Summary:

- Adobe delivers a very strong fiscal Q4 2022 result that saw 33 cents of operating profits for every $1 of revenue.

- Yes, these are GAAP earnings. And yes, the company is oozing free cash flow.

- On the bearish side, its growth rates are slowing down.

Morsa Images

Investment Thesis

Adobe (NASDAQ:ADBE) results didn’t quite deliver on the top line. But where it has massively delivered is in terms of profitability.

The quarter saw some positive and negative aspects that investors should keep in mind. The negative is that Adobe’s CAGR is now firmly below 20% CAGR.

The positive is that Adobe is oozing cash flows and profits.

On yet the other hand, after Adobe deployed $6.3 billion towards buybacks, its total number of shares outstanding is only down 3% y/y.

And with its Figma acquisition expected to be completed in 2023, I don’t believe that Adobe will be in a place to return more capital to shareholders any time soon.

However, overall, I’m pleased with these results and upwardly revise my sell rating on this name.

Should the Macro Matter?

There are two aspects to consider. There’s the Adobe core business and the overall investment landscape. I’ll take these in turn.

This is what Adobe’s President Anil Chakravarthy stated during its earnings call,

[…] The current macroeconomic climate requires businesses to prioritize investments, and digital remains mission-critical to drive operational efficiency, improve customer engagement and maximize long-term value realization.

That’s the core of the bull case. Now, this is the crucial question, how much an investor buys into the pull forward versus long-term secular story?

Put another way, are Adobe’s best days in the rearview mirror? Or is there enough of a secular growth story afoot that we can disregard the macroeconomic climate?

To add some context, Adobe’s President of the Digital Media Business, David Wadhwani said on the call,

When it comes to new subscribers, we added more new commercial subscribers this year than we’ve ever added in our history. And that is a really important intentional sort of activities we are doing. Many of those new users are — tend to be nonprofessionals

The message that Adobe is working hard on is to get investors to buy into their long-term secular growth story.

And indeed, remember, the whole appeal of investing in long-term secular compounders is that the macro environment should not matter. Investors can just buy and hold the biggest, brightest, and best companies and that worked out extremely well over the past five years.

Now, let’s go beyond the narrative.

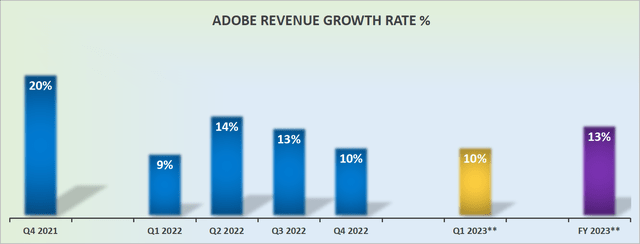

Revenue Growth Rates Mature

Before we go further, note that for fiscal Q1 2023 and full year fiscal 2023, I took the currency-adjusted guidance. While for the prior reported periods, I took the ”as-reported, GAAP” figures.

To make an adjustment on the guidance back to ”expected” GAAP, FX is a drag of around 4% in the coming year. Also, these figures do not include the Figma acquisition.

From where I’m standing, I believe that in the near term, Adobe will not be growing at 20% CAGR. This is a sub-20% CAGR story.

But is it so bad?

Rule of 40? Nope, Rule of 50

For the quarter just ended, Adobe’s Q4 2022 saw its rule of 40 reach 54%. That’s a combination of its high non-GAAP operating profits, plus its 10% top-line growth.

In a higher rate environment, when many tech companies haven’t yet figured out how to pivot their business models to reach non-GAAP operating profits, Adobe’s clean GAAP operating profits reached 33%.

While its non-GAAP operating profits reached 45%! To the best of my knowledge, for this earnings season, amongst the big tech companies, Adobe’s clean GAAP profits are by far the best.

ADBE Stock Valuation – 22x Next Year’s EPS

I was bearish on Adobe heading into this earnings report. But if the facts change, I have to change my mind.

I believe that with interest rates staying around +4% in 2023, investors will continue to seek out profitable companies ahead of growth companies.

Companies that make a lot of cash flows and are not abusing shareholders with their stock-based compensation.

On the other hand, I could make the case that in fiscal 2022, Adobe repurchased $6.3 billion worth of stock, and this only brought down its total shares outstanding by 3%.

And given that Adobe is spending about $20 billion to buy Figma in 2023, I can’t imagine that Adobe will be repurchasing any more shares any time soon.

The Bottom Line

Adobe’s CEO finished his prepared remarks by saying,

I have never been more certain that Adobe’s best days are ahead.

I’m not convinced of this statement. I believe that Adobe’s fastest-growing days are now well in the rearview mirror.

However, as I made clear in the analysis, in the current high-rate environment, companies with strong GAAP earnings will continue to be rewarded by investors.

And with that in mind, I can’t stay bearish on a company that’s clearly reporting such strong profits.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.