Summary:

- Nvidia Corporation is a talked-about stock that is well-positioned to take advantage of the AI trend.

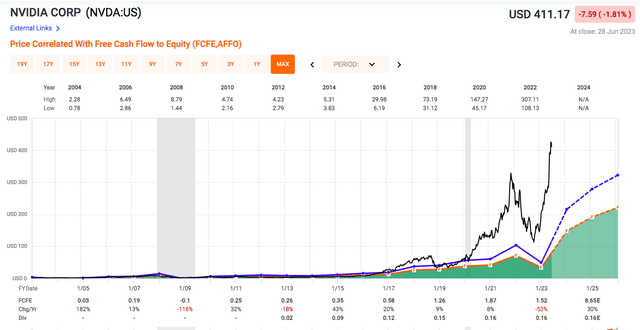

- Nvidia Q1 results exceeded expectations, however, as a result the stock has become extremely overvalued.

- I present historical examples that caution against buying at these levels.

Kobus Louw/E+ via Getty Images

Nvidia Corporation (NASDAQ:NVDA) is one of the most talked-about stocks of this year, and rightfully so. It’s one of the best-positioned publicly traded stocks to capitalize on the recent artificial intelligence (“AI”) trend.

The problem with any new technology is that it’s simply impossible to know ahead of time how big it will get. If we think back to the 90s, nobody thought the Internet could revolutionize the way we live our lives. We all wish we bought some of the leading Internet stocks at the time, but here’s the thing: in hindsight, it seems obvious, but simply buying anything that has the potential to do great is not the recipe. With one winning idea such as the Internet, you’re likely to fall victim to dozens of failures such as (perhaps) the metaverse.

And while AI seems like a sure thing at the moment, there are many things that could derail the progress. It could simply be here ahead of its time, or governments could try to prevent it via regulation or the code might simply break. Who knows. The point is that it’s impossible to predict if it will become a major part of our lives this decade or not. That’s why for my analysis of Nvidia, I will focus on the status quo.

The fact of the matter is that the company had an amazing Q1 2023, as it reported quarterly revenue of $7.2 Billion (up 13% YoY) and well above Wall Street expectations of $6.5 Billion.

Moreover, the company has become increasingly profitable as its gross margin has risen to 66.8%, resulting in earnings over the first quarter of $0.85 (up 44% over the end of 2022).

Shockingly, management has guided towards a further 52% revenue growth in Q2 2023, as revenues are expected to reach $11 Billion. Such string guidance is definitely supported by high pre-orders where Nvidia knows that it can deliver on these numbers. But the bigger question is if this is a start of a trend or a one-off. Going back a couple of paragraphs, I have to believe that it is more likely a one-off that is unlikely to be followed by a similar level of growth. At least not back-to-back.

With Q1 earnings per share of $0.85 and Q2 of $1.30, my forecast calls for a full year EPS of no more than $5.00. That’s significantly lower than the consensus which calls for $7.77, but I still consider my forecast relatively aggressive as it assumes that Nvidia will at least maintain the high level of sales they expect in Q2.

Since Nvidia’s dividend is extremely low (0.04%), one has to consider it a speculative investment. The best way to value such an investment is to look at P/E. And let me tell you. Nvidia is very expensive here. The stock currently trades at $422 per share which translates into a forward P/E of 84x. That’s a fairy-tale valuation which clearly assumes that AI will take over the world.

Don’t get me wrong, it might, but how can we possibly make money if the best-case scenario is already priced in? I think Nvidia is a great business, but it’s not worth buying at any price and right now it’s wildly overvalued.

Historically, since its IPO, the stock has traded at an average P/E multiple of 32x. With my forecast for EPS of $5.00 this year and assuming that the stock retraces to the historical average multiple (which is still fairly high to be honest), the price target stands around $150 per share. That’s 65% lower than today’s price, meaning that the downside risk is significant if the stock re-rates lower which could easily happen if management doesn’t deliver on their aggressive growth guidance or if the market sentiment turns.

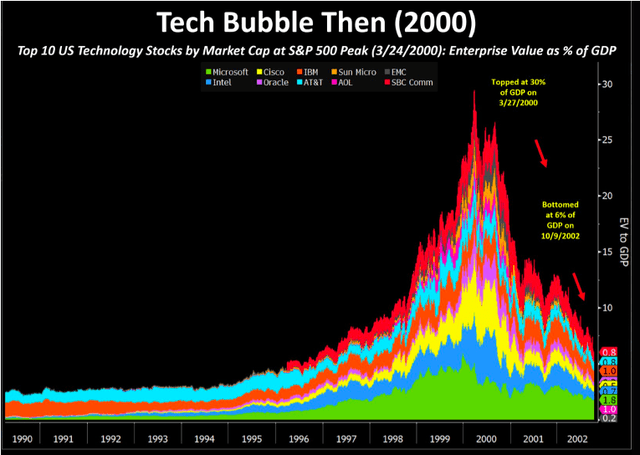

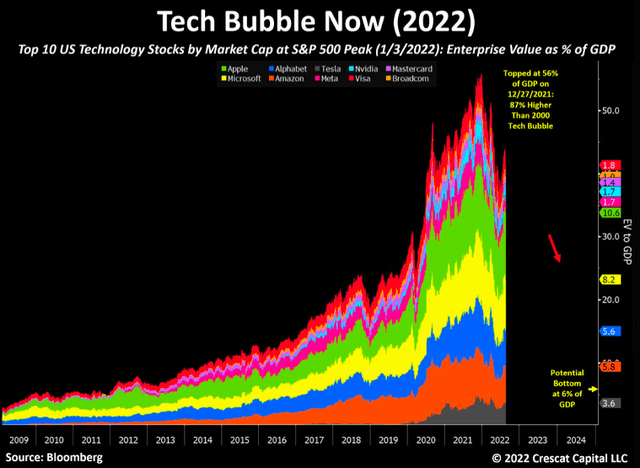

What’s even more worrisome is that the recent tech rally which has been driven by just 7 stocks that have averaged 60% YTD returns, is starting to resemble that of the tech bubble from the early 2000s. But this time, we have high inflation, high interest rates, and we are on a verge of a recession.

Everyone should make up their own mind, but I just want to present interesting statistics. During the tech bubble, the valuation of the top 10 tech stocks in terms of EVs reached 30% of the U.S. GDP, only to fall back down to 6%. Right now, we’re sitting at 45% of the U.S. GDP. A fall to 6% would mean a devastating 87% fall in price of all 7 tech giants, including Nvidia.

Of course, technology has become a larger part of our lives, so I’m not suggesting a fall to 6%, but the valuation seems stretched based on just about every metric you look at which makes investing at these elevated levels very risky.

Crescat Capital Crescat Capital

Because of this, I rate Nvidia stock as a SELL. It’s a great company, but it’s not worth buying at any price. The best course of action might be to wait for a significant pullback of at least 20-30% to limit the downside at least somewhat and enter then. If the Nvidia Corporation pullback doesn’t come, there are plenty of opportunities elsewhere in the market so no reason to feel FOMO. Happy investing!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.