Summary:

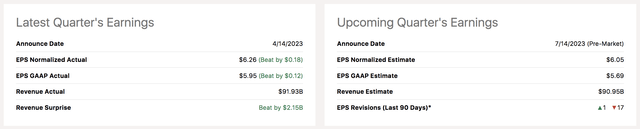

- UnitedHealth Group Incorporated is set to release its second-quarter results on Friday, the 14th.

- Risk factors such as 17 downward revisions on Wall Street and a rise in behavioral patient volume have emerged.

- However, various positives exist, namely higher life and health premium pricing, an overlooked backlog from Optum Insights, and potentially lower operating costs.

- UnitedHealth is a surreal earnings beater. However, its Q2 report is tough to call. Therefore, we warn investors that volatility will likely surface within the coming days.

JHVEPhoto

It is earnings season again for UnitedHealth Group Incorporated (NYSE:UNH), as the company is set to disseminate its second-quarter financial results pre-market on Friday, the 14th. Although UnitedHealth’s recent quarters met analysts’ expectations, the Street’s outlook for UnitedHealth’s second quarter is grim. From the forecasts sampled, 17 Wall Street analysts believe UnitedHealth will miss their initial earnings-per-share guidance, while merely one analyst thinks the firm will deliver compelling results.

A preview of UnitedHealth’s Q2 earnings makes for an exciting analysis, considering the various inflection points within the life & health industry. By combining qualitative and quantitative metrics, we discovered that a rocky road is ahead for UnitedHealth stock; here’s why.

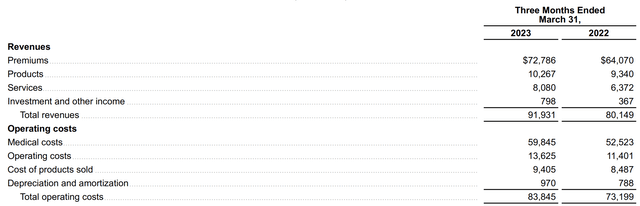

Interpolating Results

As with most of our earnings preview articles, today’s analysis attempts to formulate an outlook on UnitedHealth’s second-quarter results by interpolating the company’s first-quarter results and determining if any structural breaks have occurred ever since.

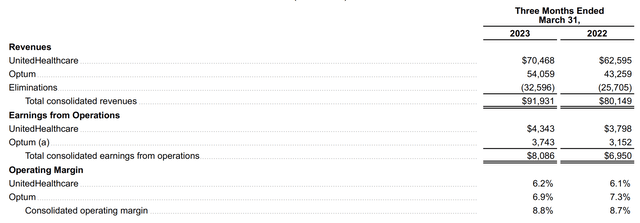

The bulk of UnitedHealth’s revenue stems from its UnitedHealthcare segment, which offers standard life & health solutions. However, its Optum business, which focuses on digital healthcare integration, is growing robustly and could soon establish itself as UnitedHealth’s primary segment. However, for the time being, we assumed that UnitedHealthcare’s salient variables will impact UnitedHealth’s Q4 earnings the most.

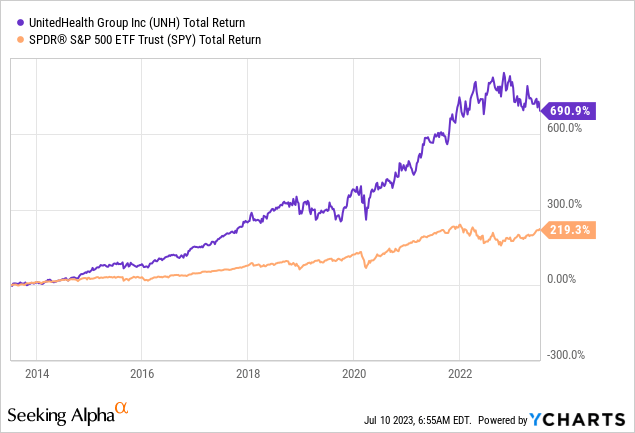

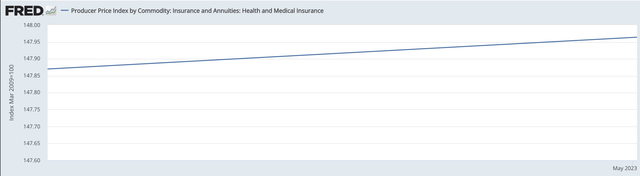

In its previous quarter, UnitedHealth’s primary segment reported year-over-year revenue growth of 13% and an operating margin expansion of 14%, stemming from additional people served. Even though we think the number of people served will continue to grow steadily, evidence suggests that the pricing of premiums has remained resilient since UnitedHealth’s last reporting date, meaning all-around growth possibly occurred.

Medical Insurance CPI (San Francisco Fed.)

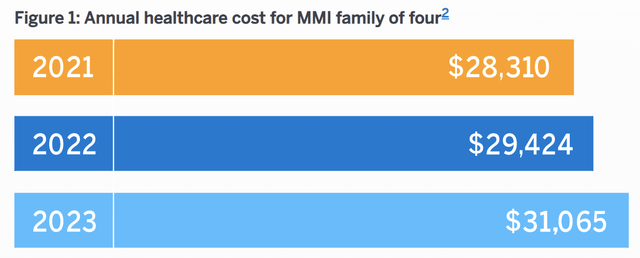

On the other end of the playing field, data analytics firm Millman’s has re-based its data in May, which now suggests a 5.6% uptick in U.S. medical care expenses is likely to realize in 2023; this could have a significant effect on UnitedHealth, as its industry-leading status will likely lead to it absorbing the forecasted data.

A related inward observation of UnitedHealth is its management’s recent claims (on June 14) that it witnessed a higher-than-anticipated uptick in Medicare Advantage patients. Moreover, an increase in behavioral healthcare patients is being observed across the healthcare sector. The general consensus is that non-critical treatments such as joint replacements (for instance) were delayed during the height of the Covid-19 pandemic and are now being attended to.

In our view, lumpy claims are a risk factor inherent to the life & health insurance business. We are now post-pandemic and think the key drivers behind UnitedHealth’s primary segment will be pricing instead of lumpy claims.

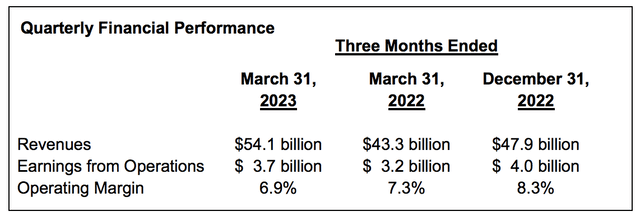

As discussed in one of our previous articles, Optum is a long-term asset for UnitedHealth. As such, strategic investors seeking exposure to Optum will probably not care too much about quarterly earnings results. Nevertheless, let’s do a quick run-through of the segment’s latest events.

For those unaware, Optum focuses on a range of value propositions, including but not limited to modern care delivery, online pharmacy, and data analytics. The segment resumed its staggering growth in the third quarter, with its revenue surging by 25%.

Optum’s three pillars (health, insights, and Rx) are all well-placed. Keep in mind that Optum Insights revealed a backlog of $30.7 billion in Q1. In our opinion, Insights will resume its growth as it feeds off of the popularity of B2B healthcare partnerships. The division possesses a market share of merely 0.68%, which means it is not yet positioned to exercise pricing power; nevertheless, it is expanding at scale.

Optum Rx is a systemic growth play, which likely received additional support in Q2 from an industry growing at an annual rate of 19.36%. Moreover, the segment rolled out a flexibility payments program in January, and we believe more cost synergies will have realized during its second quarter.

Lastly, a discussion about UnitedHealth’s investment portfolio and non-claims-related costs is warranted.

The company has long-term investments of approximately 46.88 billion on its balance sheet and generated $798 million in investment income during its previous quarter.

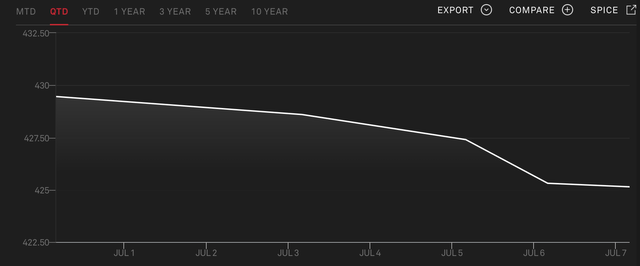

UnitedHealth’s latest 10-Q suggests that most of the firm’s investment exposure consists of long-dated U.S. debt in the form of AFS (available-for-sale) securities. Most asset classes have generated positive returns since the turn of the year; however, U.S. Treasuries have lost value since the end of UnitedHealth’s first quarter. The good news is that AFS security losses do not influence the income statement; however, we expect a lower-than-expected net asset value in UnitedHealth’s second-quarter report.

U.S. Treasury Bond Index (Market-Value weighted) (S&P Global)

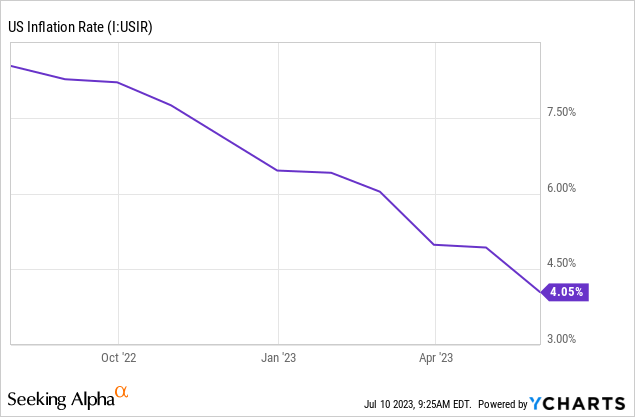

In terms of costs. We suspect some of UnitedHealth’s costs tapered (relative to revenue) during the quarter, particularly in-house costs such as wages and CapEx. Our basis here is that broad-based inflation within the United States has softened, and the labor market is less demanding than it was going into 2023.

Key Earnings Metrics

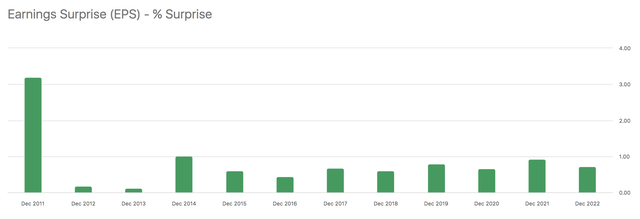

Even though most Wall Street analysts have a bearish outlook on UnitedHealth’s second quarter, the company is a surreal earnings beater. And, believe it or not, earnings momentum is a real thing. In fact, academic research supports the argument that regular earnings beaters will more likely than not beat future targets.

UNH’s Past Earnings Beats/Misses (Seeking Alpha)

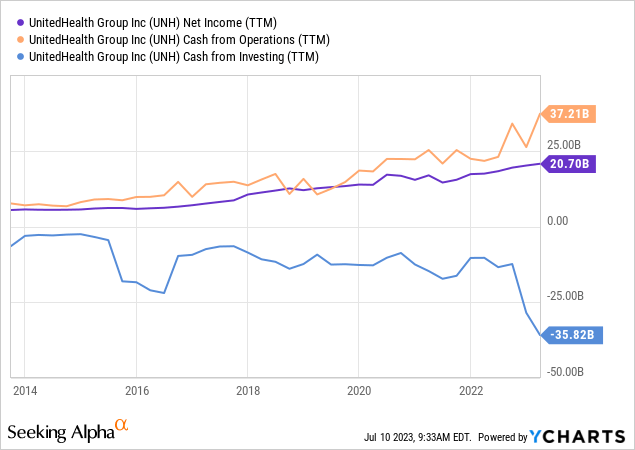

Another critical factor to consider about UnitedHealth is its lack of accruals. It is considered a positive when a company’s cash from operations outpaces its net income, as profit and loss statements are often manipulated. As such, based on the firm’s latest statements, a positive convergence between cash flow and income is likely.

Final Word

Our analysis shows that UnitedHealth’s second-quarter results could go either way. Wall Street analysts are generally bearish as many downward revisions have occurred, which is understandable given higher-than-anticipated patient volumes in the firm’s second quarter. However, factors such as higher life and health prices, a backlog from Optum Insights, and UnitedHealth’s history as an earnings beater present a counterargument.

Our consensus: Whether UnitedHealth will beat its second-quarter earnings target is indeterminate.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for structured portfolio ideas? Members of The Factor Investing Hub receive access to advanced asset pricing models. Learn More >>>