Summary:

- Johnson & Johnson is strategically shifting towards high-growth sectors like pharmaceuticals and medical devices.

- Technical analysis of JNJ’s stock price shows a strong bullish trend, indicating the potential for further growth.

- A robust bounce-back from the 50-month moving average affirms the investment potential for long-term shareholders.

yuelan

In the ever-evolving healthcare sector, Johnson & Johnson (NYSE:JNJ) is strategically repositioning towards high-growth areas like pharmaceuticals and medical devices, punctuated by the spin-off decision of its consumer health unit and robust acquisition of Abiomed. Despite looming patent expiry challenges, the company’s pharmaceutical segment remains resilient, promising robust sales, fueled by its strong portfolio and pipeline. This article undertakes a technical analysis of JNJ’s stock price, aiming to forecast its future trajectory for long-term investors. The findings suggest that JNJ’s stock price maintains a robust bullish trend, indicating a potential for further growth. Market corrections are perceived as promising buying opportunities.

Financial Performance of JNJ

JNJ has shown a strategic shift towards high-growth sectors, such as pharmaceuticals and medical devices, signified by its decision to spin off its consumer health unit. The company’s willingness to make the large acquisition of Abiomed further supports this strategic shift. This opens potential avenues for revenue and earnings growth in the upcoming years through additional high-growth sector acquisitions. Even as JNJ confronts patent expiry for Stelara, the company’s pharmaceutical segment remains robust. It’s projected to reach $60 billion in sales by 2025, demonstrating a resilience that reflects the strength of its portfolio and pipeline. A significant development that could have bullish implications for JNJ is the potential resolution of talc lawsuits. This would not only mitigate a key risk but also free up resources currently reserved for litigation costs. This could catalyze further growth initiatives.

JNJ’s commendable track record of consistent dividend growth over the years highlights the company’s commitment to its shareholders. This long streak of dividend growth offers investors a stable income, particularly valuable in times of market uncertainty. Meanwhile, the company’s strong existing product portfolio, including the potential blockbuster products in 2023, offers promising prospects for future revenue growth. Its drug pipeline, with several promising drugs in early and mid-stage clinical trials, also signals potential long-term growth.

With a current market capitalization of $427 billion, JNJ is poised to reach the trillion-dollar market cap milestone. If it maintains its growth trajectory and industry trends remain favorable, JNJ could potentially reach this landmark by 2038. Moreover, JNJ’s forward P/E ratio, though moderately higher than the industry average, is justifiable given its status as an industry leader.

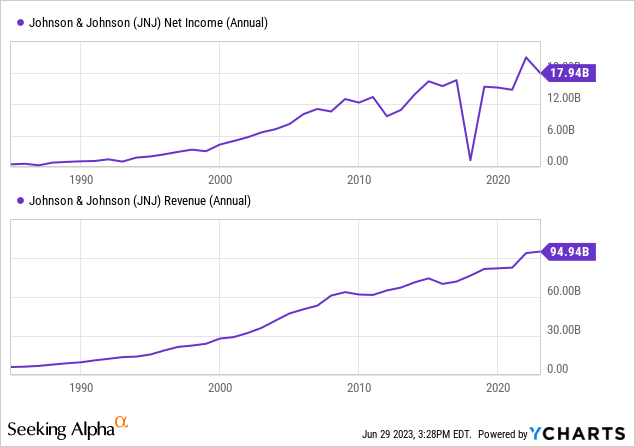

The global pharmaceutical spending forecast, projected to rise from $1.5 trillion in 2022 to $1.9 trillion by 2027, presents a growing market for JNJ to capitalize on. In addition, the expected global population growth from 8 billion in 2022 to 8.3 billion in 2027 will inevitably increase the demand for healthcare services and products, providing a broad, long-term tailwind for JNJ’s diverse healthcare-focused business. The profitability of JNJ over the past three decades is evidenced by the steady growth in total revenue and consistently high net income over the years. The linear increase in revenue, coupled with significant net income, underscores the financial strength of the company. Given JNJ’s demonstrated profitability, it is anticipated that the company has the capacity to meet the increasing demand resulting from population growth.

Continuation of the Bullish Momentum

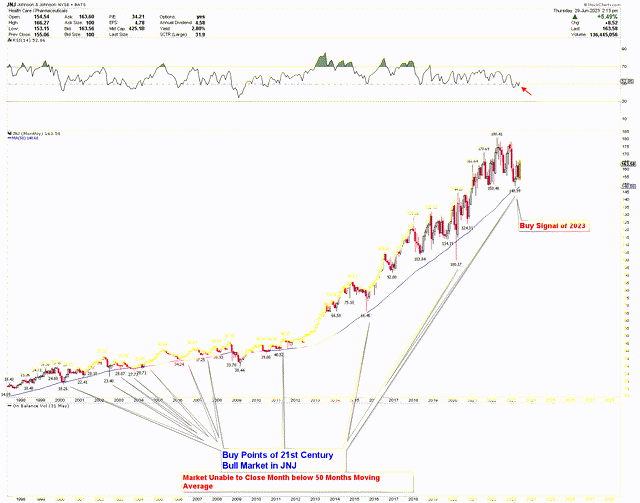

Technical analysis of JNJ paints a strongly bullish picture for the company, as demonstrated by the monthly chart. A solid bullish trend for JNJ has been noted throughout the 21st century. The trend is visualized through the use of the 50-month moving averages, which, when the stock price hits, typically sparks a robust buying signal propelling the price to unprecedented highs.

With the passing of time, an increase in price velocity has been noticed, possibly attributed to heightened stock market volatility induced by economic instability. Over ten buying signals have been identified corresponding to the hits on this moving average. However, as price volatility amplified over time, these moving average touches decreased. In 2023, a solitary buying opportunity at $148.99 materialized, as displayed in the chart below.

JNJ Monthly Chart (Stockcharts.com)

After the price hit the buying signal, a bullish hammer emerged in March 2023. This signals the dominance of bullish forces in the market, which are expected to positively influence JNJ. The RSI trading above 50 provides another bullish indication, suggesting a heightened possibility of price increases.

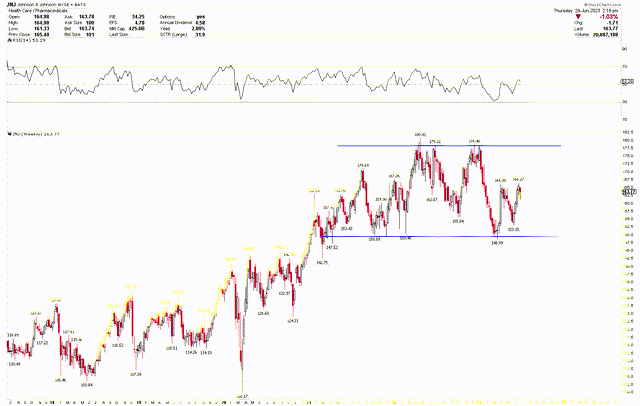

JNJ’s market is demonstrating strong consolidation, trading higher. Upon hitting the buying spot at $148.99, the market rebounds forcefully, as indicated by the weekly chart. This rebound yielded a double-bottom structure, another bullish factor for JNJ. More vigorous upward movements might occur if the price breaks above the $180.41 mark. The weekly chart’s RSI hitting the bottom line when the JNJ price hits the buying point on the monthly chart also augments the likelihood of further price increases.

JNJ Weekly Chart (stockcharts.com)

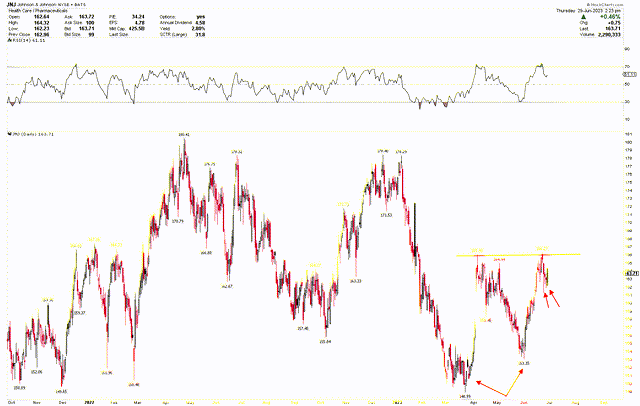

The daily chart for JNJ further underscores the bottom structure from the buying point of $148.99, indicating a price reversal. The last two days’ daily candles were inside candles, suggesting the price has the potential for a higher reversal by the week’s end. Given these signals, investors may consider buying the stock at its current price in anticipation of future price hikes.

JNJ Daily Chart (stockcharts.com)

Market Risk

JNJ’s plan to expand through acquisitions such as Abiomed introduces the risk associated with mergers and acquisitions. These risks include overpayment, failure to achieve projected synergies, difficulty integrating the acquired companies, and potential cultural discord, all of which could negatively affect JNJ’s overall performance and shareholder value. Moreover, the patent expiry for Stelara and potentially other products could result in revenue losses due to increased competition from generic brands. Despite the projected robustness of JNJ’s pharmaceutical segment, the success of its pipeline drugs is not guaranteed and will hinge on factors such as efficacy, market acceptance, and regulatory approvals.

Technically, despite the strong bullish trend evident from the technical analysis, inherent market volatility could affect the price of JNJ stock. The analysis indicates potential for price increases, but these are subject to changing market sentiments, macroeconomic factors, and potential sector-specific issues. For instance, a break below $148.99 might continue the JNJ to drop further.

Final Thoughts

In conclusion, JNJ is strategically aligning its business towards high-growth sectors, leveraging acquisitions, a robust pharmaceutical portfolio, and a pipeline to drive future revenue growth. The company’s consistent dividend growth record underscores its shareholder commitment, making it an attractive prospect for income-focused investors. Its market capitalization hints at a potential future within the trillion-dollar club, provided industry trends remain favorable. The anticipated surge in global pharmaceutical spending and population growth presents an expansive market for JNJ to capitalize on. While the technical analysis paints a predominantly bullish picture for JNJ, potential market risks and uncertainties associated with acquisitions, patent expirations, and pipeline success should not be disregarded. A breach beyond the $167 threshold could potentially trigger a rally propelling the stock to record highs. On the other hand, surpassing the $148.99 mark might elevate the likelihood of an additional market downturn. Given these circumstances, investors might contemplate purchasing shares at their present value in expectation of future price escalations.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.