Summary:

- Not surprisingly, Amazon has significantly underperformed the broader equity market, in spite of the recent rally.

- The narrative for generative AI is strong, but the share price is currently driven by other factors.

- Margin improvements are being priced-in, which significantly limits any potential upside, without monetary conditions becoming supportive.

stockcam

About 15 months ago I warned of some major risks associated with Amazon’s (NASDAQ:AMZN) share price and why the company was in a position to underperform the market.

Fast forward to today and AMZN is now 13% lower, even though the company has experienced a major rebound in recent months on the back of the generative AI hype that has grappled the big tech names.

Expectations about a rosy future for profits, driven by new AI-driven opportunities, have resulted in spectacular returns for most of the retail investors’ favorite stocks, such as Nvidia (NVDA), Tesla (TSLA), Meta (META), AMD (AMD) and Microsoft (MSFT).

All these names appreciated by double-digit rates in the past 3-month period and thus lifted the S&P 500 into positive territory.

During the same timeframe, growth stocks as measured by Vanguard Growth Index Fund ETF Shares (VUG) have also significantly outperformed their value peers (see below).

Although Amazon makes roughly 5% of VUG, it appears that high growth tech names are once again in the spotlight as far as short-term performance and momentum is concerned.

But when it comes to growth outperforming value by such a wide margin in such a short period of time, we have already been there.

During the pandemic lockdowns, VUG was outperforming VTV due to all the tailwinds for technology names and the struggles of the real economy. The exceptional amount of liquidity and loosening of monetary conditions was yet another factor that helped high growth names outperform their value peers.

As we see in the graph above, the last time we had such a violent bull market in growth stocks ended in tears in 2022 and although there is a solid narrative this time around, the expectation of a shift in monetary tightening appears to be fuelling this rally.

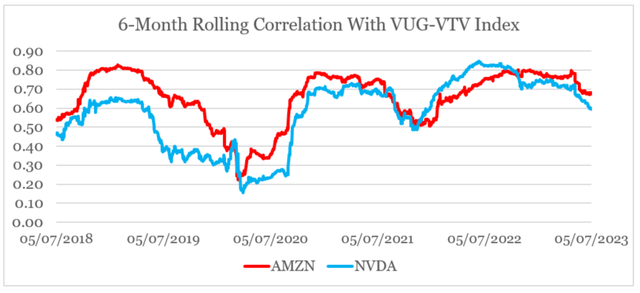

This is also the reason why since 2020, the 6-month rolling correlation of Amazon and Nvidia with the VUG less VTV index (an index that takes daily returns of VUG and subtracts the daily returns of VTV) has been remarkably similar and very high at the same time.

prepared by the author, using data from Seeking Alpha

What this clearly illustrates is that Amazon’s recent returns are largely due to monetary conditions and the hype around generative AI is still just a narrative that is supposed to explain recent movements in the share price.

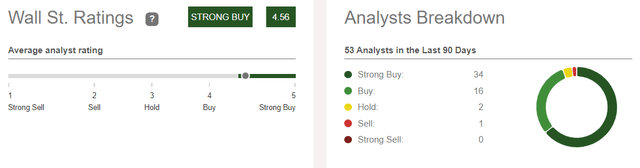

In the meantime, the expectations for Amazon to deliver are so high that both ‘Sell’ and ‘Hold’ ratings by sell-side analysts are almost non-existent and more than half of the ratings fall within the category of a ‘Strong Buy’.

Taking A Look At Business Fundamentals

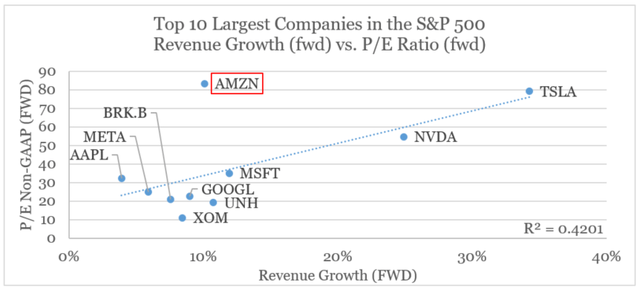

If we compare the 10 largest constituents of the S&P 500 by their forward revenue growth rates and Non-GAAP P/E ratios, we could see that there is a relatively strong relationship there. The R-Squared of 0.42 would have been far higher if it wasn’t for Amazon, which stands out as the outlier in the graph below.

prepared by the author, using data from Seeking Alpha

What that means is that either the market is already pricing in a major improvement in Amazon’s earnings which would cause the P/E ratio to cool-off (don’t forget that we are already looking at forward P/E ratios in the graph above). The other scenario would be for AMZN’s topline growth to once again accelerate to 30% and above which at this moment is mostly wishful thinking.

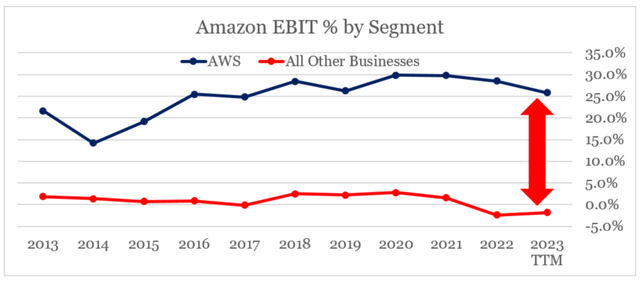

It appears that some of the headwinds impacting the e-commerce business are now dissipating, but at the same time the highly profitable AWS segment is experiencing a sharp decline in profitability.

prepared by the author, using data from SEC Filings

As customers evaluate every possible way to save money, competition in the cloud is also intensifying and at the same time Amazon has made the decision to lay-off a large number of AWS employees.

This operating income was negatively impacted by an estimated employee severance charge of approximately $470 million in Q1, including $270 million related to AWS. As we finalized our annual planning process and considered the ongoing economic environment, we made the difficult decision to eliminate 9,000 roles, impacting our AWS business as well as Twitch, devices, advertising and our human resources teams. (…)

In AWS, what we’re seeing is enterprises continuing to be cautious in their spending in this uncertain time. Customers are looking for ways to save money however they can right now.

Source: Amazon Q1 2023 Earnings Transcript

To say the least, this is concerning. However, so far the market appears to be expecting that AWS would not experience a major downturn in margins and Amazon’s other businesses would be able to lift profits in the coming years – something that appears to be largely priced-in to the stock price at this point in time.

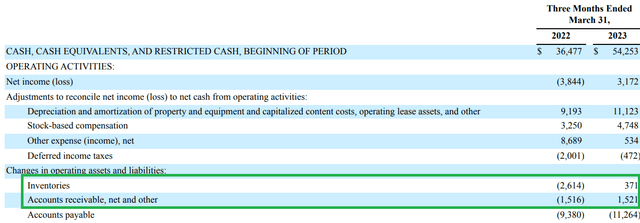

In terms of cash flow, the recent headwinds related to inventories and other working capital items are now largely resolved and should provide a tailwind through the rest of the year.

As labor availability has stabilized and inventory supply chain challenges have moderated, we’re able to implement some significant structural changes to transition our U.S. fulfillment network to a regionalized model. We believe these improvements put us in a good position to improve both delivery speed and our cost to serve customers over time.

Source: Amazon Q1 2023 Earnings Transcript

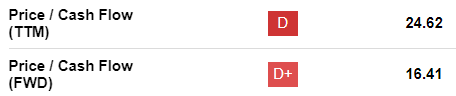

In combination with improving profitability, this should result in a strong year for the company’s cash flow from operations, which is still well-below its 2020 highs. These developments are now expected to significantly reduce the company’s price to cash flow ratio, which currently stands at 24.6.

Seeking Alpha

This is definitely good news, especially when considering the company’s price to cash flow multiple is now at one of its lowest levels for the past 5-year period.

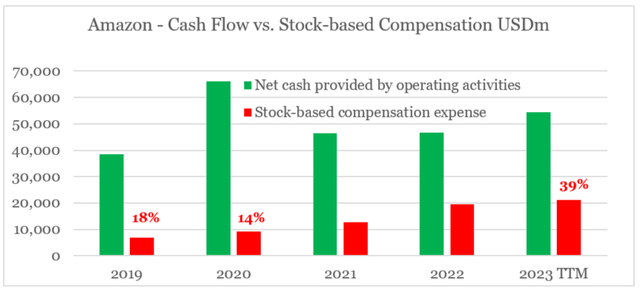

Unfortunately, however, the amount of stock-based compensation has increased dramatically in recent years and from only 14% of the company’s cash flow from operations in 2020 to nearly 40% during the past 12-month period.

prepared by the author, using data from SEC Filings

What that means is that shareholder dilution will likely continue for the time being and could also result in difficulties when it comes to keeping fixed costs under control or retaining talent in the future.

Conclusion

Just as retail investors are now piling into Amazon and sell-side analysts are as optimistic as they can be, the risk for the share price is extremely high. Most importantly, the stock remains heavily exposed to changes in monetary conditions, while at the same time margin improvements appear to be already priced-in.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

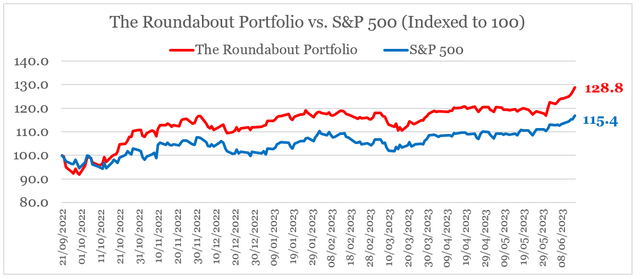

Looking for better positioned high quality businesses in the cloud and consumer discretionary space?

You can gain access to my highest conviction ideas in these sectors by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.