Summary:

- Nike’s Q4 results show the company has not yet overcome challenges, with a revision of their long-term sales growth target likely.

- The company’s inventory remains unchanged in value compared to the previous year, with the company relying on promotions to clear excess stock, which is expected to continue in FY24.

- Despite the significant 25% revenue growth in Greater China, I remain cautious about NKE’s future growth prospects in the region due to the mounting competition.

dynasoar/iStock Unreleased via Getty Images

In my previous article, I expressed my concerns about Nike’s (NYSE:NKE) future sales growth in China. I concluded that China was no longer as promising, and a revision of their long-term growth target was likely. Recently, Nike announced its Q4 results, and it appears that they have not yet emerged from the challenges they are facing. I still believe that a revision of their long-term sales growth target is highly likely, and I encourage investors to avoid investing in this stock.

Recent Result

Nike’s group sales increased by 8% year over year on a constant currency basis. It’s important to note that Nike had a very low base in Q4 FY22, and their constant sales growth was only 3% in the same quarter last year. For FY24, Nike expects reported revenue to grow in the mid-single digits, primarily driven by NIKE Direct. They anticipate low-single-digit price increases in FY24, indicating that their volume growth is also expected to be low-single-digit.

Regarding margins, Nike anticipates gross margins to expand by 140 to 160 basis points on a reported basis, which roughly translates to around 200 basis points of operational gross margin expansion when excluding the 50 basis points of negative impact from foreign exchange headwinds.

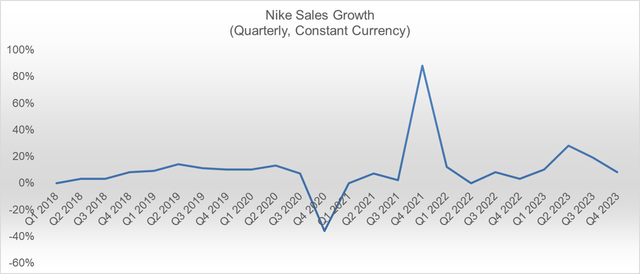

Nike’s Quarterly Results, Author’s Calculation

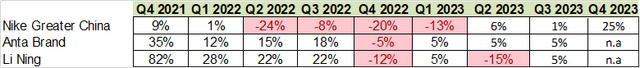

Greater China: In Greater China, Q4 revenue grew by 25% on a constant currency basis. Looking ahead, Nike expresses strong optimism regarding the prospects of NIKE and Jordan Brands, citing long-term structural tailwinds in the region. They also noted the highest level of full-price selling they have witnessed in eight quarters.

While this growth appears impressive, it is essential to consider that they are comparing it to a significantly low base in Q4 FY22. As illustrated in the table below, their constant sales growth was -20% in Q4 FY22. The leading local brands, Anta (OTCPK:ANPDY) and Li Ning (OTCPK:LNNGF), have not yet reported their recent quarterly results. As mentioned in my previous article, I believe that Nike has been consistently losing market share to these local brands in China. Therefore, Nike’s decelerating growth in Greater China can be attributed not only to the impact of COVID-19 but also to increasing competition and the boycott in China.

Nike, Anta, Li Ning Quarterly Results, Author’s Calculation

High Level of Inventories: Nike’s inventory remains unchanged in value compared to the previous year and has decreased in units when compared to 12 months ago. Specifically, apparel units have experienced a decline of over 20% compared to the prior year. The composition of in-transit inventory has returned to normal, and the number of days in inventory has shown improvement compared to both the previous quarter and the previous year.

During FY23, Nike heavily relied on promotions to clear their excess inventory, which explains the current improvements in their market inventory level. However, I believe that, in general, the marketplace still maintains a highly promotional environment. Nike acknowledges that the promotional landscape is expected to persist in FY24, putting significant pressure on their wholesale partners to manage their inventories throughout the first half of the fiscal year.

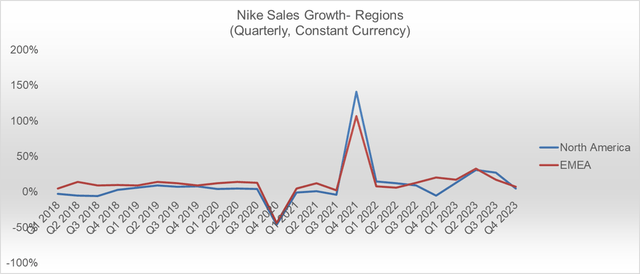

Other Regions: In North America and EMEA, Q4 revenue grew by 5% and 7% respectively, on a constant currency basis. I believe that their growth rate in these developed countries is relatively steady and expected. Nike remains committed to prioritizing the development of their Direct business, which has the potential to generate higher margins and deliver increased value to their customers.

Nike’s Quarterly Results, Author’s Calculation

Key Risks

Nike’s sales have been experiencing high-single-digit to low double-digit annual growth rates, excluding foreign exchange, since FY11. This consistent organic growth has made Nike a favorite among growth investors. During their capital market day, the company established a long-term target of high-single-digit sales growth.

In my previous article, I highlighted my primary concerns regarding Nike’s future long-term growth target. I reiterate my concerns that a revision of their long-term sales growth target is highly likely in the future due to the structural slowdown of their Greater China business.

Valuation Update

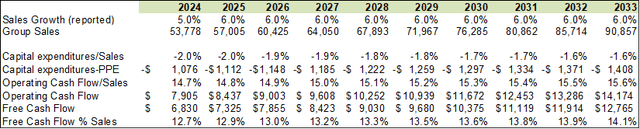

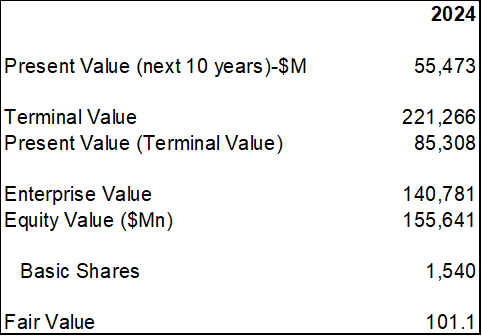

I updated the DCF model as per Nike’s recent result. In the model, I assume their Greater China business grows at high-single-digit instead, thus their group sales growth rate will be normalized at 6% in my DCF model.

In the model, the free cash flow conversion is estimated to expand approximately 10-20bps per year due to operating leverage. The FCF conversion is forecasted to reach 14.1% in FY33.

Key assumptions:10% of WACC, 4% of terminal growth rate, effective tax rate at 16%. Other financial assumptions and projections for the next ten years are:

Author’s Calculation, DCF Model

I estimate the present value of the free cash flow to the firm (FCFF) over the next 10 years to be $55 billion and the present value of terminal FCFF is $85 billion. As such, the enterprise value for Nike is $140 billion in total. Adjusting the gross debt and cash, the fair value for Nike is estimated to be $101 in the model.

Author’s Calculation, DCF Model

Conclusion

The recent quarterly results have not altered my thesis regarding Nike’s anticipated lower sales growth in the coming years. I believe it is necessary for them to adjust their long-term sales growth target due to intensified local competition, the boycott in China, and the high inventory levels in their wholesale channel. In other words, Nike is still facing challenges and has not fully overcome them yet. Consequently, the current stock price is unattractive, and I encourage investors to avoid investing in Nike.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.