Summary:

- Johnson & Johnson is a top-tier Sleep-Well-At-Night (SWAN) stock due to its consistent growth, strong cash flow, and regular returns to shareholders.

- The company’s profile is strong, but its dividend yield is weak.

- We propose a trade that stands to generate far more income from this underlying company, for those whose top objectives are income and principal protection.

yuelan

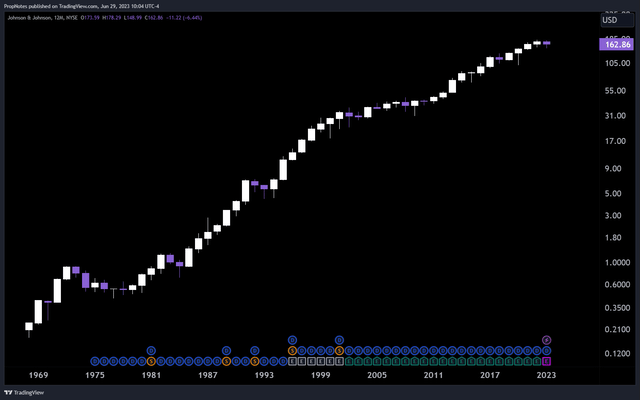

Johnson & Johnson (NYSE:JNJ) may well be the ultimate Sleep-Well-At-Night, or SWAN, stock.

The company has been public since World War 2, and in that time, the firm has endured global conflicts, financial crises, political strife, and more.

Through it all, Johnson & Johnson has maintained a consistent track record of growing revenue, increasing cash flow, and returning capital to shareholders.

Additionally, the stock itself remains one of the least-volatile mega-cap equities on the market, only ranging an average of 1.19% per day.

With such a low Average True Range, to some, the stock, along with its ‘coupon’, more closely resembles a bond than an equity, at least from a portfolio construction standpoint. For comparison, Tesla (TSLA) maintains an Average True Range closer to 4.5%, which is more in line with other, higher growth names.

But growth isn’t what most JNJ investors are after. For the majority, it’s all about principal protection and income. The equity has had lower drawdowns than the broader market in all of the recent bear markets, including in 2022, 2020 and 2008, and the company has been diligent in paying dividends and buying back shares over the long term.

All in all, the stock remains a great option for those looking to protect principal and build income over time.

There’s just one issue; the yield is meager. Sure, the dividend grows every year, but at a current yield of just 2.92%, a $100,000 investment only pays out $2,920 per annum – only $243 per month.

To replace a typical U.S. household income of $60,000, one would need to own more than $2,054,700 of stock, equivalent to about 12,600 shares.

What if there was a way to boost income in Johnson & Johnson, while actually reducing risk even further?

Thankfully, there is; it’s called put selling. Put selling is a common strategy that investors use to generate immediate cash while exposing themselves to high quality companies.

Today, we’ll lay out a short put trade in Johnson & Johnson which is poised to produce far more yield than the underlying equity, while also preserving principal more effectively than simply holding the stock outright.

Let’s dive in.

Financial Results

Johnson & Johnson is one of those companies that needs no introduction, but we’ll cover it here briefly before getting to the trade.

In case you’re unfamiliar, Johnson & Johnson is a consumer staples and healthcare conglomerate, with businesses spanning consumer health (band-aids, baby care), Pharmaceuticals (Covid Vaccine, Janssen), and MedTech (operating room products, joint replacements).

This multi-divisional approach has diversified the company’s revenue and cash flow, and its inelastic product lines have allowed for steady growth across almost all economic cycles.

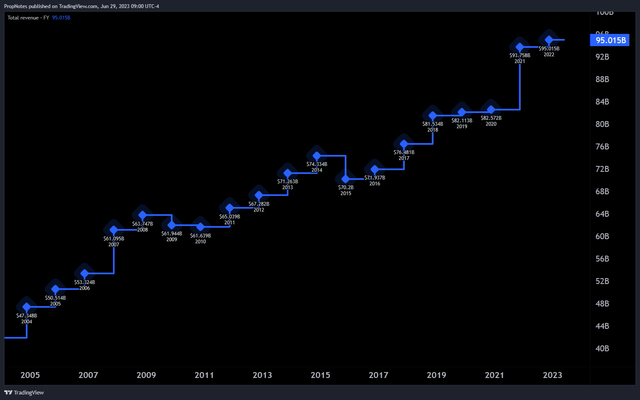

The company is simply a revenue and free cash flow powerhouse:

Revenue (TradingView)

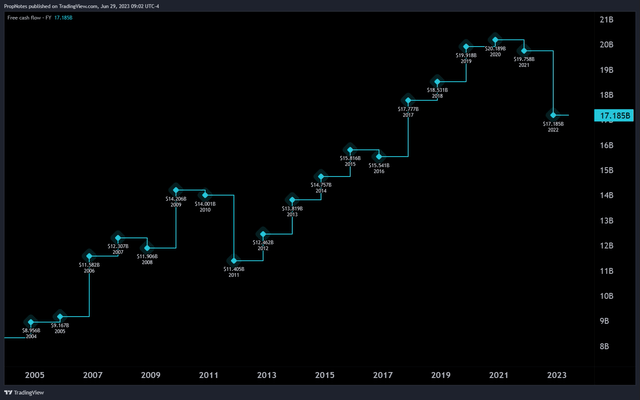

Free Cash Flow (TradingView)

Over the last 20 years, the company has grown revenues like clockwork, with sales up more than 130%, from $41 billion in 2003 to more than $95 billion in 2022.

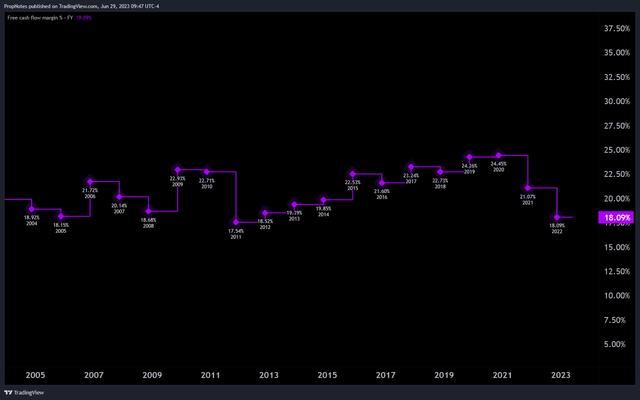

Free cash flow has also grown substantially, from $8.3 billion in 2003 to $17.1 billion last year. Growth has been lumpier, but margins have been quite steady in the 18-25% region for that period of time:

FCF Margin % (TradingView)

The recent dip was due to a poor pharma acquisition that’s led to some write-offs and additional cash expenses, in addition to the impact of inflation on the company’s consumer health segment.

However, as we mentioned before, the company has a strong track record of steadily increasing both top line sales and free cash flow to investors. While this combination isn’t particularly rare, the length of Johnson & Johnson’s track record is a serious differentiating factor. Prior to 2003, the company saw comparable or improved growth to what we’ve presented here.

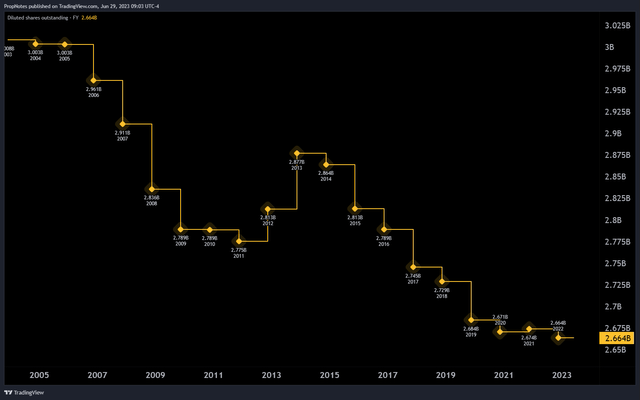

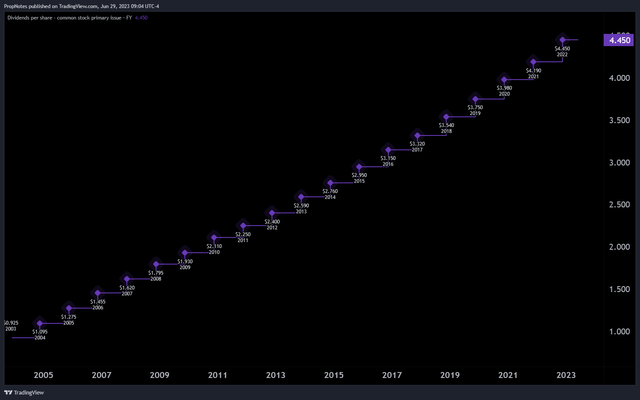

At the same time, Johnson & Johnson has also proven to be an effective capital allocator, shrinking share count significantly since 2003, while increasing dividend payments considerably:

Shares Outstanding (TradingView)

Dividends Per Share (TradingView)

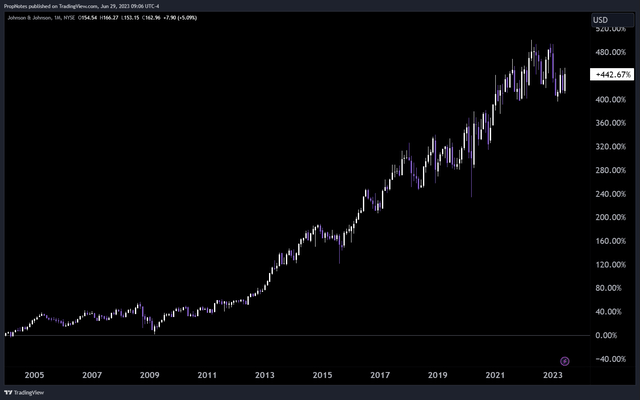

Together, this combination of increased profits, diverse and stable businesses, and higher capital returns to shareholders has resulted in enviable, stable share performance over the last two decades:

TradingView

While the company’s total returns have lagged the market, the stock rarely sees a down year, which makes our proposed trade idea even juicier:

TradingView

The Trade

Given JNJ’s extremely stable underlying business model, we think the company’s stock provides an excellent platform upon which we can confidently sell puts.

In addition, given the company’s modest growth profile, we think that investors who undergo such a short put strategy, continuously, should see improved overall risk-adjusted returns vs, holding the stock outright.

In case you’re not familiar with a put contract, it’s simply an option contract that requires the seller to stand ready to purchase shares in the underlying stock, if the stock goes down more than a certain amount. In return for this obligation, put sellers receive a cash premium immediately credited to their account.

Another way to think of it is like getting paid to put in a limit buy order for shares. Given the options we typically look to sell, the order will more likely than not avoid getting filled, but if it does, then you may be on the hook to buy shares at an attractive price. Seems like a win-win!

The Far-OTM, far-DTE contracts that we look to sell also often experience much less volatility than the stock on a day-to-day basis, which acts to smooth portfolio returns over time and increase Sharpe. Given that JNJ’s stock is already bond-like, the further reduction in volatility could be interesting to some investors.

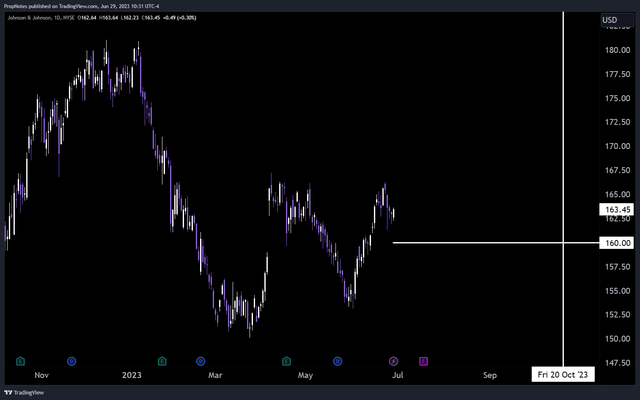

For this idea, we like the October 20th, $160 strike put contracts:

Strike & Expiry (TradingView)

They are currently bid at $3.45, which means that for every contract sold, the put seller receives a $345 credit immediately. In return, your broker will lock up $16,000 in buying power for the next 113 days. This constitutes a 2.2% return, which annualizes to a 7.1% return – much healthier than both the 2.92% dividend yield, and the 5.4% you’re currently getting for buying a 1-year treasury bond.

If the option expires and the stock remains above $160, then put sellers keep the premium free and clear. If the stock ends October 20th below $160, then it’s likely that put sellers will have to buy shares at $160. If this occurs, then the next step is typically to sell calls on the position until shares are called away.

This creates a virtuous cycle, where premiums are being generated, and stocks are “bought low” and “sold high”. JNJ seems like a great candidate for this type of option campaign given its aforementioned characteristics.

Risks

There are some risks to be aware of. Some have to do with the underlying business, and some have to do with the option trade structure we’ve highlighted.

Business

There are a few main risks to the business that we see. First, the company has a considerable amount of debt – over $53 billion of short- and long-term borrowings – which it may need to refinance at higher rates. This could cut into FCF and margins, which would likely lead to a re-rate lower in the stock.

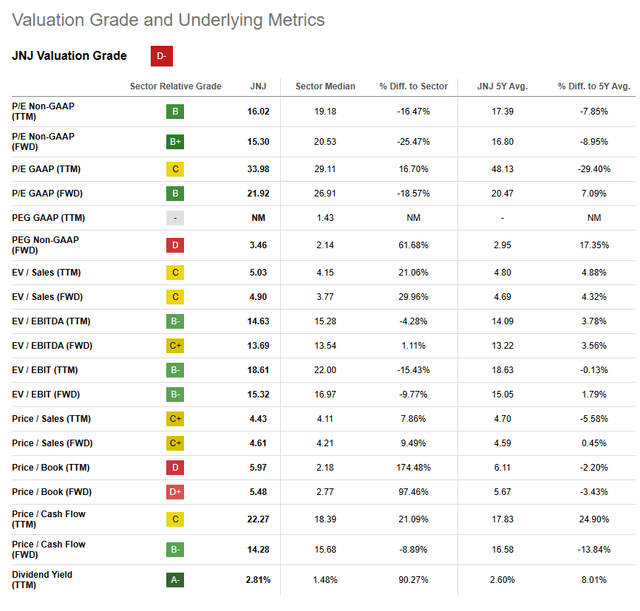

The stock also remains somewhat expensive for a consumer staples / healthcare brand, at nearly 22x free cash flow. This seems expensive to us, especially vs. the company’s own historical rating. Seeking Alpha’s Quant Rating system agrees:

Seeking Alpha

There seems to be some air in the valuation, which could dent returns if things mean-revert lower or the upcoming earnings report is lackluster.

Finally, there have been some concerns about the company’s drug pipeline. Given the importance of the pharma division to the company’s overall results (more than half of revenue), then further acquisition errors could lead to financial underperformance.

Option

The risk with selling put options is that the stock could become significantly impaired, and one would still be forced to purchase the stock at the strike price until expiry, which may be way above the market. We’ve looked to reduce this risk via careful strike and company selection, and the risk is no ‘worse’ than those investors who hold the stock outright. However, it is a risk to be aware of.

Summary

We think it’s an opportune time to utilize JNJ’s stable underlying business model to your benefit by selling well-positioned put options on the open market. This trade stands to earn investors 2.2% immediately cash-on-cash, and 7.1% over the course of a year should options continue to expire out of the money. With the company’s long, strong track record to lean on, we feel comfortable highlighting this trade as a solid win-win opportunity.

If assigned, getting rewarded by selling calls until the shares are assigned away seems like the best course of action.

Good luck to all!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in JNJ over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.