Summary:

- Intel has committed to more than $100 billion in CAPEX to build new fabs.

- Owning ARM shares and producing ARM chips would be a win-win for both companies.

- One potential problem is if the ARM IPO price is too high.

Sundry Photography

Intel Stock Key Metrics

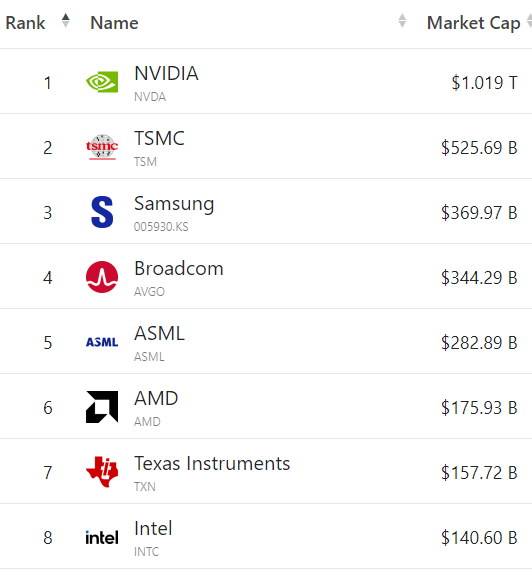

Intel Corporation (NASDAQ:INTC) is one of the largest semiconductor manufacturers in the world. In terms of market value, it is ranked 8th in the world behind Texas Instruments (TXN) and way behind the current market darling NVIDIA (NVDA) which now sports an MV over $1 trillion.

companiesmarketcap.com

Intel’s stock price has fallen precipitously, down 43% over the last 3 years, as it is committed itself to well over $100 billion in capital expenditures for new fabrication plants or what they call fabs. These fabs will be installed all over the world including recently Germany and Poland and of course in the United States. Here’s a partial list of Intel’s fab commitments: $33 billion now but maybe $80 billion total in Europe, $20 billion in Ohio, $4.6 billion in Poland, $20 billion in Arizona, $3.5 billion in New Mexico.

The massive expenditures will be offset somewhat by billions of dollars of credits from the various governments but the total amount of those credits is yet to be determined.

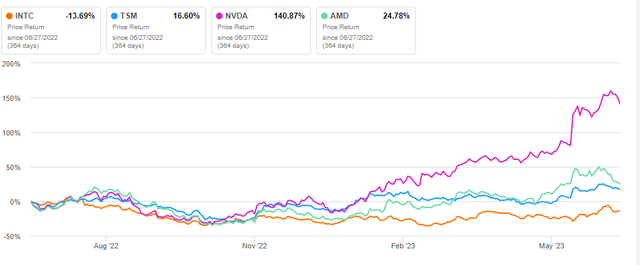

As you can see from the following chart Intel has lost share price compared to competitors such as TSMC, NVIDIA, and AMD over the last year.

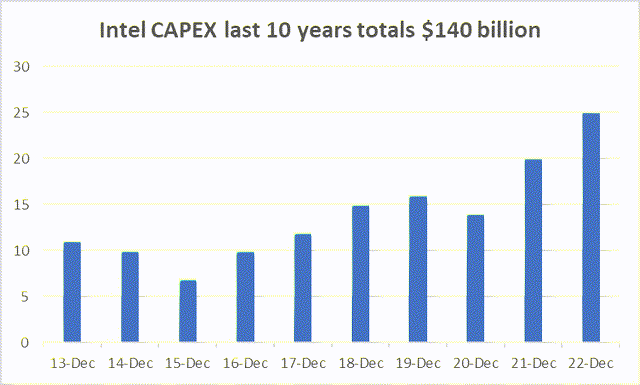

However, if you look at the history of Intel and capital expenditures you can see they have spent $140 billion in capital expenditures over the last 10 years which indicates that they are capable of meeting these huge investment commitments that they are racking up all over the world.

One of the big problems with Intel’s aggressive capital expenditure program is that many of these fabs will not be producing revenue for at least three to five years therefore there will be a lag between investment and the returns on those investments.

What Is ARM?

Arm is a chip design company owned by SoftBank (OTCPK:SFTBY) and in the last five years, ARM customers have sold more than 200 billion chips including chips from such companies as Apple, Amazon, and Qualcomm. The reason these companies use ARM chips is because ARM chips tend to use less energy than other chips and therefore they use less electricity than Intel, Nvidia, or AMD chips for example. Using less energy of course reduces electrical expense and it also reduces the drain on any battery-powered products such as watches or cell phones.

Some well-known examples of ARM chips would be those used in the Apple iPad, Amazon’s Graviton servers and soon to be into Microsoft products as Windows is converted to use the ARM chips.

Thus ARM would offer any investor, including Intel, the opportunity to expand their products with lower energy use and with certain AI productivity enhancements.

We all know from the recent buildup of AI in terms of Nvidia stock price the ability to work chips into that model could produce spectacular new revenue sources.

Thus the argument would be that ARM would add to the value of Intel via Intel’s fabs producing billions of ARM chips. Intel would then get the revenue from manufacturing the chips and it would also benefit from any increase in the market value of ARM in the market in general.

Are ARM And Intel Direct Competitors?

ARM and Intel are not direct competitors per se except that they do have some of the same customers such as for example Amazon. Most of Amazon’s EWS Cloud servers run on Intel Xeon chips which though very powerful also use huge amounts of energy with energy being one of the largest operating costs of cloud servers.

One way Amazon addresses that energy question was to design with ARM the Graviton chip which lowers their energy needs for servers that have slightly fewer computing requirements than most of the AWS servers running the Intel chips. The energy cost savings for those servers would be considerable.

Thus yes, ARM and Intel aren’t competitors in actually producing the chips but they do compete in designing chips for certain applications.

Why May Intel Invest in ARM?

The reason Intel may invest in ARM is so they could get access to chip designs that they themselves don’t have. Plus the intellectual property owned by each party would benefit each other with Intel’s manufacturing prowess allowing ARM to design more complex chips and perhaps at a lower cost using Intel’s new fabs.

Intel has over 70,000 patents and ARM has over 7,000 patents so combined you would be talking about a vast technological advantage over competitors.

Is This Good For Intel Investors?

As mentioned before Intel investors would benefit from the increased revenues from ARM production contracts not only with the current fabs but with all the future fabs coming online. Therefore ARM could add significant future revenue To Intel and Intel’s investment in ARM would also benefit Intel investors by way of the almost certain increase in value of ARM shares over time.

So I think the investment in ARM is a great idea and a brilliant way to fill up those fabs as they come online.

What Is The Future Outlook?

The ARM public IPO has been in the news for the last year and a half because of the suggested takeover of ARM by Nvidia. That deal was scuttled by regulatory hurdles that could not be overcome by Nvidia.

After the $60 billion deal was canceled ARM’s owner Softbank decided to schedule an IPO on their own and it is currently in the final stages of doing so. I would assume that the Intel investment would take place before the IPO and since Softbank has said they want to maintain at least 50 percent ownership of ARM after the IPO one would have to assume that Intel’s share would be a part of the remaining 50% though at this point in time no one knows for sure.

Bottom line

As we can see in the above analysis there are many advantages to both ARM and Intel by joining forces at some level. With the enormous extent of Intel’s new fab plan, ARM would have access to production plants worldwide in Europe, the United States, and other Western countries.

Intel as we mentioned would have massive chip production orders from ARM that would help fill the production lines of their new fabrication plants. And if they had ownership of ARM, at least partially, it would make sense that ARM do as much business with Intel as they could. This would benefit both companies because ARM could expand their customer base to whomever they want without worrying about whether they’ll be able to produce the products rapidly enough to satisfy their customers.

So in my estimation, this is a win-win deal for both companies and I personally think it will happen though I’m not sure on what basis the ownership will be with Softbank’s requirement of 50% or more of the ownership of ARM.

Therefore, from an investment standpoint, you can either buy Intel shares based on Intel’s future investment in ARM and/or buy the ARM IPO when it becomes available.

Assuming the plan for Intel to make a significant investment in ARM prior to the IPO comes true, I would rate both companies a buy at that point. The only caveat is that the ARM IPO price is not too high.

I have previously written about ARM in the article “Nvidia Stock Is Overvalued, I Prefer The ARM IPO Instead”.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you found this article to be of value, please scroll up and click the "Follow" button next to my name.

Note: members of my Turnaround Stock Advisory service receive my articles prior to publication, plus real-time updates.