Summary:

- Intel made a convincing case at its recent webinar that its cost reduction effort is realistic, which could push gross margin over 60%, beyond the previously stated (high 50s) target.

- Intel has made significant progress in engineering milestones, such as backside power delivery and fab updates, potentially increasing investor confidence.

- The company’s progress shows a new semiconductor world order may be arising with Intel at the top.

- Intel’s stock remains far from its multi-year high, but the likelihood of a successful turnaround is increasing, making it a compelling semiconductor stock option.

JHVEPhoto

Investment Thesis

While financially Intel (NASDAQ:INTC) has yet to show signs of a true recovery, I’ve previously hinted at a major turnaround, and more or less behind the scenes Intel has been hitting some crucial engineering and other milestones, which collectively might increase investor confidence.

As both AMD (AMD) and NVIDIA (NVDA) have rallied sharply already, Intel may be one of the most compelling semiconductor stocks currently.

Internal Foundry Model update: 70% GM?

Intel recently held its quite anticipated Internal Foundry Model webinar. In my initial coverage of the announcement of this model in the fall of last year, I was mainly skeptical of this, as it seemed just another way to present Intel’s financials, which means it is ultimately just an exercise in financial reporting.

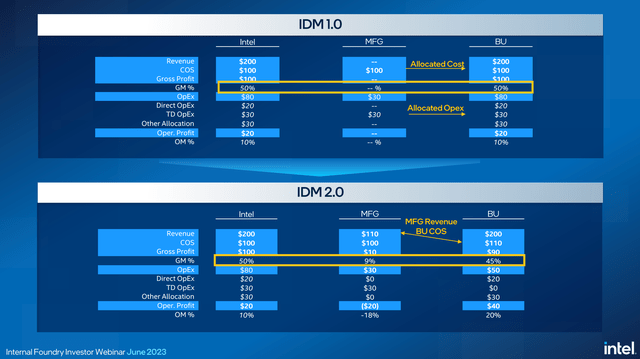

To recap, the internal foundry model means that Intel will treat both the manufacturing and product units separate with their own P&L. This means the product teams become virtual foundry customers of the manufacturing (foundry) group, which as a result becomes a completely dedicated (pure play) foundry, just like TSMC (TSM).

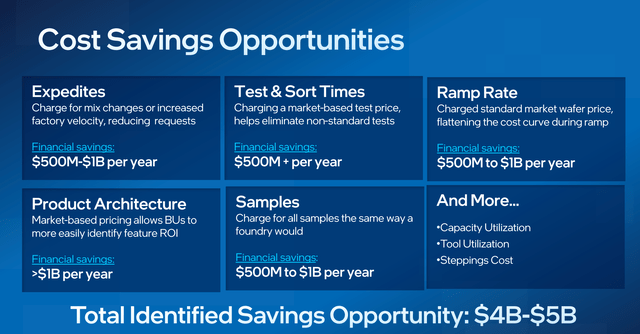

With the recent webinar, Intel has taken away most of my concerns. While Intel acknowledged that it is ultimately just a model (the actual financials remain unchanged), by running the company in this manner, new opportunities for cost improvements become visible, as Intel starts benchmarking itself to the foundry competition on an apples-to-apples basis. Ultimately, it is these cost improvements that should result in the bulk of Intel’s $8-10B cost saving plan that it launched last year.

Specifically, Intel highlighted following areas where it basically it is basically less efficient than the competition. For example, in the new model the product groups will be charged for expedites (faster wafers/hot lots, which impacts factory efficiency), which impacts their bottom line, so which they are consequently discouraged from doing, ultimately making the fabs more efficient.

More philosophically, while in principle an IDM would be more efficient than a foundry, in practice this might actually not have been (fully) the case. The main advantage of being an IDM is that the product groups do not have to pay a “foundry tax”, which means that the effective wafer cost of the company is lower than that which a fabless company needs to pay. However, that is based on the assumption that the fabs are being run just as efficient as a foundry would, which is obviously not the case if there is no accountability for being efficient with regards to things like expedites, samples and testing/sorting.

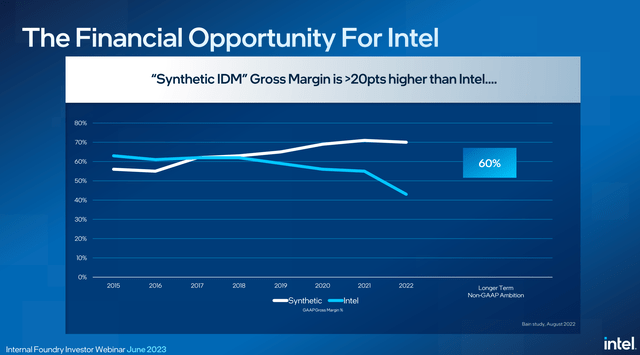

Now, one can see where this is going. If the foundry side of the internal foundry model becomes just as efficient as TSMC, that gets this side of the business to 50-60% gross margin with 40-50% operating margin. But on top of that are the product groups, which will try to achieve similar operating metrics (and which are similar to other fabless customers). But since Intel is a virtual foundry (at least for its own product groups), those margins will stack, finally reaping the full benefit of being an IDM.

To give a concrete example. If the foundry side incurs a cost of 1 unit to make a wafer, it will sell this wafer to Intel’s product groups for 2 units in order to make 50% gross margin. In turn, Intel’s product groups are charged with achieving similar gross margins as their fabless peers such as AMD and Nvidia. Let’s take AMD as comparison. In order for Intel’s product groups to achieve 50% gross margin, they will now have to sell the wafer for 4 units. But since this is just an internal foundry model (i.e. virtual foundry), by selling a 1 unit cost product for 4 units, Intel overall will achieve (and report) 75% gross margin.

For comparison, in the pre-internal foundry model case, Intel would sell the wafer for 2.5 units to make 60% gross margin. Or given the inefficiencies, perhaps the actual cost would be 1.4 units which would be sold for 3.5 units.

Either way, as bottom line, the message here is that Intel’s goal from the 2021 investor meeting was to return to high 50s gross margin. But on top of that, the internal foundry model exercise has uncovered that there are additional cost reductions to be achieved ($4-5B), which could push the gross margin into the 60s.

So while the official goal is to return to 60% gross margin, the less official goal seems to be for the IDM side of Intel (i.e. without the real foundry business) to achieve 70% gross margin over time. Of course, including the “real” foundry business (Intel said the internal foundry means Intel will become the second largest foundry in the world, behind TSMC and slightly ahead of Samsung), a gross margin around 60% would be more realistic, depending on how large this business becomes.

Final IDM thoughts

Of course a key Intel risk remains execution. Nevertheless, the internal foundry model exercise adds yet another tool in the quite versatile toolbox that Intel has to drive shareholder returns.

- As a baseline, as the inventory digestion nears its completion, demand should rebound at least closer to previous levels.

- Several of Intel’s existing main businesses should experience demand growth over time, such as networking and edge, and data center.

- Intel’s three big bets (foundry, Mobileye and graphics/AI) are each capable of becoming large additional businesses in their own right, driving further revenue growth.

- By solving the process issues and returning to leadership, gross margin could expand back towards 60s as Intel could charge more for its leadership transistors (which begets leadership products at leadership cost per transistor). Also note that some portion of the current gross margin headwind is due to this investment phase in fabs and process leadership, which should normalize over the next few years.

- By making the company more efficient with the internal foundry model, resulting in cost reductions, as well by getting leverage from revenue growth, gross margin could further expand, even beyond historical levels.

The goal is a $100B+ revenue company with ~60% gross margin and ~40% operating margin. Overall, this is a quite exciting prospect for shareholders. While before I was a bit skeptical if Intel could really become such an efficient and profitable company (since Intel has quite a high fixed cost component from things like R&D), the internal foundry effort may perhaps be the final ingredient to make this reality.

Business analysis

There have been some news items recently, while incrementally small, together move the needle a few steps forward for Intel.

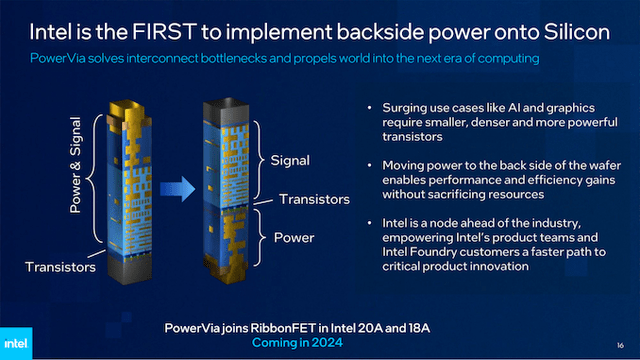

1. Industry-first: backside power delivery

On the same day as the Apple (AAPL) Vision Pro revealed, a more obscure but technologically certainly no less impressive development was announced. Intel revealed some more details about its PowerVia implementation of a backside power delivery network.

In simple terms, the idea is to use the backside of the wafer to implement the power delivery network. For comparison, in a conventional silicon chip, the fabrication process starts with the transistors (called front-end of line or FEOL), followed by the interconnects for power and signals (back-end of line or BEOL).

Intel’s implementation will be both the most technologically advanced, as well as earliest to market, likely beating Samsung and TSMC by 2-3 years. Overall, this is another sign that Intel is on track to its goal of regaining process leadership over the next 18 months.

As an aside, Intel’s disclosure was based on an internal node that it created based on Intel 4. While this node will not go into commercial production, Intel showed that its yield was nevertheless trailing just a few months behind Intel 4. One could also make the case that while Intel has been touting the 5 nodes in 4 years strategy, this internal node together with the 18A pull-in actually makes it 6 nodes in 3 years.

2. Fab updates

There have also been several fab updates. The most major of which are the updated plans for its (initially two) German fabs. Intel has increased the investment to over $30B and is also getting a larger subsidy package worth over $10B. While the timeline seems to be shifting a bit further out towards 2028 potentially, Intel also said that it will use more advanced process tech than initially expected, using its most advanced process at that time, which in 2028 should be 1.0A (or 1.2A perhaps).

Secondly, Intel announced an assembly and test fab in Poland, further on-shoring the semiconductor supply chain in Europe.

Thirdly, Intel announced a new Israel fab. Together with the existing $10B Fab 38 project (adjacent to Fab 28), the total investment has been upgraded to $25B (indicating the new expansion is worth $15B), with the third Israel fab slated for 2027.

Together with the already announced Ohio and Arizona fabs (two at each location), Intel is clearly continuing to move forward with its original plans to vastly expand its factory network in anticipation of future demand, for both its own as well as foundry customers’ products.

Regarding foundry, in recent months Jensen Huang disclosed that it has received the results of a test chip, presumably for 18A.

3. Data center progress

Intel recently showed its benchmark results of Sapphire Rapids compared to Genoa. While certainly Intel has likely cherry picked favorable comparison, the fact that it is competitive or even leading in many benchmarks shows that after many years Intel finally has a decent product again to compete in the data center. Especially in AI workloads, Intel’s lead is strongest due to its dedicated AMX accelerator.

As a reminder, Intel has several more products in the pipeline, which Intel says are successfully hitting their engineering milestones on schedule. While Emerald Rapids in Q4 should be a small upgrade, the move to Intel 3 with Granite Rapids and Sierra Forest around mid-next year should further solidify its product offering. These products are already in volume validation with customers, Intel said. From a high level, Granite Rapids will have a bigger increase in core count than Zen 5, so Intel could completely close the core count gap, as both parts are expected to have around 128 cores.

4.Other

Several other notable items:

- Intel announced the availability of a 12-qubit chip for researchers.

- Intel won a $1.5B patent case.

- There has been a rumor of Intel being involved in the Arm IPO.

- At a conference, CFO Dave Zinsner reaffirmed its Q2 guidance, in light of the Nvidia results, indicating that GPUs were not significantly cannibalizing CPU demand. In fact, Q2 was trending towards the upper half of the guidance range.

Investor Takeaway

Even before the recent webinar, a leaked internal slide had shown how Intel concluded that it is a much less efficient company than what for example a hypothetical TSMC+AMD IDM could or would be. So from that light, it is perhaps not too surprising that Intel has found multiple quite major opportunities for cost reductions. Nevertheless, before the webinar this was all quite vague, and as such Intel’s claim that it could save up to a $10B by 2026 was still open for skepticism. While of course it remains to be seen if Intel can really implement all these points, the webinar has made this effort far more credible as Intel has detailed the quantitative categories where it is less efficient than the industry.

Notably, what I hadn’t appreciated before (because it was so vague) is that this effort goes beyond the goal from the 2021 investor meeting to return to high 50s gross margin. So in the worst case, the internal foundry model effort de-risks the gross margin recovery, while in the best case gross margin (at least on the ex-foundry side) could meaningfully surpass the official target.

With regards to the business evolution, overall the process and product updates are most significant. Intel has been hitting its process milestones for the last three years, and recently its product milestones as well. What this means is that a new semiconductor world order is rising, with Intel at the top. Financially, this is reflected in the fact that Intel is currently planning or building no less than 8 leading edge fabs.

With regards to the stock, it has actually outperformed both AMD and Nvidia since the opening the day after Nvidia’s earnings results, although admittedly the other stocks had already rallied significantly off their lows. Still, Intel stock remains far off its multi-year high, so the stock is still very far from pricing in any sort of turnaround, which by now seems ever more likely of succeeding as most of the headwinds move into the rearview mirror and plenty tailwinds become visible.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.