Summary:

- Airlines are among the best valued stocks in the market today, recovering from the pandemic-related slowdown with strong expected growth.

- American Airlines is a major beneficiary of this trend, with a low valuation and promising future growth driven by strong and growing demand for air travel.

- The company’s return to profitability in 2022 and 2023 after two years of pandemic-related losses is expected to further drive the stock higher.

Joe Raedle/Getty Images News

Some of the best-valued stocks in the market today include the airlines. I’ve covered some recently here, here, and here. The airlines have been recovering from the pandemic-related slowdown. Air travel demand has been strong and is expected to remain strong for multiple years. Given the low valuation and strong expected growth, I expect most airlines to outperform the broader market through the remainder of the decade. American Airlines (NASDAQ:AAL) is one of the beneficiaries of strong air travel demand.

American Airlines is another major airline with a low valuation and strong expected future growth. The company’s growth is being driven by strong bookings from consumer interest in spending on experiences and air travel, along with increased business travel. The company’s return to profitability in 2022 and 2023 after two years of pandemic-related losses is another positive to help drive the stock higher.

Record Independence Day Weekend Travel

The recovery from the pandemic-related travel slowdown is evident in the record amount of travelers during the Independence Day weekend. AAA is projecting that a record 80.7 million Americans will travel 50 miles or more this holiday weekend. This represents an increase of 2.1 million travelers over the same period last year.

Air travel is expected to set a new record with an expected 11.2% increase to 4.17 million passengers this holiday weekend over the same period last year. The amount of air travel passengers this holiday weekend is also 6.6% higher than the same period in 2019 which was prior to the COVID pandemic. This record amount of air travelers demonstrates that air travel is now exceeding pre-pandemic levels. This is likely to provide a strong tailwind for American Airlines.

Room for Growth

While American is seeing strong record demand, there is room for improvement in other areas. American has not yet returned to the capacity that it had prior to the pandemic in 2019. The company believes (according to CEO, Robert Isom) that the airline industry will return to the historic relationship between airlines revenues and GDP, which is 9/10 of a percent of GDP.

American Airlines plans on increasing capacity by 5% to 8% in 2023 to better serve the increase in demand that the company is experiencing. One challenge that they have with increasing capacity is securing enough pilots to fly the 150 regional aircraft that American plans to deploy over the next 18 to 24 months. However, the company is working diligently to accomplish that. The company also believes that they can get an additional 2% to 3% of utilization from the existing fleet.

The global airline market is expected to grow at an annual pace of about 3.7% to 2030. This growth is expected to be driven by rising disposable income, increased demand for air travel, and the growth of the tourism industry. This industry growth should provide a positive tailwind for American Airlines to increase revenue and earnings to 2030.

American Airlines is expected to grow revenue by 7.7% in 2023 and by about 4% in 2024. EPS is expected to grow 492% in 2023 and 10% in 2024. The expected growth rate is skewed high for 2023 as a result of pandemic-related issues and higher fuel prices last year.

Attractive Valuation

American Airlines is trading with an attractive valuation, with a forward PE of about 6. This is below the sector median forward PE of 17 and the industry average forward PE of about 7. It is not too common to find profitable companies trading with PEs below 10 in this market.

AAL’s forward PE is based on expected EPS of $2.96 for 2023. The company’s EPS was upgraded significantly by 32% from $2.24 90 days ago. The EPS upgrades likely led to the stock’s strong performance over the past few months.

The airlines tend to remain valued below the rest of the market due to various reasons. This can be a result of the sensitivity of the industry to fuel costs, which can significantly affect profit margins. The low valuations can also be due to the high amount of net debt that the airlines tend to carry. American has $30.6 billion in net debt. However, American does have positive cash flow to pay down that debt over time.

Technical Perspective

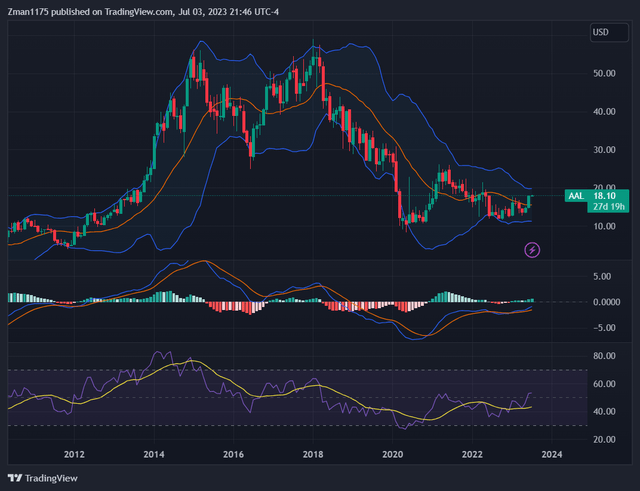

American Airlines monthly stock chart w/price, MACD, RSI (tradingview.com)

I zoomed all the way out using the monthly chart, which provides a long-term multiple-year perspective. We can see that the stock still has a long way to go to get back to the pre-pandemic levels. I would like to point out that the stock is overbought on the daily chart (which is not pictured here) according to the RSI. So, the stock could experience a pullback in the short term.

The monthly chart shown here has the stock beginning a long-term uptrend as indicated by the positive MACD crossover in the middle of the chart (blue line crossing above the red signal line). The RSI (purple line at the bottom of the chart) rose above 50 into the bullish zone, indicating positive momentum for the stock.

While a pullback can happen at any time in the short term, I’m expecting AAL’s stock to get back to where it was trading before the pandemic over the next several years. This could take longer if we experience a significant recession this year or next year.

American Airlines: Long-Term Outlook

Overall, American Airlines is likely to perform well through the decade. The expected growth in air travel demand should support this. American’s efforts to increase capacity over the next couple of years to meet the strong demand should help drive revenue and earnings growth.

Investors should be aware that a recession could temporarily set the company back a bit. However, I doubt we will experience a severe recession. It is possible that a moderate recession could keep fuel prices contained while air travel demand doesn’t suffer too drastically.

The low valuation and strong expected growth should allow the stock to perform well and eventually return to the levels it was trading at prior to the pandemic. However, it may take two to four years to get there.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The article is for informational purposes only (not a solicitation or recommendation to buy or sell stocks). David is not a registered investment adviser. Investors should do their own research or consult a financial adviser to determine what investments are appropriate for their individual situation. This article expresses my opinions and I cannot guarantee that the information/results will be accurate. Investing in stocks involves risk and could result in losses.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Consider joining Kirk Spano’s Margin of Safety Investing which offers a more in-depth analysis of individual companies.

Try Margin of Safety Investing free for two weeks and get your first year for 20% off.

Learn the 4-step investment process that top hedge funds use.

Invest with us in a changing world that demands a margin of safety.