Summary:

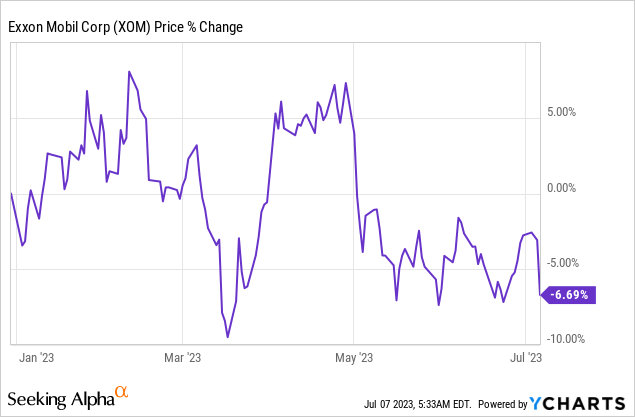

- Exxon Mobil issued a profit warning for Q2 due to falling natural gas prices, causing a 4% decline in the company’s stock price.

- The company’s average natural gas price in the U.S. fell 52% in Q1’23, and the change in prices is expected to negatively impact Q2’23 earnings by $1.8-2.2B in the production segment.

- The profit warning and declining natural gas prices indicate that Exxon Mobil and other petroleum companies are already in an earnings recession.

JHVEPhoto

In the clearest sign yet that profits in the petroleum and natural gas business are further coming under pressure and that EPS estimates are set to continue to decline, Exxon Mobil (NYSE:XOM) issued a profit warning for Q2’23 in a regulatory disclosure on Wednesday… which caused the company’s stock price to decline almost 4% yesterday. Petroleum prices are in a 1-year down-trend after the market dealt with the fall-out of the Russia-Ukraine war, and sharply declining natural gas prices are now the industry’s latest concern. With Exxon Mobil’s profit warning implying a significant quarter-over-quarter decline in earnings, I expect analysts to further lower their EPS estimates ahead of Exxon Mobil’s Q2’23 earnings report, which is estimated to be released on 7/28/2023. I expect shares of Exxon Mobil to make new lows in the near future and reiterate my sell rating!

Exxon Mobil’s profit warning for Q2

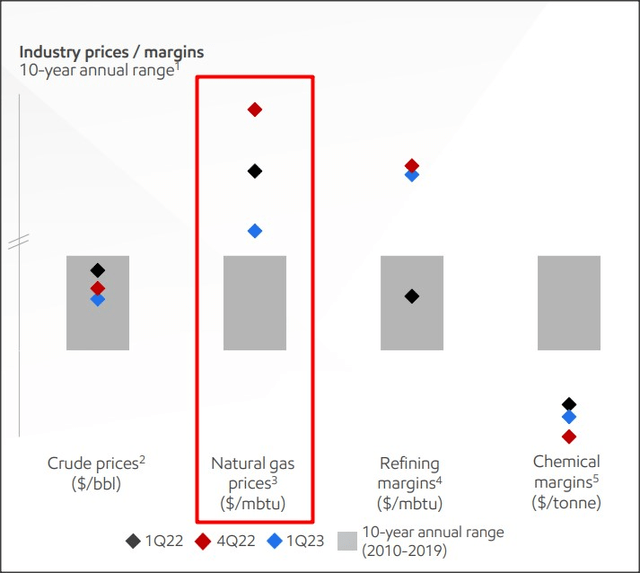

Natural gas prices in the last year have fallen way outside of the historical norm due to a number of factors including Russia’s invasion of Ukraine, attacks on the Nord Stream 1 pipeline spurring supply fears and OPEC’s output cuts to beef up prices. However, both petroleum and natural gas prices are normalizing, which is set to take a big chunk out of Exxon Mobil’s earnings going forward.

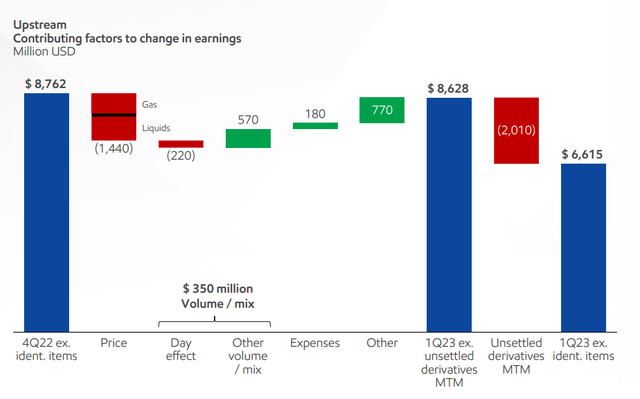

Source: ExxonMobil

Exxon Mobil’s average natural gas price in the U.S. already declined 52% quarter over quarter in Q1’23 to just $3.20/kcf and more earnings pressure is building.

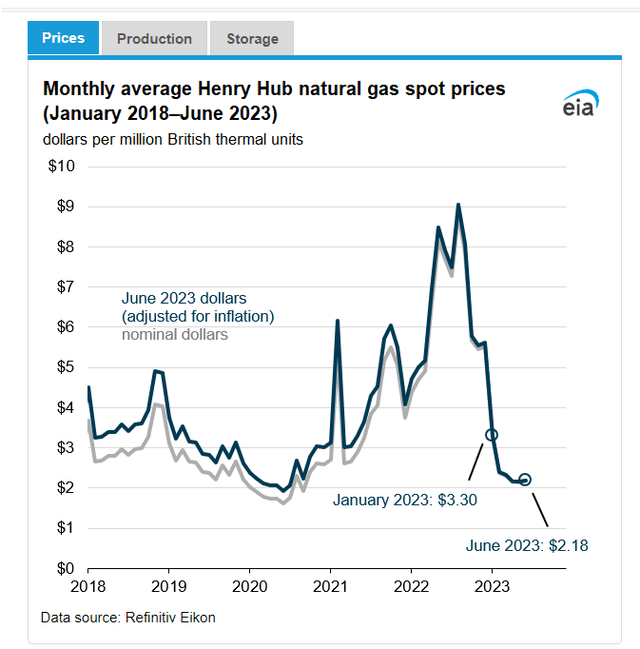

U.S. natural gas futures currently indicate a price of about $2.68/MMBtu, meaning Exxon Mobil’s average natural gas prices declined significantly from the company’s average price in the first-quarter. In the third-quarter of FY 2022, natural gas prices were above $8/kcf (and Exxon Mobil averaged $8.38/kcf). The weakening of the natural gas pricing environment relates to stronger production and increasing natural gas storage levels due to warmer weather, according to the U.S. Energy Information Administration (Source).

Source: IEA

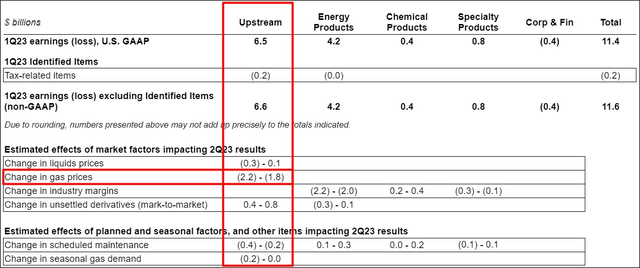

For Exxon Mobil, this trend in natural gas prices foreshadows drastically lower second-quarter earnings. In a regulatory disclosure, dated July 5, 2023, Exxon Mobil said that the change in natural gas prices is set to negatively impact the company’s Q2’23 earnings by $1.8-2.2B in the production segment.

The production segment reported $6.6B in earnings in Q1’23 and with the projections contained in the regulatory disclosure, Exxon Mobil is likely to see a 27-33% decline in its production earnings in the upcoming second-quarter alone. The decline in natural gas prices as well as Exxon Mobil’s explicit profit warning confirm my earlier view that the party is likely over for Exxon Mobil and the earnings release for Q2’23 could be a catalyst that drives XOM into a new down-leg.

Source: SEC Regulatory Disclore

Weaker petroleum and natural gas prices already were the largest negative factors in Exxon Mobil’s first-quarter earnings card. In total, I expect a total decline in Exxon Mobil’s second-quarter earnings of 30-40%, quarter over quarter, due to weaker average prices for petroleum and natural gas as well as lower margins in the energy and chemical products segments.

Source: ExxonMobil

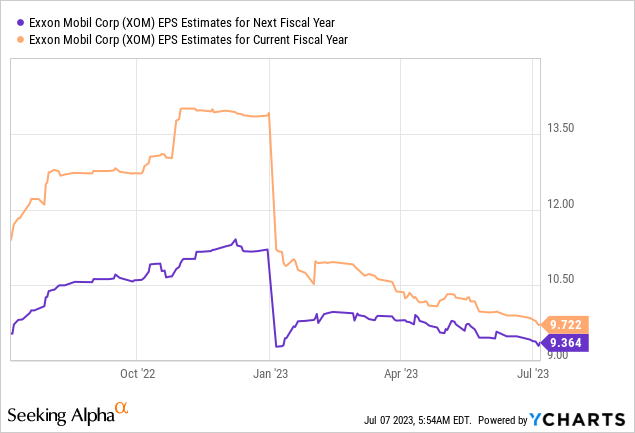

Exxon Mobil’s valuation and EPS risks

The profit warning had a negative impact on Exxon Mobil’s share price yesterday, which declined 4% on Thursday. I believe that analysts are going to reset their EPS estimates sharply to the downside in the next few weeks leading up to the Q2 report, and shares of Exxon Mobil could become much more expensive as a result. With earnings expected to decline sharply in Q2 and EPS estimates already dropping consistently throughout the first six months of FY 2023, I believe the risk profile remains highly unattractive.

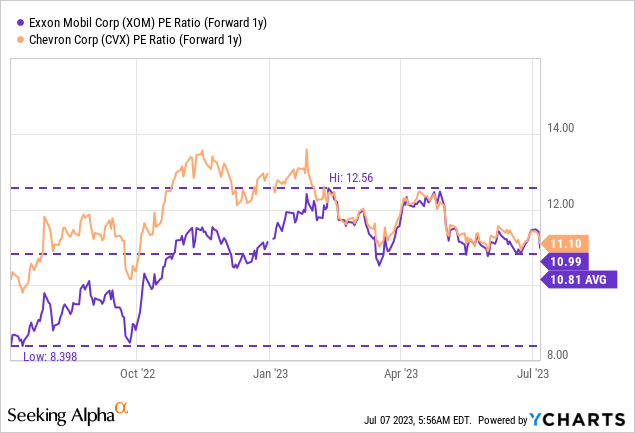

Exxon Mobil currently has the same price-to-earnings ratio as Chevron (CVX), about 11.0X, but I expect both ratios to rise as EPS projections appear to be set to decline. Exxon Mobil suffers like all other energy companies from falling commodity prices, and the expectation of a material Q2 earnings decline is set to weigh on the company’s valuation as well. With earnings predictions falling, Exxon Mobil could see a sharply higher P/E ratio as a result.

Risks with Exxon Mobil

The biggest risk for Exxon Mobil obviously is a decline in average prices for petroleum and natural gas products, which have already fallen significantly. Exxon Mobil, therefore, may see much lower capital efficiency and lower profit margins going forward. However, the labor market received some good news yesterday as private employers generated close to half a million new jobs, more than twice the estimate. If the labor market continues to out-perform, the U.S. economy may avoid a recession, which could help stabilize commodity prices.

Closing thoughts

Exxon Mobil is headed for a very weak Q2 earnings release at the end of the month. The profit warning is driven chiefly by lower natural gas prices, and it is only the latest indication that cyclical energy companies like Exxon Mobil are already in an earnings recession which could get worse in the second half of the year if petroleum and natural gas prices continue to decline and global growth prospects weaken. With EPS estimates now set to be revised to the downside even further, Exxon Mobil’s shares remain a sell!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.