Summary:

- Apple Inc. continues to hit new all-time highs as analysts expand valuation multiples for the stock.

- The tech giant has the forecasted slowest growth rates of the hot Magnificent Seven stocks questioning the inclusion in the group.

- Apple stock has to trade at mid-30x P/E multiples to reach a $3.5 trillion valuation, which isn’t warranted for the current growth rates.

sankai

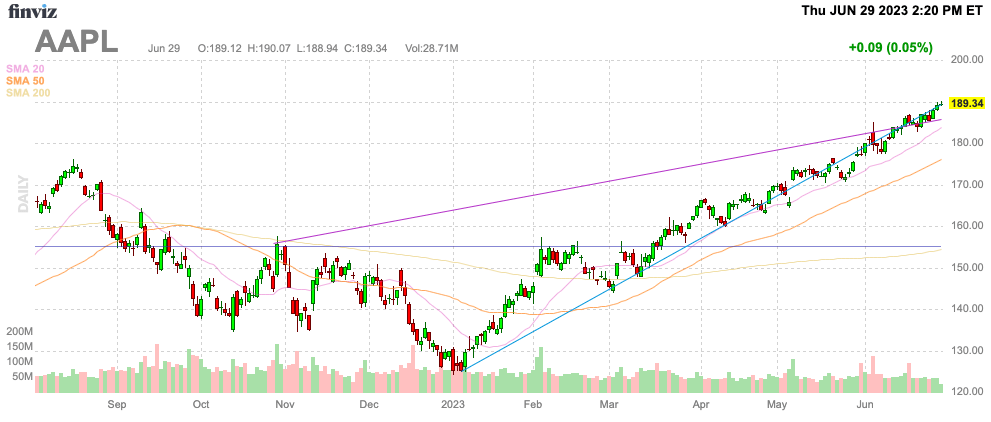

Apple Inc. (NASDAQ:AAPL) continues to rally on vaporware from bullish analyst calls disconnected from reality. The stock rallied into the VR device release, and now Apple continues to rally despite no actual product launch. My investment thesis remains Bearish on a stock with sales in decline and investors claiming this comes from a great chess player.

Source: Finviz

Services Perspective

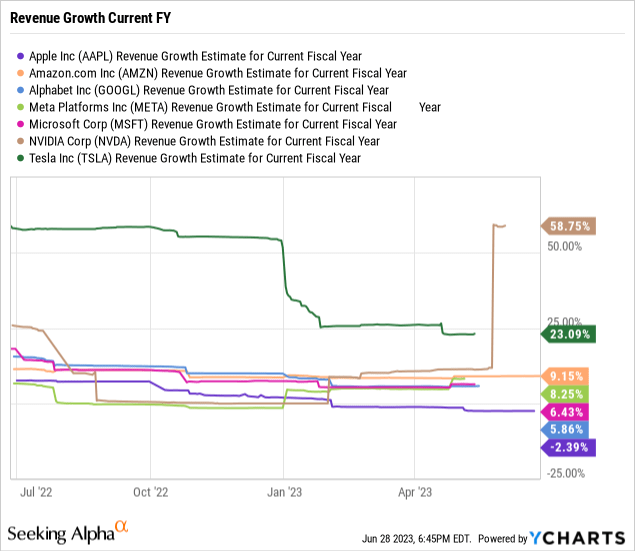

Wedbush Securities riled up the market with a claim Apple is on a pace to a $4 trillion market cap as the tech giant plays chess while others play checkers. The problem with this statement is that Apple is the only stock in the Magnificent Seven reporting sales declines, and the company has the lowest revenue growth target for the group as follows:

Apple is forecast to see FY24 revenues rally back to nearly 7% growth, but the other Magnificent Seven stocks all forecast double-digit growth rates in 2024. Amazon (AMZN), Alphabet (GOOG, GOOGL), Meta Platforms (META) and Microsoft (MSFT) will barely top 10% growth while Nvidia (NVDA) and Tesla (TSLA) are forecast for growth rates topping 20%.

Analyst Dan Ives has remained ultra-bullish on the stock, but the rationale remains disconnected from reality. Apple saw a massive revenue pull forward from Covid, when people stuck at home needed new smartphones and computer devices for work-from-home and virtual school.

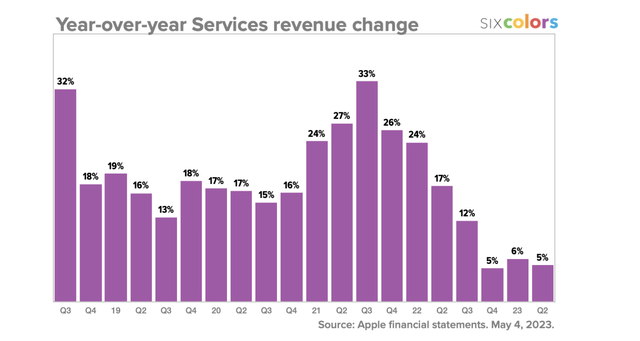

The problem here is that Apple wasn’t a big growth story heading into Covid. Even the Services areas highlighted by Ives aren’t the same growth driver anymore.

As the analyst mentions, Services soared from $50 billion in FY20 to a run rate of nearly $84 billion now. The issue here is again the Covid pull forward where Apple saw Services revenue soar by 33% in FQ3’22 to $17.5 billion. The Services growth rate has dipped to only 5% in the last quarter.

Another big headwind to growth is that product launches from Apple TV+ also boosted revenues during the last few years, leading to far less growth in the years ahead. Remember, though, Apple was only producing a growth rate in the 15% range heading into Covid.

As Ives highlights, the Services business could reach $100 billion by FY25, though this only amounts to 10% annual growth rate. The tech giant has to generate over $8 billion in new revenues to grow the Services segment by over 10% annually. Worth noting is that Disney (DIS) only produces annual revenues of $90 billion now with a thriving media and entertainment business, and the Services business of Apple alone would be a top 100 company in the S&P 500 (SP500).

Insane Valuation

The insane part of the Wedbush call for a $220 price target leading to a $3.5 trillion market cap is the actual lack of the revenue and profit growth to warrant the rally. The call is mostly based on concepts and not financial facts and projections.

As hashed out before, Apple already trades at 31.5x FY23 EPS estimates of nearly $6. The stock trades at 28.7x FY24 EPS targets, and the Vision Pro isn’t likely to contribute to profits one bit due to the higher costs and forecasted low volumes following an expected official release in early 2024.

For Apple to actually hit these targets, the stock would have to trade at these following multiples:

- $3.5T, $220 = 36.7x PE FY23.

- $3.5T, $220 = 33.6x PE FY24.

- $4.0T, $255 = 42.5x PE FY23.

- $4.0T, $255 = 38.9x PE FY24.

A lot of investors fail to do the math on future price targets. While Apple already appears extremely overvalued, one has to justify an even further expansion of the P/E multiple due to the lack of earnings expansion in the analyst targets.

The company isn’t even expected to help investors much. Revenue is only forecast to grow 6.6% in FY24 and not much more in FY25 when the VR headset should finally hit holiday sales.

The amazing disconnect is that if analysts actually thought Apple was a Magnificent Seven stock with exceptional growth in the years ahead, why aren’t the numbers included in the analyst estimates. Investors need to keep in mind that Apple actually guided to FQ2’23 sales to dip up to 2.5% to match the FQ1 dip when analysts were forecasting positive sales growth heading into the updated guidance.

For Apple to warrant a $4 trillion valuation, one has to argue how the most valued company in the world with bullish investors willing to pay historically high valuation multiples for the stock is actually going to crush estimates. If anything, the numbers still appear aggressive, with the Vision Pro unlikely to move the needle with only 100K sales forecast in FY24 and who knows how many in FY25 without details on any future AR/VR device launch.

Takeaway

The key investor takeaway is that Apple Inc. stock can definitely rally on bullish analyst calls, but what the company actually needs is new product launches and to return to reporting sales growth. The company has the lowest forecasted growth rate of the large-cap tech stocks in investor favor right now, but Apple management doesn’t appear to be playing chess at all.

Investors should continue looking at Apple stock strength as an opportunity to unload expensive shares, though one shouldn’t rule out a quick rally to Dan Ives’ target at $220 in a blow-off top move.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.