Summary:

- Bank of America stock has been pressured downward by the narrative surrounding the paper losses in its Held to Maturity portfolio.

- However, as a percentage of total assets and total deposits, these paper losses are relatively small.

- Today, the bank trades at a discount to book value that we believe is an overreaction to the downside by the market.

Brandon Bell

Recent History

The precipitous rise of interest rates in 2022 has had multiple effects throughout the market and the economy, but perhaps one of most interesting was the rippling, time-lagged effect which they wreaked on the balance sheets of banks. During a long period of near-zero interest rates, several banks, unable to find yield elsewhere, loaded up on low-interest, long duration Treasury debt. Of course, this debt was high quality–there is very little risk that the United States government or the government-backed entities which issued it would not repay it–but a pesky problem arose once interest rates began to move north and investors realized that all of those pristine Treasuries were suddenly worth a lot less on the open market than what the banks had originally paid for them.

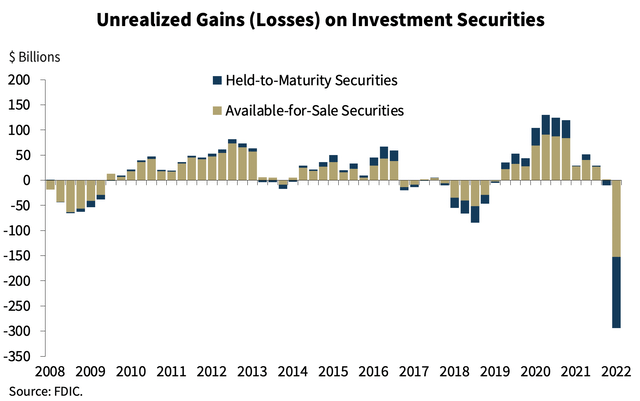

Banks, for their part, attempted to cast these paper losses in a more favorable light by counting them as ‘Held to Maturity’ (an accounting designation created after the great financial crisis) versus ‘Available for Sale.’ (The chart above from the FDIC illustrates total losses and gains throughout the entire banking sector with HTM and AFS securities.) By designating debt securities in this way banks could say that they the losses needn’t be reflected on their balance sheets since they had no intention to sell those securities, but rather intended to hold them until maturity.

As the previously obscure concept of HTM went viral among investors (and depositors), bank stocks suffered and fears of deposit flight and possible contagion within the banking sector spread. Of course, these fears are largely misplaced. A decline in price on a high-quality asset in its secondary market doesn’t mean that the holder will not receive their principal at the maturity date–it simply means that if the holder were to sell today that they would receive less than what they originally paid for the instrument. Nevertheless, fear in the wider market prevailed.

All of this played out remarkably fast–over the course of just a few weeks–and today several banks have still not yet recovered. Today we will make the case that Bank of America (NYSE:BAC) is an institution worthy of a second look by investors. Let’s dive in.

Deposit Flight & Held To Maturity Securities

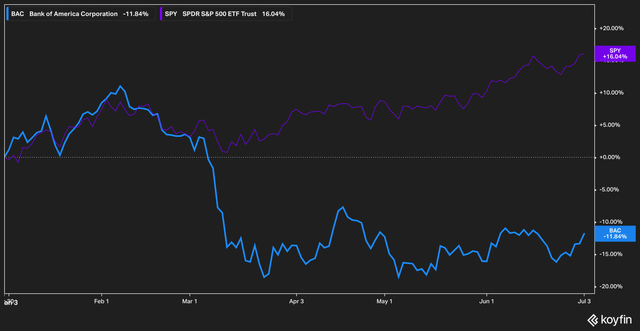

Bank of America has had a down year for the reasons outlined above. In March the stock plummeted by around 25% from its February high and has yet to recover, while the broader S&P 500 (SPY) has rallied 16% year-to-date.

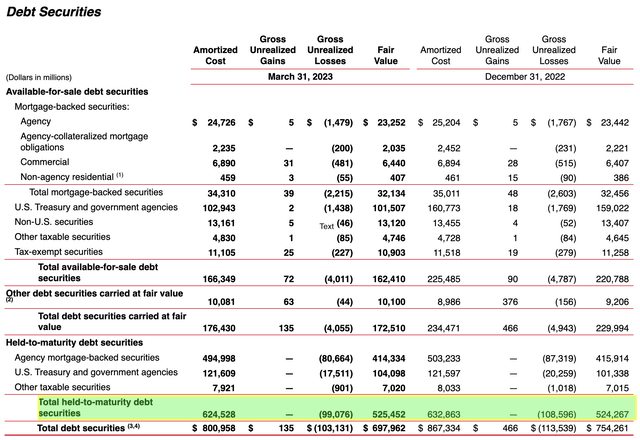

Of course, investors will argue that the bank has given them reason to worry. In Q1, after all, the bank posted that the market value of its HTM portfolio was down almost $100 billion (up a bit from the prior quarter, where unrealized losses totaled $108 billion).

Company Filings (Highlight By Author)

For a lot of investors, this figure is understandably quite concerning. $100 billion is a lot of money. Holding $624 billion of HTM, the argument goes, also limits the bank’s ability to pay out a higher interest rate to depositors, which has been a major worry among investors as depositors fleeing to higher-yielding products and away from low-yielding bank accounts has become a headline story. They also point out that a poorly managed HTM book is what brought down Silicon Valley Bank.

We believe, however, that these concerns are overblown when it comes to Bank of America, which is the second-largest bank in the United States and a designated Globally Systemic Important Bank.

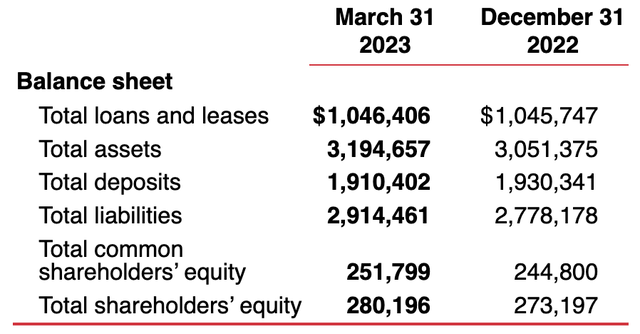

For context, let’s review the bank’s total deposits and assets, the latter of which clocked in at $3.1 trillion for Q1 2023.

In the sequential Q4 2022 to Q1 2023 quarters, total assets at the bank rose by about $144 billion to $3.1 trillion, while total deposits decreased a relatively modest $20 billion to $1.9 trillion. For context, the 2022 high water mark for deposits at Bank of America was $2.04 trillion in Q1 2022.

Placing the paper losses of the HTM portfolio into context against these numbers shows that the total HTM gross losses were roughly 3% (3%!) of the bank’s total assets, and about 5% of total deposits. These figures, in our review, hardly present a crisis for an institution of Bank of America’s size and scale.

While deposit flight can happen for a number of reasons and the outflows of cash from low-yielding bank accounts into higher-yielding money markets has tested previous assumptions about the stickiness of bank deposits, the numbers over the past year have demonstrated to us that, at least for the major banking institutions, the question of deposit flight is not nearly as serious a threat as it is to regional banking players.

Buying At A Discount

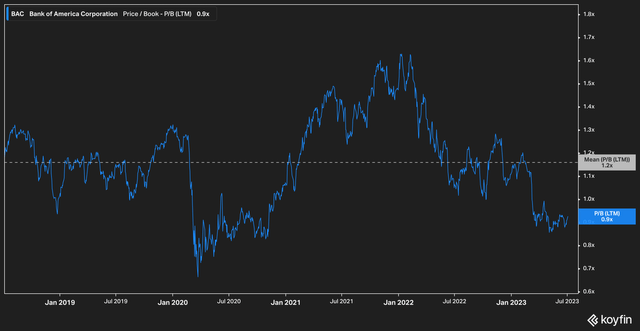

Markets, of course, can be irrational, and stories that dominate the headlines of the financial press can cause reactions far outside what is warranted. To this end, we point to Bank of America’s current price to book value, which as you might expect has taken a beating recently.

Over the past five years Bank of America shares have traded at an average of 1.2x book value, and they have only briefly dipped below 1x before returning. Today the stock trades hands at 0.9x book value, which to us represents an opportunity.

In short, a premium above book value means the market believes the holdings of a bank to be high quality. The fact that shares can be bought at a discount to book today while the larger narrative around that bank is that a problem with paper losses (which, again, amount to 3% of total assets and are paper losses on bonds which the bank fully expects to be repaid its principal) is, to us, striking and an indication that the market may have taken things too far.

Furthermore, the bank’s operations are generating large amounts of cash, and revenue trends are moving upwards, at least in near term.

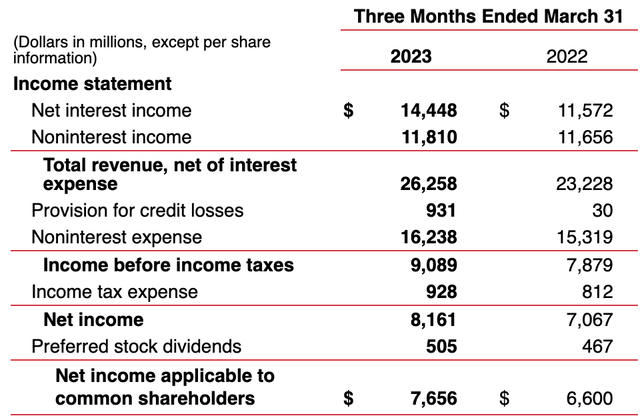

Year over year the company boosted total revenues from $23 billion in Q1 2022 to $26 billion in Q1 2023, while net income to shareholders grew from $6.6 billion to $7.6 billion in the same time frame.

This growth in bottom-line income boosted the bank’s CET1 ratio and prompted CEO Brian Moynihan to imply in the most recent conference call that share buybacks were not out of the question later in 2023.

The Bottom Line

Investors have every right to be concerned with the losses in Bank of America’s HTM portfolio, but we believe that the concerns throughout the market are out of proportion with the reality of the bank’s situation. Bank of America’s sheer size and the scale of its operations are generating large amounts of cash for shareholders, which leads us to believe that the current discount to book value of the bank’s shares presents an possible opportunity that investors may find interesting.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The information contained herein is opinion and for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. The opinion of the author may change at any time and the author is under no obligation to disclose said change. Nothing in this article should be construed as personalized or tailored investment advice. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.