Summary:

- Meta Platforms, Inc. CEO Mark Zuckerberg has picked a fight with Twitter leader Elon Musk by releasing Threads, a direct threat to Twitter in terms of features – an unsurprising move in light of Meta’s penchant for copying.

- We may see the social media giant achieve FY2023 revenues of $118.78B (+1.8% YoY), adj operating income of $41.38B (+23.3% YoY), and margins of 34.8% (+6 points YoY) at the midpoint.

- These projections are impressive indeed, given Meta’s aggressive “Year of Efficiency,” despite the increased R&D efforts in launching Threads, way surpassing Twitter’s previous margins.

- The fact that Zuckerberg leads the world’s most used social media apps must not be ignored, given the opportunities from Meta’s existing pool of advertisers, with 75M of new signups.

- However, investors must be aware of the pitfalls of adding here, since the Meta Platforms rally has been overly fast and furious, suggesting a baked-in premium.

Image Source

The Social Media Investment Thesis Remains Robust Under Mark Zuckerberg’s Leadership

We previously covered Meta Platforms, Inc. (NASDAQ:META) in June 2023, comparing its Quest AR/VR headsets with Apple Inc.’s (AAPL) Vision Pro.

While the former’s Metaverse strategy had been somewhat confusing thus far, Quest 3’s promising details suggested that the social media giant might release an improved product by September 2023, potentially putting up a good fight against the Cupertino giant.

For now, it appears that Meta CEO Mark Zuckerberg has picked a fight with another CEO, namely Tesla, Inc.’s (TSLA) Elon Musk, by releasing a new social media platform, Threads. This is a direct competitor to Musk’s Twitter in terms of features. This move is inevitable in light of META’s penchant for copying, one that we have previously discussed in depth.

Interestingly, many market analysts have also written down Twitter’s valuations to approximately $15B by early 2023, a drastic discount of -65.9% compared to the $44B Musk paid previously. This cadence suggested that Musk might have overpaid for the platform, with it only achieving earnings “breakeven” by April 2023, despite the drastic layoffs and cost optimizations thus far.

For reference, before Musk took Twitter private, the social media app recorded an annualized revenue of $4.7B (-2.5% QoQ/ -1.2 YoY) in FQ2’22, largely attributed to advertising dollars. The platform also reported erratic profitability with gross margins of 54% (-3.7 points QoQ/ -11 YoY) and operating margins of -29.2% (-19.2 points QoQ/ -31.7 YoY).

However, we believe that Zuckerberg’s Threads may do much better. This is why.

For example, META had averaged gross margins of 81.9% (-1.3 points YoY) and operating margins of 44.6% (-3.6 points YoY) in FY2019, prior to the Covid-19 pandemic and the AAPL privacy changes. While the latter has drastically impacted the company’s margins, we believe that management’s efforts may pay off in the intermediate term.

Based on its FQ1’23 performance and the CFO’s FQ2’23 revenue guidance/ FY2023 expense guidance, we may see the social media giant achieve FY2023 revenues of $118.78B (+1.8% YoY).

Assuming that META’s COGS remains stable at $24.9B (+4.9% YoY based on FY2022 cadence), we may see its adj operating income improve drastically to $41.38B (+23.3% YoY) and margins to 34.8% (+6 points YoY) at the midpoint.

These numbers are impressive indeed, suggesting that Mark Zuckerberg’s aggressive cost optimizations and layoffs have worked as intended in boosting META’s profitability, despite the increased R&D efforts in launching Threads.

Most importantly, our FY2023 projections have yet to include any contribution from Threads, suggesting that further top and bottom line upsides are entirely possible, likely to boost its stock performance at the same time. For now, with 75M of new signups over the past two days, it is unsurprising that Musk is threatening a lawsuit.

With Facebook, Instagram (modeled after Snapchat (SNAP) and Reels modeled after TikTok (BDNCE)), and WhatsApp under the belt, literally the world’s most used social media apps, it may not be wise to bet against Zuckerberg’s Threads after all, given his expanding expertise with the social media scene and digital advertising market.

This is on top of the highly synergistic opportunities from META’s existing pool of advertisers and the growing daily user base of 3.02B (+2% QoQ/ +5.2% YoY) in the Family of Apps globally by the latest quarter, with at least 77% of internet users active on at least one platform.

Given these metrics, it is unsurprising that Mark Zuckerberg has agreed to the cage fight with Elon Musk, due to the immense advertising opportunities on the social media platforms and stock prices alike. The latter has been touted as a hype machine for a reason.

So, Is META Stock A Buy, Sell, or Hold?

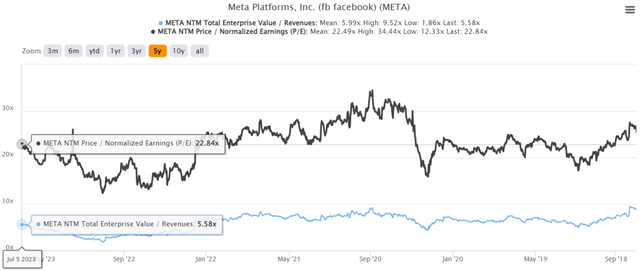

META 5Y EV/Revenue and P/E Valuations

For now, META’s valuations have already recovered drastically to NTM EV/ Revenues of 5.58x and NTM P/E to 22.84x, compared to its 1Y mean of 3.58x/ 18.15x, nearer to its 5Y mean of 5.99x/ 22.49x, respectively.

Based on the market analysts’ FY2025 adj EPS projection of $16.56, we are also looking at a long-term price target of $378.23, suggesting a decent upside from current levels, despite the impressive rally of +220.9% from the October 2022 bottom.

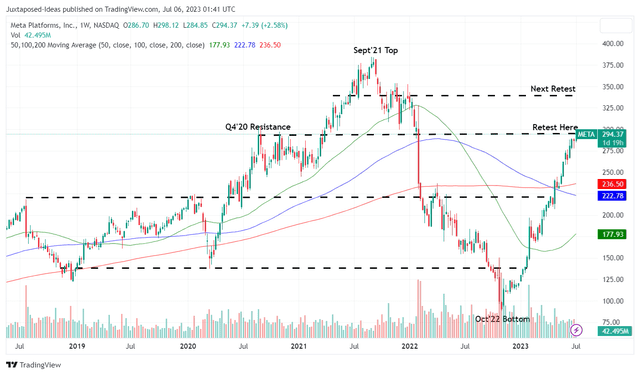

META 5Y Stock Price

Then again, META is now likely to retest the Q4’20 resistance levels in the near term. While we believe its FQ2’23 earnings call will deliver great results, it is uncertain if the optimism may last, due to the softer advertising market and peak recessionary fears.

For now, the market analysts expect the YoY growth for digital advertising to decelerate to 8.4% in 2023, “the slowest rate of increase since the 2009 financial crisis,” likely attributed to the pulled forward growth during the hyper-pandemic and “maturity of the digital space:”

With digital now more than two-thirds of total advertising, digital growth at historic double-digit rates has become difficult to achieve, and we expect digital to decelerate further over the next five years. (The Wall Street Journal.)

However, we continue to rate META stock as a Buy here, especially since the social media giant is expected to generate an excellent top and bottom line CAGR of +9.4% and +21.3% through FY2025, respectively, thanks to Mark Zuckerberg’s “Year Of Efficiency.”

Assuming that its cost optimization strategies are sustained over the next few quarters, it is not overly bullish to see another raised FY2023 guidance, potentially boosting Meta Platforms, Inc. stock valuations at the same time.

Then again, investors that add here must also calibrate their expectations, since the rally has been overly fast and furious thus far, suggesting that most of the growth may already be baked-in.

While our portfolio also consists of Meta Platforms, Inc. stock, we will not be adding here since we have done so during the November 2022 bottom, aggressively lowering our dollar cost averages then.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, TSLA, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.