Summary:

- Earlier this month, Apple Inc. presented its upcoming mixed reality headset Vision Pro that could revolutionize the computing industry.

- It’s too soon to say whether Vision Pro will be massively adopted, given its expensive price, but it can certainly bump Apple’s sales and make the company’s stock more attractive.

- At the same time, Apple’s Vision Pro will likely be more successful in monetary terms in comparison to Meta’s VR/metaverse projects.

Justin Sullivan/Getty Images News

The upcoming release of Apple Inc.’s (NASDAQ:AAPL) Vision Pro headset in early 2024 could revolutionize the computing industry and make the company experience another iPhone moment that could strengthen its dominance in the consumer electronics market even more. At the same time, there are reasons to believe that Apple’s new headset could be a much more successful project, even with all of its downsides, than Meta Platforms, Inc.’s (META) own VR/metaverse project that continues to lose billions of dollars each quarter. Therefore, as we all await the release of Vision Pro next year, this article aims to highlight all the major features of Apple’s upcoming device and explain how its launch could affect the overall business along with the company’s share price.

Is This The Start Of A New Computing Era?

Vision Pro’s unique selling point is that it’s a VR-AR headset that in addition to virtual worlds also makes virtual objects appear in the physical world. At the same time, Vision Pro doesn’t have any controllers and relies on countless sensors and cameras to support eye-tracking capabilities that make it possible for its users to interact with other environments. What’s more is that Apple calls Vision Pro a spatial computer, which implies that the new device could give the start for a new kind of computer era where the interface would be based around eyes and hands, and the experience would be more immersive than anything that we’re experiencing today.

The only issue, though, is that it’s too soon to say whether the initial version of Apple’s Vision Pro will succeed or not. However, if we are heading in a direction where smart headsets become a vital part of our lives just like phones, then Apple is the one company that could make widespread adoption of such headsets possible.

What’s also important to note is that it looks like Apple’s Vision Pro is likely to be more successful than, for example, Meta’s VR/metaverse projects combined in monetary terms. As I’ve previously noted, one of Meta’s biggest issues is that its Reality Labs division that’s responsible for all of those projects is one big money pit that losses billions of dollars every year and is unlikely to generate any returns anytime soon. Instead of going for the same go-for-broke approach and making the same mistakes, Apple is more than likely to either lose less money or even make a profit right away from each sale of Vision Pro even if the overall sales volume will be lower in comparison to Meta.

At the same time, Apple is notorious for its cross-selling tactics. That’s why it’s more than likely that the company would be selling accessories like headbands, light seals, premium prescription lenses, and perhaps bigger battery packs for Vision Pro to make even more money on each sale. In addition to this, we should also expect an influx of apps and services that will be populating the Vision Pro ecosystem and creating an additional income stream for Apple, which would be able to collect fees from the app store and improve its overall performance at the same time.

The Revival of Meta Vs. Apple Rivalry Is Upon Us

Apple and Meta have a difficult love-hate relationship with each other. In the past, both companies have been in talks about creating a joint advertising and subscription project that could’ve prevented a rivalry between both tech giants. Once the talks failed, we witnessed one of the greatest Big Tech wars of our generation, which resulted in Meta losing dozens of billions of dollars in lost revenue and even more in market capitalization as Apple’s new privacy policy made it harder for Meta CEO Mark Zuckerberg’s business to efficiently provide targeted ads to its users.

That’s why it came as no surprise that Mark Zuckerberg was one of the first to comment about the release of Apple’s new mixed reality headset, which would directly compete with the lineup of Meta’s own VR headsets from the Quest series and revive the rivalry. One of Mark Zuckerberg’s biggest concerns about Apple’s new device is its pricing. Apple’s starting price for the Vision Pro headset is expected to be $3,999 against the Meta’s Quest 3 price tag of only $499. The pricing concern is a valid one, since at such a price the initial version of Vision Pro would likely be only a niche product for a small group of customers until a cheaper version potentially comes out.

At the same time, Mark Zuckerberg in his letter to employees has also stated that Meta and Apple have different visions for the future of computing. Meta’s CEO critiques the Vision Pro demonstration in which the person that wears the headset is constantly sitting alone on a couch for hours, which is something that Mark Zuckerberg’s metaverse and VR projects want to avoid.

However, even though those and other concerns from the letter about the Vision Pro are more than reasonable, it would nevertheless be foolish not to take Apple’s entrance into the mixed reality market seriously given the company’s ability to disrupt industries.

As I’ve already explained earlier, Apple’s launch strategy is likely to be more successful in the end. At the same time, the ability to interact in augmented, and virtual realities without the need to change devices is one unique selling point that would likely make Vision Pro an overall better device to own. It would also make Apple once again the winner in its rivalry against Meta in the long run.

What’s Next For Apple?

Vision Pro is expected to be released in early 2024 in the United States and later in other countries. If the headset becomes successful, it would be able to help Apple mitigate the effects of the expected weak performance of some of its other product categories. The company’s latest earnings report for Q2, which was released in May, showed that sales of iPhone barely increased Y/Y during the quarter, while sales of laptops, wearables, and tablets were down Y/Y.

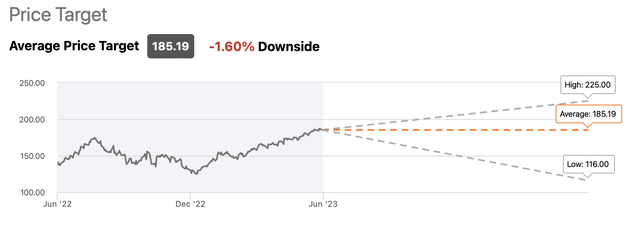

At the same time, the company’s partner Foxconn expects more economic uncertainty ahead. Add to all of this the fact that the Street believes that there’s no longer an upside in Apple’s shares and it becomes obvious that a potential boost in sales of Vision Pro in less than a year could improve the performance of overall business, raise expectations, and revolutionize the way we interact with each other at the same time.

Apple’s Consensus Price Target (Seeking Alpha)

The Bottom Line

If Apple manages to convince the world that smart headsets will become a vital part of our lives and would be able to make Vision Pro an attractive device to own, then there’s a high chance that it would be able to give a start to a new computing era that’s based around such devices. If that’s the case, then Vision Pro could have the same effect on the computing industry as the initial iPhone had on the phone industry. It would make Apple’s new product more successful than Meta’s VR/metaverse projects combined in monetary terms.

At the same time, even though Vision Pro’s expensive price tag will limit the potential customer base at the start, Apple’s ability to cross-sell accessories and collect fees from third-party apps could make the headset successful in the end. Therefore, the upcoming launch of Vision Pro would likely help Apple mitigate some of the downside caused by the recent relatively weak performance of its other product categories and bump up its sales in less than a year. This, in the end, would likely make Apple’s stock a more appealing investment for the long run.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He's/It's/They're solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!