Summary:

- Intel Corporation faces significant challenges in the near term and needs to prove it can compete with major players in the fabrication industry like Taiwan Semiconductors.

- Despite a healthy working capital ratio, Intel’s debt has significantly increased over the last decade, and its return on assets and equity are below minimum thresholds.

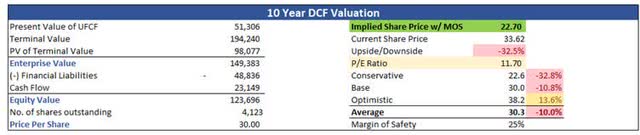

- The company’s intrinsic value is $22.70, implying a -32.5% downside from the current valuation, making it a “sell” for now.

Justin Sullivan

Investment Thesis

In this article, I will go over Intel Corporation’s (NASDAQ:INTC) potential catalyst that may propel the company’s turnaround and will look into its financial history, and will perform a DCF valuation to see what the company is worth and if is it a buy right now. In short, I can see a company that will face a lot of hurdles in the near term and will have to prove to us that it can compete with the big players in the fabrication industry like Taiwan Semiconductors (TSM). I rate the company a “sell” for now, and I do not think it is the right time to jump on board if you are looking to open a fresh position as the turnaround story is going to take a long time.

Outlook

The company has been trying to come back to life in recent years. It is trying to reinvent itself and become the leader in the chip industry. Intel has been hard at work making a bunch of investments in the US and abroad to extend its reach across the globe. With the recent announcements of investments into Germany, Poland, France and further investments in Ireland Intel is sending a message to the world that it wants to be taken seriously, again.

The IDM 2.0 strategy is well on its way and all these investments that the company is making look promising. This way the company can become a third-party manufacturer for other fabless chipmakers like Qualcomm (QCOM) and Nvidia (NVDA). The CEO of Nvidia already had some preliminary tests done with the chips made by INTC and said the tests “were good”. That doesn’t mean that NVDA will start using Intel for their next GPUs. Most of Nvidia’s GPUs are made by TSMC right now, so I’m guessing the reason the company is open to working with INTC is to have less exposure to geopolitical risks that stem from US-China and China-Taiwan relations.

Intel will have a long way to go if it wants to become the leader in manufacturing chips. I think it’s a little ambitious to say they will be a leader by 2025. TSMC has been doing this for decades and the company knows what it is doing there, that’s why almost 30% of total chip market share production is coming from TSMC.

The big reason for many semiconductor companies using TSMC or Taiwan in general for manufacturing semis is because it is much cheaper than in the US. According to TSMC founder Morris Chang, it is 50% more expensive to produce chips in the US than in Taiwan. With the CHIPs Act in the US and Europe coming out with their own Chips Act in 2022, I believe INTC has a fighting chance of being relevant in the industry with its $100B capex investments across the US and Europe. The main reason that Taiwan is such a popular destination for chip manufacturing is exactly these sorts of incentives that allow to lower the production costs of semis. With these two acts in place, Intel will be able to compete with TSMC and other Taiwanese companies, however, it is very early to tell because no production is predicted to begin until 2025 at the earliest, so I believe there is still time before we see any sort of reinvigoration in the company’s revenues.

Financials

As of Q1 ’23, INTC had around $19B in cash and equivalents against a whopping $48.8B in long-term debt. The debt has ballooned over the last decade; however, I don’t think it’s that much of an issue as long as the company manages to pay down the annual interest on that debt. Granted, the company has been experiencing some top-line growth issues, but I don’t think the company will have trouble paying the annual interest. It is worth keeping an eye out on how the company is going to perform in the next year or two because the debt might just become a bit too much if Intel’s not careful.

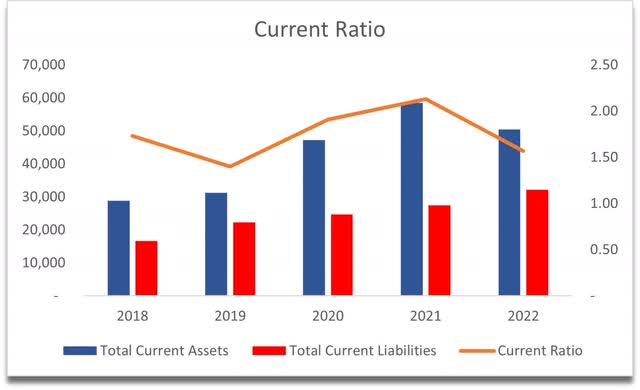

The company’s working capital ratio or the current ratio has been healthy for the last while, which means the company is not in any trouble in paying off its short-term obligations. In my opinion, the company is in no solvency or liquidity trouble right now, but the recent downtrend can become an issue if it continues.

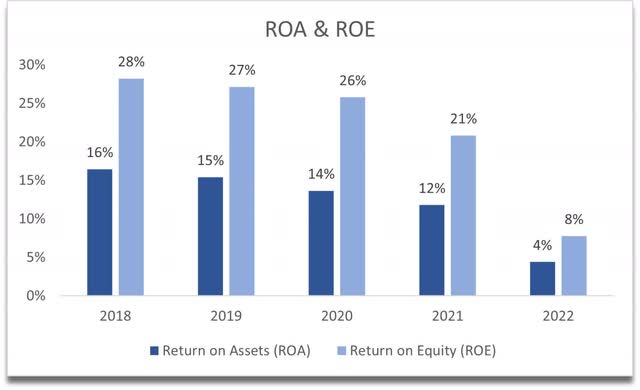

In terms of efficiency and profitability, we can see that the company dropped the ball a few years ago. As of FY22, ROA, and ROE are below my minimum thresholds of 5% for ROA and 10% for ROE. The graph below suggests to me that the management has been misusing the company’s assets and shareholder capital, and it shows that the share price has not been going in the right direction for the last 5 years, right when the trend started to turn downwards.

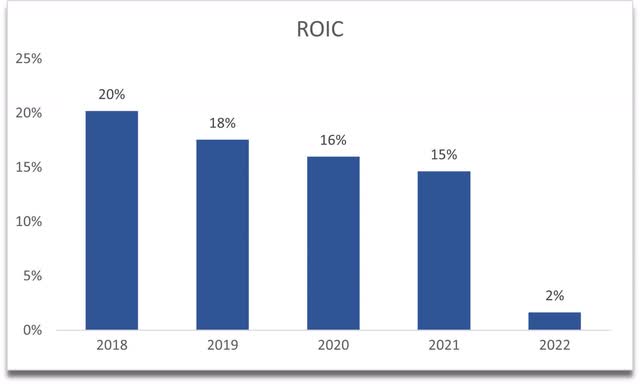

We can see the same developing in the company’s competitive advantage and its moat, which if we look at the latest figure for ROIC or return on invested capital, is non-existent right now and the management needs to change this if it wants to be the leader in the industry.

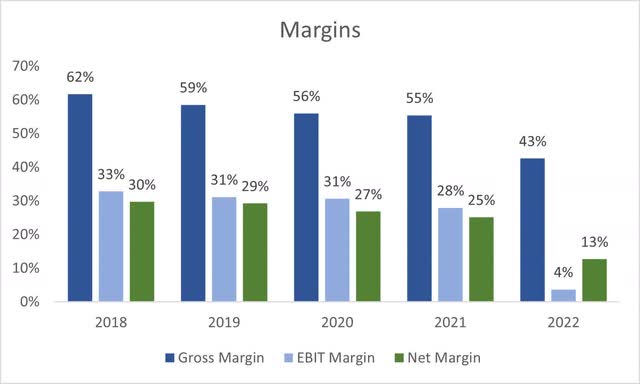

In terms of margins, we can see that the company went wrong somewhere after 2018 as it started to lose efficiency and profitability, just like the previous graphs are showing us also. The margins are well below the company’s long-term target of 60% gross margins, and I don’t see any turnaround just yet.

It looks like the current management is aiming to get back to levels the company has been at around FY18, and only time will tell if their strategy works out in the end, as so far it looks like it’s getting worse. With the investments across the US and Europe, I could see a lot more short-term pain before the company sees meaningful results.

Valuation

The analysts are predicting -18.5% revenue growth in ’23, so I went with that for my base case also. After ’23, I decided to grow revenues at around 10% per year, which over the next decade if we include the -18.5% drop in ’23, will give me around 7% CAGR until ’32. For the optimistic case, I went with 11.4% CAGR, while for the conservative case, I went with 5% CAGR.

I feel like these figures are slightly optimistic but even with such assumptions in place, it is not going to sway the results very much in the end.

In terms of margins, I decided to be on the more optimistic side also, and I modeled improvements of around 700bps or 7% on gross and operating margins over the next decade, which will bring net margins from around 6% in FY23 (projected) to around 15.5% which is quite an improvement.

With a margin of safety of 25% on top of these assumptions, the intrinsic value of Intel Corporation is $22.70, implying a -32.5% downside from the current valuation.

Closing Comments

With how the company is doing currently, the turnaround is nowhere near to be seen, and I do believe that you could have your money sitting somewhere more productive than in Intel right now. There will be people who are going to bet on the turnaround, and I don’t doubt that will come, however, I don’t think it’s going to come quickly, and everything is sunshine and rainbows going forward. The company will keep investing in the new factories for the next couple of years which means that the catalysts to propel revenue growth further are not there yet and the company may continue to underperform for the next two or three years.

If the company comes closer to the implied share price above, then I would consider looking into buying as that would be a much better risk/reward profile for me. The stock price has seen a 50% rally since February of this year, and I don’t think that is warranted right now, and I wouldn’t be surprised if the volatility in the global markets will make a lot of people take some profits or sell their position completely.

The company has a lot of work ahead if it wants to become a more profitable and efficient company that can compete with the likes of TSMC and other similar companies. As I said, only time will tell if it works out.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.