Summary:

- Amazon is expected to report Q2 earnings per share of 34 cents, a significant increase from the -20 cents reported in Q2 2022. Revenue is expected to be around $131 billion, an 8% increase from the previous year.

- Predicting Amazon’s EPS is hard given its inclination to fund growth. Revenue remains the story that is likely to move the stock’s needle.

- With AWS slowing, I expect the company to highlight advertising and AI efforts.

- Amazon’s stock is showing technical strength without being overextended.

HJBC

Amazon.com, Inc. (NASDAQ:AMZN) is set to report results for its Q2 that ended June 30th, 2023 after hours on Thursday, July 27th. While it may seem a little early to preview more than three weeks out, I don’t expect most of these items in this article to change materially with earnings on tap. In addition, an early assessment may help the readers prepare their game plan early, as the earnings deluge will soon take us all by storm.

Before we get into Q2 preview, a quick recap on my most recent Amazon coverage. After Amazon’s Q1 earnings report, I wrote that the report was fairly good and the stock was likely punished due to management’s tone on the conference call than for actual results. Since then, the stock has gone up nearly 25%, outperforming the S&P 500 by a factor of 4. I believe the stock is still a buy despite this run up, as I believe Amazon is still adjusting to its pandemic excesses and will come out much stronger than before.

Now, let’s preview Q2 without any further ado.

Steadily Increasing Expectations

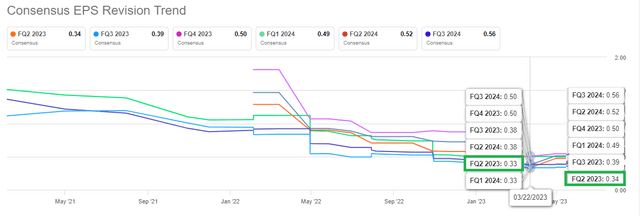

Amazon is expected to report earnings per share of 34 cents when it reports its Q2, which would represent an impressive turnaround from the -20 cents the company reported in the same quarter in 2022. Revenue is expected to come in at $131 billion, ~8% higher compared to the $121.23 billion in the same quarter in 2022.

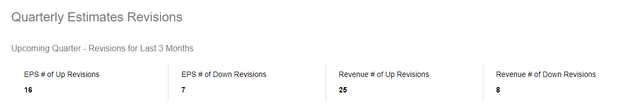

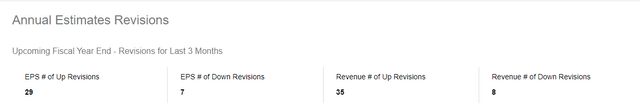

Another way to confirm increasing expectations is by looking at estimates revision over the last 3 months. Both the upcoming quarter’s estimates and the current fiscal year’s estimates have gone up. Amazon has always been a revenue story and it is not surprising that upward revisions on revenue outnumber EPS revisions (both as percentage and raw numbers), both on quarterly and annual basis.

In short, expectations are on the rise as we await Q2 results.

AMZN Qtly Revisions (Seekingalpha.com) AMZN Annual Revisions (Seekingalpha.com) EPS Trend (Seekingalpha.com)

Beat or Miss? It’s a Coin Toss

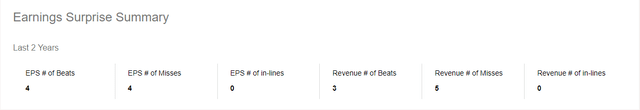

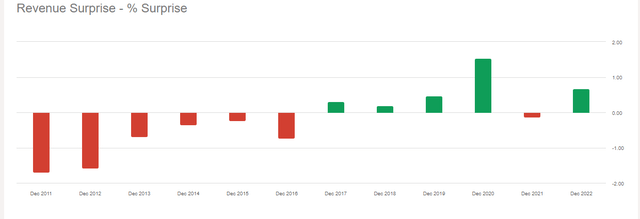

Will Amazon beat or miss? It’s a coin toss, almost literally based on recent history. EPS missed by huge margins twice while the beats were impressive as well. Revenue has always been the more consistent story with Amazon and I expect more of the same when the company reports its Q2. The market is likely to be paying more attention to revenue guidance than profit, given the company’s inclination to use proceeds from profitable segments to find the next growth avenue.

Going back a little further, in the last 8 quarters, Amazon has a 50% record on EPS beat and just a 37.50% on revenue beat. In short, it is a fool’s errand to predict what Amazon’s EPS is going to be, given their inclination to invest as they please. I expect revenue to come in between $131 billion (meeting expectations) and $132.5 billion (1.50% beat).

AMZN EPS History (Seekingalpha.com) Revenue Surprise (Seekingalpha.com)

AWS with an AI Twist and Advertising

A slowdown in Cloud computing was expected in 2023 but I don’t believe Amazon investors were prepared to see AWS becoming the industry laggard, as was the case in Q1 2023. Q2 AWS revenue and more importantly, Q3’s AWS revenue guidance will be key factors that determine the stock’s price action post-earnings. With AWS revenue rumored to cross $100 billion in 2023, a strong Q2 from AWS (say $25 billion) will go a long way in setting up the rest of the year. However, that would represent a growth of nearly 27% from the $19.7 billion that AWS recorded in Q2 2022. I don’t believe Amazon will be able to report something that impressive and project a low to mid teen growth percentage. In other words, I expect AWS revenue to come in between $22.30 billion and $23 billion.

Given the growth concerns in AWS by and of itself, Amazon already has its strategy in place for revenue generation. As CEO Andy Jassy explained, there are three layers of support to enhance revenue by providing (1) compute resources, (2) training capabilities, and (3) applications for generative AI and large language models (“LLM”). In my review of Q1 results, I noted that Amazon’s tone in the conference call did not inspire much confidence and was one of the reasons I believed the stock got hammered despite decent numbers. This time around, I won’t be surprised to see Amazon talk further about the hottest topic in town, AI, and its plans on leveraging its existing ecosystem to support AI applications.

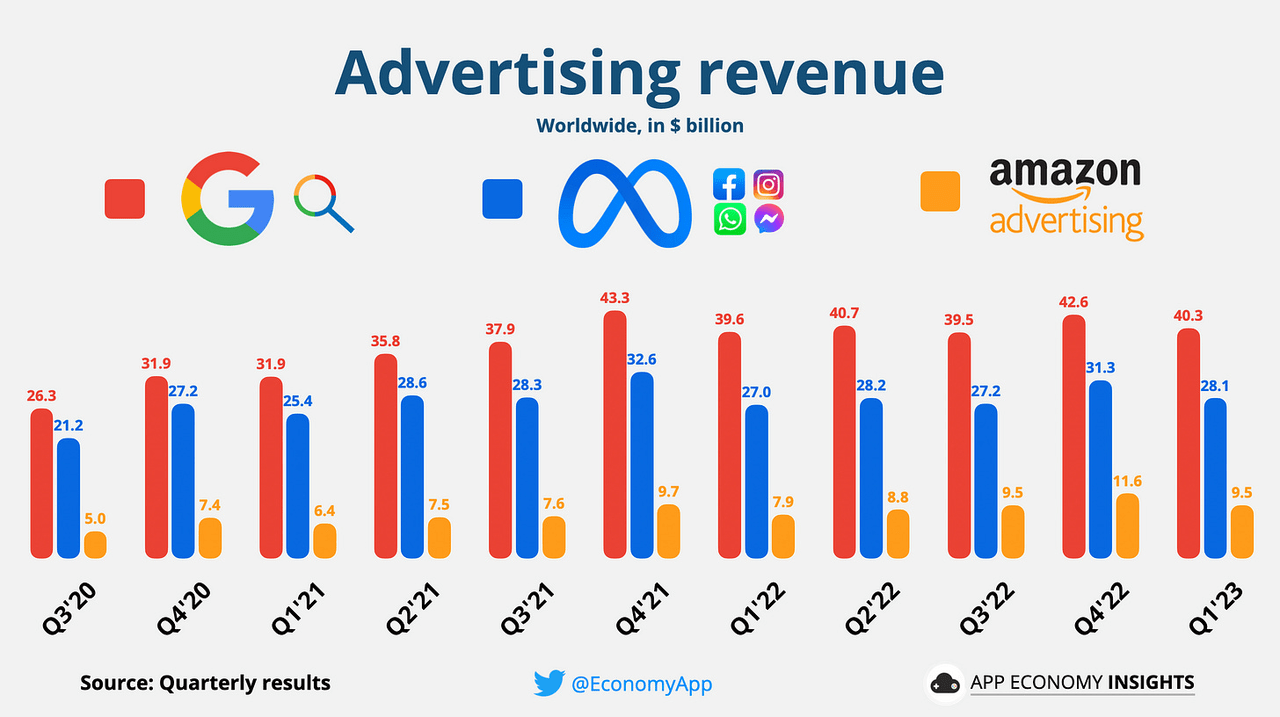

Advertising’s importance to Amazon has been steadily increasing over the last few years with the segment contributing nearly 7.50% to the overall mix in 2022 at $38 billion. To put this into context, Amazon’s advertising revenue of $9.5 billion in Q1 2023 already represents 25% of Google’s and more than a third of Meta Platforms, Inc.’s (META). Dating back to Q3 2020, the lowest growth rate this segment has shown on a YoY basis was 17% with the average being nearly 27%. This segment is growing at the right time for Amazon given the slowdown in AWS and I predict Amazon’s advertising revenue to cross $10 billion only for the second time ever (on quarterly basis) when the company reports its Q2 results.

AMZN Ad Revenue (appeconomyinsights.com)

Cheap and Pricey

I recall authors and readers alike quarrelling in the comments section on Seeking Alpha over 10 years ago as to whether Amazon’s stock was cheap or pricey. More than a decade later, this debate is still not settled, although bulls are the more happy campers. Even now, the stock is both cheap and pricey at the same time. Let’s take a look.

- At about 2.50 times 2022’s revenue, Amazon is far cheaper than other mega-caps on price-to-sales ratio. Apple, Inc. (AAPL), for example, is trading at nearly 8 times 2022’s revenue. Alphabet Inc. (GOOG) is trading at 5.40 times 2022’s revenue and so on. Obviously, the catch here is that Amazon’s low-margin retail business makes up nearly 50% of its revenue, denting its profit margin.

- Speaking of profit, Amazon is still operating with the mindset of a company in growth spurt as it funnels profits from one segment to fund the next revenue driver. As a result, Amazon’s EPS has always been and will likely be under pressure (compared to its revenue). Despite that, a forward multiple 83 is too pricey for a trillion-dollar behemoth.

- But investing is all about the future. So, Amazon’s expected earnings growth rate of 72%/yr gives it a Price-Earnings/Growth (“PEG”) of 1.15 even with the ridiculous sounding forward multiple of 83.

- Back to the pricey side, the stock is already up 50% YTD and has reached another 52-week high. How much room does it have up here even if it delivers on the increasing expectations?

- Okay, you get the gist. Amazon’s stock remains a valuation conundrum as we gear up for Q2’s results.

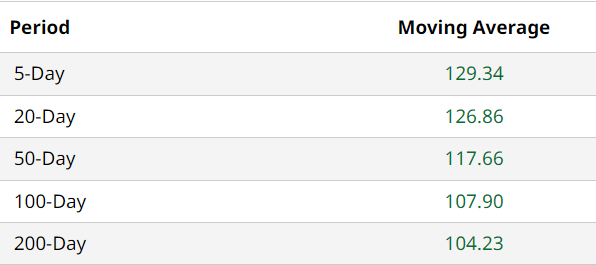

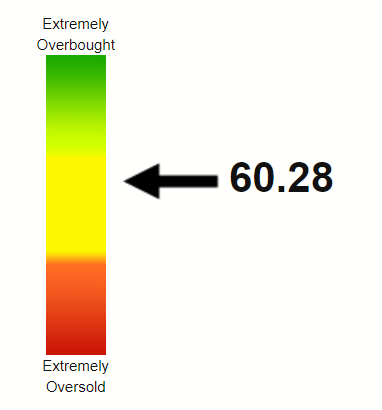

Technical Strength

Amazon’s stock is showing some solid technical strength heading into the earnings. The stock’s moving averages are progressively better as shown below, indicating growing accumulation and strength. Despite this strength, the stock’s Relative Strength Index (“RSI”) is at 60, which gives the stock plenty of room to keep ticking higher before it gets overextended technically.

AMZN Moving Avgs (Barchart.com) AMZN RSI (Stockrsi.com)

Conclusion

With inflation cooling down and the Federal Reserve showing signs of relenting as well, the market has been on a tear with growth names leading the race. Once again, as an example, Amazon’s stock is up nearly 25% since I reviewed its Q1 earnings and has outperformed the market by a factor of 4. I don’t expect Q2 to bring in such outperformance given the stock’s run up already but a strong revenue guidance, especially on AWS front is likely all that is needed from the company to give the stock another forward jolt. I will also be keen on the advertising revenue to see if its importance to the overall mix keeps increasing. My strong belief in Amazon’s strong ecosystem makes me comfortable enough to hold the stock through tough times and add on weaknesses.

What do you think of Amazon’s upcoming results? Please leave your comments below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, AMZN, GOOG, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.