Summary:

- Roku jumps on news of a shoppable advertising deal with Shopify.

- The company has faced a tough year for advertising and progress towards shoppable ads should change the trajectory of revenues.

- The stock is cheap below 3x ’24 sales targets that appear very conservative considering the current engagement growth rates.

Justin Sullivan

As predicted back in April, Roku (NASDAQ:ROKU) was only treading water before a big rally. A recent boost in small-cap stocks and a partnership with Shopify (SHOP) has the market far more bullish on the streaming platform. My investment thesis remains ultra Bullish on Roku with the stock finally regaining investor interest after the brutal lows at the end of 2022.

Source: Finviz

Action Ads

The holy grail of the ARK Investment Management LLC (ARKK) ultra-bullish thesis on Roku was the digital advertising bucket. The streaming platform continues to make massive progress in making ads shoppable providing substantially more value to merchants.

The partnership announced today with Shopify builds on the Roku Action Ads now allowing Shopify merchants, like True Classic, to sell men’s apparel directly purchasable off Roku using the remote. Paige Decker, Vice President at True Classic, had this to say about the Roku ad platform:

Offering a great purchase experience for customers and having sound channel measurements are critical to True Classic’s success. Roku Action Ads address both these needs, providing a frictionless path to purchase for customers while allowing us to measure the impact of this strategy with the end-to-end Shopify integration. Merging performance-based tactics with the scale of TV is a win-win, and we are excited to explore Roku’s innovation.

Roku already has a seamless checkout experience and Action Ads offer down funnel actions such as sending users a text, scanning a QR code, or making a purchase expanded with the deal with Shopify to provide inventory. All of these actions add up to the digital marketing machine ARK Invest has predicted as a stock with a $605 price target for 2026 as a base case.

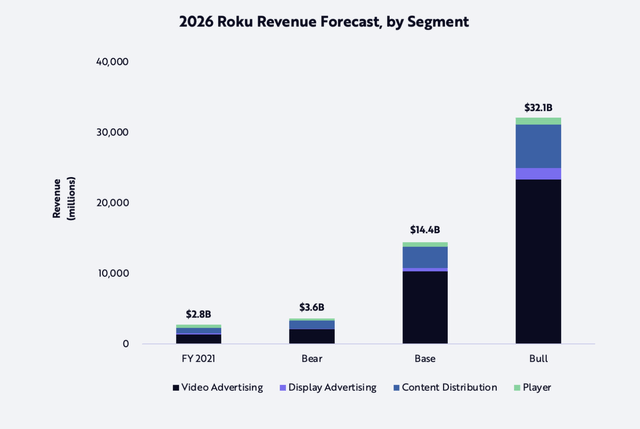

The major basis of the revenue upside is the digital advertising gains. ARK Invest forecast a base case for 2026 revenues of $14.4 billion mostly on revenue growth in video ads due to the above shoppable ads integrated with Shopify offering a huge path to achieve this goal.

Source: ARK Invest research report

The major differences between the base and bull cases are the amount of Roku active accounts and the net platform monetization rates per hour. The monetization rate is forecast to leap from only $0.03 per hour in 2021 to $0.05 in the base case for 2026 to $0.10 in the bull case. The bull case forecast a 233% increase in the monetization rate alone.

Still Cheap

Roku has soared through $75 today. The stock has already doubled off the lows in late 2022, yet Roku is still cheap.

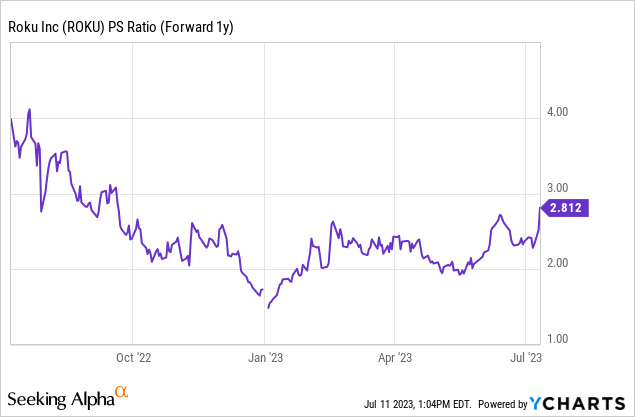

Based on the ARK Invest analysis, naturally Cathie Wood and her analysts see Roku as extremely cheap at only $75 now. The key here is that even without the digital ad revenue boom forecast by the analyst firm and any boost to numbers from the Shopify integration, the stock is still cheap at below 3x forward sales targets.

Analysts only forecast sales growing at a 15% clip in 2024 with Roku revenues hitting just $3.8 billion. The potential here is a far bigger growth rate with higher monetization of ad inventory after a period over the last year where TV ad scatter market revenues were extremely weak.

In the last quarter, engagement was still up 20% with streaming hours up 20% to 25.1 billion. Even the active accounts grew by 17% to 71.6 million accounts.

The only issue was the monetization of the additional viewers with ARPU down 5% to only $40.67. The shoppable ads deal with Shopify could very well help boost monetization and hopefully, management will provide more details on the Q2’23 earnings call in a few weeks.

Takeaway

The key investor takeaway is that Roku appears poised for a major breakout above $75. The stock has already rallied substantially, but Roku remains cheap. Any progress the streaming platform makes on monetizing existing streaming time via the Shopify deal should only provide an upside to current revenue estimates and place Roku closer to hitting the big price targets of ARK Invest.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ROKU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.