Summary:

- Meta stock has recovered most of the losses of last year and is now merely 20% away from its prior peak.

- Meta’s resilience in the face of Apple’s privacy changes, TikTok growth, and regulatory challenges supports the bull case for the stock.

- Meta is already looking to build an alternative to Twitter, and we could see future social media features getting assimilated within the company’s platform.

- We could see 15% to 20% annual EPS growth through operational efficiency, higher monetization, and buybacks in the next few years.

- There are a lot of growth avenues available for Meta in the next few years, which should help the company deliver good returns.

Justin Sullivan

Meta Platforms (NASDAQ:META) stock has seen a significant turnaround in the last few months. The stock is now only 20% lower than the prior peak reached in September 2021. The company has also shown a lot of resilience in dealing with significant challenges including Apple’s privacy changes, growth in TikTok, and regulatory pushbacks. If the upcoming competitor of Twitter built by Meta is successful, it would show that the social media ecosystem is still a winner-takes-all system. This should allow Meta to add new social media features in the future and gain new revenue streams.

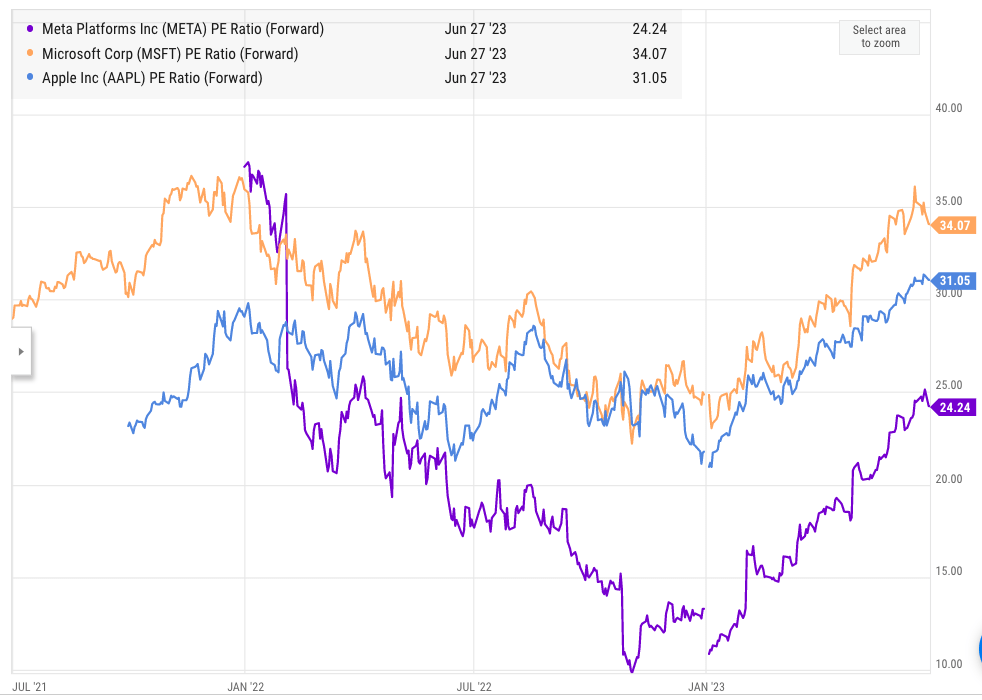

The recent operational efficiency and buyback initiative of the company should help in building a better EPS growth trajectory. In the previous article, it was shown that the buybacks can give a 5% EPS growth annually on a standalone basis. While the stock is not cheap with a forward PE ratio of 24, it is still 25%-30% cheaper than other big tech peers like Apple (AAPL) and Microsoft (MSFT) in terms of forward PE. The launch of new features in the near term should support bullish sentiment toward the stock, making it a good buy-and-hold option.

Overcoming major headwinds

In the last few quarters, Meta has overcome significant challenges. One of the biggest obstacles for the company was the privacy change made by Apple, which is reported to have cost billions of dollars in lost revenue. Meta seems to have found a workaround for the privacy restrictions and has likely suffered a much lower decline compared to earlier estimates. AI is also a major tool for Meta which helps in the delivery of more targeted advertisements.

Another major challenge for the company has been TikTok. At one point, TikTok’s parent ByteDance was trading at over $500 billion valuation in secondary markets. This has reduced to close to $220 billion, mostly due to the restrictions put on the app in Western markets and also due to the growth of Reels. The ability of Meta to build a good alternative for TikTok and to gain significant traction is a big positive for the long-term future of the company. Citi analyst recently pointed to higher monetization and engagement on Instagram compared to TikTok.

Meta has also absorbed most of the regulatory pushback in the last few years. There are still fines and restrictions in several regions, but the overall impact on the company’s bottom line will likely not be significant.

The network effect is still alive

Meta is looking to build an alternative to Twitter. There is a very good chance that the company will be successful in gaining a strong customer base for this feature. Meta’s platforms already boast a customer base of more than 3.5 billion people. The benefit of a successful clone of Twitter will be more than the impact on the bottom line. If Meta is successful in launching a Twitter clone, I believe it will be a signal to Wall Street that the social media ecosystem is a winner-takes-all system. Within this system, new social media features built over the next few years can be assimilated within Meta’s platform.

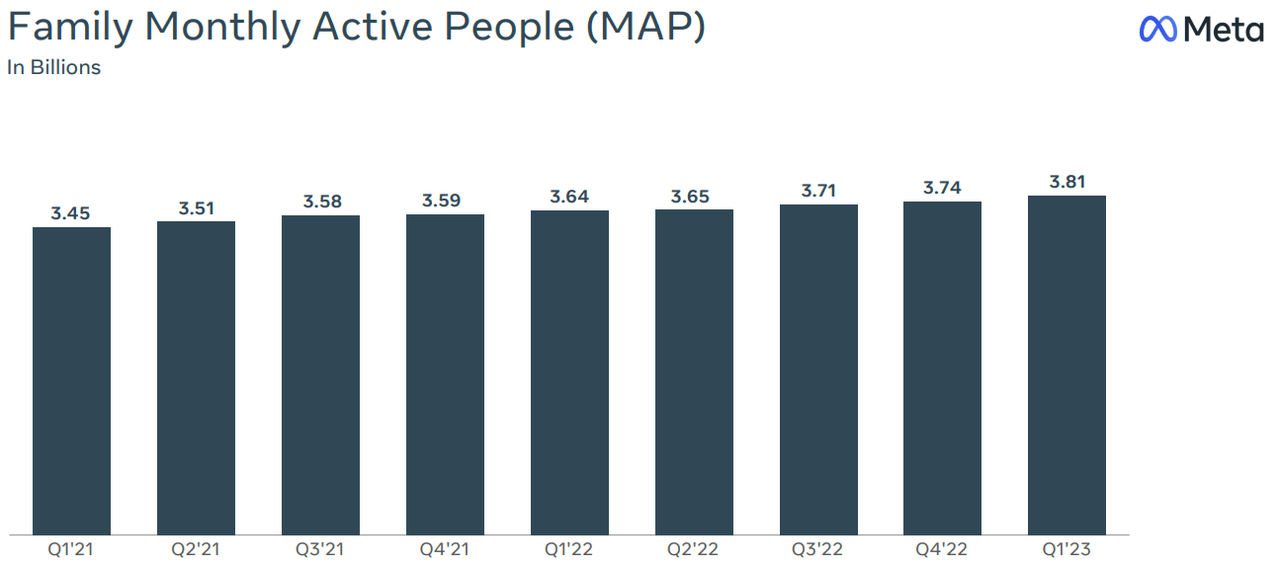

Figure 1: Monthly active people on Meta’s platform. Source: Company Filing

The addition of a Twitter clone should allow the company to improve the Monthly Active People (MAP) growth rate for its platform. Steady growth in MAP is still quite important for the company as it improves the moat for its ecosystem and signals the future growth trend.

Growth in EPS

Meta, like all big tech companies, is facing a large base effect. It is difficult to move the needle when the revenue base of the company is already over $100 billion. Hence, future growth projections will need to be moderated. However, Meta still has a number of growth drivers including monetization of Reels, new social media platforms like Twitter clone, VR growth, AI tools, and more. In addition to these, Meta is also undertaking massive buybacks. Even after the recent bull run, the buybacks will provide a 5% annualized improvement in EPS on a standalone basis.

The downside for Meta stock is limited due to its strong ecosystem and network effect. The company has overcome the recent challenges mentioned above. At the same time, Meta’s growth drivers and buybacks should be able to deliver 15%-20% annual EPS growth over the next few years.

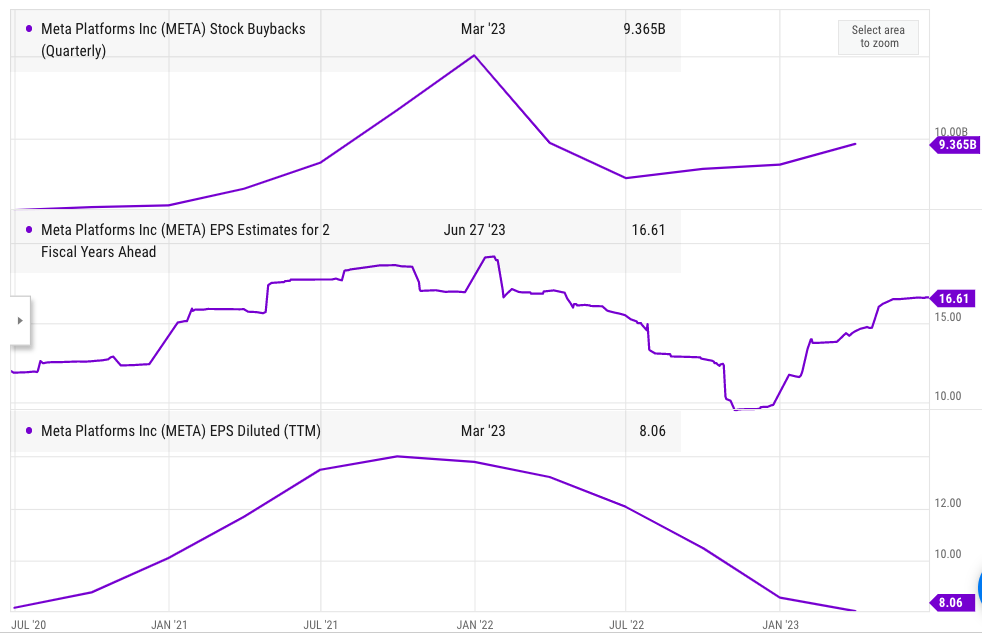

YCharts

Figure 2: Buybacks, EPS, and forward EPS projections of Meta.

The consensus EPS estimate for 2 fiscal years ahead is $16.61. The consensus estimate doubled the EPS projection after the company undertook cost-cutting measures. At the current estimate, Meta stock is trading at 17 times the EPS estimates 2 fiscal years ahead. This is relatively modest when we look at the long-term growth potential of the company.

Future growth trajectory of the stock

In the year-to-date, Meta stock has jumped by 130%. This might give pause to some investors who would like to take profits. However, the long-term bull case for Meta stock is still very strong. The company produces massive cash flow while it does not need significant investment other than in the Reality Labs. This should leave enough resources to undertake big buybacks in the future. The network effect provides a good floor during recessionary times, and it also allows new social media features to be added with ease.

The success of the Stories and Reels feature on Instagram shows that the company can easily add new popular social media trends. The recent Twitter clone could be another driver for bullish sentiment toward the stock.

YCharts

Figure 3: Forward PE ratio of Meta, Apple, and Microsoft. Source: YCharts

While Meta stock is only 20% away from its pandemic peak, the forward P/E ratio of the company is still 25% below that of Apple and 30% below that of Microsoft. In the short term, we could see some slowdown in bullish momentum, but the long-term bull case for Meta stock is quite good.

Investor Takeaway

Meta has shown a lot of resilience in dealing with challenges over the last few quarters. Major headwinds like Apple’s privacy changes have not hurt the company as much as predicted. We are yet to see the full monetization potential of Reels, which should help the company improve its bottom line. A successful Twitter clone could add to the bullish sentiment toward the stock as it shows the ability of the company to use the network effect in order to launch new social media tools.

At the same time, the buybacks should help the company improve its EPS by as much as 5 percentage points annually on a standalone basis. The forward P/E ratio of the stock is quite high, but it is still lower than other big-tech peers. The long-term annual EPS growth rate could be between 15% to 20% which makes the stock a good buy-and-hold option.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.