Summary:

- Meta Platforms’ new app, Threads, has quickly gained traction as an alternative to Twitter, amassing over 30 million users within days of its launch.

- Despite Threads’ initial success, concerns about its lack of monetization strategies and functionality compared to other platforms have led to a negative market reaction, with Meta’s stock closing almost 1% lower.

- Meta’s stock has seen a significant rally this year, but investors should exercise caution due to the stock’s elevated valuation, which may lead to near-term pullbacks.

Urupong

Investment Thesis

Meta Platforms (NASDAQ:META) has skyrocketed an impressive 134% YTD rally and significantly expanded its valuation within 6 months, largely due to its strategic roadmap for AI transformation that will likely reaccelerate its top-line growth. In the past quarters, we notice that META placed heavy focus on its AI investments given the transformational opportunities ahead, from Metaverse concept to Oculus Quest series. Moreover, the CEO Mark Zuckerberg’s emphasis on efficiency in FY2023 further supports its margin expansion, which I believe the market has already priced in these near term tailwinds.

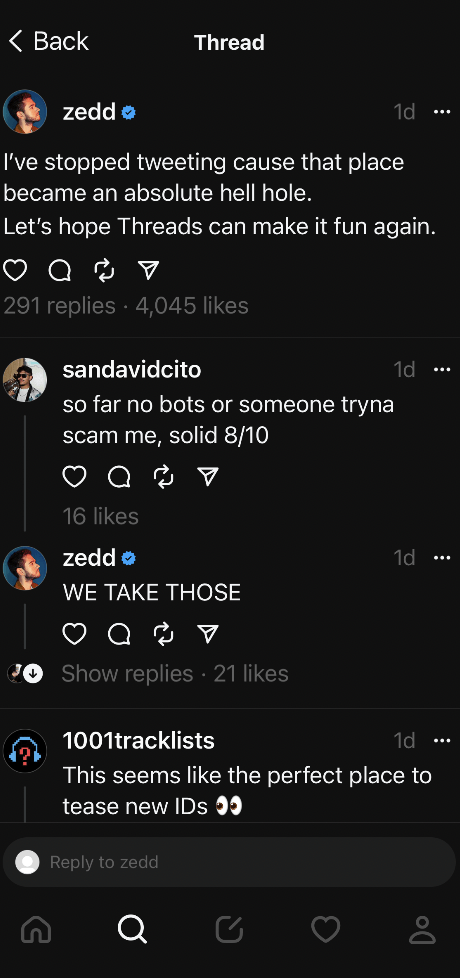

This week, META launched Threads, a new app that shares some similarities with Twitter. Remarkably, within just one day, Threads totally went viral and attracted 30 million users. This rapid adoption highlights the strong demand for an alternative platform that can captivate users, as they are getting tired of Twitter, in my opinion, and want something new to grab their attentions. However, we don’t want to see another Clubhouse fallout. As investors, we should not only consider Threads’ functionalities but also monetization strategies.

While I maintain a bullish outlook on META in the long term considering the substantial upward earnings revisions, given the significant expansion in stock valuation, caution is warranted for near-term pullbacks. This article will discuss some key takeaways from Threads and Meta’s fundamental aspects.

What is Threads

Threads Screenshot

This week, Mark announced Threads, which is developed by the Instagram team. Here are some positive takeaways: I think META’s goal with Threads is to build a social network ecosystem where all of their apps can work together seamlessly. This allows the company to grow its user base efficiently and stay at the forefront of the social media industry.

Threads Screenshot

Moreover, the timing of this announcement has the potential to create a viral trend and capture people’s attention. As we all know that, Twitter’s reputation has faced challenges, particularly since Elon Musk’s mention of privatizing the company. This has led to a deterioration of trust and confidence on Twitter among many users. Given the current backdrop, the introduction of Threads as an alternative platform indeed presents an opportunity to attract users who are looking for a new and refreshing social media experience.

In addition, this comes as the company’s family apps have shown slower growth in recent years, resulting in a 1% YoY decline in advertising revenue in FY2022. Launching a new app like Threads is seen as a strategic move to boost growth. So what exactly is Threads?

Threads is META’s first app that works with open social networking. It can be downloaded on iOS and Android devices in over 100 countries. Threads builds on Instagram’s existing features and allows users to share text-based content. Once you log in to Threads using your Instagram credentials, you have the opportunity to send a notice to all your Instagram followers. Your Instagram page will also display a link to your Threads profile. Additionally, you can personalize your profile on Threads, making it unique to your preferences.

According to Meta Newsroom, you can create posts on Threads with up to 500 characters, including links, photos, and videos. Moreover, Meta plans to make Threads compatible with ActivityPub, enabling connections with other apps. The development team is also collecting user feedback and strives to make continuous improvements to the app.

Is It a Threat to Twitter

I think the current version of Threads is unlikely to pose a significant threat to Twitter, as users can actively use both apps instead of completely switching from Twitter to Threads. There are some major limitations that affect Threads’ functionality. For instance, unlike Twitter, Threads lacks the ability to send direct messages to friends, which is an important feature in social media platforms. Additionally, you can’t “#” your posts, which makes it difficult to find content on specific topics. Threads also lacks a search feature to look for specific texts, similar to what you can do on Instagram. Furthermore, Threads can only be accessed through the mobile app, and not through a website, which may bother some users like me who prefer using desktop. Therefore, these limitations make it unlikely for users to switch from Twitter to Threads entirely.

My biggest question for Mark Zuckerberg is how to make money from Threads. META hasn’t revealed how they plan to include and scale up advertisements in the app. While users generally prefer fewer ads in their apps, advertising revenue is crucial for META’s overall revenue growth. In 1Q FY2023, 98% of their total revenue came from advertising.

If Threads doesn’t have ads, it could still boost user engagement and attract new users by connecting them with different apps. However, without a clear plan for monetization, I believe this new announcement won’t be a catalyst to push the stock higher. The initial market reaction to the Threads announcement was negative, as the stock closed almost 1% lower.

What Have Been Priced In

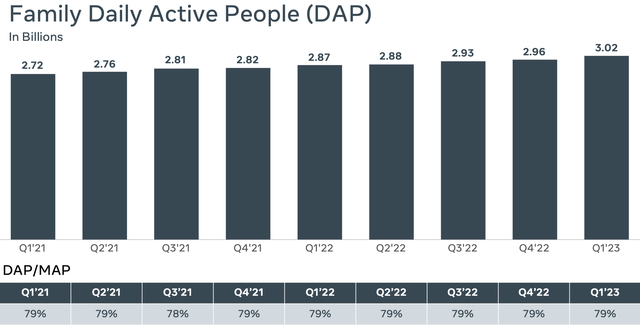

Given the significant rally of the stock this year, it’s likely that many short-term expectations and market excitement have already been priced in. In the 1Q FY2023, META achieved a milestone with a daily active user base of 3.02 billion, showing improvement compared to the previous quarter. However, we should understand that an increase in user numbers does not guarantee overall revenue growth for the company. The key lies in improving monetization and effectively generating revenue from the user base.

Therefore, it would be beneficial for the management to provide more insights and discuss Threads’ monetization plans in the next earnings call. This would allow investors to gain a clear picture of how META plans to leverage the app’s potential for revenue generation.

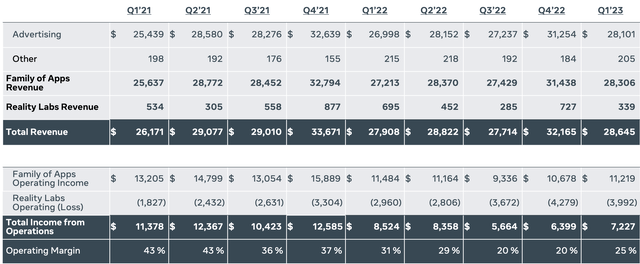

According to the table from the company’s presentation, META’s total revenue grew 3% YoY in 1Q FY2023, beating the market expectations. However, the growth rate was lower than the 7% achieved in the same quarter of FY2022. Taking into account the impact of currency fluctuations, the growth rate was still 4% lower compared to the previous year. We should also keep in mind that META experienced 1% revenue decline in FY2022. This decline can be attributed to increased competition and a cyclical slowdown in the advertising industry.

Investors were very disappointed with META’s margin contractions in recent quarters. The operating margin dropped from 43% in 1Q FY2021 to 20% in 4Q FY2022, showing a sharp decline in operational efficiency. However, there is a positive sign as the margin improved to 25% in 1Q FY2023, marking the first rebound in two years. This aligns with what Mark had previously mentioned about focusing on efficiency in FY2023. Investors have been hopeful for a recovery in revenue growth and margins in the near term, which has led to an impressive 134% YTD rally in just 6 months.

Valuation

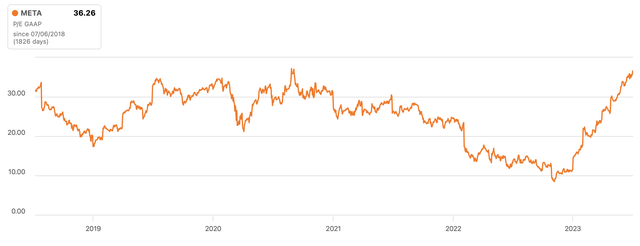

META’s P/E GAAP TTM has expanded significantly over the past 7 months, going from a low of 10x in November last year to the current multiple of 36x. This marks a new high in the past five years. However, when we consider the P/E GAAP Fwd, which looks at the forward earnings consensus, the stock is currently trading at 25x. This suggests that the stock is still relatively expensive, even though there is an anticipated rebound in EPS growth for FY2023.

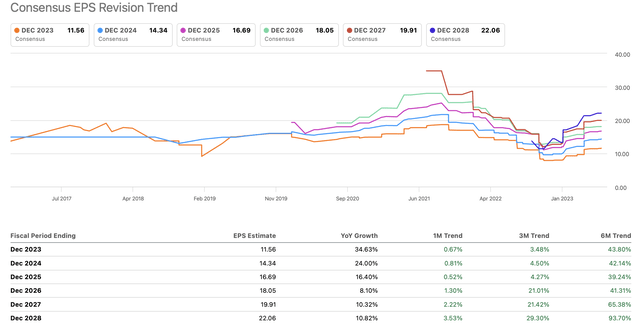

It’s not surprising to see a significant improvement in earnings consensus for FY2023 based on 6M Trend. In theory, if the trend has improved by 44%, as indicated on the table, we might expect the stock to trade around 44% higher without an expansion in its valuation. However, as the company’s fundamentals start to improve, it’s reasonable to see the valuation trending higher. Nevertheless, investors should be cautious on any stock that has experienced a strong rally in the short-term, as excessive expansion in valuation can potentially lead to potential pullbacks.

Conclusion

In sum, if Threads can successfully monetize users by scaling up advertisements, it may present an additional growth opportunity for META. Its strong initial adoption and demand for an alternative platform indicate a positive reaction from users. However, we should also consider the potential impact on the user base when Threads implements advertisements. In addition, Threads is still in the development stage, investors should consider its functionalities, as the app is less functional compared to Twitter and other social media platforms. The success of Threads in boosting customer engagement and attracting new users will heavily depend on its ability to generate revenue and monetize its user base effectively.

On the other hand, META has seen a remarkable rally in its stock price, driven by factors such as improved earnings consensus and significant investments in AI. The company’s focus on efficiency and the anticipated rebound in EPS growth for FY2023 have contributed to investor optimism. However, it’s important to exercise caution due to the stock’s elevated valuation, which may lead to near-term pullbacks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.