Summary:

- NVDA has outperformed its peers, but there may be fluctuations ahead, as the sustainability of high valuation depends on long-term fundamentals rather than hype.

- NVIDIA is well-positioned to capitalize on accelerated computing and generative AI transitions, with plans for new product offerings to sustain revenue and profitability.

- Investors’ sensitivity towards NVIDIA during the AI hype cycle has led to high expectations for its profitability and valuation.

- NVIDIA’s stock price appears overvalued based on high valuation multiples, with technical indicators indicating a potential correction in the short term.

Justin Sullivan

Investment Thesis

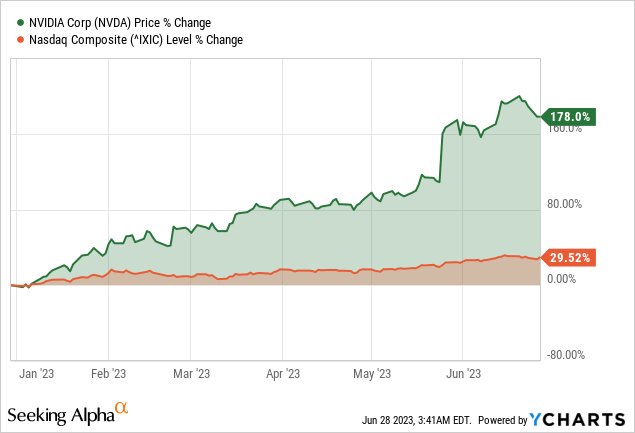

NVIDIA Corporation’s (NASDAQ:NVDA) year-to-date price return has strongly outperformed its peers and the market. Bullish momentum became more aggressive during the Q1 2024 earnings call, as it was considered “the iPhone Moment” of Artificial Intelligence (AI).

For short-term bullish momentum, AI-oriented products and market sentiment (toward AI) have already priced in NVIDIA’s stock price in 2023. However, in today’s analysis, we explore the short-term bearish stance on NVIDIA’s stock price as the AI hype starts to fade out, and a lack of fundamental support.

The Transformative Impact

The transformative impact of ChatGPT and its role in transitioning from large language models (LLMs) to a more dense chatbot-based technology must be addressed. The integration of various technologies, such as guardrails, reinforcement learning, and knowledge vector databases, has been instrumental in realizing the potential of ChatGPT.

NVIDIA, the leading supplier of the underlying technology, describes this convergence as the “iPhone moment” where all the necessary components came together to create an exceptional and competent solution. During the Q1 2024 call, NVIDIA emphasized that it was already fully producing its Ampere and Hopper architectures, indicating its readiness to leverage the emerging opportunities resulting from this transformative development.

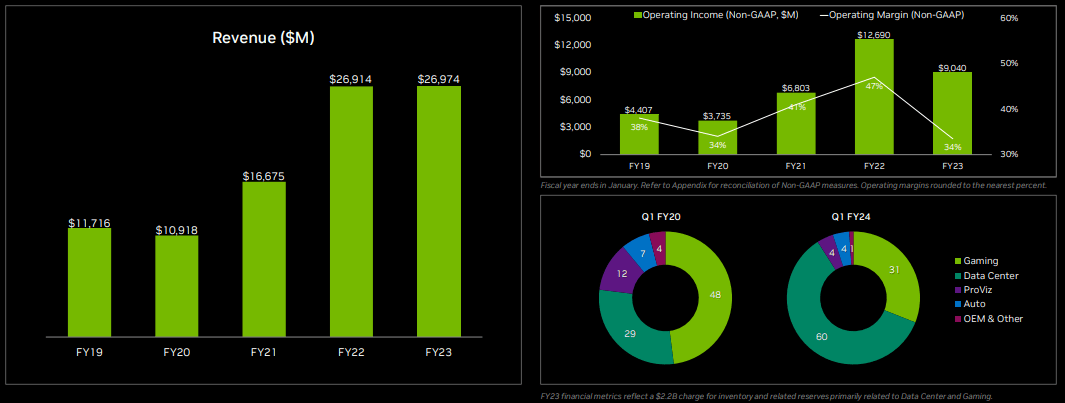

In detail, NVIDIA’s Q1 results showed significant growth in the data center segment, driven by increased demand for accelerated computing platforms in generative AI applications. The company achieved record revenue in this area, with cloud service providers, consumer internet companies, and enterprises adopting NVIDIA’s Hopper and Ampere architecture GPUs. NVIDIA’s partnerships with major cloud providers and the availability of the DGX H100 and DGX Cloud have expanded its market reach.

Also, the launch of NVIDIA AI Foundations allows its clients to build and operate custom LLMs and generative AI models tailored to their needs. In the gaming segment, NVIDIA reported solid demand, supported by the release of the 40 Series GeForce RTX GPUs, especially in laptops. The company’s focus on AI-powered gaming experiences, collaboration with Microsoft (MSFT) for Windows PC gaming, and expansion of the GeForce NOW gaming service position NVIDIA well for continued growth.

Investor Presentation

Additionally, Pro visualization revenue saw sequential growth due to increased demand for workstations in the public, healthcare, and automotive sectors. NVIDIA’s Ada Lovelace GPU architecture and integration of generative AI capabilities into its workstation offerings are expected to drive further growth. The announcement of Omniverse Cloud and Fully Managed Service in collaboration with Microsoft Azure provides a comprehensive platform for designing, developing, deploying, and managing industrial metaverse applications. Also, its automotive segment demonstrated solid year-on-year growth, driven by the NVIDIA DRIVE Orin platform and expanded partnerships.

Notably, NVIDIA aims to increase investments while delivering operating leverage. Its solid gross margins, driven by higher-valued products and software integration, support its growth. For Q2 fiscal ’24, NVIDIA expects optimistic total revenue of $11 billion, primarily driven by the data center segment’s increased demand for generative AI and LLMs. The company has secured substantial supply for the year’s second half to meet customer demand, extending the visibility of data center demand for a few quarters.

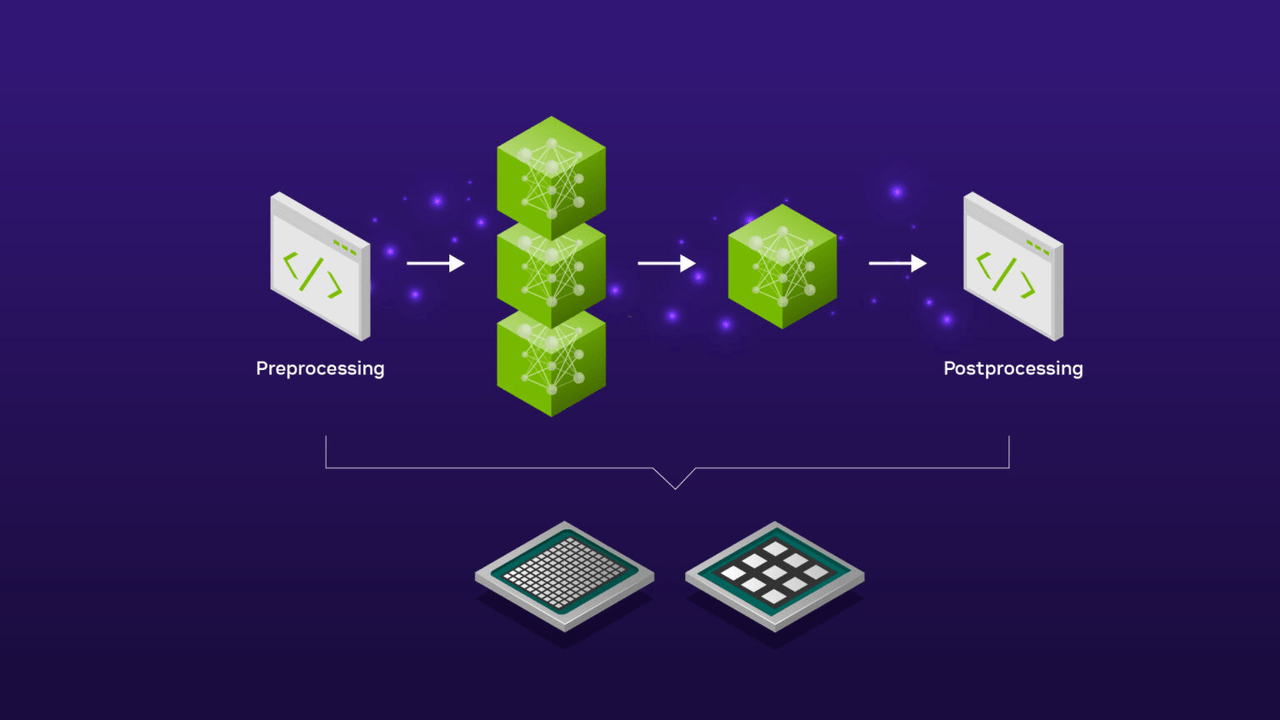

Further, NVIDIA expects significant growth in training and inference for generative AI workloads, with accelerated computing being the future of data centers. The company aims to reduce the cost per query and enable widespread adoption across different devices and platforms. NVIDIA focuses on preprocessing and postprocessing in the inference process and aims to provide fundamental capabilities through partnerships with cloud service providers and AI Enterprise solutions.

However, competition remains a challenge, but NVIDIA’s low-cost and low-total-cost-of-ownership solution, complete stack optimization, and comprehensive approach give it a unique edge over competitors. Also, NVIDIA’s high utilization, scalability, and expertise in data centers and software set it apart from competitors.

NVIDIA is well-positioned to capitalize on accelerated computing and generative AI transitions. The company expects most data centers to adopt accelerated computing, and it plans to deliver new products to meet demand, including H100, Grace, and Grace Hopper Superchips, and BlueField-3 and Spectrum-4 networking platforms. These offerings will provide energy-efficient and sustainable data center-scale computing and continue supporting NVIDIA’s revenue stream and profitability.

Beyond the forward-looking perspective, NVIDIA’s profitability and valuation need to be evaluated to determine whether all the expected efficiency in the AI transition results in any favorable improvement in financial performance and valuation.

Profitability & Valuation

Investors have become too sensitive about NVIDIA during the ongoing AI hype cycle due to its progress in the field. But in absolute terms, NVIDIA provides underlying technology to support AI use cases and industrial applications conceptualized and formulated by its clients. Being a leading supplier of AI technology, its revenue, and profitability are still highly connected to client demand for its products and services.

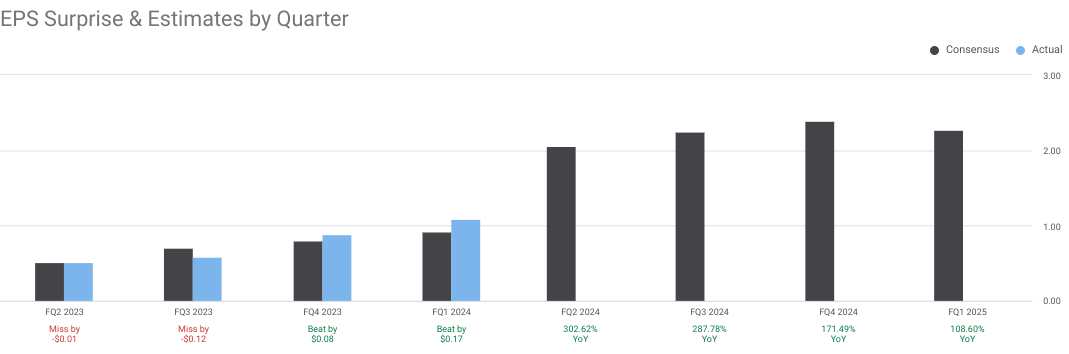

EPS Estimates Remain Too Optimistic

The street is making aggressive EPS expectations for the coming quarters. NVIDIA is not isolated in the industrial ecosystem. The economic conditions need to improve as expected, specific to its clients, NVIDIA may not be able to deliver an EPS surprise. Any slight earnings miss may lead to a rapid correction in its market value. The EPS revisions are 41.92% higher than NVIDIA’s 5-year average and 75% higher than its sector median. It is a too optimistic expectation considering the current macro environment.

seekingalpha.com

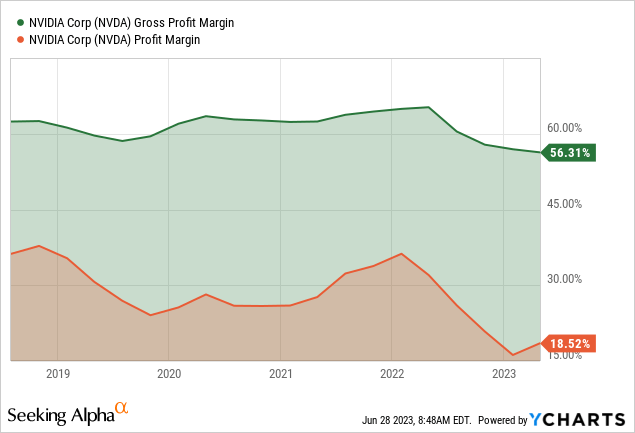

Profitability Remains Under Pressure

NVIDIA’s Net Income Margin (on a Trailing 12-month or TTM basis) is 18.52%, 35.51% below the company’s 5-year average of 28.72%. Similarly, the Return on Total Capital (TTM basis) is 7.52%, which is -55.53% below the company’s 5-year average of 16.90%. Interestingly, Return on Equity Growth (Forward) indicates a minor pace of 1.73%.

The share price decline in early 2022 was caused by multiple factors, such as supply chain issues in the semiconductor industry, enhanced gaming inventories with retailers, an unsustainable pricing model, and adversities in cryptocurrency mining. Thus, the profitability levels indicate that the investors made an early move on NVIDIA before its profitability levels reached the surface to demonstrate an actual long-term improvement in margins and returns.

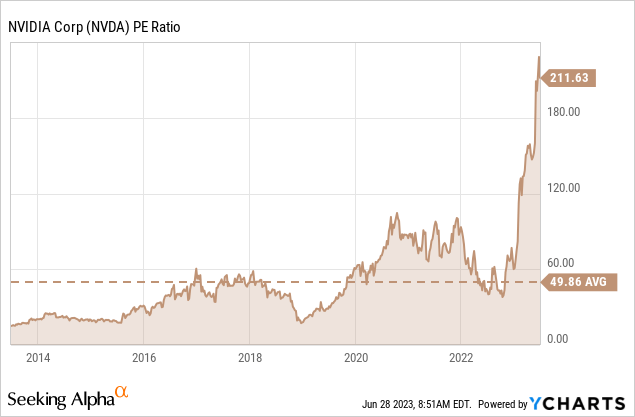

Valuation Offers No Margin Of Safety

The elevated stock price of NVIDIA is also not supported by valuation multiples. Its P/E Non-GAAP (TTM basis) is 137.94, 667.59% above the sector median of 17.97 and 175.49% above the company’s 5-year average of 50.07. It signifies that AI hype is benefiting NVIDIA more aggressively than the sector.

Interestingly, P/E Non-GAAP (Forward) is 54.29, which returns to fair valuations from current P/E levels based on aggressive earnings expectations, or stock price will drop if earnings cannot maintain the expected rapid pace. The sector becomes overvalued with an increased P/E Non-GAAP (Forward) of 22.14. These valuation multiples signify an inverse motion in NVIDIA’s forward value against the sector.

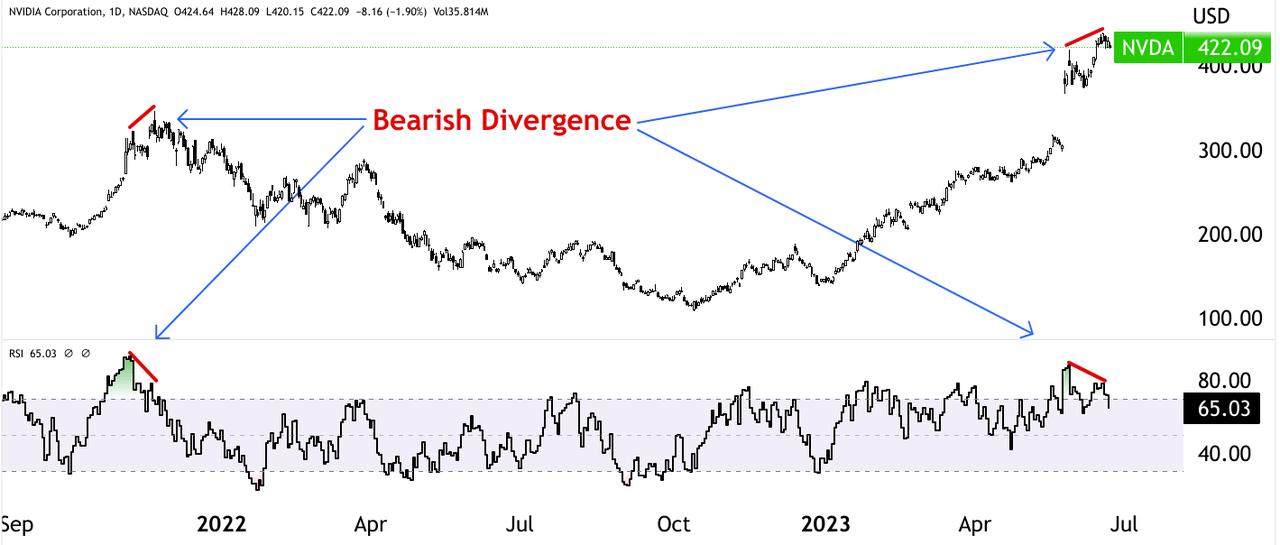

Technical Indicators Suggest A Bearish Divergence

Technically, the price chart of NVIDIA’s stock indicates a bearish divergence with a higher high price level and Lower high RSI levels over 70. The same pattern was observed during November 2021’s peak. In the coming weeks, it signals a significant markdown phase in the stock price (of the ongoing AI hype).

Takeaway

In conclusion, while NVDA has experienced significant gains driven by the AI hype, there are reasons to adopt a bearish stance. The AI factor is already priced into the stock, and the lack of fundamental support raises concerns about the sustainability of its high valuations. The company’s profitability metrics have declined, and valuation multiples do not justify its elevated stock price. Technical indicators also point towards a potential correction in the short term. Finally, considering the risks associated with the current market conditions, the AI hype may not be enough to sustain NVIDIA’s stock price in the long run.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a stock-market research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.