Summary:

- AT&T recently announced a quarterly dividend of $0.2775 per share on the company’s common shares.

- Such a dividend translates to about $2B in total and exceeds its free cash flow of $1B in the most recent quarterly by about 100%.

- Combined with the company’s other obligations (debt service, preferred shares, CAPEX, et al), I am concerned about its overall financial health.

- After all, dividends do not lie.

Ronald Martinez

Thesis

Readers familiar with my writings know that I have been a long-term bull on AT&T (NYSE:T) till very recently. I have been arguing for a BUY thesis on T since early 2022 and downgraded my rating around April/May 2023. The main reasons that caused me to change my mind in April/May were valuation risks and operational challenges that I saw at the time, as detailed in my last two articles.

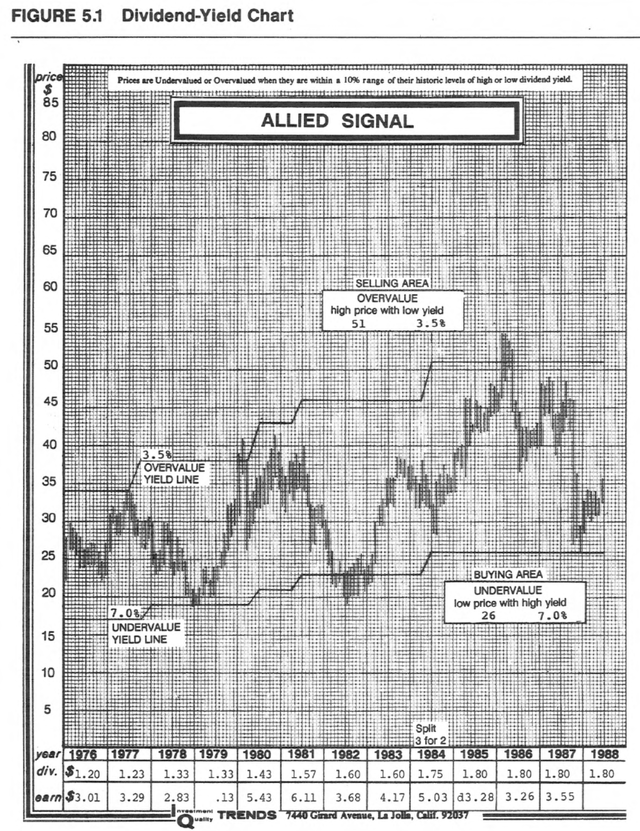

This article details another concern I have developed given T’s recent cash flow status and also its dividend announcement. This article examines T’s dividend safety following a similar approach used in an earlier article I published back in Feb 2023. In that article, I analyzed T using the dividend bands following Geraldine Weiss’ classic, Dividends Don’t Lie. An example of such bands is provided in the first chart below for Allied Signal, a blue-chip stock in its own days just like T. The key insight is that for a company like T, dividends provide much more accurate insight into its financial health than accounting EPS. At that time, T was attractively valued according to the dividend bands and can comfortably cover its dividends with its free cash flow (“FCF”).

Source: Dividends Don’t Lie by Geraldine Weiss

Against this backdrop, the update in this article is triggered by the following two key developments since then. And in the remainder of this article, I will detail further my thought process to downgrade the stock from my original “BUY” rating to “HOLD” based on the following.

- Its free cash flow (“FCF”) reported in Q1 2023 was significantly lower than what I expected. Therefore, I was concerned if the company will be able to meet its full-year FCF target of $16 billion. If not, it could lead to difficulties in covering financial obligations such as dividends and capital expenditures, which in turn could make the company less competitive and attractive to investors.

- Its price changes since my last article also made its valuation less attractive according to the yield band.

The yield bands

These days, we have better technology to plot the yield bands than Weiss as shown in the chart below. As seen, the dividend bands of T had fluctuated over the past 5 years between about 4.5% and 9.3%, indicating extreme overvaluation and undervaluation, respectively.

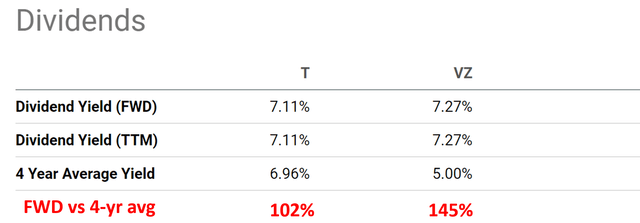

Currently, T’s dividend yield is about 7.11% on a TTM basis. It is an attractive level in absolute terms. However, it is not that attractive when properly contextualized. For example, it is only a bit higher (about 2%) than its 4-year average of 6.96%. When compared to its close peers like Verizon, it becomes even less appealing to be detailed later.

Source: Author based on Seeking Alpha data

T’s dividends

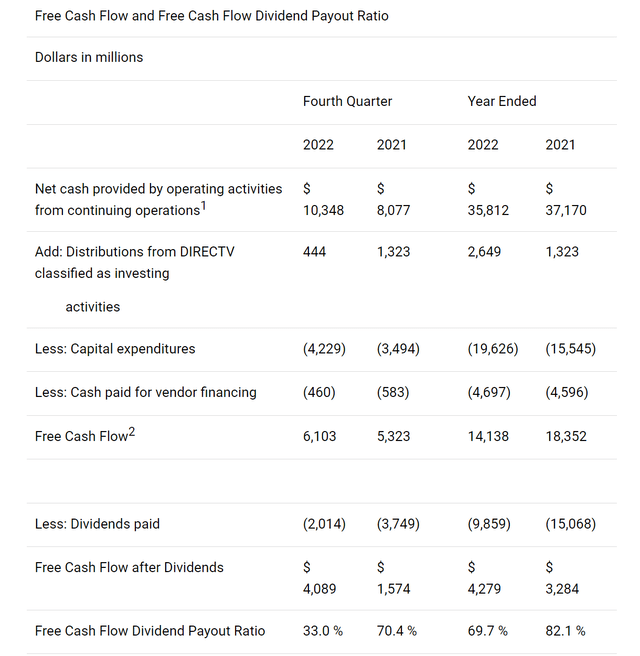

As aforementioned, T just announced a quarterly dividend of $0.2775 per share on its common shares, translating into about $2B in total dividend obligation on its common shares. At the same time, the company reported an FCF of only $1B in the most recent quarter, only about ½ of its dividend for commons shares (or in other words, an FCF dividend payout ratio of ~200%). To put things under a broader context, the chart below shows its FCF dividend payout ratio in 2021 and 2022. At the time of my original article, T just released its 2022 Q4 results. And as seen, it was able to cover its dividend obligations with a ~33% FCF dividend payout ratio on a quarterly basis and ~70% on an annual basis.

To add to the financial pressure, T also has a variety of other financial obligations at the same time. For example, its capital expenditure came in at $4.3 billion in the past quarter and capital investment reached $6.4 billion. In terms of dividends, the company also has a payout obligation on its preferred shares in addition to the common shares. To wit, the board just announced quarterly dividends in the range of 4.75% to 5% on its Perpetual Preferred Stock, Series A, and Series C shares. Finally, bear in mind that T also faces a sizable debt burned at the same time (more on this in the next section).

Considering all these obligations, I see it as a plausible scenario that T could cut its dividends in the near future. Even worse, I am worried about the company’s ability to generate organic cash flow to maintain or increase its capital spending to build out its 5G network.

T’s debt obligations

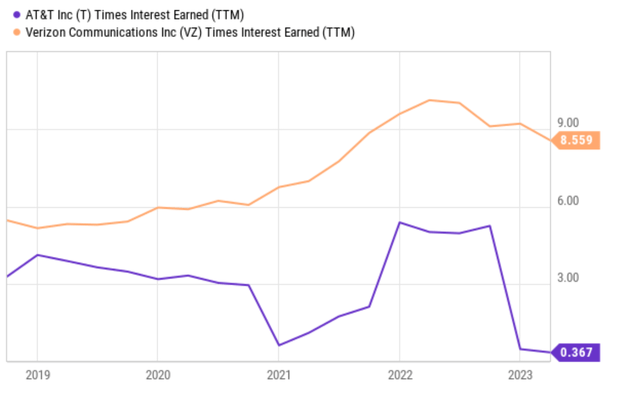

It is common for telecom companies to use relatively high leverage. However, T’s leverage is high even by telecom standards. As shown in the chart below, T’s interest coverage is only a fraction of its close peer Verizon (VZ). High debt could trigger a vicious cycle. For example, as a result of their different financial strategies, T and VZ have different credit ratings. AT&T’s credit rating is BBB+ by Fitch, while Verizon’s credit rating is A- by Fitch. Such a difference could lead to higher borrowing costs for T and further compound its financial pressure.

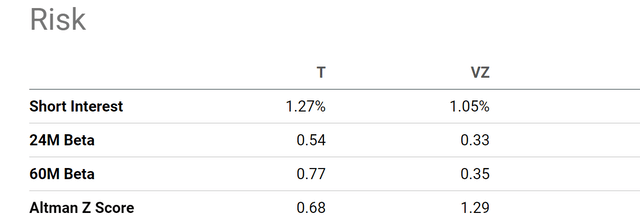

Overall, I view T’s financial health as below the borderline as confirmed by the Altman Z-score. The Altman Z-score is a financial metric that is used to assess a company’s overall financial health. A higher Z-score means a stronger financial position. To wit, T’s Altman Z-score is only 0.68 currently, not only far below Verizon’s 1.29 but also below my borderline threshold of ~1.2.

Source: Seeking Alpha data Source: Seeking Alpha data

Valuation: less attractive than on the surface

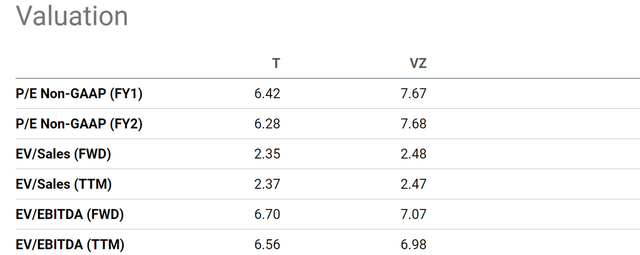

In terms of P/E multiples, the valuation of T does seem attractive. As seen in the chart below, its FY1 P/E ratio is about 6.42x, a sizable discount compared to VZ’s FY1 P/E of 7.67x.

However, remember that T has much higher leverage than VZ as just discussed above. As a result, leverage-adjusted valuation multiples are much more appropriate here. And once the leverages are considered, T’s valuation discounts become much smaller. For example, T’s EV/sales ratio is 2.35x on an FWD basis, not that different from VZ’s 2.48x (only a difference of about 5%). Similarly, its EV/EBITDA ratio hovers around 6.70x on an FWD basis, very close to Verizon’s 7.07 also. Considering the dramatic difference in their financial positions, I have difficulty justifying T’s current valuation multiples.

And finally, as mentioned up front, for blue-chip telecom companies who consistently pay dividends, dividend yields represent a much better valuation metric than multiples based on accounting EPS. As shown in the next chart, T’s current dividend yield of 7.11% is only about 2% above its 4-year average of 6.96%, indicating a valuation discount in the noise level. In contrast, VZ’s current dividend yield of 7.27% is more than 45% above its 4-year average of 5.0%, signaling a much larger discount.

Source: Author based on Seeking Alpha data

Other risks and final thoughts

Besides the above issues, I also see a number of other challenges. The telecommunications industry has been quite competitive in recent years, both among established players like T and VZ and also with new entrants such as Google Fiber. The competition has pressured T’s pricing power and at the same time also forced it to invest heavily in its network to stay competitive, leading to substantial CAPEX expenditures as analyzed in the article. It is also a well-known problem that T’s traditional revenue streams, such as cable television and landlines, are facing secular declines. Finally, T also faces regulatory risks, both in the United States and abroad. The company has been the target of various lawsuits and investigations in the past and very likely in the future as well. A recent example involves the Federal Trade Commission’s lawsuit due to the misleading information it provided to consumers about its unlimited data plans.

There are certainly some upside risks here too. T offers a strong brand name and a large customer base. As an industry leader, it is well-positioned to benefit from the growth of 5G, cybersecurity, and cloud computing. However, overall, I see the negative catalysts to be the more dominating force in the near future. And as a result, I am downgrading my rating to HOLD. To recap, in the near term, I am concerned that the company may experience difficulty covering its dividends and/or remain competitive on the capital investment front. At the same time, its valuation is not that attractive when its leverages are adjusted for.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.