Summary:

- Cisco Systems is undervalued despite its strong balance sheet, large profits, and free cash flow. The company’s entry into the AI space with its new G200 and G202 chips could be a game-changer, potentially disrupting competitors and strengthening CSCO’s position in the market.

- CSCO’s financial performance indicates it is operating a strong cash-generating machine. The company has generated significant revenue, cash from operations, free cash flow, and net income since 2013. Despite this, the investment community has overlooked CSCO, presenting a potential investment opportunity.

- The company has a strong track record of rewarding shareholders through dividends and share buybacks.

- If CSCO’s move into AI and machine learning-based chips proves successful, it could see its valuation align more closely with the tech industry in the future.

Sundry Photography

Cisco Systems (NASDAQ:CSCO) is similar to International Business Machines (IBM) as they both have been left out of the tech boom, despite strong balance sheets, generating large amounts of profits and free cash flow (FCF), and rewarding shareholders through enticing capital allocation programs. CSCO isn’t grabbing headlines like Apple (AAPL), NVIDIA (NVDA), or Tesla (TSLA), but that doesn’t mean this company is dead money. CSCO just unveiled AI-focused networking chips that aim to optimize the real-world performance of AI/ML workloads. Networking isn’t normally thought of when AI hits the headlines, but networking is the backbone of every organization’s technological infrastructure. Even if you’re a small business with 100% remote workers utilizing cloud services, chances are those cloud providers heavily rely on on-prem infrastructure. CSCO has reinvented itself in the past by diversifying its revenue to incorporate service and subscription products. CSCO has used retained earnings to grow its profit centers and reward shareholders through top and bottom-line growth while allocating tens of billions toward its dividend and buyback program. Sometimes there are companies flying under the radar, and CSCO continues to be an unloved old-school tech company when it has the potential to be a great investment. CSCO has all the components that investors should love, including a low P/E, low P/FCF, growing revenue, buybacks, and dividends, but for some reason, CSCO continues to be overlooked. I think the focus on AI could be the fuel needed for CSCO to escape value territory.

Seeking Alpha

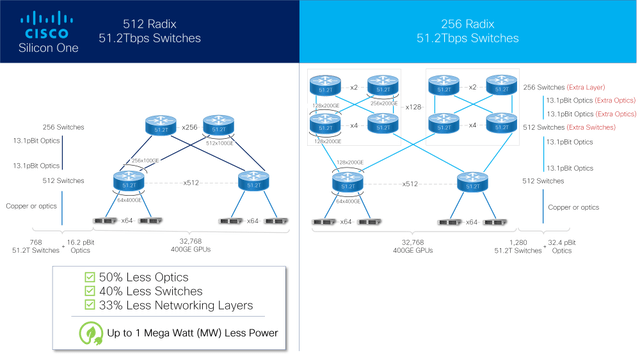

Cisco Systems entering the AI space with their G200 and G202 chips is a big step in the right direction

In December of 2019, CSCO unveiled its plan for building the internet for the next decade of digital innovation. On June 20th, CSCO announced its 4th generation set of devices which include the Cisco Silicon One G200 and Cisco Silicon One G202, which customers are sampling. The Cisco Silicon One G200 focuses specifically on enhanced Ethernet-based artificial intelligence/machine learning (AI/ML) and web-scale spine deployments. The G202 is a similar chip with half the performance of the G200. The G2000 and G202 chips have optimized high-bandwidth devices purpose-built for spine and AI/ML deployments allowing customers to save money by deploying fewer and more efficient devices. These devices will also improve their AI/ML job performance with innovative load balancing and fault discovery techniques and improve network debuggability. As more customers adopt these products, we could see an upgrade cycle occur sooner than later to support the technologies of tomorrow that all companies will be required to utilize to stay relevant.

Cisco Systems

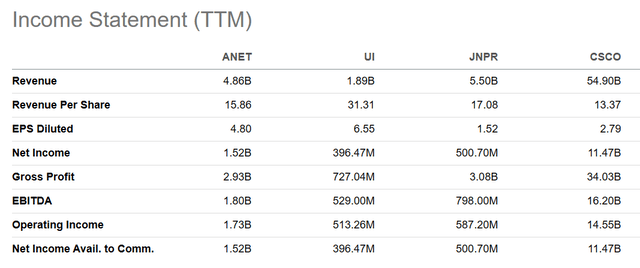

Some of CSCO’s largest competitors are Arista Networks (ANET), Ubiquiti (UI), are Juniper Networks (JNPR). CSCO is the 800-pound gorilla in the room when it comes to size, as they have generated $54.9 billion in revenue during the TTM and delivered $16.2 billion in EBITDA and $11.47 billion in net income. While ANET has seen 53.78% YoY revenue growth with a 3-year CAGR of 27.58%, CSCO still produces more than 10x the amount of revenue than them.

Seeking Alpha

Nobody can accurately forecast how impactful AI and ML will be in the coming years, but it’s widely agreed that these computing aspects are here to stay. As AI and ML continue to advance, companies will eventually upgrade their network infrastructures to capitalize on all their capabilities. By CSCO unveiling the Cisco Silicon One G200 and G202 chips, it could hinder ANETs’ large growth rates, and continue to fortify CSCO’s foothold in the space. CSCO probably won’t stop on the hardware side, as they have made large strides on the software side and will probably offer new services and subscriptions around AI and ML for network infrastructures that will be critical for organizations.

Why I feel CSCO is undervalued and Mr. Market isn’t giving CSCO the multiple it deserves

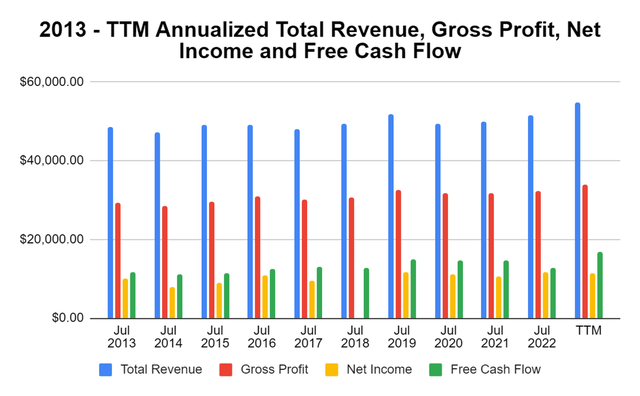

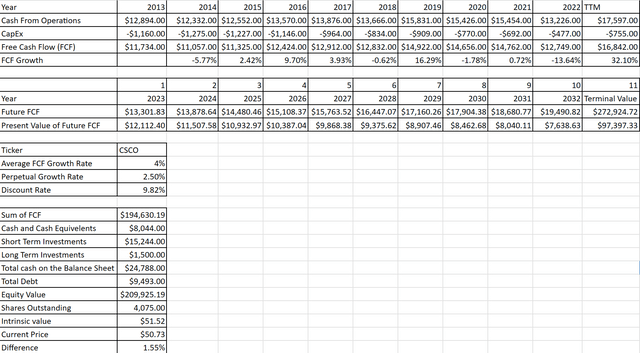

CSCO’s financials indicate that CSCO is operating a strong cash-generating machine. Since the close of 2013, CSCO has generated $548.97 billion in revenue, $156.42 billion in cash from operations, $146.22 billion in FCF, and $103.98 billion in Net income. I feel that CSCO’s revenue growth of 12.94% from the close of 2013 to the TTM, which is already in CSCO’s Q4, has been why the investment community isn’t excited about CSCO, and this is why I believe there is a real opportunity. CSCO has grown its cash from operations by 36.47%, FCF by 43.53%, and net income by 14.9% in this period as they have become much more profitable. They are generating so much in pure profits that they have allocated $55.31 billion toward dividends and repurchased $84.83 billion worth of shares through their capital allocation program since 2013.

Steven Fiorillo, Seeking Alpha

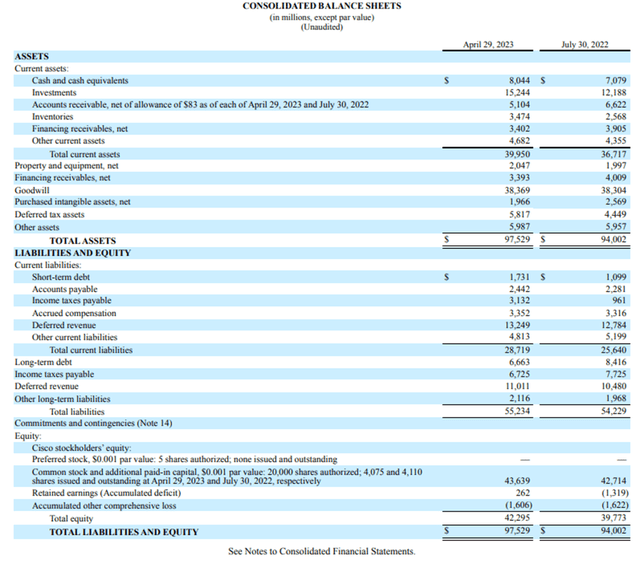

CSCO has a fortress balance sheet with $8.04 billion in cash on hand and $15.24 billion in short-term investments. CSCO has $23.29 billion in on-hand liquidity with $1.73 billion in debt due within 1-year, and $28.72 billion in total long-term debt. There is $43 billion in total equity on the books, and CSCO is in a position of strength with a balance sheet that is unlevered.

Cisco Systems

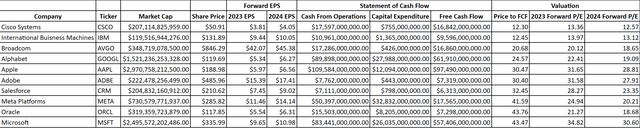

From a valuation standpoint, CSCO looks undervalued. I compared CSCO to IBM, Broadcom (AVGO), Alphabet (GOOGL), Apple (AAPL), Adobe (ADBE), Salesforce (CRM), Meta Platforms (META), Oracle (ORCL), and Microsoft (MSFT). I looked at the current valuation, the projected 2023 and 2024 EPS, the amount of FCF produced and compared all of the P/FCF ratios and forward P/E metrics. CSCO trades at 12.3 times its FCF and has a 2023 forward P/E of 13.36 and a 2024 forward P/E of 12.57. The average P/FCF of the group is 29.21x, while the average 2023 forward P/E is 24.24, and the average 2024 forward P/E is 21.3.

Some may argue that companies such as CRM, ADBE, or ORCL deserve higher multiples because of their growth rates, but when you look at the cash from operations, and FCF generated, CSCO is generating more than CRM, ADBE, and ORCL yet trades at a severely discounted P/FCF multiple. Over the past decade, CSCO has been very consistent in the levels of FCF it generated and grew the amount of FCF produced by 43.53% over the past decade. If you were to purchase the entire company at the current market cap, it would take 12.3 years to generate your initial investment in FCF compared to 32.45 years for CRM, 30.40 years for ADBE, or 43.76 years for ORCL based on the TTM numbers.

Steven Fiorillo, Seeking Alpha

When I rebuild the model and assign a 29.21 FCF multiple to each company, 4 companies look undervalued, while AAPL and ADBE are within 5% of their current market caps, and 4 companies look overvalued by 9-33%. If CSCO traded at the peer group multiple of 29.21x its FCF, it would have a market cap of $492.04 billion, meaning that shares would need to appreciate by 137.57% to reach this valuation. Even if CSCO traded at a 20x FCF multiple, shares would need to appreciate by 62.30%. There isn’t a perfect way to value stocks and using P/FCF and P/E metrics are just a couple of tools investors can use, but by these metrics, CSCO looks undervalued.

Steven Fiorillo, Seeking Alpha

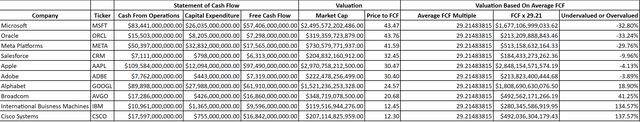

Some people have been asking me to build discount cash flow models in addition to or in substitution of my FCF and PE metrics. I built a DCF model for CSCO, which is below, I am interested in how the readers like it, so please leave me a comment.

Steven Fiorillo, Seeking Alpha

According to Investopedia, the average S&P 500 annualized return since 1928 has been 9.82%. Some like DCF models, and others don’t. I use DCF models as one component of my valuation process. I have used 2013 thru the TTM instead of 2022 for CSCO because they have already reported 3 quarters in their 2023 fiscal year. Based on CSCO’s average FCF growth rate of 4%, a perpetual growth rate of 2.5% for the economy, and a discount rate of 9.82% to match the S&P 500 average, the intrinsic value for CSCO would be $51.52, which is 1.55% higher than the current share price. When you make an investment, you’re paying the present value for all future cash flow the company generates. The DCF model is a way of indicating what investors should pay for all future cash flows according to the assumptions they are making for the future. The DCF model isn’t perfect because nobody can predict the future, but that’s why it is discounting all of the cash flow going forward to find the intrinsic value. Based on the assumptions I have made, CSCO is undervalued in this DCF model. If you were to change the discount rate to 12% to outperform the S&P 500, CSCO would look overvalued as its intrinsic value based on the other assumptions, I made would be $40.22. DCF models are not a perfect science, but for me, it reinforces my assumptions on the current P/FCF and P/E multiples being undervalued.

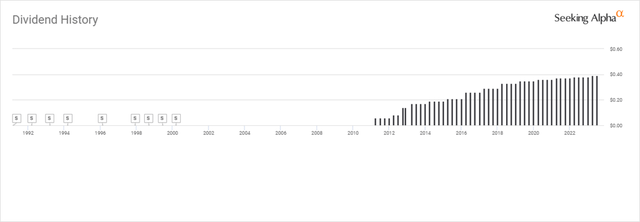

Cisco Systems has been a champion of allocating capital to shareholders with a strong dividend and buyback program

Since 2013, CSCO has returned $55.31 billion in dividends to shareholders while repurchasing $84.83 billion in shares. CSCO paid its first quarterly dividend on 4/20/11 and since then has delivered $13.10 in dividend income. At the start of 2011, CSCO traded at $20.97, and if you had purchased shares at that price, CSCO would have paid you 62.47% of your original investment through dividends prior to accounting for compounding from reinvesting the dividends. CSCO has increased the quarterly dividend for the past 11 years and has grown the quarterly dividend by 550% in this period from $0.06 to $0.39. Today, CSCO is paying out 55.14% of its TTM EPS in dividends, and the dividend is currently yielding 3.07%.

Seeking Alpha

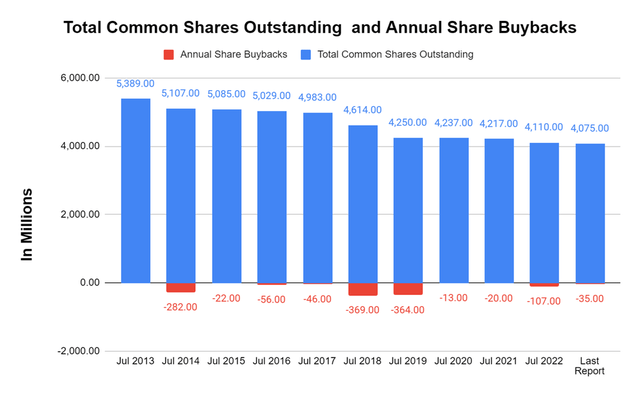

CSCO ended 2013 with 5.39 billion shares outstanding. As of their Q3 2023 filling, CSCO had 4.08 billion shares outstanding. Over the past decade, CSCO has allocated $84.83 billion toward buybacks, and repurchased 1.31 billion shares which is 24.83% of the company. There aren’t many companies that are returning this level of capital to shareholders annually, and CSCO continues to increase each shareholder’s ownership level as they continuously buy back shares on the open market.

Steven Fiorillo, Seeking Alpha

Conclusion

CSCO isn’t grabbing headlines, but I feel it’s one of the most undervalued tech companies in the market. I believe that the AI/ML revolution is real, and technological advancements will be staggering over the next decade. CSCO should be a large beneficiary as it could capture a larger piece of the pie when companies upgrade their network infrastructure. CSCO’s move into AI/ML-based chips will be critical for the next generation of computing, as network infrastructure will always be needed. Even though CSCO operates in a segment that is out of sight and out of mind, the revenues and profits are real, and CSCO consistently generates over $10 billion in FCF annually. I believe CSCO will continue to grow its EPS, retain enough earnings to grow its profit centers, raise the dividend, and allocate capital toward buybacks. I feel that CSCO will keep grinding higher and that the market could reward them with a valuation that is more in line with the tech industry in the future if their AI/ML chips are a success.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CSCO, META, GOOGL, AAPL, ORCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.