Summary:

- Bank of America is expected to release its Q2 earnings in mid-July, which is significant for the market as bank earnings provide indicators about the state of the economy.

- Analysts predict BAC will report $25.17 billion in revenue and $0.85 in EPS for Q2, which would be a decline from Q1 but positive growth from the prior-year quarter.

- BAC may beat expectations on revenue due to increased retail sales and healthy mortgage rates but may struggle to meet earnings expectations due to rising PCLs.

- Despite potential risks such as further interest rate hikes, yield curve inversion, and a possible recession, I believe BAC’s stock is currently undervalued and am comfortable holding it ahead of the Q2 earnings release.

Brian Moynihan Drew Angerer/Getty Images News

Bank of America (NYSE:BAC) is set to release earnings in the middle of July. We don’t have an exact date yet, but based on previous earnings dates, we’d expect them to come out sometime between July 14 and July 18.

This is a very important earnings release, not just for BAC shareholders, but for everybody in the markets. Bank earnings tell us a lot about the tightness or looseness of financial conditions. Fed policy isn’t the only factor in access to money; the banks’ willingness to lend within what the range of what they are able to is a factor as well. Recently, Charlie Munger said that banks were “tighter on real estate” than they were in the past, “tighter” meaning less willing to lend. With credit card delinquencies rising, the banks may be getting tighter in other categories as well.

Recently the banking sector got some good news when the Federal Reserve revealed that all 23 big banks passed the annual stress test. BAC stock rallied the day after that was announced. The stress test showed BAC with capital ratios above regulatory requirements, although not as high as some other banks tested. Bank of America did not rally as much as JPMorgan (JPM), which had truly excellent capital ratios, so it looks possible that investors were trading banks based on their stress test results Thursday.

The Fed’s stress test is an important metric for bank investors, but earnings are even more important. This year, banks are shoring up their capital positions and raising provisions for credit losses (“PCLs”) to cope with potential withdrawals. It’s well known that this is going on, the question is, what will profits look like with all these defensive measures being taken. When banks raise their PCLs, they also increase their allowance for credit losses, leaving less equity and therefore less money to lend out (assuming they’re serious about meeting their target capital ratios). So, increases in PCLs tend to suppress bank profitability. Initially, the increase in PCLs itself creates an on-paper charge that reduces net income. Later, actual cash flows can be affected, as a rise in PCLs usually signals increased future defaults, and reduced willingness to lend.

It’s still not clear whether Bank of America really is about to see a big increase in defaults. Credit card defaults are up, but still not at pre-pandemic levels. BAC increased its PCLs by $901 million last quarter, compared to nearly nothing in the year-ago quarter. Given BAC’s tendency to be conservative, we would expect that actual defaults will increase by less than $900 million.

When I last covered Bank of America, I rated it a ‘strong buy’ based on the fact that it had gotten too cheap during the Spring banking crisis. Since then, the stock has appreciated 4.75%, (5.6% if you include dividends). Given the fact that the stock is up and has an earnings release just around the quarter, I figured it was time for a second look, to see if my original rating was still valid.

After researching the stock some more, I concluded that Bank of America is still a buy, but no longer a strong buy. It’s still a great company but the gains made since my last article demand a re-rate. In this article, I’ll defend that opinion by looking ahead to BAC’s upcoming Q2 earnings release. First, I will look at what analysts are expecting from the bank. Then, I’ll share my own views on what is likely to be revealed. As you’ll see shortly, a further increase in PCLs could eat into the high earnings growth BAC put out in the previous two quarters. Nevertheless, I expect the bank’s earnings to be strong on the whole.

What Analysts Expect

According to Seeking Alpha Quant, analysts are expecting Bank of America to report $25.17 billion in revenue and $0.85 in EPS in its second quarter release. Both figures, if met, would represent declines from first quarter earnings. However, $25.17 million in revenue would be 13.5% growth from the prior year quarter, and $0.85 in EPS would be 16.7% growth over the same timeframe. So, analysts are expecting Bank of America’s year-to-date trend of positive earnings growth to continue.

Is the Consensus Accurate?

Having looked at what analysts are expecting from Bank of America in Q2, we need to ask whether the expectations are reasonable or not.

To begin with, I think there’s a pretty good chance that Bank of America beats on revenue in Q2. The analyst consensus is that revenue will decline compared to Q1, yet retail sales increased sequentially in April and May. Credit card spending tends to rise with retail spending, so we’d expect BAC credit card balances (and interest) to increase for April and May. We have seen a small increase in charge offs, but nothing major. In the meantime, mortgage applications remain healthy, even with interest rates rising. So Bank of America will be collecting more interest than it did last year on variable rate mortgages, and it may even originate more new mortgages than expected. For these reasons, I would expect Bank of America’s Q2 revenue and pre-tax, pre-provision income to come in strong.

It’s a very different story with net income. This metric is influenced by PCLs, and PCLs are rising all across the industry this year. As we saw previously, Bank of America raised them by $901 million last quarter. There is a lot of room to increase PCLs from there. For example, in the second quarter of 2020, reserves went all the way to $5.1 billion. Such a large increase in PCLs would certainly negatively impact Bank of America’s earnings, though it probably won’t occur. A smaller increase is likely, though, so I’d say that BAC is less likely to beat on earnings when compared to revenue. I have no other estimate to offer here that differs with the analyst consensus, I just think that that bar will be harder to clear than the revenue bar.

Valuation

Having looked at analyst expectations for Bank of America’s upcoming quarterly earnings release, it’s time to look at how the stock is being valued by the markets.

According to Seeking Alpha Quant, Bank of America currently trades at:

- 8.43 times earnings.

- 2.4 times sales.

- 0.89 times book value.

- 8 times operating cash flow.

Overall, BAC looks pretty cheap, even for a bank.

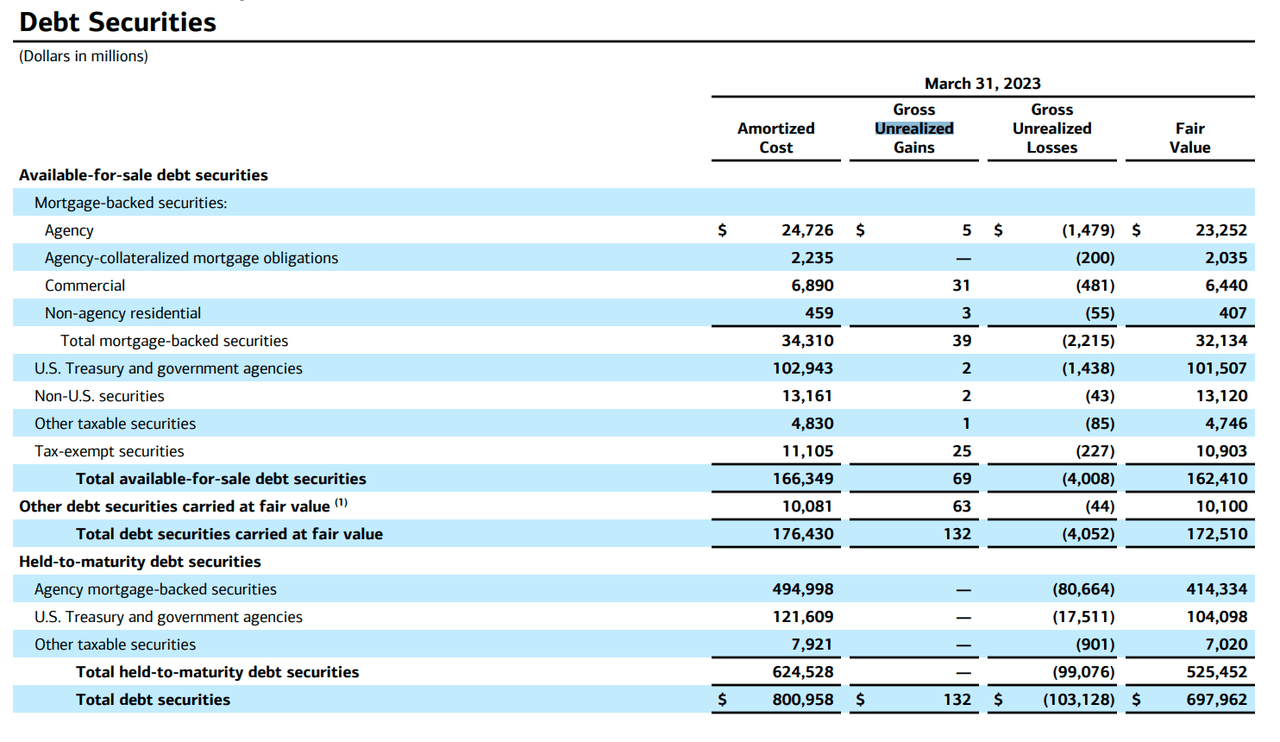

One thing is worth mentioning here: the price/book multiple is calculated with the bank’s held to maturity securities valued at amortized cost. The market value of these securities is lower. BAC reported $280 billion in book value last quarter, but that amount falls to $181 billion if you adjust the HTM securities to fair value. Dividing that by $8.064 billion in shares outstanding gets us to $22 in book value per share, and a 1.28 price to book ratio. That’s still fairly low, but not the “deep value” multiple you get looking at BAC at first glance.

Bank of America unrealized losses (Bank of America)

Risks and Challenges

As we’ve seen, Bank of America is a healthy bank with a reasonably cheap valuation and decent growth. It looks like a buy, and indeed I am long Bank of America, but there are many risks and challenges to keep in mind. These include:

- More interest rate hikes. Interest rate hikes have a mixed impact on banks like BAC. So far this cycle, BAC’s net interest income has been rising thanks to rising rates, despite the yield curve being extremely inverted, but on the other hand, the bank’s treasury holdings have been declining in value. It’s largely the decline in the value of these treasuries that investors have been worried about. As mentioned previously, it reduces the “real” measure of BAC’s book value. Additionally, it reduces the bank’s ability to cope with bank runs. So, further interest rate hikes that depress the value of treasury securities are a risk for Bank of America.

- Yield curve inversion. Related to interest rate hikes is the phenomenon of yield curve inversion. The U.S. 10 year-2 year yield spread has been inverted ever since the Fed started raising rates back in 2022. More recently, the entire curve has been inverted, from 1 month all the way to 30 years. Banks borrow on the short end of the curve and lend on the long end. This should theoretically reduce lending margins/net interest income. So far that hasn’t occurred, but the yield curve is currently more inverted than at any other time in the last year and a half. We’d expect Bank of America’s margins to be slimmer going forward.

- The widely expected recession. Economists have been calling for a recession ever since the first half of 2022. As of the most recent reports, U.S. GDP growth remained positive, but a recession could still occur. With the hot economic data that’s been coming out, it doesn’t look like we’ll see a recession in 2023, but a downturn in 2024, or even straddling the fourth quarter of 2023 and the first quarter of 2024, is definitely possible.

These are serious risks for Bank of America and its shareholders. Nevertheless, the stock is cheap enough that they appear to be priced in already. Personally, I’m comfortable being long BAC ahead of its second quarter earnings release.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.