Summary:

- AT&T’s dividend is unlikely to be cut in the foreseeable future due to efforts to de-risk balance sheets and a strong financial buffer.

- However, T has extremely minimal capital appreciation potential, despite most analysts assigning a buy or strong buy status.

- These concerns around the potential for multiple expansion and stronger earnings stem from 2 colliding situations, where T is set to de-risk its balance sheet, while the need for CapEx is rising.

- Additional headwinds for T are blowing from the increased competition, potential entrance of Amazon, and weak positioning in the 5G space.

Ronald Martinez

About a month ago, I published an article on AT&T Inc. (NYSE:T) elaborating on T’s sustainability of its dividend in the context of stagnant FCF and high indebtedness. Mainly due to the relatively recent dividend cut and ambitious efforts to de-risk the balance sheets, the conclusion was clear – it is highly unlikely that T’s dividend would get cut in the foreseeable future. And as of now, the financial buffer is strong enough to not worry about any cuts even if the FCF suffered a notable decline.

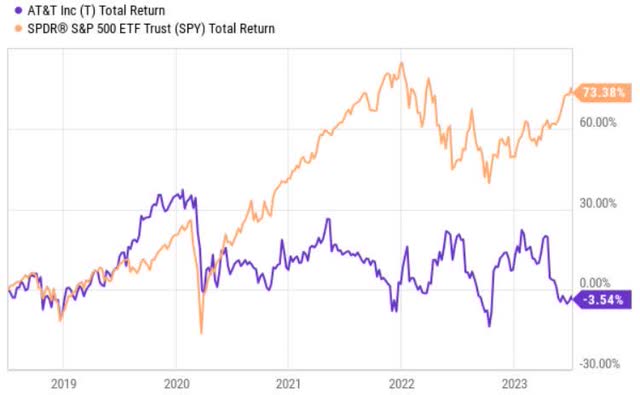

However, I also made it clear, without going into too much detail, that T should be viewed as a pure play income stock with very minimal capital appreciation potential.

Considering that under rational conditions we (investors) should not be bound by the income component only, but instead view return prospects of our investments on a total return basis per unit of a some measure of risk, I think that there is a merit of providing more elaborate assessment on T’s capital appreciation potential.

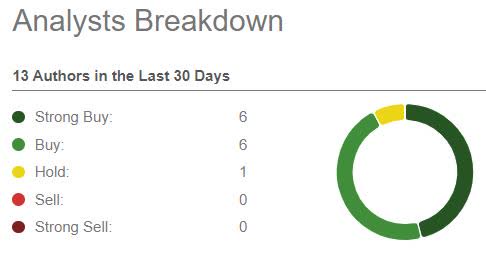

Seeking Alpha

This is especially timely given that most of the Seeking Alpha analysts have assigned either buy or strong buy for T, thereby sending a strong message of expected outperformance going forward.

Seeking Alpha

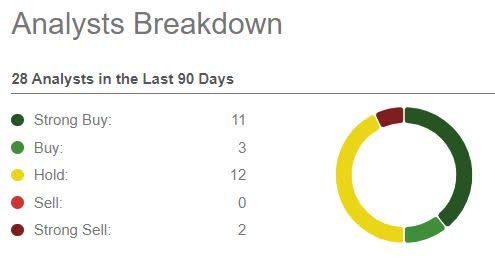

Whereas if we look at what the Street has articulated on T, the picture is not that straightforward.

Disclosure

The objective function of this article is to highlight elements, which embody high probability of putting a strong downward pressure on T’s potential to deliver returns in the form of capital appreciation. Hopefully, this will be thought provoking and challenge status quo in the unanimous buy argumentation.

Moreover, readers should be aware that my recent thinking is skewed towards a bearish scenario for the overall equity market. For example, 3 of my last 6 articles have been bearish. So, naturally, I am not that optimistic about T’s currently depressed multiple expansion to a more juicy level.

Thesis

As of now, T yields ~7% and is priced at FWD P/E of 6.4x, which optically is extremely attractive. Other valuation metrics such as EV/EBITDA, P/B and P/CF also indicate that T is trading at a historically low and attractive zone.

At the first glance, this seems like a wonderful opportunity for investors to capture two things: (1) stable and attractive yield of 7%, and (2) returns from multiple expansion towards a more reasonable level.

Again, as outlined above and in my previous article on T, the dividend aspect is safe and investors could count on these streams of income at least in the foreseeable future.

Nevertheless, the second component (i.e., multiple expansion) is more concerning. Namely, I highly doubt that T will be able to compensate investors via an uptick in the valuation or stronger earnings.

The chatter around T’s valuation and how it is unfairly punished by the market has been active for several years. The 5-year P/E average of T is ~8.3x, which is significantly below average equity valuations we see in the market today.

Well, the long-awaited and heavily discussed ‘normalization’ of T’s multiple has not realized in the past 5 year period. And, frankly, the macroeconomic prospects, interest rates and sector specific dynamics have become more unfavourable than before.

Let me describe my thinking of key elements, which clearly go against the buy thesis or expectations that T will be able to reward investors with alpha or meaningful returns on top of the ~7% yield.

Extreme leverage in combination with ‘higher-for-longer’ scenario equates to status quo

As of now, we know that it is highly likely that we will experience further rate hikes by the FED with the base case of FED Funds rate being at 5.25 – 5.50% range in September, 2023. Moreover, we see an increased formation of interest rate expectations gravitating towards a 5.72 – 6.00% range as driven by the more aggressive rhetoric on maintaining rates high for a longer period of time.

Against the backdrop of T’s financial standing, the aforementioned clearly does not bode well for finding a capital to fund potentially accretive CapEx or M&A plans down the road.

Currently, T is way more leveraged than the sector average. While the Net Debt / EBITDA of 3.4x might seem rather healthy on an absolute level, in reality it is not. This is because the EBITDA of telcos is not fully discretional as there is a high, structural pressure to cover the D&A component with incremental CapEx to maintain quality and competitiveness within the ever evolving telco landscape.

A better measure of determining T’s financial risk would be Net Debt / FCF, which, primarily, accounts for the CapEx spend and the interest costs, which you cannot really avoid. On a TTM basis, the Net Debt / FCF of T lands at ~11x. This is high.

To make a picture a bit worse, we can take a look at T’s interest costs that are associated with the ~ $130 billion of interest-bearing debt. Currently, the weighted average interest rate of T’s long-term debt portfolio, including the impact of derivatives, is ~ 4.1%.

Given where the interest rates are now and where they are likely heading, we can safely conclude that there will be a gradual uptick in the interests costs, which, in turn, will impose additional headwinds for future FCF.

The relatively recent bond issuance (back in February, 2023), showed that T managed to secure financing at ~5.5%. The ~ 140 basis points of spread (current w.a. interest vs market rate) is not that bad, but since February this year, rates have climbed higher (and will continue to do so). Namely, the spread is set to worsen.

At the same time, the Management has outlined an ambitious strategy to decrease leverage, while staying committed to the dividend. Looking also the tempo of debt reduction in the past couple of quarters, it is evident that slowly but surely more and more capital is being allocated towards reducing the debt load.

What this implies is that T should gradually pay off its past sins of assuming extreme amounts of (unsuccessful) leverage at the expense of fresh capital that could be directed towards growth opportunities. In fact, the Management has already communicated that it plans to trim down on the future CapEx spend to free up capital for debt reduction activities.

So, there is and will be an increased focus on optimizing the balance sheet to mitigate financial risk and avoid unfavourable surge in the interest cost component stemming from system-wide increase in cost of debt levels.

As a result, quite naturally the potential consequences of deemphasizing growth are set to rise, materializing via impaired competitive position in the context of CapEx-intensive 5G era and an increased competition from likes of Amazon (AMZN) and DISH Network (DISH).

Being defensive when it is time to make bold and strategic investments is an indicative of subpar performance

By continuing the point on T’s lower ambition targets on CapEx, we can add more meat on the bone with the following:

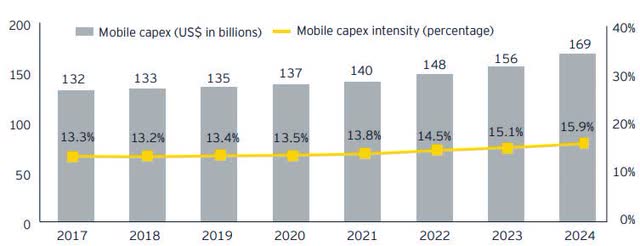

According to the EY, there is a growing need for additional CapEx to capitalize on 5G opportunities, modernize networks and enter into CapEx heavy tie ups in the B2B or B2G, and thus unlocking the growth potential via various 5G use cases.

At the same time, there are notable headwinds for telco CapEx programs stemming from cost inflation factors, which make the underlying investments more expansive. So, going forward, T will invest less not only due to an absolute reduction in the CapEx, but also from a deteriorated purchasing power per $ of allocated investment.

Granted, T is not the only one in the game that has decided to assume less aggressive stance on the CapEx front. Verizon (VZ) and T-Mobile US, Inc. (TMUS) have also indicated a slowdown in the CapEx activity in 2024.

However, the recent dynamics of the closest competitors send a strong message for T that it cannot afford to stay complacent.

For instance, thanks to a relatively recent T-Mobile’s acquisition of Ka’ena Corporation, TMUS has significantly strengthened its positioning in the digital audience. Moreover, TMUS merger with Sprint is set to unleash notable synergies, allowing the Company to compete more aggressively. According to the Peter Osvaldik, CFO of TMUS:

The company will conclude and finalize all the integration activity and achieve the recently updated synergy number of $8 billion in run rate in 2024. As such, the company’s free cash flow growth in 2023 is now projected to be 75% up year-over-year as synergies are finally coming to fruition.

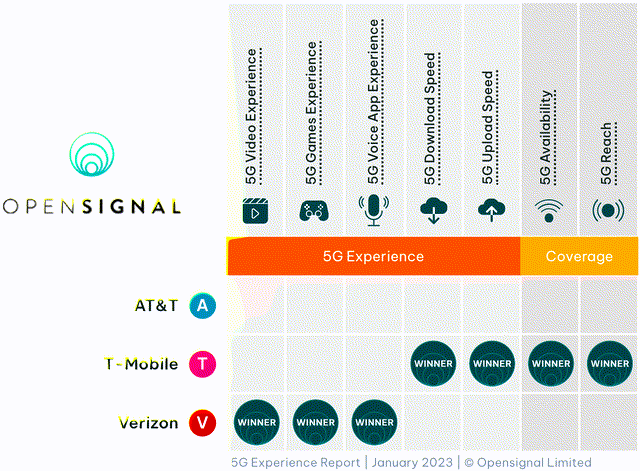

It is also a common knowledge that to win and remain competitive in the 5G space, a company has develop an appealing value prop. This is especially true for non-corporate consumers, which do not care so much about having even lower latency and higher throughputs as 4G and NSA 5G services are already strong enough to enjoy “95%” of digital offerings / needs.

According to the 5G experience report by Opensignal in January, 2023, it seems that T is in a very difficult situation. It does not meet the expectations neither on the coverage nor the 5G experience front (and certainly does not provide some notable advantage over TMUS and VZ).

So, the fact that T has reoriented its focus towards debt reduction by reducing its CapEx spend, while the CapEx elements have become more expensive and the competitors more aggressive and established in the 5G segment, does not bode well for T’s prospects to deliver growing earnings.

You have to respect Amazon

A month or so ago, there were circulated reports on how AMZN is weighing an entry in the mobile market, which immediately sent the conventional mobile operator stocks lower (obviously, including T).

For the big three carriers – T, VZ and TMUS – this is a nightmare considering AMZN’s intentions to develop a phone plan offering ranging from free to $10 a month. In the context of the prevailing pricing from the big three, even the ceiling price of $10 would imply a significant discount to the current offering.

Currently, we can only speculate about how the AMZN’s entrance in the telco space would change the market structure. However, there are a couple of things clear:

- Sooner or later, once AMZN enters, we will not be talking about price increases in the sector, but instead experiencing an outright pricing war.

- Hence, the big three will have to cut prices on their plans, which will cause a negative rate of change in the sales and create an enormous drag on the underlying profits.

- The matters will likely become worse not only due to the pricing, but also from declining customer base.

Given AMZN’s track-record, its ability to disrupt businesses and its access to sizeable capital, I do not see how we could be talking about acceptable earnings growth for T.

Lower penetration of 5G use cases and inflationary pressure put a notable drag for T’s earnings growth

As mentioned a bit earlier, 5G is mostly about the enabling of new and powerful use cases, which were not supported by the 4G signal. These new uses cases consume more data and, most importantly, allow businesses and governments to optimize and digitize their operations.

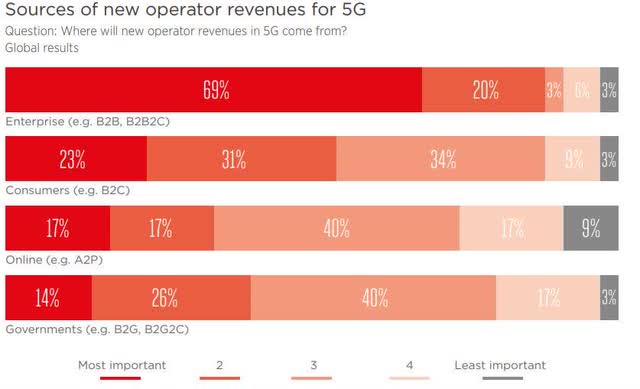

According to the study conducted by GSMA, B2B and B2B2C segments will be the ones accounting for the incremental source of revenues via telco activities in the 5G sector.

These new revenues will not be about higher consumption of data (as this pricing of data is extremely low and on a structural decline), but instead about creating tailored made offerings for business customers.

The key strategy by telcos to capitalize on these opportunities is through establishing tie ups with large-scale businesses. Unfortunately, the offering from telcos requires rather heavy CapEx such as rolling out private networks, and investing in new NSA networks to enable the surrounding 5G devices.

Now, considering that only ~20% of T’s sales are exposed to business customers (or with focus of managed professional services), which are experiencing a declining trajectory, and the fact that T is deliberately shying away from higher CapEx spend, I just do not see how T could establish a strong position in the 5G space.

Finally, there are two additional factors, which weaken the thesis of T’s outperformance.

First, according to forecasts by Omdia, we will see a more pronounced uptake of 5G use cases starting only from 2024.

Multiple factors have slowed down the transition to 5G such as lower handset sales driven by cost-of-living crisis and inflation, poor network coverage, low performance gain perception, and lack of 5G specific applications. Furthermore, an increasing portion of mobile connections – approximately 30% – are not handsets and will be slower to convert to 5G (e.g., IoT, connected tablets/laptops, wearables).

Despite the massive investments in 5G, it is still unclear on telco ability to monetize these proceeds. There are many structural bottlenecks for this such as fully functioning 4G solutions, inflationary forces (especially for the 5G chipsets and hardware), and lack of new 5G use cases, which offer a solid value-for-money for businesses that currently are facing serious macroeconomic headwinds.

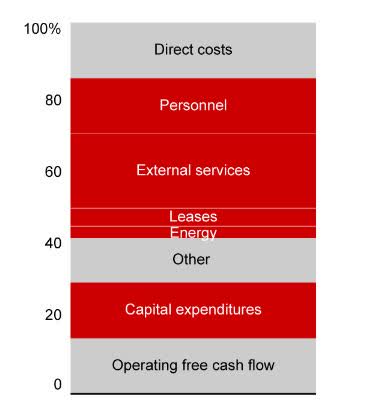

Second, Bain & Company estimates an increased pressure for the telcos to maintain their margins due to inflationary forces.

Bain & Company

Personnel, energy, CapEx, external services and leases constitute roughly 60% of the average cost structure of U.S. telcos. In situation, where a significant portion of total costs is subject to major cost inflationary forces, it is hard to imagine how profits could increase going forward (especially given the analysis above).

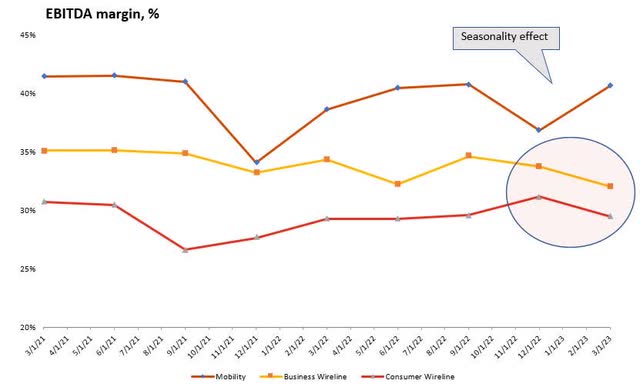

In fact, looking at the rate of change dynamics of T’s quarterly EBITDA margins, we can already notice some signs of worsening earnings prospects.

Bottom line

In my humble opinion, allocating relatively sizeable amounts of capital towards T is not an optimal choice as the sector specific prospects in conjunction with T’s massive leverage neutralize any capital appreciation potential.

I still do believe that T will maintain its ~7% dividend and satisfy the expectations of dividend-seeking investors.

However, from a total return perspective, it is highly unlikely that T will be able to deliver returns in line with the market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.