grow year-on-year at a significant pace, despite the continued crisis in the semiconductor industry. As a result, since the beginning of 2023, Nvidia’s share price has grown by about 190%, outperforming such major competitors in the technology sector as Advanced Micro Devices, Inc. (AMD), Broadcom (AVGO), and Taiwan Semiconductor Manufacturing Company Limited (TSM).

Author’s elaboration, based on Seeking Alpha

We initiate our coverage of Nvidia with a “hold” rating for the next 12 months.

The financial position of Nvidia and its prospects

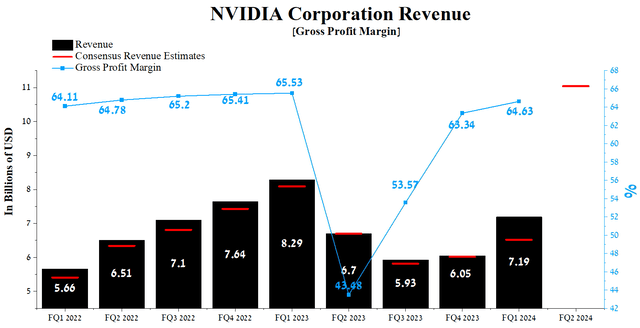

Nvidia’s revenue for the first three months of 2023 was $7.19 billion, up 18.8% from the previous quarter and down 13.3% from the first quarter of fiscal 2023. Despite a year-on-year decline in revenue, it far outperformed analysts’ forecasts, and, more importantly, Nvidia’s management expects its cumulative sales to reach $11 billion plus or minus 2% in Q2 FY 2024, which could be an all-time high in the company’s history.

Author’s elaboration, based on Seeking Alpha

One of the key markets for Nvidia’s financial position is data centers, which posted $4,284 million in revenue, up 14.2% year-over-year, driven by growing demand for AI-powered technologies from the world’s top cloud providers.

On the other hand, total gaming revenue was $2,240 million, down $1,380 million from the first quarter of fiscal 2024, due to increased geopolitical and macroeconomic pressures in Europe and Asia that continue to weigh on the PС market and lower video card shipments. At the same time, Colette Kress noted the continued high demand for the new GeForce RTX 40 series GPUs, which, according to our estimates, will make one of the main contributions to revenue recovery in the Graphics segment.

The GeForce RTX 40 Series GPU laptops are off to a great start, featuring four NVIDIA inventions, RTX Path Tracing, DLSS 3 AI rendering, Reflex Ultra-Low Latency rendering, and Max-Q, energy efficient technologies. They deliver tremendous gains in industrial design, performance and battery life for gamers and creators.

Nvidia’s revenue for Q2 FY 2024 is expected to be $10.96-11.85 billion, up 69.3% from analysts’ expectations for Q1 FY24. We believe that several factors will drive Nvidia’s revenue surge. The first of these is the rapid development of areas such as artificial intelligence, data processing, robotics, and deep learning, in which an increasing number of companies are starting to use Nvidia GPUs due to their higher efficiency compared to solutions developed based on x86 CPUs.

What’s more, 2023 has been the year of AI hype due to the rising popularity of ChatGPT. We expect that AI will begin active implementation in medicine, the entertainment industry, science, and the financial world, and not only, which will ultimately require constant IT infrastructure development.

We believe that the growth of the Data Center segment will be provided by products developed on the NVIDIA Hopper GPU architecture. Its current flagship is the NVIDIA H100 GPU, which will be able to deploy numerous generative AI-based solutions, accelerate large language models, and more.

On June 27, 2023, Nvidia published the results of MLPerf, a set of specific tests that, among other things, help determine the performance of machine learning hardware. The company’s GPU set records in all tests, and more importantly, it was the only one to pass them all in the study. This is an important point, as it demonstrates to the industry the versatility of Nvidia’s AI platform, in contrast to competitors such as Google’s supercomputer, running on tensor processing units.

For example, the completion of the DLRM-dcnv2 and ResNet occurred in 1.6 minutes and 0.18 minutes, respectively, while training GPT-3 ended 11 minutes after the start of measurements.

Moreover, the optimization across the entire technology stack contributed to a linear performance increase in the LLM test.

Another favorable moment that can become a decisive factor when choosing equipment for data processing centers is the energy efficiency of processors. Since the company’s GPUs use fewer server nodes than competitors, this results in lower power consumption. As a result, this reduces the cost of maintaining these centers, reduces the likelihood of equipment going out of service, and is beneficial to the environment.

As the Fed cuts interest rates, we expect consumer spending on games and gaming hardware to rise. This will boost sales of the company’s GPUs, equipped with technologies such as NVIDIA RTX and NVIDIA DLSS, which can increase the realism of game scenes and frame rates, which is undoubtedly essential for young people who want to become more immersed in the world of games.

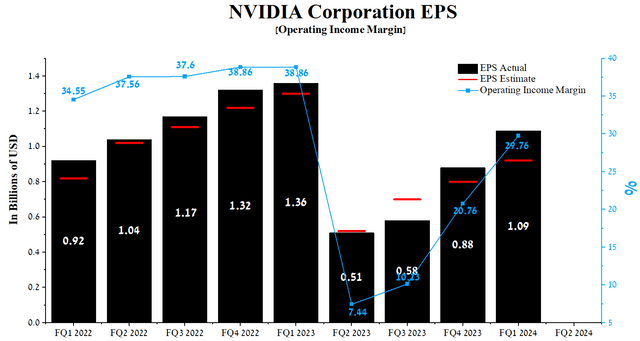

Nvidia’s operating income margin in Q1 FY 2024 was 29.76%, continuing the growth that started in Q2 FY 2023 and exceeding its median of 28.39% for the period between January 1, 2021, and the end of March 2023 of the year. Moreover, this financial indicator is higher than that of the technology sector and that of major competitors such as Advanced Micro Devices and Intel Corporation (INTC), another factor attracting investors to choose Nvidia as a long-term investment.

We forecast Nvidia’s FY 2024 operating income margin to reach 34.5% and increase slightly to 36.1% by FY2025, driven by the company’s higher GPU sales due to continued growth in demand from cloud service providers. In addition, the intensifying economic and geopolitical confrontation between China and the United States was considered, which could lead to stricter export licensing requirements and restrictions on exports of the company’s flagship AI-focused GPUs to China.

The company’s EPS for the first three months of 2023 was $1.09, up 23.9% quarter-on-quarter and, just as importantly, beating analyst consensus estimates in seven of the last nine quarters.

Moreover, Nvidia’s Q2 EPS is expected to be in the $1.76-$2.37 range, up 123.9% from the Q1 FY 2024 consensus estimate. At the same time, Nvidia’s Non-GAAP P/E [TTM] is 136.85x, which is 642.59% higher than the average for the sector and 172.04% higher than the average over the past five years. On the other hand, the Non-GAAP P/E [FWD] of 53.86x is one of the factors indicating that the company’s shares remain overbought in the current period of declining AI hype and tense trade relations between the U.S. and China.

Author’s elaboration, based on Seeking Alpha

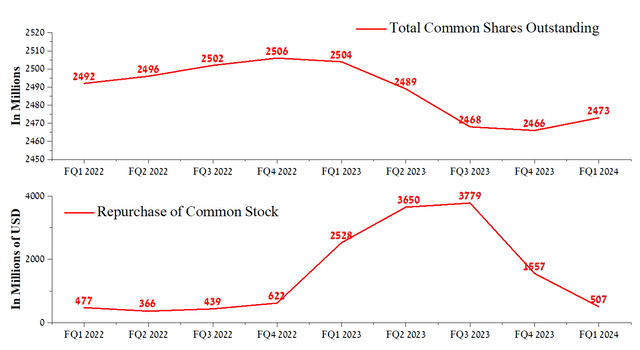

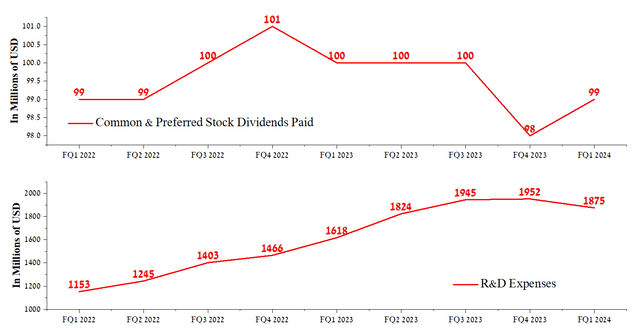

The main reason for Nvidia’s beating the consensus EPS is mainly due to the sharply improved margins of the business and not the impact of the share buyback program. For the first quarter of fiscal year 2024, Nvidia bought back about $507 million worth of its shares, one of the lowest numbers in recent quarters. At the same time, at the end of April 2023, the remaining authorization to repurchase Nvidia shares amounted to $7.23 billion. Given the current heightened stock volatility driven by the AI hype and the need to increase investment in next-generation chip development, we do not expect the active use of the share repurchase program to continue as it was in 2022.

Author’s elaboration, based on Seeking Alpha

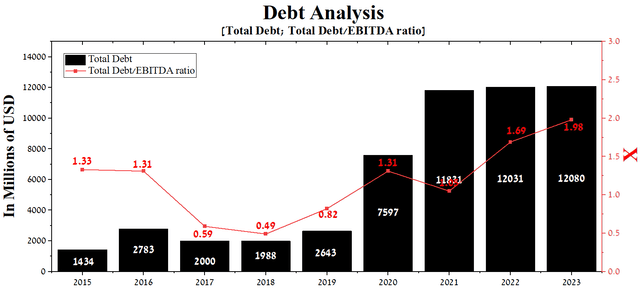

At the end of the first quarter of 2023, Nvidia’s total debt was about $12.08 billion, up slightly from 2021. However, due to a sharp decline in EBITDA in the second and third quarters of fiscal 2023, the total debt/EBITDA ratio increased from 1.05x to a record of 1.98x for the company.

Author’s elaboration, based on Seeking Alpha

With senior notes maturing between 2023 and 2060, cash flow growth, and total cash & short-term investments of $15.32 billion, we do not expect the company to have any problems redeeming them. As a result, Jensen Huang will likely maintain current R&D spending and dividend payments.

Author’s elaboration, based on Seeking Alpha

Conclusion

Founded in 1993 by Chris Malachowski, Jensen Huang, and Curtis Priem, Nvidia Corporation is one of the largest technology companies in the world and has become a global leader in visual computing and artificial intelligence.

2023 has been a year of hype around artificial intelligence due to the growing popularity of ChatGPT. We expect that AI will begin active implementation in medicine, the entertainment industry, science, and the financial world, and not only those areas, which will ultimately require constant IT infrastructure development.

Based on the NVIDIA Hopper GPU architecture, the company’s flagship is the NVIDIA H100, whose performance and energy efficiency continue to delight the market. So, on June 27, 2023, Nvidia published the results of MLPerf, in which the company’s GPU set records in all tests, and more importantly, it was the only one that passed them all in the study.

On the other hand, the intensifying economic and geopolitical confrontation between China and the U.S., which could significantly reduce exports of the company’s flagship GPUs to China, is putting downward pressure on Nvidia’s share price.

Given the geopolitical tensions in the world, and the Fed’s high interest rate path, which slows economic activity recovery in Europe and Asia, we expect Nvidia Corporation’s share price to correct to strong support in the range of $382-384. We initiate our coverage of Nvidia with a “hold” rating for the next 12 months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article may not take into account all the risks and catalysts for the stocks described in it. Any part of this analytical article is provided for informational purposes only, does not constitute an individual investment recommendation, investment idea, advice, offer to buy or sell securities, or other financial instruments. The completeness and accuracy of the information in the analytical article are not guaranteed. If any fundamental criteria or events change in the future, I do not assume any obligation to update this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.