Summary:

- Cisco Systems, Inc. is fairly priced and could be a good long-term investment, despite lacking significant growth catalysts.

- Cisco’s recent venture into AI and its new AI-focused networking chips, G200 and G202, are not expected to significantly impact revenue growth.

- Cisco’s software revenue saw an 18% year-on-year increase, leading the company to raise its FY23 outlook. However, this might be an outlier event.

- Cisco’s financials are strong, with $8B in cash and $15B in short-term investments, against $8B in short and long-term debt.

Alexander Koerner

Investment Thesis

With full year results coming out next month, I wanted to take a look at Cisco Systems, Inc.’s (NASDAQ:CSCO) potential to see if it is a good time to buy before the report by looking at the company’s prospects and its financial performance. In my opinion, CSCO does not have any growth catalysts that will propel its revenue growth to the next level. However, a simple discounted cash flow (“DCF”) analysis shows that the company is priced fairly right now. If it chugs along at the historical growth numbers, it should be a good investment for the long-term investor.

Outlook

In my opinion, the company needs to come up with something interesting to see much higher revenue growth going forward. Is artificial intelligence, or AI, the answer here? It has been for many other companies that just mention their involvement within the AI space, their market caps shoot up 10% in a day. That is going to be hard to predict. Recently, the company unveiled AI-focused networking chips, the G200 and G202. I feel like if this news was out a couple of months earlier, we would have seen the stock jump over 10% in a day. This news was a non-event, however, as the stock went nowhere.

It is not the right way to invest if people are just looking for that buzzword to make waves in the stock markets. That is too short term, and since CSCO is only experimenting with select customers, I don’t want to speculate how much of an impact these chips will have on the company’s revenues going forward. I don’t think these chips will be the catalyst that will propel the company’s rather abysmal historical growth over the last decade, but it is a good start.

Software revenue saw a nice bump y-o-y of around 18%, and that is across both the product and service segments. The company even raised its FY23 outlook once again, which is a very positive sign. To me, this seems like an outlier event because the company expects to see around 10% revenue growth for FY23 and then expects the revenue to go back down to around 2%-4% a year, which is more in line with what the company was doing in the last decade. It seems like the management is not very optimistic about their prospects even with double-digit growth in software revenues and AI hype.

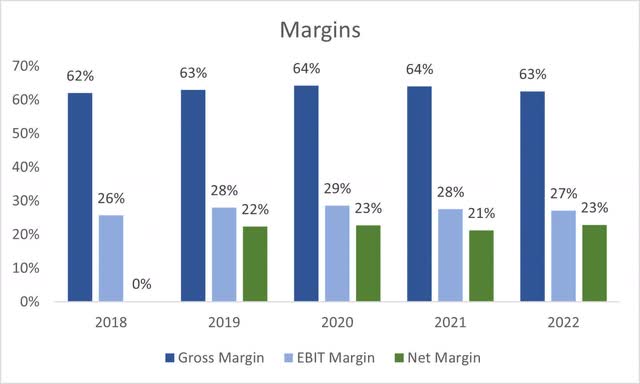

In terms of margins outlook, I don’t think the company can improve these by a lot over the next decade. Cisco has really good margins in my opinion, and the best outcome scenario would be if they manage to keep these margins going forward or a slight improvement. The competition is fierce in this industry, and it may be tough to keep such a competitive advantage for long, especially if other companies try to take market share from CSCO with aggressive price cuts that will hurt them in the short run but will have a long-term benefit.

I don’t see CSCO losing much on market share here, given that it is such a big company with so much cash that it can continue to innovate and excel. However, there is always that possibility that another company might make something more efficient than them, and that would cost them if they are caught slacking.

Financials

In the latest quarter, the company had $8B in cash and a whopping $15B in short-term investments, which brings the company’s liquidity to $23B against around $8B in short- and long-term debt. This shows me that the company has no liquidity issues at all. Interest expense on debt is easily covered by EBIT and interest on short-term investments is higher than the interest on debt. This gives the company a lot of room for many different strategies it may want to employ. For instance, if it wants to acquire more companies for inorganic growth, continue share buybacks, and/or pay dividends. I’m not against any of these options, just maybe the buybacks if the share price is elevated.

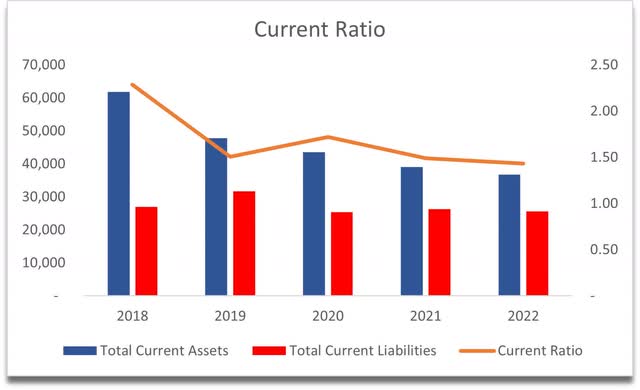

Continuing with liquidity, Cisco’s current ratio has been decent over the last 5 years, and in the latest quarter, it stood at around 1.4, which means it has no liquidity issues and can pay all of its short-term obligations without issues.

Current Ratio (Own Calculations)

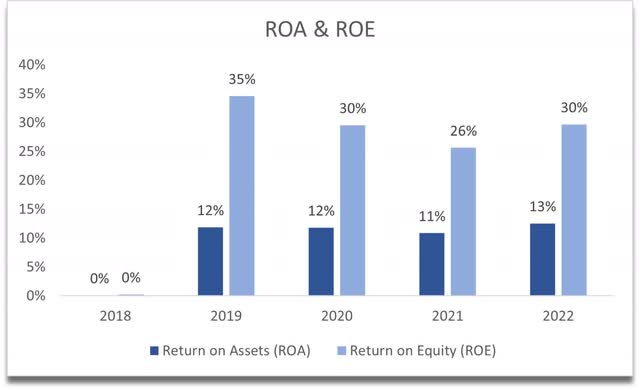

In terms of profitability and efficiency, CSCO boasts some impressive metrics here. ROA and ROE have been well above my minimums of 5% for ROA and 10% for ROE. In FY22 it managed to increase from the year before. This tells me that the management is competent and is able to utilize the company’s assets and shareholders’ capital efficiently and is creating value for the investors.

ROA and ROE (Own Calculations)

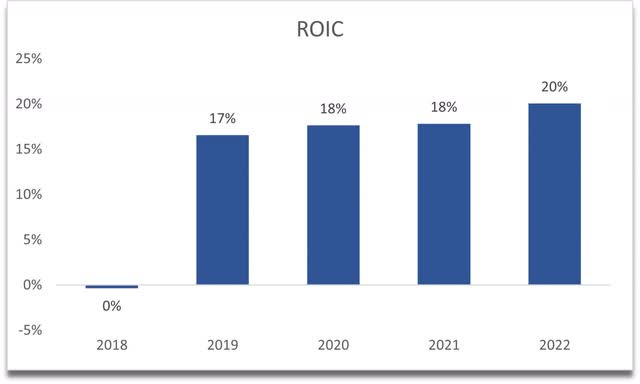

The same story can be said about the return on invested capital. It has seen a slight increase from the prior year and is well above my minimum of 10%. This tells me that the company still enjoys quite a competitive advantage so far and has a strong moat. I would start to worry if over time this metric starts to downtrend, which may mean that the company is falling behind its competitors and needs to do something quick. But, right now, this metric is very good.

I touched on margins briefly already and told you my concerns, so I’ll be quick here. I see that the margins have contracted slightly in FY22, however, now that we have 3 quarters out already for FY23, with the latest quarter showing a 240bps or 2.4% improvement in gross margins of the products segment, this means the margins are improving back to the normal levels we saw over the last decade.

Overall, the company seems to be very well equipped financially for any sort of downturn in the global economy, which is supposedly coming in the next year or so, but I won’t be holding my breath. The management is competent in my opinion, and they do know how to run a profitable business over the long run.

Valuation

As I have outlined in the outlook section, I don’t see much in terms of catalysts that will bring growth to new levels, so the way I’m going to approach the valuation here is going to be very basic.

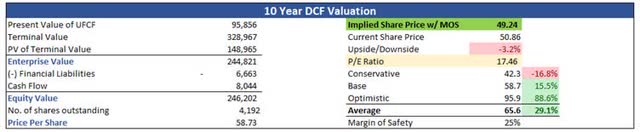

For the revenue growth, for FY23 I modeled 10% growth because the company had a decent year all around and that is one the management has guided. After that, in the transcript, the management was looking for a 5%-7% growth in EPS while also mentioning that revenue growth would be around half the EPS growth, so I modeled 3.5% for FY24 and linearly grew it down to 3% by ’32. This gives me around 3.9% CAGR over the next decade for the base case scenario.

For the optimistic case, I went with a 7.7% CAGR, while for the conservative case, I went with around 2% CAGR.

In terms of margins, I assumed that the company keeps its competitive advantage due to the company having the resources to innovate further to help with efficiency and maintain market share and competitive advantage. I decided to improve gross and operating margins by 200bps linearly over the next decade. This adds around 2% to net margins by ‘32, which I think is very reasonable. For the conservative case, the margins are slightly worse than the base case, and vice versa for the optimistic case.

On top of these assumptions, I will add a 25% margin of safety discount. This is the minimum I give to all the companies I analyze, and it only increases if the balance sheet and financials are not great. In this case, CSCO has very good financials.

With that said, Cisco System’s intrinsic value is $49.24, implying a 3% downside from current valuations, or priced fairly in my opinion.

Intrinsic Value (Own Calculations)

Closing Comments

In my opinion, Cisco Systems, Inc. is priced fairly and, in the long run, will reward its loyal shareholders. It’s a company that will not fluctuate too much over time, and I think investors will not be losing too much sleep over it.

The company has a good competitive advantage and a strong moat, which makes it a leader in the industry. I’d say Cisco Systems stock is a buy at these levels, but if you are a bit hesitant, there’s no rush, especially if the volatility in the global markets persists. Inflation is still high and interest rates will be raised further. This does not signal to me that the volatility is gone, rather the opposite. There may be a better entry point for Cisco Systems, Inc. if there is no rush.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.