Summary:

- GameStop’s former CEO has essentially been replaced by large shareholder Ryan Cohen, founder of online pet retailer Chewy.

- Cohen could try to make a major transformative acquisition to save the company, as he has cash and an overpriced stock price to work with.

- A turnaround without an acquisition, however, seems unlikely.

FinkAvenue

Back in late April, I wrote that GameStop’s (NYSE:GME) valuation looked way overdone at current levels and that the company faced multiple headwinds. Since then, the stock has risen nearly 20%, outpacing the S&P’s 6% gain. Let’s take another look at the stock.

Company Profile

As a reminder, GME is a video game retailer that sells its products both through retail stores and online. It also sells related gaming hardware and accessories, as well as collectibles. It stores are operated under the GameStop, EB Games, and Micromania brands.

It had over 4,400 stores at the end of January, according to its 10-K. Over 2,900 of its stores were located in the United States, while there were over 800 in Europe, over 400 in Australia, and over 200 in Canada. It also has around 50 Zing Pop Culture stores that sell collectibles, toys, apparel, gadgets, and electronics in Australia and Europe.

The company sells both new and used video games, and customers can trade-in their pre-owned games in exchange for cash or credit. The retailer’s PowerUp Rewards loyalty program has over 56.7 million members (source 10-K), although only 15 million of these members bought or traded in a game in the last year. It also has 5.6 million pro member loyalty members that pay to be members.

Cohen Takes Over As CEO Terminated

When GME reported its Q1 results a month ago, the company issued a brief press release saying that its former CEO Matthew Furlong had been terminated and that Ryan Cohen had been elected as Executive Chairman. Cohen is the founder of online pet retailer Chewy, and his RC Venture firm first took a nearly 10% stake in GME back in September 2020.

Cohen has invested in other down and out stocks, including Bed Bath & Beyond, where his firm took a nearly 10% stake in March 2022 only to sell out of its in August. He, along with former Bed Bath & Beyond CFO Gustavo Arnal, have been accused of a pump and dump scheme in a class action suit. Arnal jumped off a skyscraper following the accusations.

General Counsel Mark Robinson was appointed General Manager of the company, and in an 8-K it said that Robinson was the company’s “principal executive officer.” Robinson’s appointment was not announced in a press release, and it seems a bit odd to have a lawyer as the head of the company. That said, he’ll report to Cohen who seems to have the real power, and whose role includes capital allocation and evaluating potential investments and acquisitions.

For his part, Cohen bought another $10 million worth of GME shares after the announcement, picking up shares at an average price of $22.53. Directors Lawrence Cheng and Alain Attal were also buying shares at the same time as Cohen.

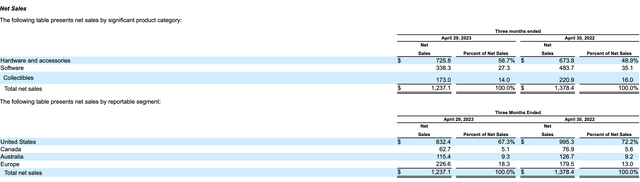

With the firing of Furlong, the company issued only a brief earnings release and held no earnings call. Not surprisingly sales were not good, falling -10% to $1.237 billion. That missed analyst estimates by $121.3 million.

As I noted in my original article, collectibles had been one of the few areas of strength for the company, as it had focused a lot of its efforts on selling collectibles, toys, and pop culture merchandise. The category saw a 17% increase in sales last year to $965 million. However, the category was weak in Q1, with sales dropping a whopping -21.7% to $173 million in the quarter. This was one of the few areas the company was seeing some momentum, so this had to be very disappointing.

Software, which includes the sale of new and pre-owned video games, meanwhile remained weak. Sales for the category plunged -30% to $338.3 million. Hardware sales were a strong point, with sales climbing 7.7% to $725.8 million.

GME had been focusing on cutting costs, and on that end it did a good job. SG&A expenses fell to $345.7 million, or 27.9% of net sales, versus $452.2 million, or 32.8% of net sales, a year ago. Meanwhile, gross margins improved 150 basis points to 23.2% from 21.7%, despite the decline in its generally higher margin collectibles business.

That was still not enough to see the company turn adjusted EBITDA profitable or generate positive free cash flow. Adjusted EBTDA was -$29.4 million, a big improvement from -$125.5 million a year ago, while FCF improved to an outflow of -$111.8 million from an outflow of -$314.7 million. The company still has a ton of cash, with $1.3 billion in cash and marketable securities and minimal debt, thanks to the company issuing equity during its meme stock surge.

Conclusion

With a market cap of nearly $7 billion and an enterprise value of around $6.4 billion, the valuation of GME makes less sense today than when I originally wrote about it. That values the company at around $1.5 million per store.

For the stock to work, Cohen will likely have to make a major transformative acquisition. There doesn’t seem any way to really save the core business at this point. Collectibles seemed like a slight possibility it could work, but after Q1 that slight hope seems to be slipping.

He has a lot of cash on the balance sheet and an overpriced stock to work with, so he is in good position to make a big deal. If he wanted to double down on collectibles and toys, he could easily buy Funko (FNKO), but I’m not sure if that is a big enough bet.

Cohen has an online retail background, so it would make sense he does something in that arena. And maybe a large acquisition will get investors excited and push the stock higher. That said, the current valuation of the stock makes no sense, and any turnaround without an acquisition seems unlikely. So, I’d be a bit surprised if he doesn’t try to make an acquisition.

That said, I’m going to keep my “Sell” Rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.