Summary:

- JPMorgan is one of the largest financial institutions in the USA and its investment banking division boosts the financial results.

- The preferred shares are interesting, but the yield of 5.5-5.6% may not be appealing to every investor.

- A mix of common and preferred shares may be the best way to go.

Michael M. Santiago

Introduction

JPMorgan (NYSE:JPM) doesn’t need a lengthy introduction as it is one of the household names in the US financial sector. The bank will report on its second quarter results soon and I already wanted to have a look at one of its series of preferred shares ahead of the earnings report. The Q2 financial statements will likely be (positively) impacted by the purchase of in excess of $200B in assets from First Republic Bank, which was seized by the FDIC.

A decent result in the first quarter indicates the preferred dividends are safe

I will keep my review of the current situation at JPMorgan brief by looking back at the bank’s Q1 results from the perspective of an investor in preferred shares. The bank’s Q2 (and H2) results will likely look very different so I will follow up on this article with an update once JPMorgan has released its Q2 report.

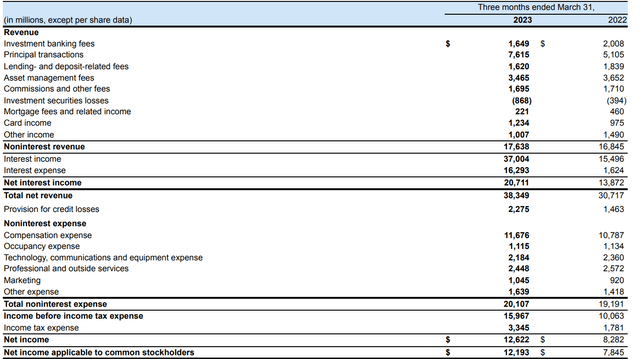

In the first quarter of this year, the bank saw its interest income more than double while its interest expenses ten-folded. While the latter sounds pretty bad, keep in mind that in absolute numbers the $21.5B in interest income increase was more than sufficient to cover the less than $15B in interest expense increase. Indeed, the net interest income increased very substantially in the first quarter of this year. Whereas JPMorgan reported a net interest income of $13.9B in Q1 2022, this jumped to $20.7B in Q1 2023.

Meanwhile, JPMorgan was also able to keep the net non-interest expenses pretty low. In the first quarter of the current financial year, JPM spent $20.1B on non-interest expenses while it generated a $17.6B non-interest income for a net non-interest expense of $2.5B. This, in combination with the net interest income of $20.7B, resulted in a pre-tax and pre loan loss provision income of just over $23B and after deducting the $2.3B in loan loss provisions, the pre-tax income was a very respectable $16B (a 60% increase compared to Q1 2022 despite a 50% increase in the total loan loss provisions). The net income attributable to the common shareholders of JPMorgan was $12.2B or roughly $4.11 per share.

That is excellent news from the perspective of a preferred shareholder. The bank paid a total of $356M in preferred dividends during the first quarter. This means the bank needed less than 3% of its pre-preferred dividend net income to actually pay those preferred dividends. That’s an excellent position to be in and although the preferred dividends are non-cumulative in nature (JPM doesn’t have to pay all potentially missed preferred dividends before paying a dividend on the common shares), the very low payout ratio means the preferred dividends are definitely very affordable.

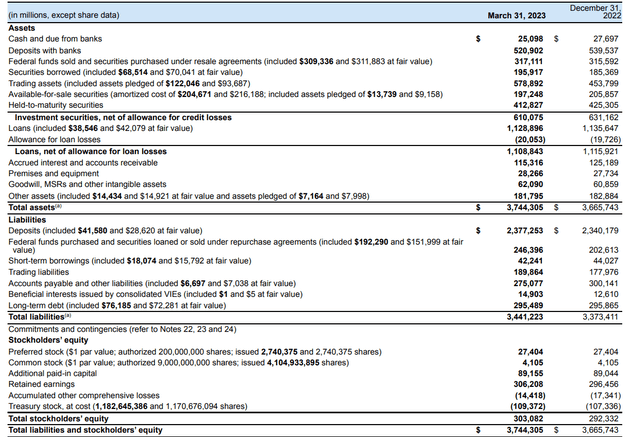

The $3.75T balance sheet also looks good from the perspective of a preferred shareholder. As you can see below, there’s a total of $303B in equity on the balance sheet and approximately $27.4B of the total equity comes from the preferred shares.

This means there’s in excess of $270B in equity ranked junior to the preferred shares, and that $270B in equity will be a first buffer to absorb losses. Also keep in mind JPMorgan is retaining the majority of its earnings on its balance sheet, so I expect the total ‘cushion’ of common equity to increase on a quarterly basis.

In a previous article, I had a closer look at the MM series of the preferred shares trading with (NYSE:JPM.PM) as ticker symbol but I’m also keeping an eye on the Series GG which are trading with (NYSE:JPM.PJ) as ticker symbol. These preferred shares have a fixed preferred dividend of 4.75% based on the $25 principal amount, which works out to $1.1875 per year, payable in four equal quarterly tranches. This series of preferred shares is currently not callable: the first call date is in December 2024 but given the current situation on the financial markets and the market interest rates I don’t think it is likely.

That specific series of preferred shares is trading at $21.33 per share which means the current yield is approximately 5.6%. That’s clearly lower than the yield on the fixed rate preferred shares of for instance the Bank of America (BAC) which I discussed here, and that is a clear signal the market ‘trusts’ JPMorgan more than the Bank of America. That’s not a new situation, but it does mean the 5.6% preferred dividend yield is a bit too low for me personally.

The recent acquisition of First Republic assets makes Q2 guesstimates tough

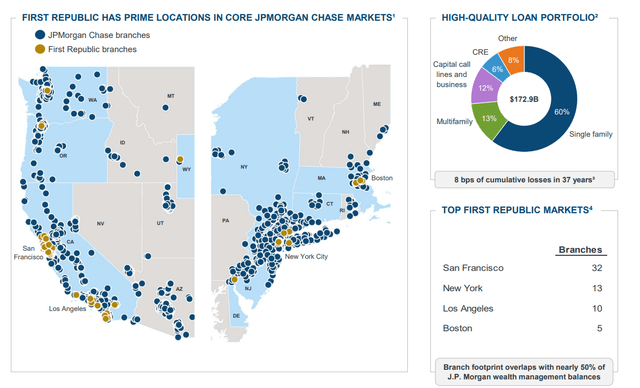

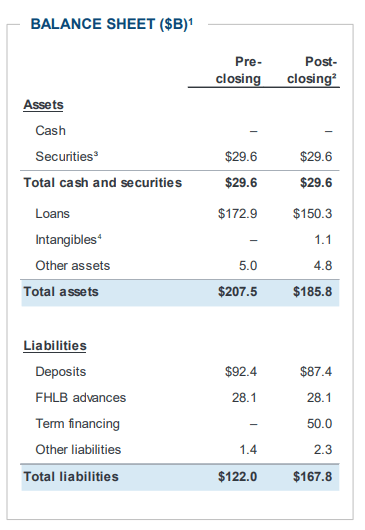

JPMorgan is always on the lookout for good deals and during the second quarter, the bank acquired about $173B of loans and $30B of securities from the FDIC which seized the assets of the First Republic Bank. The assets are backed by $92B in deposits and $28B in FHLB advances, and JPMorgan acquired these assets for $10.6B in cash.

Back in 2008 the concept of a ‘Jamie-Deal’ was launched when JPMorgan initially got an amazing deal on the government-backed acquisition of Bear Stearns. And it looks like JPMorgan’s deal to acquire these assets from First Republic is another ‘Jamie Deal’. The FDIC has entered into loss share agreements and will provide 80% loss coverage on residential mortgages in the first seven years and 80% loss coverage on commercial loans during the first five years. Additionally, the FDIC is providing JPMorgan with a $50B fixed rate financing for a period of five years. This will replace the $25B in deposits from large US banks.

JPMorgan Investor Relations

The transaction is structured in a way that allows JPMorgan to immediately report a non-recurring after-tax gain of $2.6B. This excludes the restructuring expenses of $2B which will gradually be realized in 2023 and 2024 resulting in a net income accretion of $500M between now and the end of 2024. That’s obviously good news as JPMorgan is able to share the risks with the FDIC but will still be able to report a bargain purchase gain while it will likely generate a 250-300 bp net interest margin on the acquired loans and securities. A good deal for JPMorgan, but it will make it difficult to analyze the Q2 results which are due soon.

Investment thesis

While smaller regional banks are still suffering, the large-caps are doing quite well. JPMorgan was able to pick up the bits and pieces of First Republic Bank it wanted and it got some backing from the FDIC in the process.

Due to my personal tax situation as a foreign investor, a 5.6% preferred dividend yield is not sufficient to generate an after-tax return that is sufficiently appealing for me. But there obviously are plenty of investors in tax jurisdictions where a position definitely could make sense as JPMorgan only needs a low single digit payout ratio to cover the preferred dividends and as there is in excess of $270B in equity ranked junior to the preferred shares. The common shares of JPMorgan are more appealing after the recent dividend hike, as the possibility to generate capital gains (which is limited in the case of the preferred shares) should result in a higher total return on an investment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!