Summary:

- Despite the OPEC+ cuts, the uncertain macroeconomic outlook continues to compress Brent spot prices, with CVX still trading at a premium.

- While the stock’s support around the $70s Brent level may be a new normal due to the balance sheet improvement, it remains to be seen how long the optimism may last.

- For now, CVX continues to project a more than doubled FCF generation to approximately $22B by 2027, despite the increased capex at the same time.

- This cadence may boost shareholder returns, with $75B already pledged to share repurchases.

- However, with the stock trading at an elevated Enterprise Value to Proven Reserve ratio of 27.29x, compared to 2019 average of 21.87x, anyone who adds here may experience portfolio volatility indeed.

mgkaya

The New Normal In The Oil/ Gas Investment Thesis

We previously covered Chevron (NYSE:CVX) in April 2023. Despite the OPEC+ cuts thus far, the uncertain macroeconomic outlook continues to compress the Brent spot prices, running against the market analysts’ expectation of a new normal in Brent prices at around the mid $80s through 2026.

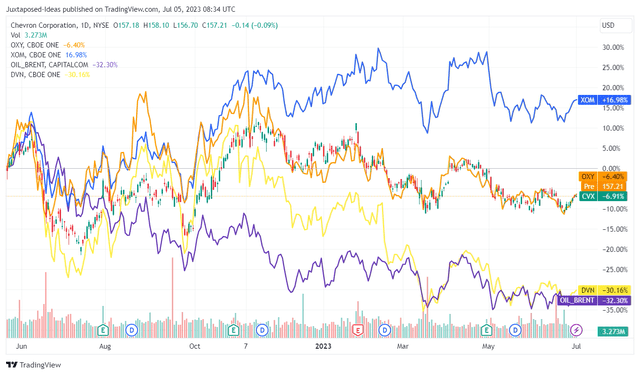

CVX 1Y Stock Price In % Relevance To Brent Spot Prices

Since the collapse from peak oil/gas prices, the Brent price has already retraced from its peak of $119.02 in mid-2022 to $75 at the time of writing, suggesting a widening gap to the premiums witnessed in many oil/gas stocks, such as Exxon Mobil (NYSE:XOM), Occidental Petroleum Corporation (NYSE:OXY), and CVX.

Interestingly, Devon Energy (NYSE:DVN) has been excluded from this party, with its stock prices better correlating with the moderating Brent spot prices. This divorce has been interesting to observe indeed, since it means that CVX may be trading with notable baked-in premiums, compared to a more normalized pre-pandemic cadence.

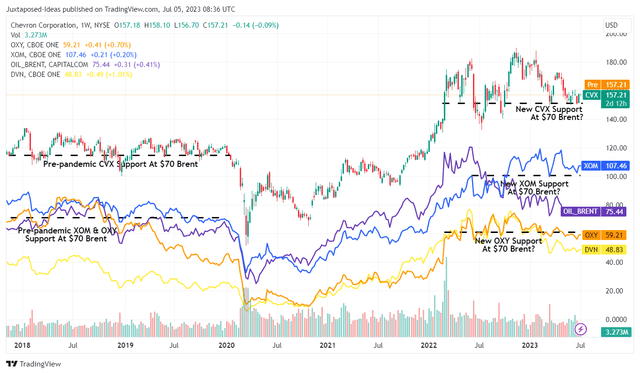

CVX 5Y Stock Price

Then again, one may also argue that CVX’s current stock price may suggest a new normal in regards to Brent prices, with support at the $70s price level, due to the massive improvement in its balance sheet thus far. For example, thanks to the hyper-pandemic windfall, the producer has been able to deleverage from its peak long-term debts of $42.32B in FQ4’20 to $20.27B by the latest quarter.

This is on top of the expansion in its cash/ short-term investments from $5.62B to $15.79B, while growing its total current assets from $28.32B to $48.35B at the same time, thanks to its acquisitions, including Renewable Energy Group for $3.15B. This is on top of PDC Energy for $6.3B, to be completed by the end of 2023.

The CVX management has also returned much value to its long-term shareholders, with $15.92B of shares repurchased and $33.65B of dividends paid over the past three years, with no dividends cut during the worst of the pandemic, something that was observed with OXY from Q2’20 to Q4’21.

As a result of the promising developments, we suppose the premium embedded in its stock prices is somehow understandable, though it remains to be seen if the optimism may last through the potential recession in H2’23 and the Fed’s uncertain pivot. Only time may tell.

So, Is CVX Stock A Buy, Sell, or Hold?

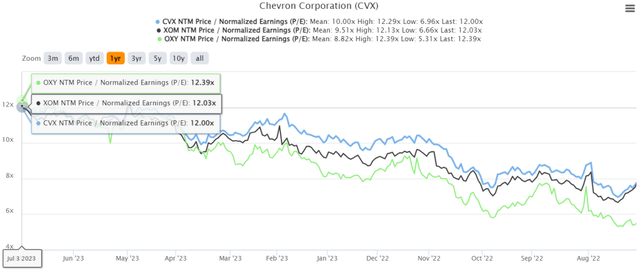

CVX 1Y P/E Valuations

For now, CVX’s valuation continues to climb to a NTM Market Cap/ FCF of 12x, compared to its 1Y mean of 10x and 3Y mean of 6.33x, a trend that we similarly observe in other oil/gas producers. Then again, these numbers still pale in comparison to the former’s 2019 mean of 16.1x and 3Y pre-pandemic mean of 18.77x.

Interestingly, this may be attributed to the slower expansion in the former’s FCF generation at a normalized CAGR of +10.1%, between 2019 levels of $13.2B and market analysts’ FY2025 projection of $23.47B. This is compared to the pre-pandemic CAGR of +36.2%, between 2017 levels of $7.11B and 2019 levels of $13.2B.

Then again, investors may take comfort in the absolute expansion in CVX’s projected FCF, thanks to the improved Brent spot prices of $75 at the time of writing, compared to the 2019 averages of $63. This is on top of the expanded 2027 output of 4M barrels of oil equivalent daily [BOED], compared to 2019 net oil/ gas production of 3.05M BOED (+4.3% YoY).

Therefore, it is unsurprising that the producer has already guided for a more than doubled FCF generation to approximately $22B by 2027, based on $60 Brent prices, $4.50 Henry Hub, and $13.50 international LNG, potentially contributing to the improvement in its balance sheet and shareholder returns moving forward.

These numbers are impressive indeed, despite CVX’s committed capex of up to $15B annually through 2027, compared to pre-pandemic averages of $13.7B. This is on top of the potential widened gap to the producer’s Brent break-even rate of $50, assuming that the OPEC+ production cuts support the spot prices as intended.

Then again, despite the potential new normal in spot prices, CVX continues to trade at an elevated Enterprise Value to Proven Reserve ratio of 27.29x at the time of writing, based on its EV of $306.24B and its 2022 proven reserves of 11.22M barrels of oil equivalent [BOE]. This is compared to the 2019 valuation of 21.87x, based on the average EV of $250B and 2019 proven reserves of 11.43M BOE.

The former’s premium is also visible, compared to XOM’s current valuations of 25.41x, based on EV of $450.91B and the 2022 proven reserves of 17.74M BOE, and OXY at 21.55x based on EV of $82.14B and the 2022 proven reserves of 3.81M BOE. Given the relatively attractive valuation of OXY, we find it unsurprising that Warren Buffett’s Berkshire Hathaway (BRK.A)(BRK.B) has recently raised its OXY ownership stake to more than 25%.

However, investors must also be aware that this metric ignores CVX’s downstream segment (comprising chemical and renewables strategies), comprising an annualized earnings of $7.2B (+443.8% YoY) or the equivalent of 25.8% (+21.3 points YoY) of its annualized total earnings of $27.84B in the latest quarter (-4.1% YoY).

Nonetheless, despite the -16.3% discount from the previous November 2022 peak, there is still minimal upside potential from current levels to our price target of $169.32, based on the stock’s NTM P/E valuations of 12x and the market analysts’ FY2025 EPS projection of $14.11.

Therefore, while CVX’s execution remains excellent, we continue to rate the stock as a Hold here, due to the minimal margin of safety and exposure to the highly cyclical oil/gas industry. These inflated levels also trigger lower forward dividend yields of 3.84%, compared to its 4Y average of 4.52%, an ailment similarly impacting XOM at 3.39%/ 5.54%, respectively.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.