Summary:

- The Walt Disney Company ESPN streaming idea is a very good one.

- This idea may spread to other linear divisions or businesses.

- Management will not just “sit and take it” when a business is declining. Instead, expect management to find a way to change to take advantage of the future.

- Cash flow has made darn good progress compared to the previous fiscal year. More progress appears to be in store.

- Streaming showed financial improvement, even if the market had an unfavorable reaction to that improvement.

Drew Angerer

The Walt Disney Company (NYSE:DIS) announced that ESPN would consider the streaming route for the future. This actually makes a lot of sense, as streaming appears to be the way that “everything” is going to head. So, ESPN may as well join the crowd. I have never understood the logic behind the idea that management would just “sit there and take it” and watch the audience go away. The same idea goes for linear television. If streaming is going to be the route to deliver content, then the current competition can expect a lot of companies to join an already diverse crowd. Streaming is going to get very crowded. Therefore, the survivors will need an edge. Disney likely has that edge to survive and thrive.

I honestly think that cable will likely do just fine with streaming, as many customers still want what cable offers. They just want it a different way. Now time will tell if all that will come true. But it appears that Disney has begun to get things rolling in that direction. In fact, Disney is likely to get things rolling in every possible direction (and then will pick and choose the survivors).

Traditional television stations are also likely to head towards streaming. Now, whether they stay with a package along the lines of cable or decide to “go it alone” remains to be seen. But there really is no logical reason to assume that part of the industry will disappear when a transition to streaming is available.

But if this happens as I expect, then there is going to be a whole lot more available on streaming than anyone can imagine now. Technology keeps advancing, so it would not be too far-fetched to predict a wireless future for a lot of things that now require wires. There are already so many things that have happened in my lifetime that I never saw coming when I grew up. That is likely to continue for future generations.

ESPN is likely to become a very valuable part of Disney as a result. It offers Disney a venture into a part of entertainment that is very different from the rest of the company. It is the only part with that familiar mouse not a major part of the division (nor is the mouse a necessary part of success or failure). As such it could prove to be a very valuable diversification if management can “make it work” in the future. The failure of this division because it is so different is also an investment risk.

Quarterly Progress

The company is still ramping up from the shutdown in fiscal year 2020. The coronavirus challenges are still in that “fading” process. Companies like this just don’t immediately bounce back. They take time to get back to operating as they once were.

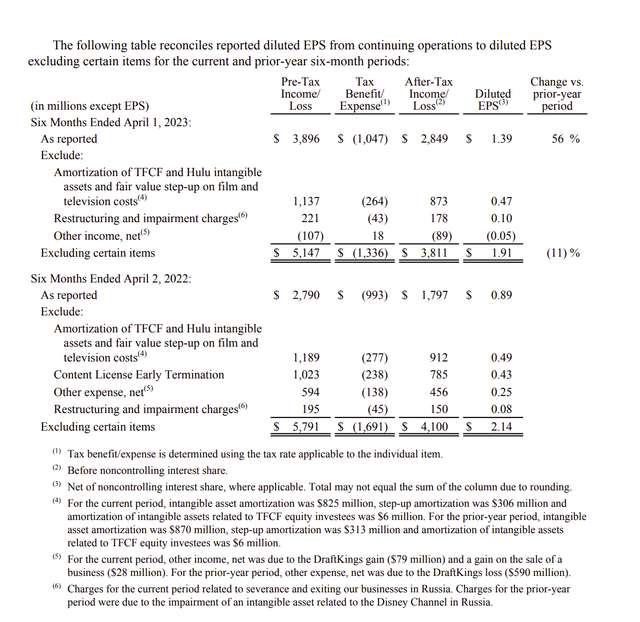

Disney Calculation Of Income Excluding Certain Items (Disney Second Quarter 2023, Earnings Report)

Probably the biggest thing affecting the quarterly comparison was the early termination of a content license. This change in strategy effectively changed how Disney was delivering its content. No future quarters would be benefitting from what was previously income.

But more importantly, Disney intends to deliver its material itself through divisions, including streaming, that exist. Licensing to others is going to be restricted – if it happens at all.

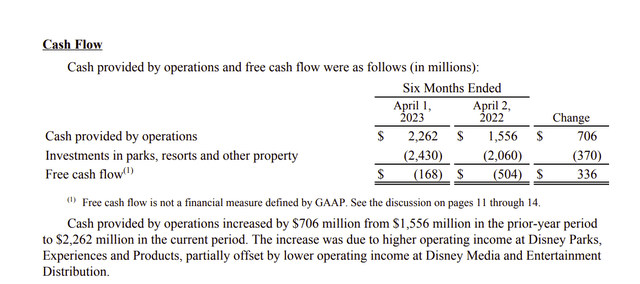

Disney Second Quarter Cash Flow And Free Cash Flow Calculation (Disney Second Quarter 2023, Earnings Press Release)

Despite the early termination of a content license, cash flow provided by operations, a GAAP measure, improved noticeably over the previous fiscal year. This continues the company recovery from the covid shutdown.

Similarly, despite the higher investment in various projects, the free cash flow similarly improved at the six-month interval over the previous period. This company frequently reports a strong second half when it comes to cash flow. Therefore, the outlook for the fiscal year right now appears to be particularly good.

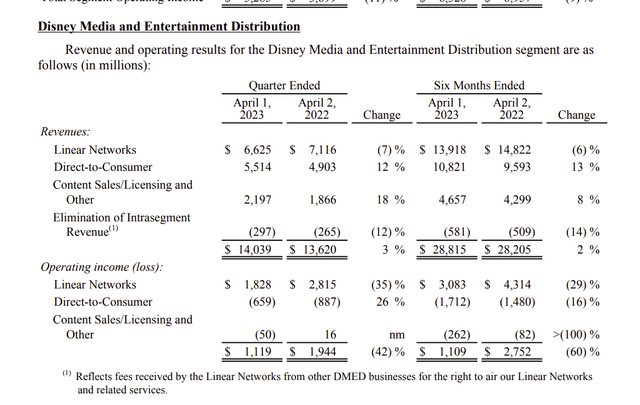

Disney Operating Income By Business Segment (Disney Second Quarter 2023, Earnings Press Release)

The linear networks continued the declining trend. But this quarter the trend was aggravated by a soft advertising market and some timing issues. Therefore, the next quarter could show some “bounce back” that will not change the overall direction, but could provide a better comparison than the market expects.

Probably the key market disappointment was the direct-to-consumer results shown above. The comparison did turn positive, as was the case with some competitors. But the progress was obviously not what the market expected. Since results like that are based upon decisions made at least a year in advance, this could be one of the unstated items that led to a change in the CEO’s.

Another issue seems to be a focus on the movies. The market appears to expect every single movie to be a blockbuster. Disney has had bombs in the past, just like every other movie producer in the business. What Disney has in excess of the competition is more blockbusters and successes. How this year turns out remains to be seen. But so far, the first two movies “Wakanda Forever” and the “Avatar” movie appear to have set up the year to be better than the year before “no matter what.”

There are always going to be ways to improve what actually happened. Hindsight is always 20/20. But this fiscal year for movies is turning out to be decent, despite some market concerns. Probably the thing not noticed is that just the sheer cash flow improvement as the release schedule heads to normal could well overwhelm anything but a series of huge bombs (combined with no winners and big winners). That is unlikely to happen now or in the future. Investors can count on management to review the results and improve what can be improved in the future.

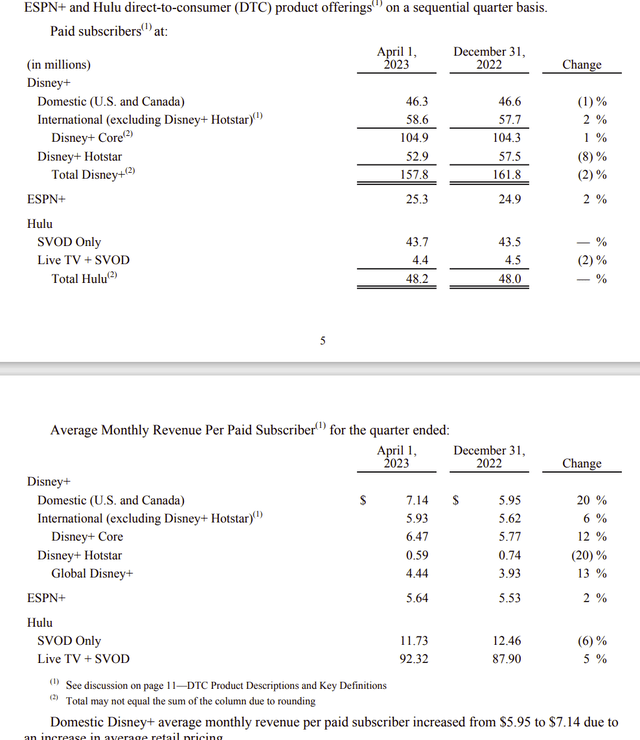

Disney Summary Of Streaming Subscriber Results (Disney Second Quarter 2023, Earnings Press Release)

Just about anytime an investor sees a significant increase in the average revenue per paid subscriber, like that shown above, that same investor can likely expect a pause in subscriber growth. Still, the market has never been very patient about pauses in growth for any reason. Despite the rather small size of this division, it generally has an outsized effect on the market reception to earnings.

What needs to be understood is that Disney is far more than this division. Should this division not work out, then Disney can acquire one that is working (one way or another) and allowed the acquired division to sort things out.

But more importantly, the streaming area is a highly fractured area where no one competitor has a lot of market share. That usually means there is plenty of time to “work things out” and report satisfactory results. Disney does have a decent number of subscribers, and it has a lot of franchises. Therefore, despite the market apprehension, the whole situation is likely to work out to something the market will like in the future.

Overall Progress

The parks are basically back to normal, and cruises are operating. The movie business is still ramping up this year, with more scheduled releases than was the case in the previous fiscal year.

The good part about more movies is that there will be more income to offset movies being made for future revenue. During the ramping up (after the shutdown), there was a needed initial cash outlay for movies to be made before they could be shown. So, there were costs without revenue. The future will resemble the past more closely than was the case in the immediate past.

Similarly, the parks and cruises will operate as they had before the covid challenges appear.

Management appears to be tackling the streaming losses, even if progress was something less than desirable for the market. To me, growth is not as important (going forward) as are profits. Therefore, expect Disney to now focus upon streaming profits (and worry about growth later). The streaming business is a decent size, so this new emphasis can probably be handled before growth resumes.

Disney has a lot of franchises that many others do not have. Even ESPN is well known in its field. So, the integration of the acquisition from a few years back will now resume (this probably happened more so last year). The coronavirus challenges were the worst possible thing to happen right after an acquisition. It often takes twice as long to shut down an acquisition related optimization process and then start it up again as it does to just get the process done without interruption.

Make no mistake, the last few years have cost this company billions. But now, with a lot of ramp-up operations coming to completion in the current fiscal year, the company can look to the usual competitive challenges. This Disney management still has a lot of work to do. But it appears to have handled the last few years better than a lot of companies.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of DIS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies, related companies, and Disney in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.