Summary:

- Unfortunately, there are some signs that Microsoft stock may correct or enter a boring consolidation phase.

- The technology sector is losing its steam – a bad backdrop for MSFT.

- The market values management’s long-term growth forecasts at a premium, making the stock vulnerable to possible EPS and guidance misses.

- The stock is already up 40.75% YTD as it has historically reached one of the highest valuation multiples.

- From what I see, I can’t confirm my earlier Buy rating – this time MSFT looks like a Hold.

David Becker

Intro & Thesis

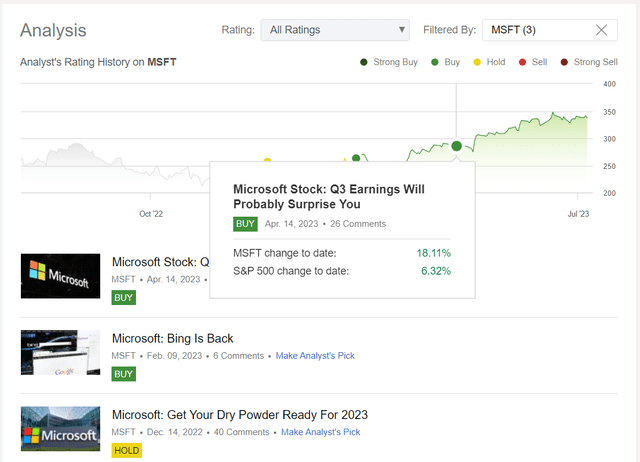

I began covering Microsoft Corp. (NASDAQ:MSFT) stock in mid-December 2022 and advised investors to prepare for potential buying opportunities in 2023. However, following the unveiling of the new Bing and the promising prospects of AI within the company’s ecosystem, I reassessed my rating and have since maintained a positive stance on the stock. This recommendation has proven favorable compared to the performance of the S&P 500 Index (SPX) (SP500):

Seeking Alpha, my coverage of MSFT stock

However, any rally – no matter how strong it may seem at first glance – tends to lose its strength, leading to a trend reversal or, at best, a consolidation. Unfortunately, there are some signs that MSFT stock may soon follow this pattern.

Why Do I Think So?

Since the beginning of the year, the total returns of the 7 most highly capitalized companies in the S&P 500 Index have shed ~10 times the returns of the other 493 constituents. Why? Goldman Sachs analysts [July 5, 2023 – proprietary source] wrote in their recent note that they see a few reasons: a favorable macroeconomic environment, improved positioning with reduced tech exposure in the prior quarter, rotations driven by “There Is No Alternative” (TINA) momentum in FAAMG+ stocks, positive earnings revisions supported by cost reductions, and growing excitement around artificial intelligence (AI) stories.

The current concentration of market performance in the top 7-10 stocks is noteworthy, but it’s not unprecedented, as equity returns tend to be concentrated in a small group of outperformers in any given year:

![Goldman Sachs [July 5, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/7/10/49513514-16889673908290815.png)

Goldman Sachs [July 5, 2023 – proprietary source]

However, the share of the technology sector is now disproportionately higher than before, and exactly the 7-10 companies responsible for such a strong YTD rally of the stock market belong to this sector.

![EPFR, Haver Analytics, Goldman Sachs Global Investment Research [June 30, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/7/10/49513514-16889675937736642.png)

EPFR, Haver Analytics, Goldman Sachs Global Investment Research [June 30, 2023 – proprietary source]

In my opinion, the positive factor of the lack of positioning has thus been completely exhausted – which is why I see the short-term prospects for SPY as relatively bearish overall (maybe I’ll update my macro view shortly).

Another driver – valuation – has also risen much higher than a few weeks ago. This is a rather relative term, however, in the context of relation to other sectors of the U.S. economy, the technology sector looks overbought at this point:

![TME newsletter, Credit Suisse [July 8, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/7/10/49513514-16889680690022163.png)

TME newsletter, Credit Suisse [July 8, 2023 – proprietary source]

One of the arguments for buying MSFT, which I wrote about in April, was the relative cheapness of the company against the backdrop of the prospects logically arising from the AI innovations/optimizations the company will be making in the foreseeable future.

So my buy thesis last time was to buy MSFT before analysts’ forecasts had time to settle into the EPS and EBITDA consensus numbers. Right now, this has already happened, resulting in the P/E and EV/EBITDA ratios already looking unreasonably high even with ~15% YoY [FY2024] growth forecasts:

![YCharts [author's notes]](https://static.seekingalpha.com/uploads/2023/7/10/49513514-16889693693879104.png)

YCharts [author’s notes]

Now, I’m confused by the fact that MSFT’s future success has become the market consensus – almost all Wall Street analysts are extremely bullish on the stock, predicting that it will join the $3 trillion club by the end of the year. In my experience, if everyone believes the market will move in a certain direction, it is unlikely to happen.

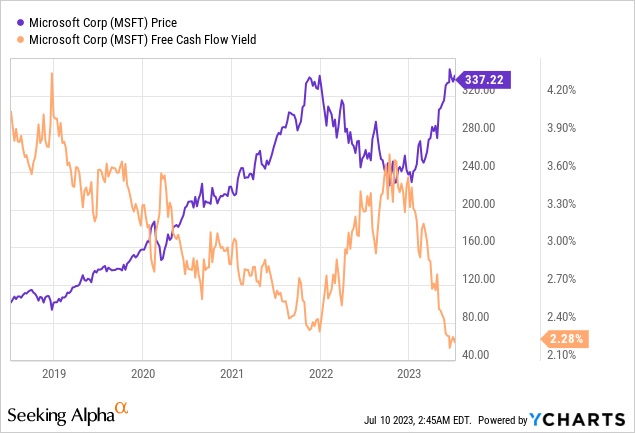

I am also puzzled by the FCF yield, which has fallen below the previous local bottom and could serve as an additional red signal of overvaluation:

Of course, no one buys a growth story based on FCF yields – but we need to understand that MSFT needs mountains of cash to ride the AI revolution – CAPEX is going to grow in absolute terms over the next few years, leading to shrinking FCFs and less cash available for buybacks.

Any development has to be gradual. We see the management talking about the corporate growth of ~10% per annum; the market sees growth of ~14.6% [through FY2028]; the stock is already up 40.75% YTD as it has historically reached one of the highest valuation multiples. All this suggests that it should be very difficult to go further.

![TrendSpider Software, MSFT [daily], author's notes](https://static.seekingalpha.com/uploads/2023/7/10/49513514-16889728791035187.png)

TrendSpider Software, MSFT [daily], author’s notes

In my opinion, from today’s perspective, unless there are additional unforeseen tailwinds that reignite the market’s greed, MSFT stock should enter a correction or consolidation. In the first case, investors will lose money if they buy MSFT at the current price; in the second case, they will lose time [i.e. opportunity cost].

For all the reasons mentioned above, I am downgrading the stock as I see more opportunities in other companies.

The Verdict

In the long run, I am relatively optimistic about Microsoft stock, but currently, I don’t share the enthusiasm for the company at such a high price level. Everything takes time. The company needs to grow out of the premium valuation the market is now giving it, expecting more than what management is counting on. What happens to a stock if/when AI does not deliver as much as the market is ready for?

![Barclays [June 22, 2023 - proprietary source], author's notes](https://static.seekingalpha.com/uploads/2023/7/10/49513514-16889736596350255.png)

Barclays [June 22, 2023 – proprietary source], author’s notes

The risk of disappointing investors is quite high, and the high valuation makes the stock quite vulnerable to earnings and guidance misses. From what I see, I cannot confirm my earlier Buy rating – this time MSFT looks like a Hold.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!