Summary:

- Pfizer is trading at a cheap valuation due to normalizing earnings and an uncertain outlook.

- This is where a long-term investor can take advantage of the weakness before the company successfully repositions for better growth going forward.

- At the very least, you are looking at a decent dividend due to share price weakness while they transform the company.

Jeenah Moon

Written by Nick Ackerman. TA version of this article was originally published to members of Cash Builder Opportunities on June 23rd, 2023.

Pfizer (NYSE:PFE) is presenting an opportunity for dividend growth investors to pick up shares while they are cheap. The stock price has continued to slide as the Covid boost they received wanes and earnings normalize. Growth in the future is expected to be fairly slow but trending higher as they face patent cliffs. The uncertainty going forward seems to be keeping this name at a cheap valuation. That’s where a long-term investor that can stay invested for several years can benefit from this cheap valuation today.

They are also looking to make a massive acquisition by buying Seagen (SGEN) to offset the expectation for lost revenue as they hit these patent cliffs later in this decade. They anticipate it will deliver $10 billion in revenue by 2030. However, there could be some challenges against this deal, and it isn’t set in stone that it’ll be completed. The company expects the deal to close by late 2023 or early 2024.

If not, Pfizer will likely have to look at other potential smaller candidates to acquire. PFE is a healthcare behemoth and that puts them in a great position to navigate going forward. This merger would be in addition to other new launches and co-promotions that’ll lead to sales.

Pfizer Outlook

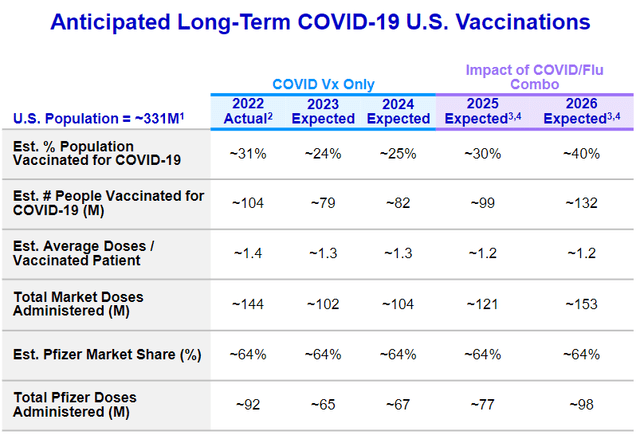

In looking at the future of Covid vaccination sales, they expect sales to continue where they remain the dominant player with a market share of 64%. They are looking at the impact of a Covid/Flu combo vaccination to help drive sales. While they anticipate that Covid vaccinations alone will decrease in the coming years, with the combo, it could lead to doses eventually increasing.

Pfizer Expectations For Covid Vaccinations (Pfizer)

So it would appear that despite the pandemic being behind us, there is still a need going forward. In the latest quarter, they noted that Covid products contributed to $7.1 billion in revenues for the first quarter alone. Total revenue for the first quarter was $18.3, which represented a 29% decrease. A contributing factor was a decrease in Comirnaty sales. They also were hit by an “unfavorable impact of foreign exchange.” When looking at revenue excluding Comirnaty and Paxlovid, company revenues actually grew 5%.

In more recent news, they announced they were dropping one of their two weight loss pills. This sent shares lower, but they intended to only go forward with one or the other based on the data that came in. This was mentioned just as recently as the last earnings call.

Yes, we are very excited about our two oral GLP, the 1532 and Danuglipron 1530 called Lotiglipron, and we’re looking for a differentiated profile that will be a combination of rapid onset, high control of HbA1C bringing it down, and bodyweight loss at various doses to be very competitive, and a more easily tight treble drag that can optimize a preferred profile versus injectable when it comes to nausea and other well known effects.

So, we look forward very much to data. Maybe later this year or possibly early next year and cherry pick the winner here.

This was also discussed going back to Q2 2022.

We’re excited to share that new data on our oral GLP-1 receptor agonists, two abstracts on twice-daily danuglipron and one on our once-daily candidate known as 1532 have been accepted for the European Association for the Study of Diabetes conference in September. These investigational medicines were designed in-house by Pfizer’s innovative chemistry and discovery teams. In a Phase 1 study in adults with Type 2 diabetes, after only six weeks of treatment, 1532 robustly reduced mean daily glucose to almost near-normal levels. Participants also experienced weight loss of up to 5 kilograms, compared with 2 kilograms for placebo.

We believe this to be a potentially best-in-class profile across both injectables and orals. Similar changes in body weight were observed in participants with non-diabetic obesity, 1532 is characterized by favorable once-daily pharmacokinetics, a low risk for drug-drug interactions, robust efficacy across multiple metabolic endpoints and GLP-1 receptor agonist class-like tolerability which overall encouraged us to plan for a Phase 2 study to pick the winning candidate prior to a potential Phase 3 study start. These development programs may lead to potential indications in Type 2 diabetes, obesity, NASH and cardiovascular risk reduction in Type 2 diabetes and obesity patients.

Bold text from the author to emphasize.

Perhaps it was dropped a bit sooner than anticipated, causing concern and leading to the subsequent price drop that has happened more recently. Additionally, it wasn’t really that both were just so successful that they had to choose from the best; it was issues with elevated liver enzymes that made them stop the development of Lotiglipron.

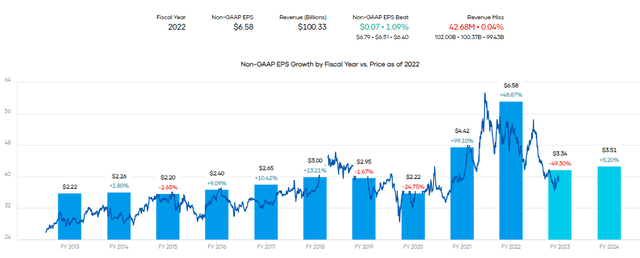

Looking back at their earnings from 2020 to 2022, we can see these were clearly some volatile years for earnings, as expected. However, those earnings are coming crashing down this year before potentially rebounding with growth going forward. This is to be expected as earnings normalize at this point. Earnings are still expected to be higher this year than they were pre-Covid. Meaning that they are delivering a trend of earnings growth, and the market seems to currently discount that.

PFE EPS History And Forward Estimates (Portfolio Insight)

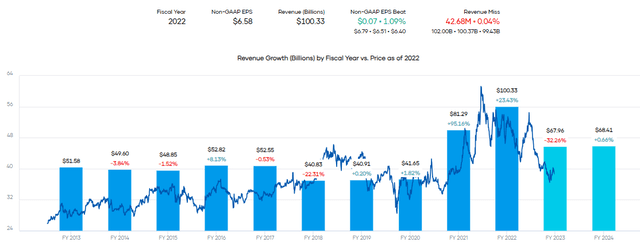

The revenue Pfizer has delivered showed a similar trajectory to the earnings shown above. However, prior to Covid, they had been looking quite flat.

PFE Historical Revenue And Forward Estimates (Portfolio Insight)

They expect SGEN to provide some significant sales growth by 2030 and even have the potential for significant growth beyond that year, as they noted in their earnings call. Also, mentioning that even with potentially acquiring SGEN that they’d have enough flexibility to create shareholder value.

As a result, we believe acquiring Seagen could contribute more than $10 billion in 2030 risk-adjusted revenues, with potential significant growth beyond 2030. Even with the Seagen deal, given the strength of our balance sheet and cash flows, we continue to have the flexibility to take additional actions to create shareholder value. Dave will provide more details on this during his presentation.

SGEN is the largest acquisition they are looking to do, but it wasn’t the only acquisition. They acquired Arena Pharmaceuticals in 2022, which was around a $6.7 billion acquisition. They also bought out the rest of Biohaven that they did not already own in 2022. The reason for the frenzied acquisitions and transformation of Pfizer is quite simple and quite familiar. They are facing patent expirations through this decade and are looking to replace those sales and earnings.

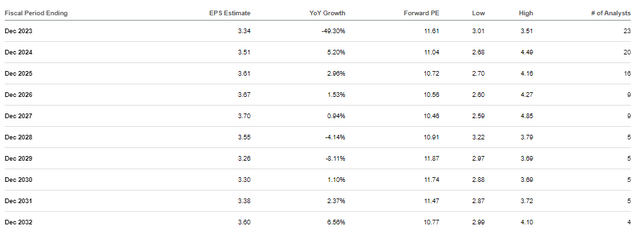

That’s why they’ve been so focused on positioning themselves more aggressively with larger acquisitions. Earnings through the next decade are expected to be quite tepid but generally trend higher. If successful, the earnings growth could end up being much better.

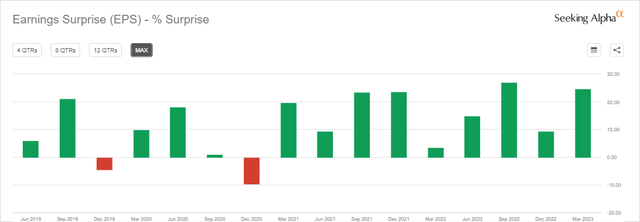

PFE EPS Estimates (Seeking Alpha)

They have a history of regularly topping analysts’ estimates anyway (as most companies do), so this is probably fairly conservative.

PFE EPS Earnings Surprise History (Seeking Alpha)

Pfizer has a long history of making acquisitions, which is basically their growth strategy. As a large player, they can afford to buy out smaller companies showing promise. This also isn’t unlike what AbbVie (ABBV) had been doing as they looked to transform themselves before the Humira patent cliff kicked in this year.

Historically, the company has averaged trading between a P/E of around 17x to 18x over the last decade. At a forward P/E of only around 11.6x, shares are quite cheap at this time. Wall Street analysts have an average price target of $46.68, which would put it at a more moderate 14x based on this year’s earnings.

Dividends And Repurchases

After this potential acquisition of SGEN, they would be looking to take a “more balanced capital allocation,” which would include investing in the business and returning value to shareholders.

The dividend is clearly important to their priorities going forward, and that includes dividend growth. Repurchasing shares is also something that they are looking to start back up.

As you know our strategy includes three pillars: reinvesting in the business; growing and paying dividends; and repurchasing our shares.

In the first three months of 2023, we have invested $2.5 billion in internal R&D and returned $2.3 billion to shareholders via our quarterly dividend, and importantly, allocated approximately $43 billion for the proposed Seagen acquisition. Over the last few years, we have reinvested heavily into our business to drive long-term growth and enhance long-term shareholder value. We have invested in Pfizer’s own science, while acquiring the best external science to supplement our pipeline.

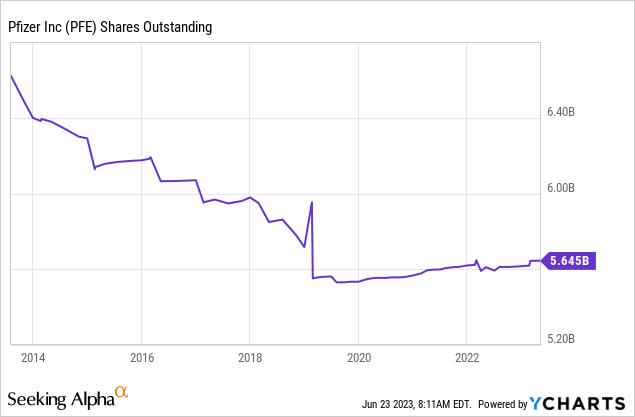

Repurchasing shares is clearly not something they have been doing since around 2019 as they looked to invest in their business instead. While that seems like an obvious move to better position the company, it’s not actually something every company regularly does. Some companies place too much emphasis on capital returns to shareholders and leave little in the way of new development for growth in the future.

YCharts

They boast 14 years of dividend increases. Their dividend payout ratio is healthy at around 50% based on forward estimates this year. This puts them in a position where they are indeed flexible, where they can grow the dividend and invest in the business. Growth in the dividend has been more restrained in recent years – again, for the same reason as repurchases had ceased – so they could invest more in the business.

PFE Dividend Growth (Portfolio Insight)

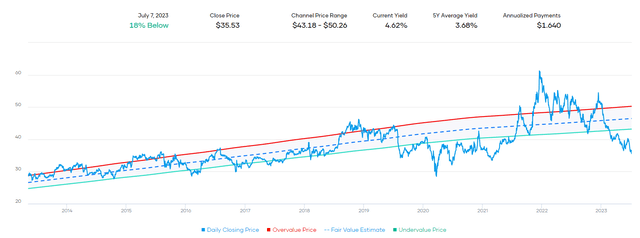

In looking at the dividend, shares of PFE are trading well below their channel range based on the average yield. While PFE isn’t necessarily an income-oriented investment, it gives us some further context on how cheap PFE is looking at this time. The decline in value has pushed the current yield to a respectable 4.62%.

PFE Fair Value Range Based on Historical Dividend Yield (Portfolio Insight)

Conclusion

PFE stock is cheap and is presenting long-term investors with an opportunity to invest in this solid healthcare company. As a recession is anticipated on the horizon, it could provide some downside protection as it remains recession resilient. The longer-term outlook is that they successfully reposition themselves for the coming patent cliffs they will experience. With the latest acquisition spree looking to be sent off with a grand finale in acquiring SGEN, they’ll turn their attention to a more balanced approach going forward. That could look at investors being rewarded more richly through better dividend growth and share repurchases while they still leave the capacity to invest in the underlying business.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Interested in more income ideas?

Check out Cash Builder Opportunities where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investor’s income even further.

Join us today to have access to our portfolio, watchlist and live chat. Members get the first look at all publications and even exclusive articles not posted elsewhere.