Summary:

- Apple remains a highly profitable company, but the stock is currently overpriced and set to drop due to market saturation for its products and an extremely overbought technical condition.

- The reasons behind the recent rally are speculative in nature and have driven up the multiple to treacherous territory, especially as we approach an uncertain earnings season.

- Investors currently holding Apple should consider trimming their stakes, while those looking to invest should wait for a better entry point later into the future.

Wirestock/iStock Editorial via Getty Images

About a week ago, we wrote an article titled “Nvidia, It’s Time To Trim“, where we argued that Nvidia (NVDA) was a great company, but the price of the stock at that moment was high and set to drop substantially.

While the stock is down about 6% from our report (as of writing), we expect much further downside as the momentum runs out of the A.I. trade, and funds trim gains for quarterly rebalances.

In the same vein as Nvidia, we think Apple’s (NASDAQ:AAPL) stock is now similarly positioned.

The company’s shares have recently reached levels of euphoria that can only be described as speculative. Now priced to perfection, there’s no room for Apple’s underlying operations to disappoint, which is asking a lot of the company.

All in all, we still think Apple is an unbelievable company, but there’s no denying the stock is on precarious footing heading into earnings season.

If you’re not yet invested in Apple, we think a better entry will be available later this year at some point. If you are invested, to us, the most prudent course of action is to trim some exposure here in order to re-enter lower.

Let’s jump in.

Financial Performance

First, the good.

Apple remains highly, highly profitable. The company, in its most recent quarter, beat on EPS and Revenue, and delivered solid gross and net profit margins of 43.1% and 25.5%, respectively.

Earning a 25% net profit margin when reported top line revenues are nearly $100 billion is extremely impressive. It’s simply difficult to execute on something so well on that scale.

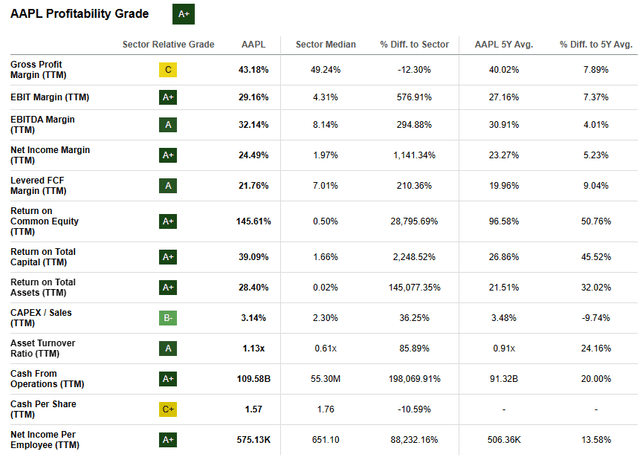

Seeking Alpha’s Quant Ratings underscore this point, assigning Apple a profitability rating of “A+”, an assessment we wholeheartedly agree with:

The company’s cash conversion is strong, employee efficiency is up, and cash from operations over the trailing twelve-month period has been robust.

In addition, the company’s beats were not out of character. As you can see, the company has missed/met on EPS and Revenue in only 2 and 3 times respectively out of the last 16 quarters, which is highly impressive:

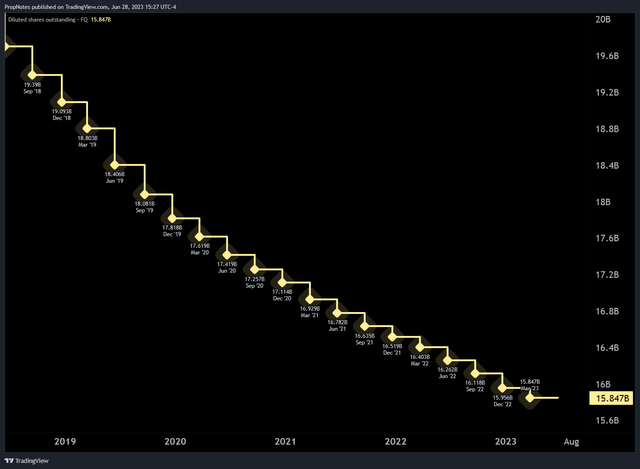

The company has also been diligent when it comes to returning capital to shareholders, having bought back nearly 20% of the company’s stock over the last 5 years:

In short, we’re fans of Apple. It’s a great company with a great track record of earning for its shareholders.

Saturation

That said, despite the recent and sustained strength in financial results, there is one looming issue for Apple: saturation.

The dreaded word.

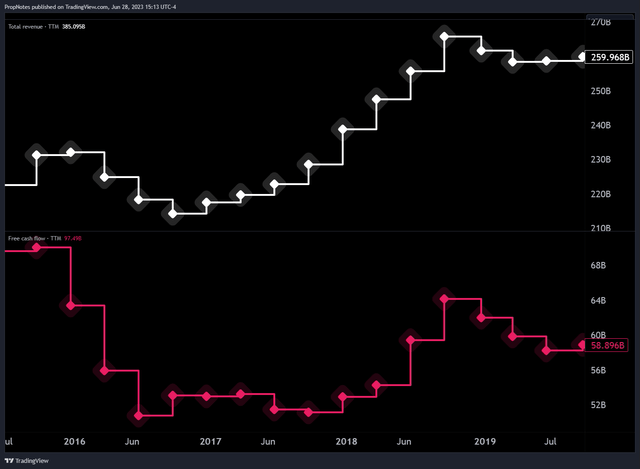

Zooming out somewhat, you can see that back in 2016, Apple actually saw declining TTM revenues and cash flows for a year or two:

Analysts at the time attributed this to a lengthier-than-expected upgrade cycle, and often speculated that the iPhone 6 was so good that the company struggled to encourage customers to upgrade to the 7 and 8 in subsequent years. In other words, the market was saturated, and everyone who wanted an iPhone, and could afford one, had one.

To combat this, Apple pulled on the few levers it could in order to boost growth and profitability, but it had little immediate effect.

In 2017, Apple came out with the iPhone X, which launched with no home button, Face ID, a much better screen, and a much higher price tag of $1,000.

This phone, combined with a push into services in the latter half of 2019, sent revenues higher. However, it took another full year for free cash flow to catch up, which mostly happened as a result of the global pandemic.

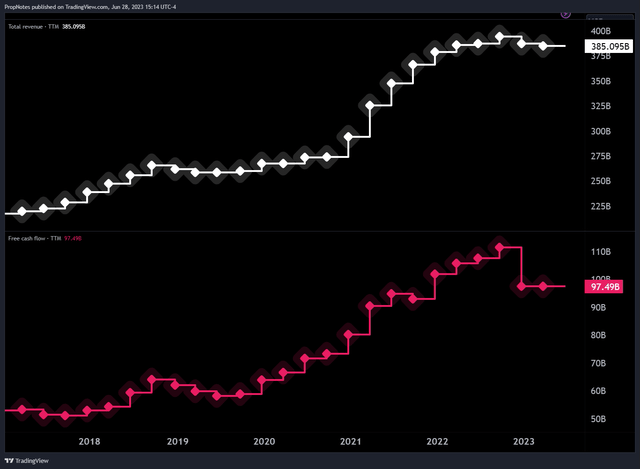

The combination of a new and improved Mac lineup, improved entertainment options in Apple TV Plus and Apple Arcade, and the end of a long upgrade cycle, paired with endless hours of lockdown, finally re-invigorated demand for Apple’s products. The stimulus checks didn’t hurt, either.

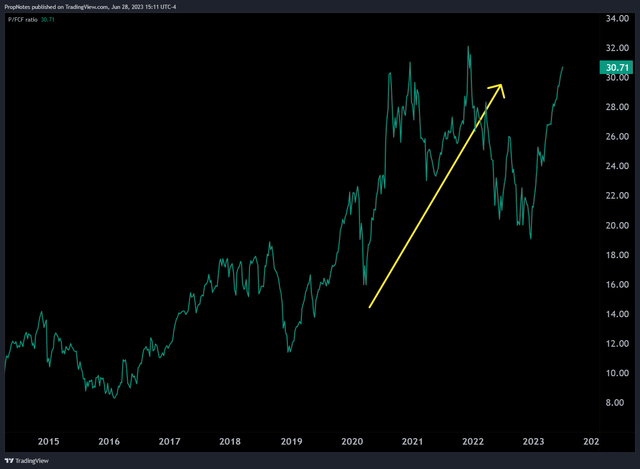

And thus, for the first time since 2016, the FCF ceiling was shattered:

Not only did financials improve, but the growth story was back; the multiple grew considerably, and the stock raced higher:

The issue with Apple right now is that it seems to be having another iPhone 6 moment. Most consumers have relatively new personal computing hardware as a result of the pandemic, and Apple Services is now a mature business. Combined with weak consumer sentiment across the board, and it’s not a rosy demand picture for Apple’s premium products like it was 24 months ago.

Sure, the company can grow profits and revenues incrementally, but the company is once again up against a figurative ceiling of saturation.

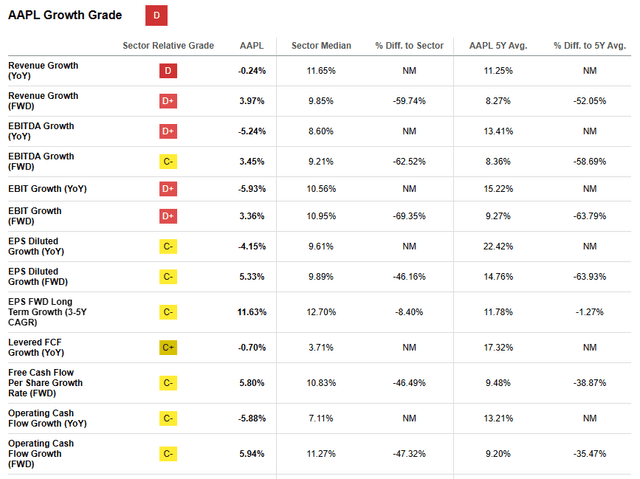

You can see this in recent growth numbers, which have been disappointing:

Revenue in the most recent quarter actually declined YoY, and quarterly sales growth has been flat for the better part of a year and a half. This makes sense, and we expect a continued period of weakness until the Vision Pro device hits markets and re-invigorates broader interest in the company’s line of products.

The Rally

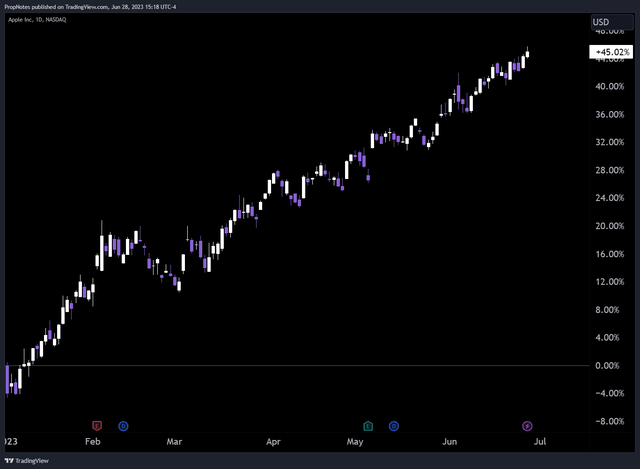

Despite the potential for demand destruction as we’ve outlined, so far, in 2023, Apple’s stock is up 45%:

In our eyes, there are three main reasons that the stock has made the move it has. However, we don’t think they are powerful enough arguments to keep the stock where it is, especially when compared with the larger aforementioned issues around flatlining demand.

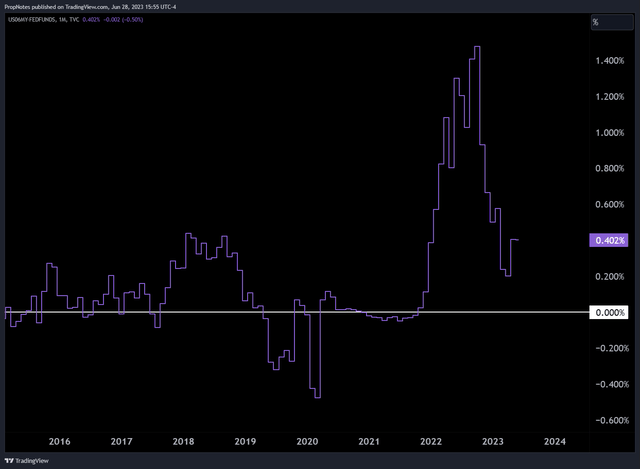

First, the market has seen inflation begin to taper off. Thus, rate hikes, in kind, are viewed by the market as having less of a long-term impact than potentially imagined. If rate hikes pause for a while or are actually cut back to lower levels, then Apple’s multiple should naturally re-inflate as a result of NPV of FCF.

We get that, but given the weak economic outlook, it seems a bit premature to be bidding the company up this much on that view.

Plus, more rate hiking is still expected, as 6 month bills currently trade above the Fed Funds rate:

Second, all big technology companies have caught a serious bid in 2023 as a result of having the resources and talent to build new generative AI applications into existing products. Nvidia has been the go-to ‘picks and shovels’ play, Google (GOOG) (GOOGL) has launched Bard, along with a ton of other tools, and Meta’s (META) LLaMA leaked, which has led to an explosion in open-source development.

However, Apple remains silent in this race. The company’s recent WWDC event came and went, with no meaningful AI product launches or news. We think there’s room for Apple to build products in this area (looking at you, Siri), but right now, mum’s the word. We think the potential impact of AI tools built by Apple is being overestimated by the market.

Finally, we come to Vision Pro. Yes, the headset looks amazing. And yes, we think demand will be significant, even at the headset’s current price point. However, we are concerned about demand cannibalization vs. Apple’s other products. Who needs a new MacBook when you can just buy a new Vision Pro?

It seems to us that some buyers at this price in the stock are thinking that Vision Pro is the product needed to break through the next demand ceiling. However, the tech is unproven, and has a long way to go before we think it will see true mass adoption. If the price comes down, it directly competes with the MacBook’s current capabilities, which will likely lead to cannibalization.

We see Apple growing revenues and FCF past the current level, but incrementally, not quickly.

It’s Overbought

All in all, there’s some reasons to be bullish, and some reasons to be bearish. It seems to us that the issues around saturation in demand should outweigh speculation about products that are more than a year away, or hiking cycles that have yet to materialize.

However, the current valuation has the story backwards.

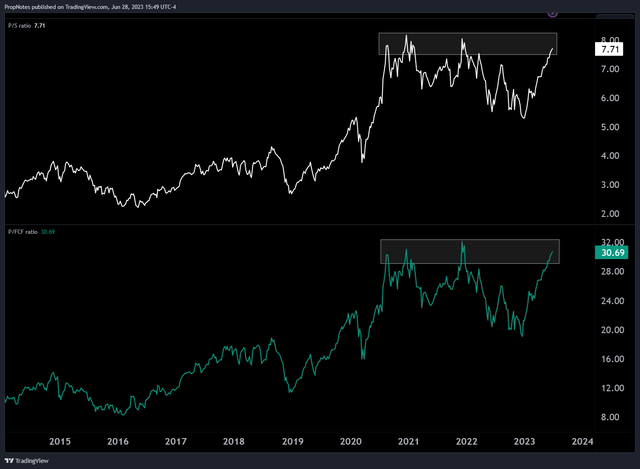

The company is trading at a peak-growth sales and free-cash-flow multiples in our view:

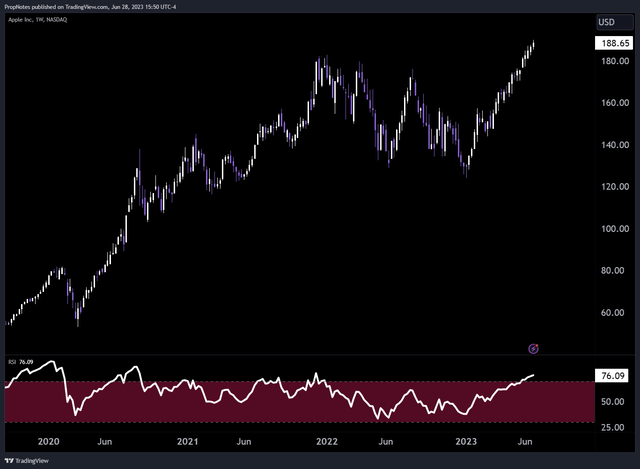

If that weren’t enough, the stock also has a weekly RSI reading of 76, indicating that the stock is significantly overbought:

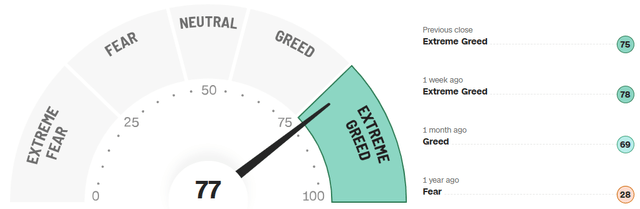

Together, we’ve got a story that’s simply mispriced as a result of strong momentum and greed in the market:

Summary

As a result, we think shrewd investors should trim stakes and new market entrants should wait to deploy capital in this overpriced, overbought behemoth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.