Summary:

- In May and June, I stated that our firm was not buying Nvidia Corporation stock at that time. Well, similar to the weather, this has changed.

- The key to Nvidia today is the large gap from their earnings report. This gap is either a breakaway gap, or an exhaustion gap.

- The $405 – $395 region will likely continue to act as strong support for the red count. This is where we added back in anticipation for a ~38% push higher.

- Looking for more solid entries into tech stocks? Join my Investor Community, including an automated hedging signal and trade alerts.

Adnan Ahmad Ali/iStock Editorial via Getty Images

The market is like the weather, it changes often. The market’s fickle nature is partly why stocks often lead to losses for retail investors. By going “all-in’ or “all-out,” individual investors can often be overexposed to the sudden changes the market brings. This is especially true when the market has treated investors well as it creates a sense of security – or worse, complacency.

Our site is unique in that we provide active management. This has helped us outperform across four audit periods. Our stance is the weather will always change – from good times to bad times, and from bad times to good times. Therefore, we are not over-exposed in either direction.

An example of this is Nvidia Corporation (NASDAQ:NVDA), our largest position. As the allocation grew well beyond 10%, we took gains. Even after taking gains, the company is currently at a 17% allocation. In May and June, I stated that our firm was not buying Nvidia at that time. Well, similar to the weather, this has changed. My firm bought a small tranche of Nvidia stock yesterday for $410. This tranche will come with a stop, meaning if the stock sells off, we will close this 2% tranche while hedging the 15% original position.

Our Current Nvidia Trade:

With the cash we raised throughout 2022, NVDA was the primary target of deploying some of this cash once our analysis signaled a bottom was in place. The below is a real-time trade notification we sent to our members on the October 13th.

The above alert was 1 of 9 alerts we sent out from 2021 – 2022 to buy NVDA below $200. However, since February of 2023, we have been systematically taking gains at key levels based on technical and macro warnings. Even with logging sizable wins while raising cash, it in the top position in 2023.

In our pre-earnings buy-plan for NVDA, we stated that

“It is our belief that NVDA is setting up for a sizable pullback, which we believe will open the door for better long-term entries.”

Though we do believe that lower levels will manifest in time, the recent earnings report moved forward expectations regarding AI, which is showing up in the price action. We have been discussing that Nvidia will be an AI leader for years with an allocation to match, yet predicting the exact day and month the market would finally price in this thesis is impossible to predict (and timing to this level is not necessary when holding a large longer-term position)

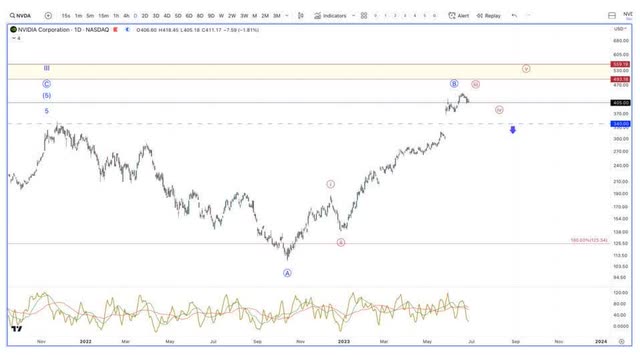

Regarding price, we work in probabilities, and when the market changes, so do we. The key to NVDA today is the large gap from their earnings report. This gap is either a breakaway gap, or an exhaustion gap. If it is a breakaway gap, which is represented by our red count below, then it is the halfway point in this push higher. On the other hand, if price breaks below $340, likely on some type of “event,” then the gap is an exhaustion gap, and will mark a larger top. This is represented by our blue count.

The $405 – $395 region will likely continue to act as strong support for the red count. This is where we added back in anticipation for a ~38% push higher. Our stop for this move will be a break below the $340 critical support region, which is ~14% lower than our entry.

Unlike many, we do not believe AI is a bubble, nor do we think the valuations in some of these names is stretched, as many believe. What does concern us regarding possible “events” are: 1) geopolitical tensions forcing a ban of selling NVDA’s chips to China – which Beth spoke about in May with Bloomberg Asia; 2) the inevitable recession that will likely start to be priced into equities in Q4/Q1, but could get pushed forward due to an unforeseen event.

Because of these risks, we are buying with an exit plan for any new entries. It is our belief, based on the economic data, that a recession is a more likely than not for the U.S. economy. However, based on current projections on timing, we could see a continued push in AI leadership through year-end. This is what we are further positioning our portfolio for, with the realization that we could top out sooner than anticipated.

The Tech Insider Network has been beating the drum about AI for 5 years. Now that it is here, we are targeting choice mid-cap to mega-cap names in the coming pullback. Once this exuberance runs its course, and the market gives up on AI, we will be buying the dip for this once-in-a-lifetime tech trend that is just starting. Join us the week following the holiday, Thursday, 7/13, at 4:30 EST where we will go over the specific AI stocks we are targeting. We will provide the macro backdrop, along with entry prices.

Recommended Reading:

- Nvidia Stock: How To Value The Metaverse

- Nvidia Will ‘Still’ Surpass Apple’s Valuation

- Nvidia Stock: Evidence Gaming Bottomed And Why It’s Important

- Nvidia Stock Is Ready To Rumble With RTX 40 Series And H100 GPUs

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Check out Tech Insider Network

Check out Tech Insider Network

We offer tech sector coverage that combines fundamentals and technicals. After recommending a stock, we provide entries and exits.

Our audited 3-year results of 47% prove we are a top-performing tech portfolio. This compares to popular tech ETFs at negative 46% and the Nasdaq at 19%.

We are the only retail team featured regularly in Tier 1 media, such as Fox, CNBC, TD Ameritrade and more.

Our services includes an automated hedge, portfolio of 10+ positions, broad market analysis, real-time trade alerts PLUS a weekly webinar every Thursday at 4:30 pm Eastern.